Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 11:49am On Apr 09 Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 11:49am On Apr 09 |

Congratulations to her!🎉 Time to get her own tear rubber Lexus  Daddy is capable! Lexusgs430:

I am so elated today....... My daughter just passed her practical driving test (1st attempt) ......... 🎉🎊🎉🎊🎉

My daddy taxi days are now over .......😂 |

Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 12:57pm On Mar 26 Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 12:57pm On Mar 26 |

Something like this? 3 Likes

|

Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 7:22pm On Sep 29, 2023 Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 7:22pm On Sep 29, 2023 |

Did for my Son in June in London and still not received yet. Iruobe1987:

Please does anyone know if the online passport application tracker actually works. I renewed my daughters passport in July but its at "application received by the centre" since then without moving to the next stage. Do I need to worry about this? |

Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 2:10pm On Sep 19, 2023 Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 2:10pm On Sep 19, 2023 |

Thank you! I LagosismyHome:

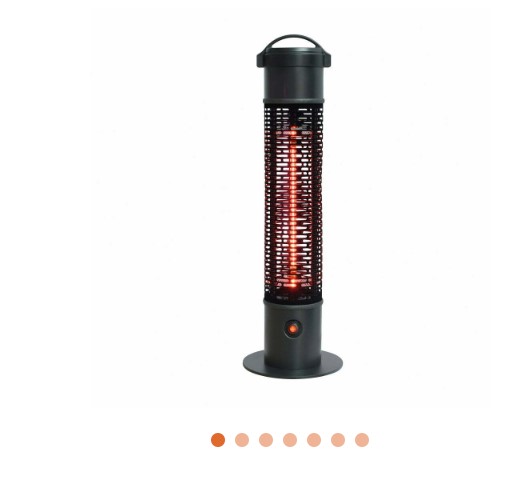

No please .... this can even be a potential fire hazard. This is meant only for garden where there is proper ventilation. Do not use this indoors at all |

Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 3:33pm On Sep 17, 2023 Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 3:33pm On Sep 17, 2023 |

Good afternoon all, please help advise if it is advisable to use this Patio Electric Infrared heater indoors. Thanks.  |

Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 11:35am On Sep 15, 2023 Travel / Re: Living In The Uk-life Of An Immigrant (part 3) by DoubleN(m): 11:35am On Sep 15, 2023 |

2 Likes

|

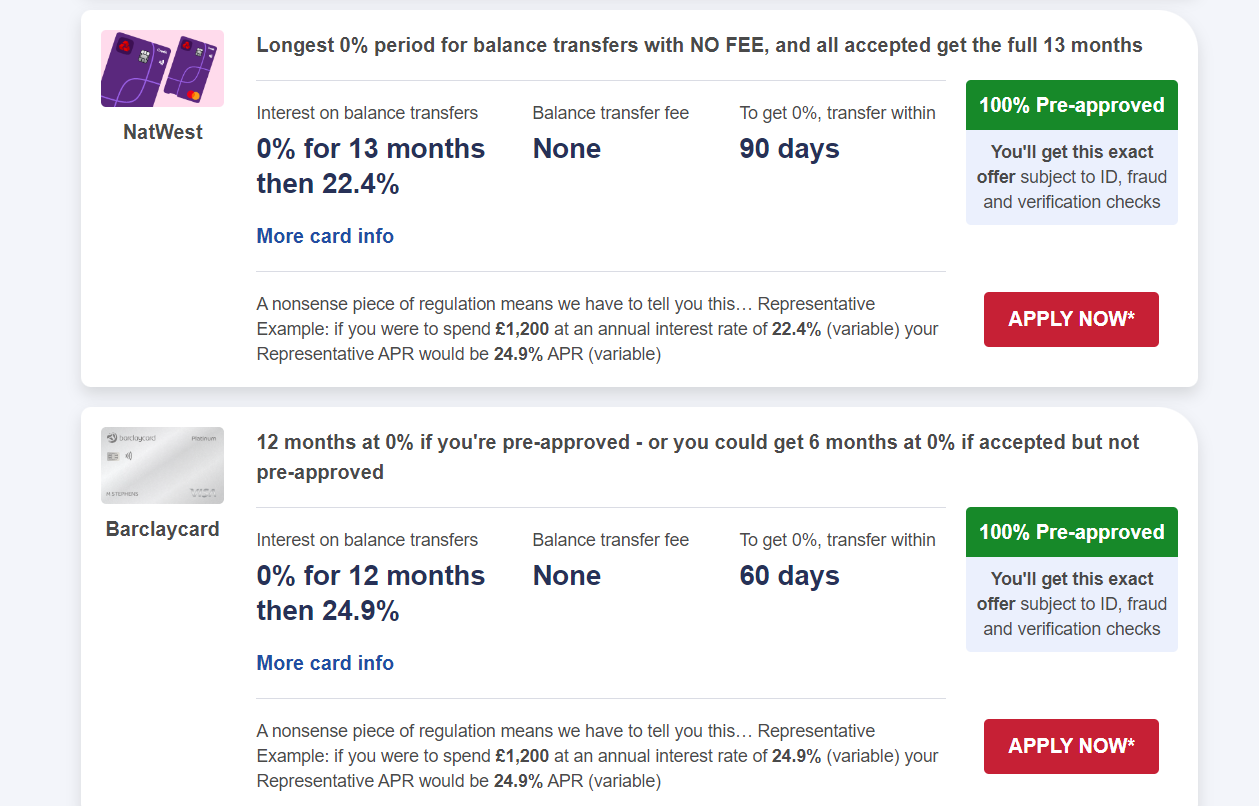

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:07am On Apr 10, 2023 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:07am On Apr 10, 2023 |

Yes OKOCHA1:

Is this advisable for individuals still on Tier 4 Visa. |

Travel / Re: Living In The UK: Property,Mortgage And Related by DoubleN(m): 5:21pm On Feb 02, 2023 Travel / Re: Living In The UK: Property,Mortgage And Related by DoubleN(m): 5:21pm On Feb 02, 2023 |

Moneybox is not bad. hustla:

Which Lisa apps are the best?

Looking to sign up for one that's easy to get on |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 10:35pm On Jan 23, 2023 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 10:35pm On Jan 23, 2023 |

Thank you. Pearlyfaze:

Customer service job.

1. Sensee

2. Capita

3. Concentrix are all hiring WFH |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:23am On Jan 22, 2023 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:23am On Jan 22, 2023 |

Good day all,

Please what type of Jobs can a Tier 2 dependent mom with child care responsibilities do from home?.

Thank you all. |

Travel / Re: Parenting In The UK As A Nigerian Migrant. by DoubleN(m): 1:42pm On Jan 21, 2023 Travel / Re: Parenting In The UK As A Nigerian Migrant. by DoubleN(m): 1:42pm On Jan 21, 2023 |

Good day all,

Please what type of Jobs can a Tier 2 dependent mom with child care responsibilities do from home?.

Thank you all. |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 4:20pm On Jan 19, 2023 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 4:20pm On Jan 19, 2023 |

1 Like |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 1:14pm On Jan 16, 2023 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 1:14pm On Jan 16, 2023 |

There is a direct train service from London King Cross Station to Newcastle using LNER. https://www.lner.co.uk/dustydee:

Take the LNER train from London Kings Cross station. MelaninGemstone:

Hi guys, I just got to London 2 days ago and I would be traveling to Newcastle in a few days (Northumbria University)

Please how can I book a train to Newcastle from London and which train station would I depart from ?

Do all the London Underground travel to other cities ?

Please advise |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:56am On Dec 28, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:56am On Dec 28, 2022 |

Morning All,

Please can anyone advise fun places to visit or do in London this period with family?

Thanks. 1 Like |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:20am On Dec 23, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:20am On Dec 23, 2022 |

Morning Guys,

Please any alternatives to Booking.com and AirBnB for short term stays? I am looking for something in London.

Thanks! |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:55pm On Dec 21, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:55pm On Dec 21, 2022 |

Help still needed, please. thanks! DoubleN:

Hi Guys,

Please are there any other sites to book short stays apart from AirBnB and Booking.com? Will appreciate a plug.

Thanks. |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 12:51am On Dec 21, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 12:51am On Dec 21, 2022 |

Hi Guys,

Please are there any other sites to book short stays apart from AirBnB and Booking.com? Will appreciate a plug.

Thanks. |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 6:03pm On Dec 13, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 6:03pm On Dec 13, 2022 |

dustydee:

I use Revolut. I tried it some weeks ago after I read here that banks close accounts and they haven't closed mine. I also used it two days ago.

Curious, why go through this route and pay more fees? Why not Wallet >> Binance >> Revolut? I have a Binance NG and couldn't add a UK bank account to it. Adding a Bank account to coinbase is straightforward so I just used it to cash out instead. |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 3:59pm On Dec 13, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 3:59pm On Dec 13, 2022 |

Used Revolut some days ago as a first timer withdrawing. Opened Coinbase and Revolut minutes apart just to do this. So the Process used was this Wallet >>Binance>>Coinbase>>Revolut. Come back with your testimony  Viruses:

On the Monzo, my worry is whether there'll be implications even if it goes through.

You know say those of us without ILR/Citizenship sabi fear  . . 2 Likes |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 3:17pm On Nov 01, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 3:17pm On Nov 01, 2022 |

koonbey:

For dental, private PAYG is good enough, IMO. Alternatively, if you have a dentist that has a subscription service nearby, that could work too - like 15 per month for one dentist visit and one or two hygienist visits. 65 per month is for health insurance generally not just dental work, right? I'm not familiar with the costs as I get mine through work so I can't advice if it's a reasonable price, but it's important that you check the fine print to be sure what kinds of dental work is covered. For instance, some cover routine exams but others will say only emergency dental treatment. There's also often a time lag before you can claim.

The 65 per month is actually just only for dental. I have health insurance at work though but it doesn't cover dental. I have gotten the details on the routine jobs, restorative work and emergency treatment. There is also a 4 month waiting period before restorative can be activated. The cost of PAYG I am seeing is on the high side for consultation and treatments and paying 780 annually for dental insurance looks pretty steep. I'll look into the subscription services. Thanks for your feedback. 1 Like |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 2:16pm On Nov 01, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 2:16pm On Nov 01, 2022 |

Morning Guys, I am here again.

Can anyone advise on how to go about getting a dentist. It seems majority are not accepting new registrations for NHS patients.

Question: What is the best approach to getting a Private arrangement, Is it using Insurance or pay as you go? One of the major Insurance providers is quoting me £65 a month for me and my spouse. Helpful suggestions are welcome. Thanks! |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 8:53pm On Oct 29, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 8:53pm On Oct 29, 2022 |

Hi, People Thinking of coming to London from up north this Christmas season for about a week or 2 for a very 'mini' holiday. Emphasis on mini!  Any recommendations on what to do and where to go in London with Family (Kids range from 3 - 10)? Thanks in advance! |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 4:01pm On Mar 22, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 4:01pm On Mar 22, 2022 |

4 Likes 4 Shares |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 1:00am On Jan 18, 2022 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 1:00am On Jan 18, 2022 |

5 Likes 4 Shares |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:18pm On Dec 26, 2021 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:18pm On Dec 26, 2021 |

Lexusgs430:

If you want to take total control of your portfolio...........

Use your virtual equity to copy -:

(Jaynemesis)

(Jeppe Kirk Bonde)

This two above, you can no longer copy. They are already managing over $75 Million of copiers funds each (AUM reached). But search their portfolio, to guide your purchase............

Fabrizio Zanol

Koen Dauw

TeaTea Chi

Richard Stroud

Big-Profits (forex only)

The ones above also, use their portfolio as a guide on investments................ 2 Likes |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:14pm On Oct 28, 2021 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 11:14pm On Oct 28, 2021 |

kode12:

I've got £, I need naira abeg. Mamatukwas don go international e no dey answer people again. I have naira..you can DM. |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 10:25am On Oct 25, 2021 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 10:25am On Oct 25, 2021 |

This is the very reason I remain on NL. Thanks so much for sharing. Ticha:

Thought I'd answer the questions in a general post

We started off with buying a 2 bedroom flat in Bristol - as our first home. We'd used all of our savings for the deposit but wanted to save up again so rented one room out to a Mon - Fri boarder. We also made some lifestyle changes - sold our 2nd car (we had 1 each), husband started cycling to work (50 mins each way) and I started taking public transport. It turned out the rent from the boarder not only paid all our bills but also covered our basic food costs. By the end of that year, we had saved quite a bit. We then both changed jobs, got paid more and decided to buy a proper family home. It turned out we had some good equity (thanks to rising house prices) in the flat and with our savings, we could afford to buy a bigger house, went to see a broker who also turned out to be a property investor and that's how our property journey started.

Thanks to his advice, we didn't sell the flat but rented it out and bought the biggest house we could afford close to transport facilities. We rented out 3 rooms and kept 2 rooms for ourselves. The rent from the 3 people paid the whole mortgage, bills and covered our food cost so we basically saved all our wages for about 18 months. We then moved to Norfolk - sold the family home and bought 2 houses in one go as we had more than enough equity to put down 2 deposits and even had change left over thanks to the equity from the sale. One in Bristol that we rented out straight away and a complete derelict house for our family home in Norfolk which we completely renovated but before we could move in, my husband got offered a transfer to New Zealand so we rented that one out and shipped out to New Zealand.

Because property is a long game, we have leveraged - so that first flat we bought in 2010 has appreciated so much we took out a deposit out of it to buy a fourth house 2 years ago as well as transferred some to New Zealand to buy our first home here too. This year, we leveraged the New Zealand house by demolishing it and building 2 new houses on the site, re-valued the 2 new ones, rented them out and bought a family home. Again, we have bought a slight larger house and airbnb 2 rooms which has a Jack and Jill bathroom and all the money from there goes into overpaying the mortgage.

The one thing we have done which is not advisable if you want to grow property quickly is that we have left all the mortgages on repayments rather than interest only cos we have also kept our full time jobs as we have no need for the income from the properties to live on now. Our plan is to semi- retire when at 50. That's 7 years away so we're making tracks to achieve that and that involves having at least 2 houses mortgage free.

We're now partnering with another couple - we've joined resources, bought a house sitting on a big plot of land and will demolish that to build 5 houses next year. We've got to the point where we can't service a new mortgage anymore because even if the house pays for itself, banks will still take your incomes into consideration for servicing so a joint venture is the way forward for now.

You do need a deposit and a reasonable credit rating - the higher the deposit, the better the interest rate and the better your credit rating, the better the interest rates as well. You also need to have a good handle on your spending as banks will usually go through your statements with a fine toothcomb. Clean your account up for 3 months before applying for a mortgage. Pay down any unsecured credit, stay away from pay day loans etc.

I have a spreadsheet for calculating if the property works financially or not. For a house you want to live in, most banks will consider 3x income and some even 4x income. Then stress test at around 5% even if interest rates are currently very very low. For a BTL mortgage, you need at least a 20% deposit, a minimum income of 25k (2 banks don't bother about minimum income but their interest rates are quite high), they expect the rent to be 125% of the mortgage payments (interest only so there's lots of wriggle room) but you need to factor solicitor costs, stamp duty of 3%-15% (compulsory on all second homes and 0% on first homes under 125k), mortgage fees, broker fees (you can get a free broker though) and survey fees.

So for a purchase of 100k, you need a 20k deposit, 3k for stamp duty, 600 ish for solicitor, 250/300 for survey costs, usually about 999 for the mortgage application fee and the rent has to be at least 375 a month for a BTL.

For your own home, a 10% deposit will do and with the new government schemes, you can even use a 5% deposit. Plus the additional costs of an owner occupier home is lower - solicitor, stamp duty if buying above 125k are the only extra costs.

Thanks to that first mortgage broker who opened our eyes to the possibilities of what we could do and achieve and for guiding us all the way through and pushing us forward even when we were hesitant.

Hope that helps.

7 Likes 4 Shares |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 2:15pm On Sep 28, 2021 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 2:15pm On Sep 28, 2021 |

Thank you. Will give them a call ASAP. TheGuyFromHR:

Try One Call Insurance. |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 2:14pm On Sep 28, 2021 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 2:14pm On Sep 28, 2021 |

Thank you. They are the ones that are actually recommending the black box. Mimzyy:

Try Admiral.

|

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 2:14pm On Sep 28, 2021 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 2:14pm On Sep 28, 2021 |

I will manage the miles religiously.  umarwy:

Just take not that if you exceed the 1k they will know and adjust your premium accordingly, + admin charges.

|

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 3:40am On Sep 28, 2021 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 3:40am On Sep 28, 2021 |

wallg123:

Add your wife on the insurance so both of you can drive the car without fear of breaking the law. Cuz it will cost you more if madam is tempted to drive the car uninsured and get into trouble with the law. …

Also get in mind that you still have to pass the UK driving test both (theory & practicals) before the expiration of your 1yr international drivers license for you to continue driving. If not you will go back to square 1. Thanks for the advice. Will add and see how it affects the premium. I won't even wait up to 1 year sef. Once provisional is obtained, it's sharp sharp for all the tests. I understand there is high demand at the moment in even securing instructors to aid with the practical test. |

Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 3:37am On Sep 28, 2021 Travel / Re: Living In The Uk-life Of An Immigrant (part 2) by DoubleN(m): 3:37am On Sep 28, 2021 |

dustydee:

With that blackbox and depending on how your driving is, your insurance premium may increase. So for example, if you overspeed, blackbox will take note of it and tell insurer that you are a "risk" and then insurer could then adjust your premium accordingly. Thanks, I understand it's a kind of mitigating factor for them giving that one does not yet have UK driving experience. I'll look for how to avoid it then. Any recommendations on insurers will help. Thank you. |

Daddy is capable!

Daddy is capable!