| Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by iwaeda: 7:47am On Dec 11, 2023 |

The manufacturing sector suffered a 400 percent increase in net foreign exchange loss to N466 billion in nine months ending September, reflecting the severe impact of the foreign exchange (Forex) market regime.

Sector operators said the current forex situation has compounded the pressures emanating from the removal of oil subsidy, Russia/ Ukraine war among other adverse developments.

The operators said the sector now bleeds from multiple points as a result of exchange rate revaluation losses.

Consequently, information contained in the financial reports of the top 17 manufacturing companies listed on the Nigerian Exchange Limited, NGX , indicated that while their gross earnings rose as they increase the prices of their products, their profits crashed as a result of the multiple pressure points eroding their financial stability.

Data sourced by Financial Vanguard from the financials of the big manufacturing firms on the Exchange showed a net foreign exchange loss of N466.02 billion in the nine months ended September 2023 (9M’23) representing an overwhelming increase of almost 400% from N93.219 billion loss recorded in 9M’22.

The data showed that while the combined gross earnings of the firms grew by 23.4% to N4.4 trillion in 9M’23 as against N3.6 trillion in 9M’22, the companies recorded a 24.6 percent decline in combined Profit Before Tax, PBT, to N505.148 billion in 9M’23 as against N670.089 billion in 9M’22.

Cost of consumer goods

The trend is reflected in the increased cost of producing consumer goods, which are mostly essential commodities used regularly by households.

These include foods and beverages, toiletries, over-the-counter medicines, cleaning and laundry products, plastic goods, and personal care products, among others.

Financial Vanguard findings reveal that while the companies increased the prices of their products in response to the inflationary pressures on their operating cost, this has resulted in low volume of patronage from the consumers whose income has equally been eroded by inflation.

The situation has now combined with losses they recorded in foreign exchange revaluation just as the higher exchange rate also increased the cost of foreign input forcing them to either close some production lines or scale down output below break-even points.

Data from the National Bureau of Statistics (NBS) showed that the inflation rate in Nigeria closed 9M’23 at 26.72%. The figure has since risen to 27.3 %percent as at the month of October 2023 and is projected to rise further this month, possibly sustained to year end.

Also, the Naira value against the US Dollar which stood at N448.04/US$ at the beginning of the year (2023) crashed to N832.32/US$ as at end 9M’23 following the Central Bank of Nigeria (CBN) foreign exchange reforms in mid-June.

Foreign investors in manufacturing pulling out

The protracted foreign exchange scarcity which affected Cadbury Nigeria on raw material imports, has forced its management to pass on costs to consumers by hiking prices.

The same goes for GlaxoSmithKline, GSK, Nigeria. But this has already proved unsustainable, forcing the company to announce plans by its parent company, GSK UK Group, to end manufacturing operations in Nigeria. The Company said further that it would explore a third-party direct distribution model for its pharmaceutical products.

Unilever Nigeria is another multinational consumer goods company discontinuing the manufacturing of its homecare and skin-cleansing brands.

Just last week, Procter & Gamble, P&G, an American multinational involved in manufacturing of fast moving consumer goods (FMCGs), announced its plan to discontinue their manufacturing operations in Nigeria due to the harsh operating environment.

Blue chips bleeding

The blue chip manufacturing companies, most of which are multinationals suffered more from forex revaluation losses.

Leading the pack in this adversity is Nestle Nigeria which lost N127.5billion to forex revaluation loss, thereby eroding its profitability. Consequently, the company recorded loss before tax of N56.7 billion as against profit of N58.4 billion in 9M’22. This is despite the company’s 18.9% increase in gross earnings to N396.6 billion from N333.5 billion in 9M’22.

Dangote Cement recorded a huge forex revaluation loss of N99billion which seems to have dampened what would have been a supper profit in the 9M’23. It however made a surprising 20.5% rise in profit to N404.9billion as against N335.900 billion in 9M’22, at the backdrop of a rise in gross earnings to N1.5 trillion in 9M’23 from N1.2 trillion in 9M’22,

A forex revaluation loss amounting to N86.8 billion eroded Nigerian Breweries’ profitability as giant beverage multinational declared a total loss amounting N78.2 billion during the period despite a modest 2.1% growth in gross earnings to N401.7 billion from N393.3 billion.

Another brewer, International Breweries was hit with N39.9 billion forex revaluation loss which escalated the company’s operating losses before tax to N43.5 billion as against N2.8 billion it recorded last year. This is despite the 14.6% increase in gross earnings to N183.8 billion from N160.4 billion in 9M’22.

BUA Foods reported a forex revaluation loss of N33.3billion which moderated what would have become a super profit growth at 50% to N111.4bilion from N74.3billion in 9M’22, at the backdrop of 81.0% increase in gross earnings to N524.4billion as against N289.8billion in 9M’22.

Similarly, its sister company, BUA Cement posting N24.8 billion in forex revaluation loss which dampened its profitability with a 3.4% decline N85.7 billion from N88.8 billion despite the rise in gross earnings to N335.9billion as against N262.6billion in 9M’22.

Other significant forex revaluation losses were recorded by Cadbury Nigeria which reported N20.7billion revaluation loss which eroded its profit forcing the firm to declare a loss of N10.2 billion as against a profit of N4.0 billion it recorded in 9M’22. This is despite the 39.2% increase in gross earnings to N59.2 billion from N42.5 billion in 9M’22.

GloxoSmithKline seems to be showing heavy bleeding on all fronts. It posted a forex revaluation loss amounting N11.3 billion and its PBT declined 0.8% to N0.722 billion from N0.716 billion just as gross earnings went down massively to N10.9 billion from N20.4billion,

Similarly Lafarge Cement reported forex revaluation loss amounting to N9.4 billion. But the firm also reported increase in gross earnings at N289.1 billion as against N269.9 billion in 9M’22 , with PBT growing by 13.4% to N61.2 billion from N53.9 billion.

Unilever Nigeria recorded forex revaluation loss of N2.9billion as the company’s profitability was making a rebound by 937.4% to N4.9billion from N0.5 billion on the backdrop of a rise in gross earnings to N81.6billion from N64.8billion in 9M’22,

Vitafoam recorded a forex revaluation loss of N3.8billion which contributed to the 14.4% profit decline to N6.2billion from N7.2billion in 9M’2 despite a rise in gross earnings to N52.8billion from N46.3billion in 9M’22,

Okumu Oil also recorded forex revaluation loss amounting to N2.9billion. But its PBT grew by18.7% to N29.2billion from N24.6billion in 9M’22 at the backdrop of a rise in gross earnings.

Guinness Nigeria reported that its profit went down 5.6% to N3.8billion from N4.04 billion at the backdrop of N1.9billion forex revaluation loss, despite growth in gross earnings at N59.5 billion as against N52.849 billion in 9M’22.

Notore Chemical recorded a forex revaluation loss of N1.8billion which added to its massive rise in losses amounting N66.2billion as against N0.95billion loss in 9M’22. The bad result also came with a massive decline in gross earnings to N12.7billion as against N32.9billion in 9M’22, and recorded

Nascon Allied reported a slim forex revaluation loss of N.6million and its profit grew massively by 282.0% to N16.3billion from N4.3billion in 9M’22 at the backdrop 45.6% increase in gross earnings to N59.1billion as against N40.6billion in 9M’22.

One of the surprising results is Dangote Sugar which did not record any forex loss, and its gross earnings increased by 7.4% to N309.713 billion from N288.320 billion in 9M’22, but it ended up posting a loss before tax of N41.3billion as against a profit of N36.3billion in 9M’22.

Analysts /Experts react

Reacting to this development, Tajudeen Olayinka, who is the CEO, Wyoming Capital and Partners said: “A long the local foreign exchange market continue to react to the vagaries of demand and supply side imbalances, so long economic agents with net dollar liabilities will continue to be impacted negatively by depreciation and foreign exchange losses.

“This was responsible for the huge losses suffered by those manufacturing companies you mentioned. And it will remain so until the affected companies are able to put measures in place to recover losses through necessary hedging and repricing of earning assets.”

On the implication of these losses, he said: “ The implication of these losses to the companies and economy in general is a continued elevation in inflation and further deceleration in output growth.”

Also reacting, David Adonri, the Executive Vice Chairman, HIGHCAP Securities Limited said: “The nine months increase in forex losses by manufacturing companies in 2023 is due to the huge depreciation of the Naira following deregulation of the foreign exchange market in June 2023.

“The loss was transmitted to the manufacturing account of manufacturers through their outstanding forex liability to foreign suppliers of manufacturing inputs. Notwithstanding the improvement in their revenue, the FX losses overwhelmed their Profit.

“The losses were so colossal that some of the manufacturers have lost their shareholders fund. Many others have wound down their businesses and are at the verge of exiting the country. The losses have become a threat to the existence of many of the manufacturers.”

On the implication of the losses, he said: “Government should not expect to receive income tax from the wounded companies this year. Loss of capital will definitely take a toll on the capacity utilization of the manufacturers affected, resulting in layoffs and scarcity of their products.”

Solution

On the way forward, he said: “Government needs to engage with the manufacturers to address this threat to their existence. However, the losses will be recovered in due course as the economy adjusts to the new market reforms and price level.”

Reacting, Victor Chiazor, The Head of Research of Research and Investment said: “Most of the manufacturing companies suffered severe Forex losses because most of them import their raw materials for production from outside the country.

“And given the floating of the Naira which happened in the second quarter most were forced to provide more Naira to accommodate their production inputs. This exchange rate difference was significant enough to weaken their profit levels and even throw some of the manufacturers into loss after tax for the 9 months period.”

Going forward, he said: “We may see a direct transfer in the cost differential as most manufacturers will have no option than to pass this cost to the final consumer which will eventually lead to lower sales volume and most likely lower profitability for the company.

“This would also slow down activity level in the economy as a continuous rise in the price of goods and services will weaken the purchasing power of the consumer and overall weaken consumption.

“The government will need to find a way to stabilise the FX market to enable businesses plan as well as find incentives for some critical manufacturing businesses all of which would assist in keeping these businesses afloat.” https://www.vanguardngr.com/2023/12/manufacturing-sector-bleeds-as-forex-loss-rises-400-to-n466bn/ 1 Like 1 Share

|

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by mcbreeze: 7:52am On Dec 11, 2023 |

We will teach them politics. Next time they respect us. Even if our people can't eat, we don't mind 77 Likes 6 Shares |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Validated: 8:10am On Dec 11, 2023 |

@Freestuff should come and defend his paymasters as usual. People without economic knowledge running a complex economy.

Tinubu that has never sat on any corporate board taking over from a dullard like Buhari. What were you expecting?

Some of us warned that the double edged sword of floating the Naira and fuel subsidy removal was a recipe for disaster, they called "bad loser's", see where it has landed Nigeria now. Instead of calling Buhari they are harassing Enefiele, an errand boy. 55 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by WhisperedNoise: 8:11am On Dec 11, 2023 |

Sebi they called Tinubu the "master strategist"? The man makes Buhari (a very " unuseful" president) to look like an Harvard trained economist.   Beau Harry made so many useless mistakes, but Tea Noobu is determined to "out-useless" his predecessor. It's a game of who can wreck the economy the fastest. 🤦🤦🤦 Tea Noobu is ahead by a far margin. Even the so called dollar rate that was forced down has secretly been hiked on the official bank rates. "On your mandate, we shall destroy Nigeria, Jagaban." 57 Likes 1 Share |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by iwaeda: 8:44am On Dec 11, 2023 |

WhisperedNoise:

Sebi they called Tinubu the "master strategist"? The man makes Buhari (a very " unuseful" president) to look like an Harvard trained economist.

Beau Harry made so many useless mistakes, but Tea Noobu is determined to "out-useless" his predecessor. It's a game of who can wreck the economy the fastest. 🤦🤦🤦 Tea Noobu is ahead by a far margin.

Even the so called dollar rate that was forced down has secretly been hiked on the official bank rates.

"On your mandate, we shall destroy Nigeria, Jagaban." Don't worry we will ALL turn to OWOMIDAA, Oshodi, Ilupeju, Ikeja, Ikorodu, Ogba, Ota used to be industrial areas. Go there now and see, but people who were wrongly brought up speaking as our lords.

34 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Brendaniel: 8:51am On Dec 11, 2023 |

Tinubu! Chai!! 3 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by WhisperedNoise: 9:04am On Dec 11, 2023 |

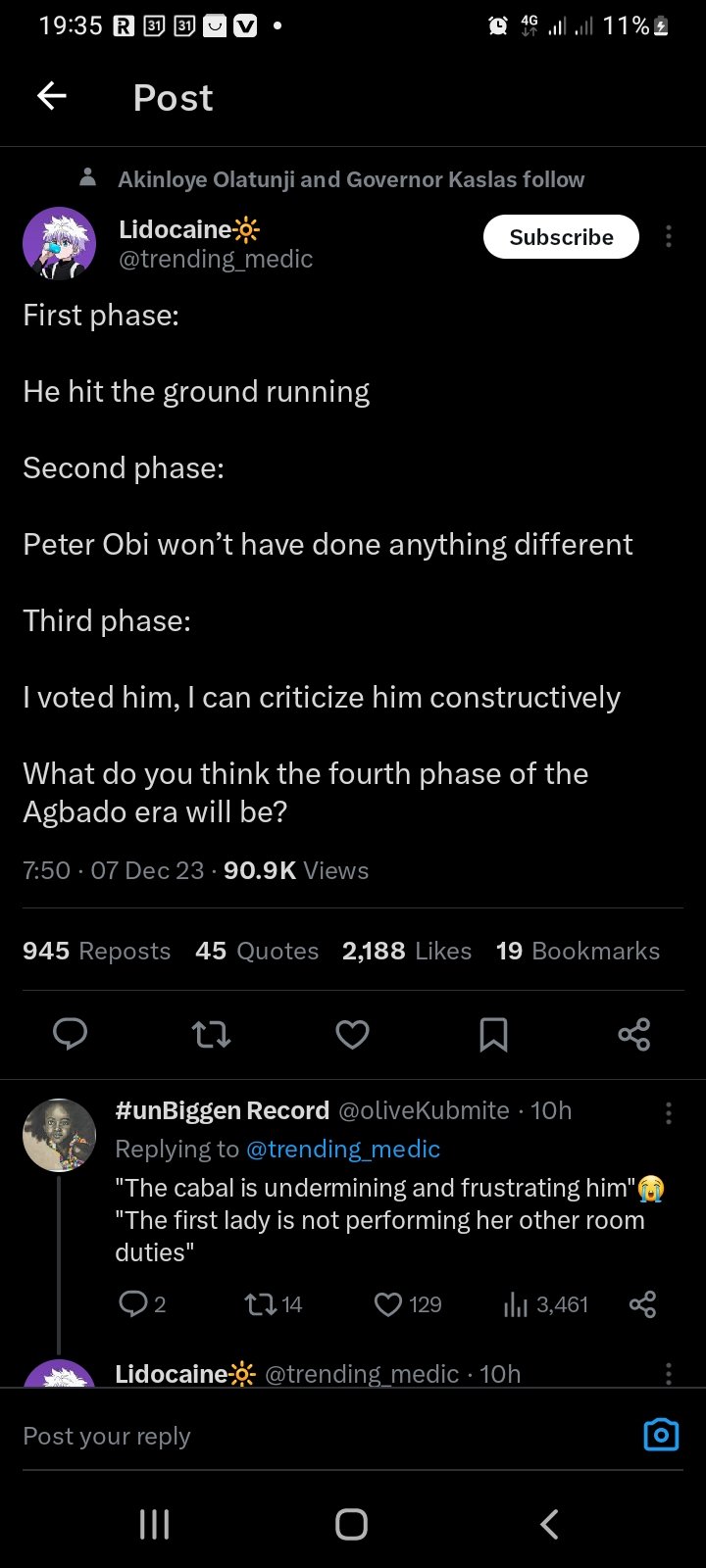

30 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by iwaeda: 9:27am On Dec 11, 2023 |

WhisperedNoise:

It's something that's disgusting in this Lagos. Touts are superior to an upstanding citizen. It amazes me. Many of them even have up to 10 or more police and military escorts, Nlfpmod, I think becoming Alaye is more lucrative.       37 Likes 2 Shares |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by AntiChristian: 10:04am On Dec 11, 2023 |

|

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Kingpele(m): 10:04am On Dec 11, 2023 |

Let keep the hopes high...the man who caused lagos to come into existence and built it from scratch is doing the good work on Nigeria...he will build up Nigeria .... in no distance time Nigeria will be more prosperous and beautiful than USA.. infact Nigeria will be so beautiful to the extent a US president will resign and migrate to Nigeria with his entire family to become a citizen of Nigeria, including millions of Europeans and ASIA ...make una continue to vote based on tribe and religion..the suffering will not be felt by the thieves that have stolen billions of public funds but the poor urchins that support them will feel the heat 22 Likes 1 Share |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by tobenuel(m): 10:05am On Dec 11, 2023 |

End time fit start from Nigeria o. But all of us go think say na cruise 14 Likes 1 Share |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Dollyak(f): 10:05am On Dec 11, 2023 |

President Tinubu miscalculated with the subsidy gone statement, and this is one of the net effect.

I am sorry, irrespective of your political stance, the subsequent actions by spending on frivolities is disgraceful. This government needs to start spending on what will benefit the economy (i.e subsidising small business) and be more fiscally responsible. 18 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Magnoliaa(f): 10:06am On Dec 11, 2023 |

I bit my tongue and broke a few teeth trying to read this topic.

It's not straightforward in the least. 1 Like |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Artiiclebeast: 10:06am On Dec 11, 2023 |

Venezuela's collapse will be a child's play to what is looming. 18 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by nairavsdollars(f): 10:06am On Dec 11, 2023 |

Where is that guy Tope Fasua? Now that you are in government, what are you doing about this? It's not about theory oo 9 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Lowkeyy: 10:08am On Dec 11, 2023 |

Fact 1 Like |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Opans: 10:08am On Dec 11, 2023 |

Hmm |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by emmyN(m): 10:08am On Dec 11, 2023 |

Are we still teaching Obidients a lesson? 18 Likes 1 Share |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Bubu4Sea: 10:10am On Dec 11, 2023 |

APShit is a curse 8 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by bonnyhope: 10:10am On Dec 11, 2023 |

WhisperedNoise:

Sebi they called Tinubu the "master strategist"? The man makes Buhari (a very " unuseful" president) to look like an Harvard trained economist.

Beau Harry made so many useless mistakes, but Tea Noobu is determined to "out-useless" his predecessor. It's a game of who can wreck the economy the fastest. 🤦🤦🤦 Tea Noobu is ahead by a far margin.

Even the so called dollar rate that was forced down has secretly been hiked on the official bank rates.

"On your mandate, we shall destroy Nigeria, Jagaban." He is strategically good at dubious thing 16 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by SensualMan: 10:11am On Dec 11, 2023 |

Lol. We need his brain not his weak body.

He did it in lagos!

He did it in Iragbiji!

He did it in Osun!

He is doing it in Yoruba land!

Jagaban! Keep doing it! 11 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Slymontee: 10:11am On Dec 11, 2023 |

Indeed the mandate thief is overrated!!! Nothing positive; things got worse; could not even resolve the crisis in the Education sector created by his party. Even wicked and failure Buhari approved something for ASUU and put it in 2023 budget, yet the mandate thief has not paid them up till this December, 2023. Now another ASUU strike is coming up Feb 2024. It will take just one more ASUU strike for the Federal Universities in Nigeria to completely collapse! Just one more!!! 9 Likes 1 Share |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by NOwazobia: 10:11am On Dec 11, 2023 |

Nothing to see here.

It is the usual Tinubunomics and his usual Lagos Expertise. 🤤

After Tinubu is done with Nigeria, many people will realized that the Government of Lagos headed by Tinubu barely has a hand in Lagos underdevelopment, which his rats termed development. 8 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by OKUCHI11(m): 10:11am On Dec 11, 2023 |

wetin.. dey. pain me be say...

once e reach 2027 ... Yoruba people go still wan support am for second term... 10 Likes 1 Share |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Flame333: 10:11am On Dec 11, 2023 |

Tinubu dey sing..... As e dey sweet us, e dey pain them

A man who could not answer mere political questions has been given the mandate to pilot the affairs of a sinking ship..

Titanic is going down, going down, my dear Agbadorians..

They Keep holding on till they reach six feet..

What a colossal administration... 10 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by TruthsFM: 10:13am On Dec 11, 2023 |

Tinubu bad economic policies destroyed Nigeria economy joor 7 Likes 1 Share |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Amigoss: 10:13am On Dec 11, 2023 |

|

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Drsnives(m): 10:14am On Dec 11, 2023 |

Kweeeeeeke oo.

The drug Baron is dealing with agbadorians seriously 6 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by SensualMan: 10:15am On Dec 11, 2023 |

TruthsFM:

Tinubu bad economic policies destroyed Nigeria economy joor It destroyed yoruba economy Sir not Nigeria! 3 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by oshonky: 10:15am On Dec 11, 2023 |

It’s well o, PZ just ran away like this 2 Likes 1 Share |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by ELKHALIFAISIS(m): 10:17am On Dec 11, 2023 |

Expect dollars to 1300 naira in Jesus name Amen 2 Likes |

| Re: Manufacturing Sector Bleeds As Forex Loss Rises 400% To N466bn by Streetdoctor: 10:18am On Dec 11, 2023 |

How it all started 5 Likes

|