| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Nobody: 6:14am On Sep 10, 2021 |

Hmm |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by gambia(m): 6:15am On Sep 10, 2021 |

This country has no direction at all. |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by forayfleo(m): 6:15am On Sep 10, 2021 |

I will always stand with my Governors on this moves Sanwo and Wike we are with you. 5 Likes 1 Share |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by israelmao(m): 6:17am On Sep 10, 2021 |

Let Baba leave so that this country can be restructured. 4 Likes |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by EdiskyHarry: 6:17am On Sep 10, 2021 |

Nigeria would have been a better place if not the northern part of Nigeria, this is nothing but the Truth. 4 Likes |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by sotomayor: 6:18am On Sep 10, 2021 |

Ibkhaleel01:

Unjust hatred for people will consume you. We see the obvious in the very hilarious VAT battle that is happening. I just dey observe.

Many supported Governor Wike's decision to be collecting VAT because they say "the North contributes nothing and they want to be collecting". But if they know their facts they will understand that they are digging a hole for themselves. They will realize it is all of us that will suffer when States collect VAT.

First of all, after Lagos, the next place that contributes the highest VAT (20%) is the FCT which is in the North. Yes this is followed by Rivers at 6% but Kano is next with 5% and this is followed by Kaduna. So no, it is not as you have been misinformed. The only special case is Lagos. So your State will suffer. Even Lagos will suffer with much more people migrating there. When resources are shared among Federating Units, it is shallow to always think it is injustice. Give Lagos 100% of it's VAT, Mukaila from Sokoto, Chinedu from Aba and even Lasisi from Osun will all migrate there. So what is the point again?

Secondly, in the federal system, companies with less than 25 million were not VATable. You think you are doing Northerners but your company will become VATable once Wike's law is replicated in your State. Why do you think commercially massive States like Abia and Anambra do not top the list of VAT contributors? Because those boys in the market were not exactly VATable, wait until what you are blindly supporting takes effect. VAT will be collected like motor park tickets. Then you will see where hate has led you.

Third, people will most likely pay VAT twice across different states with different laws because Wike does not know what is input and output VAT and did not listen to Nojeem Olasubomi Yusuf and others who politely asked him about it.

Some have even termed Wike the leader of restructuring in Nigeria. A gullible people in search of heroes. Being used and misled by every opportunist. Stop allowing yourself to be used by politicians to settle their personal scores while they tell you they are fighting for your interest.

You need to first know what your interest is to know who is actually fighting for or against it How is Abuja north?? ? what's wrong with you guys, don't you look at your map, there is nothing like north central.. It's simply middle belt. North central is a word coined by the north to steal more land. 7 Likes 2 Shares |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by timefarm(m): 6:18am On Sep 10, 2021 |

Ibkhaleel01:

You know this VAT thing is like a basta*d child confidently demanding for DNA test in protest against sharing the inheritance with another child he or she considers to be undeserving.

If every State stands alone, you will realise that your bragging is on thin air. We have clearly seen that Lagos, Abuja, Rivers, Kano lead the pack.

If we carry out a simple VAT fertility you will see that your State is VAT impotent....and your much touted beer VAT are blank shots.

Na just gum body dey make una think say your state dey fertile. That is what is needed. If any state or your state wants money, go and work. Beer is bad, yes no problem but taking the money from beer to build your religious house, is that not haram? 18 Likes 2 Shares |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Ballmer: 6:19am On Sep 10, 2021 |

Lame excuse to continue the servitude of working monkeys while baboons feast. Let everyone move to a working state so we can disolve banditry inflicted state for prosperous ones to take over that is another way to look at things instead of financing a cycles of redundancy, inefficiency n foolishness in the name of whatever disguise you are promoting that makes no single sense in the 21st century. Imagine Lagos as at 2021 labouring to build seaport airport Lekki export zone Eko atlantic etc n so many others n in your delusion a Zamfara with an academy churning out bandits in the same 21st century deserves a cut of that hard work ?! I am not sorry to say this but individuals such as you deserve to be beheaded in broad daylight to serve as detterant to others plagued with same foolish sense of entitlement n reasoning. Ibkhaleel01:

Unjust hatred for people will consume you. We see the obvious in the very hilarious VAT battle that is happening. I just dey observe.

Many supported Governor Wike's decision to be collecting VAT because they say "the North contributes nothing and they want to be collecting". But if they know their facts they will understand that they are digging a hole for themselves. They will realize it is all of us that will suffer when States collect VAT.

First of all, after Lagos, the next place that contributes the highest VAT (20%) is the FCT which is in the North. Yes this is followed by Rivers at 6% but Kano is next with 5% and this is followed by Kaduna. So no, it is not as you have been misinformed. The only special case is Lagos. So your State will suffer. Even Lagos will suffer with much more people migrating there. When resources are shared among Federating Units, it is shallow to always think it is injustice. Give Lagos 100% of it's VAT, Mukaila from Sokoto, Chinedu from Aba and even Lasisi from Osun will all migrate there. So what is the point again?

Secondly, in the federal system, companies with less than 25 million were not VATable. You think you are doing Northerners but your company will become VATable once Wike's law is replicated in your State. Why do you think commercially massive States like Abia and Anambra do not top the list of VAT contributors? Because those boys in the market were not exactly VATable, wait until what you are blindly supporting takes effect. VAT will be collected like motor park tickets. Then you will see where hate has led you.

Third, people will most likely pay VAT twice across different states with different laws because Wike does not know what is input and output VAT and did not listen to Nojeem Olasubomi Yusuf and others who politely asked him about it.

Some have even termed Wike the leader of restructuring in Nigeria. A gullible people in search of heroes. Being used and misled by every opportunist. Stop allowing yourself to be used by politicians to settle their personal scores while they tell you they are fighting for your interest.

You need to first know what your interest is to know who is actually fighting for or against it 23 Likes 3 Shares |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by SmartPolician: 6:21am On Sep 10, 2021 |

Buhari has destroyed Nigeria's delicate unity - no thanks to his parochialism, unguarded utterances, and brazen stvpidity. Now, everyone is exploring ways of withdrawing from the manipulations of the centre. 8 Likes 2 Shares |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by oyatz(m): 6:25am On Sep 10, 2021 |

Ibkhaleel01:

When you see the Southern governors, politicians, elders, elites, traditional rulers, cashivists, freedom fighters fighting for their private pockets & their hate doped retards on social media especially those from the Niger Delta talk about restructuring & resource control, you will think they genuinely love Nigeria & their region.

Sure No!

What they want is more money, more power & more control over the money without no one querying them.

Those governors, politicians, elders, elites, traditional rulers, cashivists & freedom fighters fighting for their private pockets that swallowed the 6 trillion naira in NDDC over the past 18 years meant to develop the Niger Delta in addition to squandering trillions of naira & billions of dollars that accrued to Niger Delta from federal statutory allocations, 13% derivation funds, ecological funds, Ministry of Niger Delta funds, taxes, royalties rents etc with only poverty, deprivation & backwardness to show for it every 4 years are the same governors, politicians, elders, elites, cashivists & freedom fighters fighting for their private pockets that will manage a restructured Niger Delta controlling all the resources there.

If they truly want restructuring, they would have welcomed & implemented by now Buhari's executive orders granting financial autonomy to local governments, state houses of assembly & state judiciaries instead of rejecting it & going to court to challenge the orders.

Those that are fighting for restructuring don't want independent local governments, state houses of assemby & state judiciaries because these are arms & organs of government, that if truly independent, will effectively check the excesses of the state governors & those embezzling the resources of the states in the region.

Those governors, politicians, elders, elites, traditional rulers, cashivists & freedom fighters fighting for their private pockets that want resource control are not ready to invest the billions of naira & dollars they stole from Nigeria & Niger Delta in prospecting for oil & building the massive oil infrastructures required to explore, manage, store & transport crude oil & gas.

That's why at the expiration of the oil leases held by some Nigerians & foreign companies, Buhari refused to renew them but rather passed the opportunity to own them to states so that they can control the resources & use the huge profits to better the lot of citizens of their states.

Many states in the Niger Delta & their governors, politicians, elites, elders, cashivists, freedom fighters fighting for their private pockets rejected the opportunity because it involves huge investments & rather opted to sell this opportunity of thier states owning these oil blocks to private individuals & firms for immediate cash from 10% commisions, kickbacks & convenient taxes.

They don't want the restructuring & resources control that will give the states more responsibilities, that will benefit their people or promote transparency, growth & development in their region. What they want is the restructuring that will give them more powers, more control & more money to squander.

That's why they talk about devolution of powers to states that will allow the governors absolute powers to make decisions on a lot more wide range of portfolios presently under the purview of the federal government.

That's why they are appropriating to themselves through their zombified state assemblies the powers to collect all taxes in their states including VAT.

That's why they are rejecting financial autonomy to local governments, state assemblies & state judiciary so that they can have the additional local government billions of naira to squander, pass any selfish law they want & obtain any court order they want against their opponents while eliminating scrutiny from the same institutions constitutionally empowered to query & sanction them.

That's why they are bent on having state police to intimidate, brutalize & put away any opponent or dissenting voice.

Sadly, the citizens of these states have their brains & minds so wickedly twisted by the ethno-religious hate opium they are doped daily & can no more comprehend who their enemies are.

A pathetic shame indeed!! This lengthly epistle is very irrelevant to the subject matter under discussion. Let each State collect VAT in their State. This will be a win-win for all. There's no State that has nothing to tax. 23 Likes 2 Shares |

|

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Nobody: 6:27am On Sep 10, 2021 |

Thank God. Now, when FG and NATIONAL assembly realise they can just put in law which favors them only, and they know Nigerians are vexing, Nigeria will start getting better.

The way forward is to cut off Abuja. That it. Cut it off gradually. Later Abuja will be the one begging states. And before you know it, Abuja is a goner. Enough is enough. 3 Likes 1 Share |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by blackpanda: 6:28am On Sep 10, 2021 |

Goldencheese:

This culture of monkey dey work baboon dey chop will soon be over. Why would a state like Lagos State generate N41 billion and be given N14 billion from it? How can such a paltry amount meet the development needs of the state? Same for Rivers; they generate N15 billion and end up with N4 billion. It is high time this injustice was thrown into the Atlantic ocean. You don't want people to secede because it is extinction. You don't want to restructure. You don't want to practise fiscal federalism. You don't want to stop open grazing. You ban alcoholic drinks from the south in Kano by your religious police, yet you keep pouting one Nigeria uppandan when there is injustice and lack of accountability everywhere. Buhari is hastening Nigeria's dismemberment and anyone who thinks otherwise is playing with self-delusion.

The south is the resource base of Nigeria but it has remained chained by the North. The time to break free or renegotiate this fake, one-sided, lop-sided, north-centric and Fulani-dominated union is now! Is Lagos the only state in the south? What of Oyo, osun, imo, enugu, abia etc. What did they generate  You guys always reason everything based on tribalism. There are only 5syates actually contributing to vat. 2 of them are in the north. |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Proflere: 6:29am On Sep 10, 2021 |

If you say people clamouring for state to collect VAT are gullible because if all this your baseless reasons, then you are more gullible. Talking about input VAT and output VAT, lol... Let the state laws take effect first and see for yourself. Also companies under 25m threshold won't be affected even if asked to pay VAT, in the first place the VAT is not your personal money, it is a tax that is passed to the consumers and if you already charge it, you must remit. Ibkhaleel01:

Unjust hatred for people will consume you. We see the obvious in the very hilarious VAT battle that is happening. I just dey observe.

Many supported Governor Wike's decision to be collecting VAT because they say "the North contributes nothing and they want to be collecting". But if they know their facts they will understand that they are digging a hole for themselves. They will realize it is all of us that will suffer when States collect VAT.

First of all, after Lagos, the next place that contributes the highest VAT (20%) is the FCT which is in the North. Yes this is followed by Rivers at 6% but Kano is next with 5% and this is followed by Kaduna. So no, it is not as you have been misinformed. The only special case is Lagos. So your State will suffer. Even Lagos will suffer with much more people migrating there. When resources are shared among Federating Units, it is shallow to always think it is injustice. Give Lagos 100% of it's VAT, Mukaila from Sokoto, Chinedu from Aba and even Lasisi from Osun will all migrate there. So what is the point again?

Secondly, in the federal system, companies with less than 25 million were not VATable. You think you are doing Northerners but your company will become VATable once Wike's law is replicated in your State. Why do you think commercially massive States like Abia and Anambra do not top the list of VAT contributors? Because those boys in the market were not exactly VATable, wait until what you are blindly supporting takes effect. VAT will be collected like motor park tickets. Then you will see where hate has led you.

Third, people will most likely pay VAT twice across different states with different laws because Wike does not know what is input and output VAT and did not listen to Nojeem Olasubomi Yusuf and others who politely asked him about it.

Some have even termed Wike the leader of restructuring in Nigeria. A gullible people in search of heroes. Being used and misled by every opportunist. Stop allowing yourself to be used by politicians to settle their personal scores while they tell you they are fighting for your interest.

You need to first know what your interest is to know who is actually fighting for or against it 5 Likes 1 Share |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by timefarm(m): 6:29am On Sep 10, 2021 |

Ibkhaleel01:

Unjust hatred for people will consume you. We see the obvious in the very hilarious VAT battle that is happening. I just dey observe.

Many supported Governor Wike's decision to be collecting VAT because they say "the North contributes nothing and they want to be collecting". But if they know their facts they will understand that they are digging a hole for themselves. They will realize it is all of us that will suffer when States collect VAT.

First of all, after Lagos, the next place that contributes the highest VAT (20%) is the FCT which is in the North. Yes this is followed by Rivers at 6% but Kano is next with 5% and this is followed by Kaduna. So no, it is not as you have been misinformed. The only special case is Lagos. So your State will suffer. Even Lagos will suffer with much more people migrating there. When resources are shared among Federating Units, it is shallow to always think it is injustice. Give Lagos 100% of it's VAT, Mukaila from Sokoto, Chinedu from Aba and even Lasisi from Osun will all migrate there. So what is the point again?

Secondly, in the federal system, companies with less than 25 million were not VATable. You think you are doing Northerners but your company will become VATable once Wike's law is replicated in your State. Why do you think commercially massive States like Abia and Anambra do not top the list of VAT contributors? Because those boys in the market were not exactly VATable, wait until what you are blindly supporting takes effect. VAT will be collected like motor park tickets. Then you will see where hate has led you.

Third, people will most likely pay VAT twice across different states with different laws because Wike does not know what is input and output VAT and did not listen to Nojeem Olasubomi Yusuf and others who politely asked him about it.

Some have even termed Wike the leader of restructuring in Nigeria. A gullible people in search of heroes. Being used and misled by every opportunist. Stop allowing yourself to be used by politicians to settle their personal scores while they tell you they are fighting for your interest.

You need to first know what your interest is to know who is actually fighting for or against it Go and be enjoying your 5% oooo. Kano produce 2.8billion while PH produce 47 billion, you said pH only produce 6% whike Kano produce 5%. I like your arithemetic. This approach will make everyone to sit up. It is not a antiNorth policy. This is similar to when each regions are responsible for their wellbeing then, everyone was dutiful in the whole country before oil money came and everyone just sit down and collect money. But some people have been reaping where they did not so, so it is painful free money is going. You will get over it later. Make you people stand on your feet small. 7 Likes 1 Share |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by blackpanda: 6:30am On Sep 10, 2021 |

Pls correct the title to read "PDP LAWYERS"  1 Like |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Ballmer: 6:30am On Sep 10, 2021 |

Imagine the clown stating Abuja will be the second highest earner on the list but no able to state where any is against Abuja keep it VAT to itself. I just do not understand, why should Abuja be sharing it VAT to Zamfara ? Zamfara n Bornu should start taxing bandits n boko haram to shore up their on VAT generation now. Na where person de work him de chop. oyatz:

This lengthly epistle is very irrelevant to the subject matter under discussion.

Let each State collect VAT in their State.

This will be a win-win for all.

There's no State that has nothing to tax. 5 Likes 1 Share |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by malel1: 6:30am On Sep 10, 2021 |

Ibkhaleel01:

Unjust hatred for people will consume you. We see the obvious in the very hilarious VAT battle that is happening. I just dey observe.

Many supported Governor Wike's decision to be collecting VAT because they say "the North contributes nothing and they want to be collecting". But if they know their facts they will understand that they are digging a hole for themselves. They will realize it is all of us that will suffer when States collect VAT.

First of all, after Lagos, the next place that contributes the highest VAT (20%) is the FCT which is in the North. Yes this is followed by Rivers at 6% but Kano is next with 5% and this is followed by Kaduna. So no, it is not as you have been misinformed. The only special case is Lagos. So your State will suffer. Even Lagos will suffer with much more people migrating there. When resources are shared among Federating Units, it is shallow to always think it is injustice. Give Lagos 100% of it's VAT, Mukaila from Sokoto, Chinedu from Aba and even Lasisi from Osun will all migrate there. So what is the point again?

Secondly, in the federal system, companies with less than 25 million were not VATable. You think you are doing Northerners but your company will become VATable once Wike's law is replicated in your State. Why do you think commercially massive States like Abia and Anambra do not top the list of VAT contributors? Because those boys in the market were not exactly VATable, wait until what you are blindly supporting takes effect. VAT will be collected like motor park tickets. Then you will see where hate has led you.

Third, people will most likely pay VAT twice across different states with different laws because Wike does not know what is input and output VAT and did not listen to Nojeem Olasubomi Yusuf and others who politely asked him about it.

Some have even termed Wike the leader of restructuring in Nigeria. A gullible people in search of heroes. Being used and misled by every opportunist. Stop allowing yourself to be used by politicians to settle their personal scores while they tell you they are fighting for your interest.

You need to first know what your interest is to know who is actually fighting for or against it Trash 7 Likes |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Thunderfayayou: 6:31am On Sep 10, 2021 |

3 Likes |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by kindlyheart: 6:33am On Sep 10, 2021 |

very nice. I hate laziness, every state government should start thinking outside the box to improve it's economy. I believe every Nigerian state is richly blessed to Carter for herself. 3 Likes |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by phemmie06(m): 6:34am On Sep 10, 2021 |

Wike this table you're shaking....

Tell those supporting FIRS to stop that even Sanwo Olú whose father tolerated all these odds agreed with VAT for state so which one be yours. Let all states start thinking 2 Likes |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by htdot: 6:34am On Sep 10, 2021 |

Ibkhaleel01:

Unjust hatred for people will consume you. We see the obvious in the very hilarious VAT battle that is happening. I just dey observe.

Many supported Governor Wike's decision to be collecting VAT because they say "the North contributes nothing and they want to be collecting". But if they know their facts they will understand that they are digging a hole for themselves. They will realize it is all of us that will suffer when States collect VAT.

First of all, after Lagos, the next place that contributes the highest VAT (20%) is the FCT which is in the North. Yes this is followed by Rivers at 6% but Kano is next with 5% and this is followed by Kaduna. So no, it is not as you have been misinformed. The only special case is Lagos. So your State will suffer. Even Lagos will suffer with much more people migrating there. When resources are shared among Federating Units, it is shallow to always think it is injustice. Give Lagos 100% of it's VAT, Mukaila from Sokoto, Chinedu from Aba and even Lasisi from Osun will all migrate there. So what is the point again?

Secondly, in the federal system, companies with less than 25 million were not VATable. You think you are doing Northerners but your company will become VATable once Wike's law is replicated in your State. Why do you think commercially massive States like Abia and Anambra do not top the list of VAT contributors? Because those boys in the market were not exactly VATable, wait until what you are blindly supporting takes effect. VAT will be collected like motor park tickets. Then you will see where hate has led you.

Third, people will most likely pay VAT twice across different states with different laws because Wike does not know what is input and output VAT and did not listen to Nojeem Olasubomi Yusuf and others who politely asked him about it.

Some have even termed Wike the leader of restructuring in Nigeria. A gullible people in search of heroes. Being used and misled by every opportunist. Stop allowing yourself to be used by politicians to settle their personal scores while they tell you they are fighting for your interest.

You need to first know what your interest is to know who is actually fighting for or against it The VAT of lagos is 41b, that of rivers is 15 billion while delta is about 4b and kanu 2.5b. 6 Likes |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Ibkhaleel01: 6:35am On Sep 10, 2021 |

htdot:

The VAT of lagos is 41b, that of rivers is 15 billion while delta is about 4b and kanu 2.5b. Must you lie?

|

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Resurgent2016: 6:37am On Sep 10, 2021 |

Ibkhaleel01:

When you see the Southern governors, politicians, elders, elites, traditional rulers, cashivists, freedom fighters fighting for their private pockets & their hate doped retards on social media especially those from the Niger Delta talk about restructuring & resource control, you will think they genuinely love Nigeria & their region......

. Lamentations of a zombie. So its the federal governemt under buhari that been prudent and transparent with the massive borrowings and other inflows. With the way nigeria looks right now can any right thinking person argue that the trillions buhari has been collecting was well spent? There is as at least the same (probably more) corruption in d centre as the states. Governors are more accountable to their people than a fg that can simply dismiss them as 5% or irrelevant agitations. Let the state handle their resources and deal with the people than a distant fg clearly incompetent and equally corrupt 13 Likes 1 Share |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Nobody: 6:38am On Sep 10, 2021 |

supportnija:

SAN , there is going to be amendment to constitution , now the states are going to collect VAT, state should contruct road in their state and don't wait for federal government, Education(Higher institution ) should be solely for state, Health care only be exclusively right of the state.. state police either. Telling me they should not be amendment to constitution is a lie. As it is suppose to be. Let states fed for themselves. What exactly is federal government producing? Is there production not also Coming from those states government? Maybe na governor go dey feed president very soon  2 Likes 1 Share |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by SamuelAnyawu(m): 6:38am On Sep 10, 2021 |

supportnija:

SAN , there is going to be amendment to constitution , now the states are going to collect VAT, state should contruct road in their state and don't wait for federal government, Education(Higher institution ) should be solely for state, Health care only be exclusively right of the state.. state police either. Telling me they should not be amendment to constitution is a lie. They should ensure even company taxes and petroleum tax should be collected by states. It’s now time for every state to move on with its personal development. To thy tent everyone 6 Likes 2 Shares |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by iampeterben(m): 6:39am On Sep 10, 2021 |

All of this seem like scam to me |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Nobody: 6:40am On Sep 10, 2021 |

Ibkhaleel01:

Must you lie? So why then are the northerners more adamant about this? Shouldn’t they be happy?   9 Likes 1 Share |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by oyatz(m): 6:42am On Sep 10, 2021 |

Ibkhaleel01:

Unjust hatred for people will consume you. We see the obvious in the very hilarious VAT battle that is happening. I just dey observe.

Many supported Governor Wike's decision to be collecting VAT because they say "the North contributes nothing and they want to be collecting". But if they know their facts they will understand that they are digging a hole for themselves. They will realize it is all of us that will suffer when States collect VAT.

First of all, after Lagos, the next place that contributes the highest VAT (20%) is the FCT which is in the North. Yes this is followed by Rivers at 6% but Kano is next with 5% and this is followed by Kaduna. So no, it is not as you have been misinformed. The only special case is Lagos. So your State will suffer. Even Lagos will suffer with much more people migrating there. When resources are shared among Federating Units, it is shallow to always think it is injustice. Give Lagos 100% of it's VAT, Mukaila from Sokoto, Chinedu from Aba and even Lasisi from Osun will all migrate there. So what is the point again?

Secondly, in the federal system, companies with less than 25 million were not VATable. You think you are doing Northerners but your company will become VATable once Wike's law is replicated in your State. Why do you think commercially massive States like Abia and Anambra do not top the list of VAT contributors? Because those boys in the market were not exactly VATable, wait until what you are blindly supporting takes effect. VAT will be collected like motor park tickets. Then you will see where hate has led you.

Third, people will most likely pay VAT twice across different states with different laws because Wike does not know what is input and output VAT and did not listen to Nojeem Olasubomi Yusuf and others who politely asked him about it.

Some have even termed Wike the leader of restructuring in Nigeria. A gullible people in search of heroes. Being used and misled by every opportunist. Stop allowing yourself to be used by politicians to settle their personal scores while they tell you they are fighting for your interest.

You need to first know what your interest is to know who is actually fighting for or against it Change is inevitable in any human society. It's very wrong to assume that every proposed change in Nigeria is inspired by hatred for the North and the Northerners must resist it in order to maintain the status quo. As we decentralize the collection of VAT, certain problems will crop up and we will learn how to over come them. The assumption that more people will flock to Lagos because of more revenues is actually wrong. On the contrary, the new arrangements will force POSITIVE economic reforms in other presently docile States. For instance, Zamfara and Katsina States with dwindling resources look inwards and start massive investments in their agricultural potentials with the aims of generating revenues through Taxes collected on Cattles, Tomatoes, Rice, Onions, Beans etc Instead of agitating for regular payments for Bandits (codedly put out as ammnesty for Bandits), these young men destroying lives and properties will be economically engaged as revenues collectors, modern farmers, Agricultural extension workers , produce exporters etc. In Osun and Ondo States, there will be more investment in Cocoa,Timber , Kolanuts, cassava and Poultry businesses. Ekiti, Kogi and Ondo have massive rocks that can serve as raw materials for ceramics, glass and cement industries. There's no State that can't survive on it's own if they are force to put on their thinking caps. 12 Likes |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Ynix(m): 6:43am On Sep 10, 2021 |

Ibkhaleel01:

You know this VAT thing is like a basta*d child confidently demanding for DNA test in protest against sharing the inheritance with another child he or she considers to be undeserving.

If every State stands alone, you will realise that your bragging is on thin air. We have clearly seen that Lagos, Abuja, Rivers, Kano lead the pack.

If we carry out a simple VAT fertility you will see that your State is VAT impotent....and your much touted beer VAT are blank shots.

Na just gum body dey make una think say your state dey fertile. You are right, moreover it will make them begin to think outside the box and industrialize their States 3 Likes |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by BeardedMeat(m): 6:44am On Sep 10, 2021 |

Ibkhaleel01:

You know this VAT thing is like a basta*d child confidently demanding for DNA test in protest against sharing the inheritance with another child he or she considers to be undeserving.

If every State stands alone, you will realise that your bragging is on thin air. We have clearly seen that Lagos, Abuja, Rivers, Kano lead the pack.

If we carry out a simple VAT fertility you will see that your State is VAT impotent....and your much touted beer VAT are blank shots.

Na just gum body dey make una think say your state dey fertile. Take Kano out of reckoning when talking about VAT. What they contribute is pittance compared to what they take in return. Their population is only good for election rigging, not revenue generation. Blank shots or not, if you don't drink beer (publicly), and prohibit sale in your state, is it fair to eat out of revenue so generated? VAT from beer is just a layman example of the anornaly, there are others in thousands. This is a good move from the southern governors. 10 Likes 2 Shares |

| Re: VAT Amendments: NBA, SANs Caution NASS, Fault FIRS Planned Revenue Court by Ibkhaleel01: 6:45am On Sep 10, 2021 |

maynia:

So why then are the northerners more adamant about this? Shouldn’t they be happy?   Bitterness,hatred,and frustration is your major reasons for existence. |

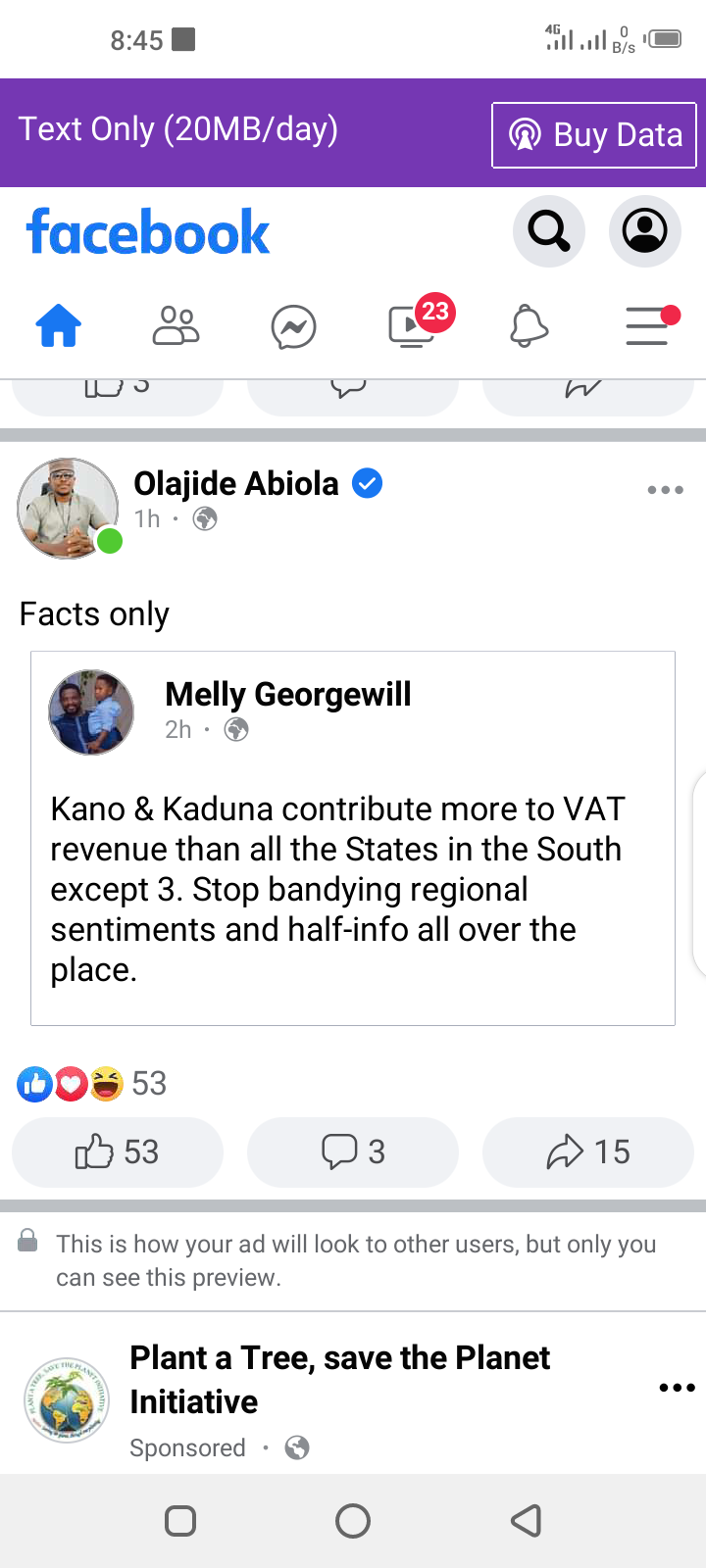

You guys always reason everything based on tribalism. There are only 5syates actually contributing to vat. 2 of them are in the north.

You guys always reason everything based on tribalism. There are only 5syates actually contributing to vat. 2 of them are in the north.