| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by LOVEALAIGBO: 12:44am On Jan 19 |

Well i for one send money straight into the domiciliary account of the beneficiary and they can withdraw it either in pounds or dollars. 3 Likes 1 Share |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by BennyDGreat: 12:54am On Jan 19 |

Jamie248:

The sensible thing is for these fools to set up their own app and capture the forex from source too but they are mentally lazy, all they will do is blow grammar, rob the treasury and whine

Brain-dead mongoloids Lol u dey para |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by linearity: 1:07am On Jan 19 |

mrrandomguy:

He is absolutely correct.

For those who don't understand, the dollars don't reach Nigeria. What the money transfer companies do is to credit the receiver with the naira equivalent. The actual dollars is then diverted away from the official market. This is why the CBN through the official market can never meet Nigeria's dollar obligations because of the low inflow of dollars.

People like the olodo called Bismarck Rewane are agents of the world bank and IMF. They have been pushing for removal of subsidy and exchange rate liberalisation for a long time despite knowing that the official rate can never be the same as the parallel rate. These people have made billions of Naira from the systematic devaluation of the naira. I don’t see the difference, that $1,000 does not necessarily have to hit Nigeria. That $1,000 triggered the payment of N1.2mil from a local bank in Nigeria to the intended recipient in Nigeria, thereby increasing the demand for Naira which would have helped the exchange rate of Naira if our monetary policies are right. Also that N1.2mil would trigger economic activities in that region of Nigeria which would have otherwise be dormant. A bricklayer would be paid, a market woman will collect part of that money in exchange for garri, etc. The situation is the same if the person brought the physical dollar into the country, they will go to aboki and aboki will go to his bank and get N1.2mil to give the individual. The reason FG is not happy is because they want to be in custody of that $1,000. Why would anyone in their right senses give the FG $1 in exchange for N800, when they can get N1,200 across the street? 7 Likes 2 Shares |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by Jamie248: 1:11am On Jan 19 |

BennyDGreat:

Lol u dey para 1,000 CFA is now 2,000 naira |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by PoliteActivist: 1:14am On Jan 19 |

mrrandomguy:

He is absolutely correct.

For those who don't understand, the dollars don't reach Nigeria. What the money transfer companies do is to credit the receiver with the naira equivalent. The actual dollars is then diverted away from the official market. *Politeness* Sooo, how do they get the naira equivalent?? |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by loswhite(m): 1:16am On Jan 19 |

Brendaniel:

Oga you should blame the central bank and the Nigerian banks for that.

Do you know the CBN policies that are affecting remittance in Nigeria?

Do you know Paypal and some other international payment platforms are not working to remit in Nigeria because of CBN not that they don't want to, I spoke with PayPal and they told me, then you have the issue of Nigerian banks not making every Nigerian account receive dollar easily, except with domiciliary account that they take charges anyhow....

I was trading BTC from Finland and I knew how hard it was sometimes to bring the money back to Nigeria, you keep looking for channels to bring the money into Nigeria.

The Nigerians in diaspora you are blaming, most don't have a choice, those are the available cheapest channels to them, I am speaking from experience, The CBN and our Nigerian banks are not really helping matters... Nigerian banks are fraudulent. You open a chanel on the app to automatically covert your dollars to naira...lol but there is no chanel to convert same naira to dollars. 2 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by kolamilan(m): 1:23am On Jan 19 |

Cbn should ban all fintech banks responsible for the exchange and bring back naira 4 dollar scheme. Shikena. |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by gotousa2013: 1:25am On Jan 19 |

Inspirer1:

You're right.

However, don't you think since people can't access the foreign currency at the cbn rate to make payment or other forms of transactions except they purchase via parallel market, such people will definitely want to sell or remit through those apps that will give them parallel market rate too when converting to naira.

E.g

If I need 1000 dollars to purchase some of my goods, and I got it via black market rate of 1200 naira per dollar (making 1.2 million naira needed), if I make profit of 100 dollar on my goods, would you prefer I remit my profit and capital (1100 dollars) through the bank? That will be 1,078,000 naira (at say 980 naira official rate) which is not up to the amount I used in buying the 1000 dollars capital I used to purchase my goods.

The best thing is for government, through relevant authorities to establish a platform through which genuine payments can be done at official rate, this will help a lot.

Can you imagine that as official as payment of uk visa and ihs fees are, there is no official platform to pay using cbn rate unless you pay by buying from black market? Just imagine the volume of black market transactions during recent japa periods in the past 2 or 3 years.

You open a dorm account in the bank, but you have to go and buy dollar/pounds from Aboki outside the bank to fund the official dorm account.

Ordinary to pay for courses worth 5, 10, 20 dollars on educational platforms, one will have to buy from Aboki.

Let government do their findings, what and what do people need any of the foreign currency for, include it on the tradesystem portal where we have the form A and other forms. Make it impossible to pay for anything except through that tradesystem portal.

If cbn and banks are not providing me the dollar for businesses, school fee and others, will I wait forever? I will jejely go to lemfi get it at parralel rate and move on with my life. 3 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by gotousa2013: 1:26am On Jan 19 |

loswhite:

Nigerian banks are fraudulent. You open a chanel on the app to automatically covert your dollars to naira...lol but there is no chanel to convert same naira to dollars. Na so we see am O |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by gotousa2013: 1:28am On Jan 19 |

linearity:

I don’t see the difference, that $1,000 does not necessarily have to hit Nigeria.

That $1,000 triggered the payment of N1.2mil from a local bank in Nigeria to the intended recipient in Nigeria, thereby increasing the demand for Naira which would have helped the exchange rate of Naira if our monetary policies are right.

Also that N1.2mil would trigger economic activities in that region of Nigeria which would have otherwise be dormant. A bricklayer would be paid, a market woman will collect part of that money in exchange for garri, etc.

The situation is the same if the person brought the physical dollar into the country, they will go to aboki and aboki will go to his bank and get N1.2mil to give the individual.

The reason FG is not happy is because they want to be in custody of that $1,000. Why would anyone in their right senses give the FG $1 in exchange for N800, when they can get N1,200 across the street? AGBADO thinking. DONT you know the exchange rate differs on these APPs compared to what it should be and it devalues naira? 2 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by okoloto: 1:34am On Jan 19 |

Not until we move from consumption to production all this economic excuses won't help us. We too like foreign goods  2 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by October1960: 2:14am On Jan 19 |

Each new govt is worse and dumber than the previous one.

Why would anyone want their savings to be trapped in a country mis-managed by buffoons and crooks.

Smart people made the app to disburse Naira in their savings accounts here and get dollars or pounds in stable well managed countries.

The govt and the corrupt crooks in politics and government is the problem not the regular citizens. 6 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by Ak47young(m): 2:18am On Jan 19 |

GboyegaD:

I agree due to the way most people do remittance however, I feel 80% might be an exaggerated figure. It's not |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by Ak47young(m): 2:21am On Jan 19 |

shadrach77:

This is a big lie! If I send money to someone back home and the person gets it, how can you say the money didn't reach Nigeria when it landed in the person's aza?  The foreign currency did not reach Nigeria that's what he means. If the currency gets here and people convert it at least banks have those funds to sell to people that need FX 3 Likes 1 Share |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by linearity: 2:25am On Jan 19 |

gotousa2013:

AGBADO thinking. DONT you know the exchange rate differs on these APPs compared to what it should be and it devalues naira? How does it devalue the Naira? You clearly don’t know what devalues the Naira. Nigeria imports almost everything and that is what devalues the Naira. If you have ever earned in dollar and one person say he will give you N800 for your dollar and another say, they will give you N1,200 for that same dollar, who will you transact with? 3 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by October1960: 2:49am On Jan 19 |

Don’t mind them. They are using sentiment and emotion to fight for Naira value. The stealing government officials and politicians have been converting Naira to foreign currency for the past 50 years. That also devalues the Naira. Most Nigerians crave foreign things even the shitty China cheap products not the expensive quality China products. linearity:

How does it devalue the Naira?

You clearly don’t know what devalues the Naira. Nigeria imports almost everything and that is what devalues the Naira.

If you have ever earned in dollar and one person say he will give you N800 for your dollar and another say, they will give you N1,200 for that same dollar, who will you transact with? 1 Like |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by October1960: 2:54am On Jan 19 |

Gbam !! He explained it clear below. 👇🏾 Corrupt politicians and government officials do not like the free market as it bypasses their greedy thieving and mis-management. linearity:

I don’t see the difference, that $1,000 does not necessarily have to hit Nigeria.

That $1,000 triggered the payment of N1.2mil from a local bank in Nigeria to the intended recipient in Nigeria, thereby increasing the demand for Naira which would have helped the exchange rate of Naira if our monetary policies are right.

Also that N1.2mil would trigger economic activities in that region of Nigeria which would have otherwise be dormant. A bricklayer would be paid, a market woman will collect part of that money in exchange for garri, etc.

The situation is the same if the person brought the physical dollar into the country, they will go to aboki and aboki will go to his bank and get N1.2mil to give the individual.

The reason FG is not happy is because they want to be in custody of that $1,000. Why would anyone in their right senses give the FG $1 in exchange for N800, when they can get N1,200 across the street? 2 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by Kobojunkie: 2:58am On Jan 19 |

FreeStuffsNG:

■ If the forex doesn't land in Nigeria then it's wrong of World Bank to classify such funds as diaspora remittances. To qualify as diaspora remittances then the fund must leave the foreign country and land in our own financial system. What predominates does not quantify as remittance because the foreign currencies remain in the overseas account of the operators of those apps who mostly open and operate their bank accounts from illicit funds havens like the British Virgin Islands, Bahamas, Ireland, Mauritius etc. So while you send $1000 from US, you get paid in naira here but your $1000 lands in a bank account in British Virgin Islands! That's not a diaspora remittance in Nigeria!

■ Those app platforms are the real wall blocking the remaining 90% of the total diaspora funds from getting into our banking system. If our financial regulatory control laws don't reach those fintechs, our tax laws should. FG must go after them and their collaborators here in Nigeria.

May God bless Nigeria for ever! Check my signature for free stuffs! It is not? What is it? Na only if the actual dollar currency you sent lands in Nigeria you go consider am remittance?  2. Wall blocking what exactly? If I send $1000 expecting that the equivalent go enter hand of person wey I send am, how is the app to blame for just that happening? Abi, you wan make we send dollars by mail to Nigeria abi wetin? That na the only time una go consider am legit remittance?  |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by Kobojunkie: 2:59am On Jan 19 |

linearity:

I don’t see the difference, that $1,000 does not necessarily have to hit Nigeria. That $1,000 triggered the payment of N1.2mil from a local bank in Nigeria to the intended recipient in Nigeria, thereby increasing the demand for Naira which would have helped the exchange rate of Naira if our monetary policies are right.

Also that N1.2mil would trigger economic activities in that region of Nigeria which would have otherwise be dormant. A bricklayer would be paid, a market woman will collect part of that money in exchange for garri, etc.

The situation is the same if the person brought the physical dollar into the country, they will go to aboki and aboki will go to his bank and get N1.2mil to give the individual.

The reason FG is not happy is because they want to be in custody of that $1,000. Why would anyone in their right senses give the FG $1 in exchange for N800, when they can get N1,200 across the street? Now this makes a whole load of sense!  |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by October1960: 3:01am On Jan 19 |

Exactly!!! They are too lazy and dull. They rely on government jobs and political appointments to make a living. Even with the apps the rates vary. Hence people tend to use the app that pays the highest exchange rate. That is how free markets work. Jamie248:

The sensible thing is for these fools to set up their own app and capture the forex from source too but they are mentally lazy, all they will do is blow grammar, rob the treasury and whine

Brain-dead mongoloids 2 Likes 1 Share |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by October1960: 3:05am On Jan 19 |

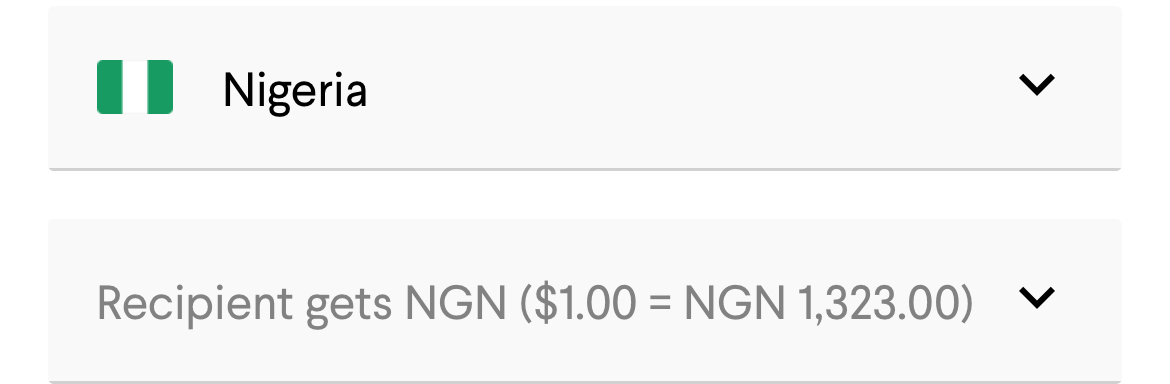

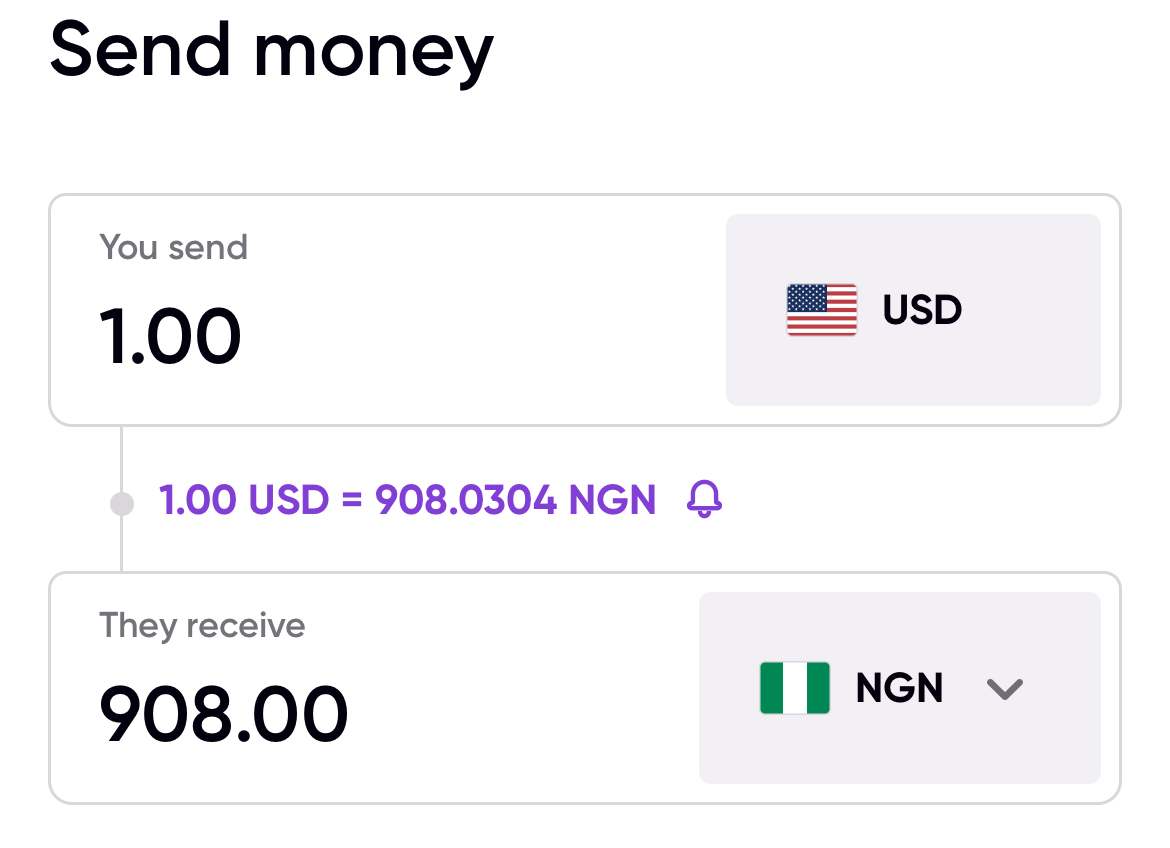

See rates today from 3 apps. 1 Like

|

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by frog12: 3:27am On Jan 19 |

blame flutterwave, worldpay and the others   FreeStuffsNG:

"We have spoken to loads of Nigerians almost everywhere, in the US, UK, etc. They told us how they send remittance. They use Apps, and we have tried some of those Apps, they use parallel market rates. So, you take $1,000 in New York, and tap on your phone that you are sending $1,000 to someone, a Fintech, they pay the Naira equivalent in Nigeria without bringing the dollars, unless of course if the source of the money is illicit.”

If the forex doesn't land in Nigeria then it's wrong of World Bank to classify such funds as diaspora remittances. To qualify as diaspora remittances then the fund must leave the foreign country and land in our own financial system. What predominates does not quantify as remittance because the foreign currencies remain in the overseas account of the operators of those apps who mostly open and operate their bank accounts from illicit funds havens like the British Virgin Islands, Bahamas, Ireland, Mauritius etc. So while you send $1000 from US, you get paid in naira here but your $1000 lands in a bank account in British Virgin Islands! That's not a diaspora remittance in Nigeria!

Those app platforms are the real wall blocking the remaining 90% of the total diaspora funds from getting into our banking system. If our financial regulatory control laws don't reach those fintechs, our tax laws should. FG must go after them and their collaborators here in Nigeria.

May God bless Nigeria for ever! Check my signature for free stuffs! |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by frog12: 3:29am On Jan 19 |

so we can't survive without remittances ?? mrrandomguy:

He is absolutely correct.

For those who don't understand, the dollars don't reach Nigeria. What the money transfer companies do is to credit the receiver with the naira equivalent. The actual dollars is then diverted away from the official market. This is why the CBN through the official market can never meet Nigeria's dollar obligations because of the low inflow of dollars.

People like the olodo called Bismarck Rewane are agents of the world bank and IMF. They have been pushing for removal of subsidy and exchange rate liberalisation for a long time despite knowing that the official rate can never be the same as the parallel rate. These people have made billions of Naira from the systematic devaluation of the naira. 1 Like |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by frog12: 3:30am On Jan 19 |

why you dey call Bismarck Rewane olodo ?   he is the best we have on TV mrrandomguy:

He is absolutely correct.

For those who don't understand, the dollars don't reach Nigeria. What the money transfer companies do is to credit the receiver with the naira equivalent. The actual dollars is then diverted away from the official market. This is why the CBN through the official market can never meet Nigeria's dollar obligations because of the low inflow of dollars.

People like the olodo called Bismarck Rewane are agents of the world bank and IMF. They have been pushing for removal of subsidy and exchange rate liberalisation for a long time despite knowing that the official rate can never be the same as the parallel rate. These people have made billions of Naira from the systematic devaluation of the naira. |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by advanceDNA: 3:41am On Jan 19 |

shadrach77:

This is a big lie! If I send money to someone back home and the person gets it, how can you say the money didn't reach Nigeria when it landed in the person's aza?  It did not land as dollars ...It landed as naira.... Fintech app has comma the dollar and send naira to ur person's account..... 4 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by Mordecai(m): 3:52am On Jan 19 |

The line of reasoning I see in the comment by the Minister is shameful. It is like saying that when I pay your debts, I did not give you money because you did not get the money in your account first. It is either the Minister is an idiot or he is trying to mislead Nigerians into blaming the ones that are actually keeping the economy going. These importers they blame are the ones keeping citizens alive while government does nothing. They are the ones that import medical laboratory equipment as well as their spare parts, manufacturing equipment, vehicles, spare parts, drugs, etc. The government does not do that. Even prepaid meters that should be provided by government is provided for by these importers. Now these importers are supposed to source their forex from banks through the CBN. Except they can't. Because the CBN would not give them the forex they need. Any forex that gets to CBN end up in the hands of top APC politicians and their cronies, like the First Ladies, Dangote et al. So who do the Nigerian importers turn to? These Fintechs. These Fintechs mop up diaspora remittances from Nigerians abroad, then credit the accounts of beneficiaries in Nigeria. They then use the forex they mopped up to satisfy the demands of these Nigerian firms crowded out of our financial system by these silly politicians. These firms pay them in Naira, so the Fintechs recoup their local currency. Rinse and repeat... Infact, these Fintechs are the patriotic ones. What I expected the Minister to brainstorm about is on how to retrieve the massive amounts of dollars stacked in politicians' personal vaults. These are the vaults they open up when elections come, or when they want to bribe INEC staff or judges. The bribe recipients then stack it in their own personal vaults too. We all heard about the dollars used to bribe delegates during the APC and PDP presidential primaries. Those monies stacked in personal vaults are the reason why there is shortage of Naira cash on circulation, and shortage of forex in the market. That is what the Minister should work on, not casting aspersions on patriotic Nigerians solving the problems their government created. 4 Likes 1 Share |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by RepoMan007: 3:54am On Jan 19 |

FreeStuffsNG:

"We have spoken to loads of Nigerians almost everywhere, in the US, UK, etc. They told us how they send remittance. They use Apps, and we have tried some of those Apps, they use parallel market rates. So, you take $1,000 in New York, and tap on your phone that you are sending $1,000 to someone, a Fintech, they pay the Naira equivalent in Nigeria without bringing the dollars, unless of course if the source of the money is illicit.”

If the forex doesn't land in Nigeria then it's wrong of World Bank to classify such funds as diaspora remittances. To qualify as diaspora remittances then the fund must leave the foreign country and land in our own financial system. What predominates does not quantify as remittance because the foreign currencies remain in the overseas account of the operators of those apps who mostly open and operate their bank accounts from illicit funds havens like the British Virgin Islands, Bahamas, Ireland, Mauritius etc. So while you send $1000 from US, you get paid in naira here but your $1000 lands in a bank account in British Virgin Islands! That's not a diaspora remittance in Nigeria!

Those app platforms are the real wall blocking the remaining 90% of the total diaspora funds from getting into our banking system. If our financial regulatory control laws don't reach those fintechs, our tax laws should. FG must go after them and their collaborators here in Nigeria.

May God bless Nigeria for ever! Check my signature for free stuffs! Keep shut sir. The fintechs intercepting them are not from the moon. They eventually get sold to Nigerians but at P2P rates in order to maximize gain. And that's where the CBN has an unmatchable advantage. They can print as much Naira and outbid any fintech to buy more dollars via their own fintech apps too. They will never do that. 2 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by pacespot(m): 3:55am On Jan 19 |

Brendaniel:

Oga you should blame the central bank and the Nigerian banks for that.

Do you know the CBN policies that are affecting remittance in Nigeria?

Do you know Paypal and some other international payment platforms are not working to remit in Nigeria because of CBN not that they don't want to, I spoke with PayPal and they told me, then you have the issue of Nigerian banks not making every Nigerian account receive dollar easily, except with domiciliary account that they take charges anyhow....

I was trading BTC from Finland and I knew how hard it was sometimes to bring the money back to Nigeria, you keep looking for channels to bring the money into Nigeria.

The Nigerians in diaspora you are blaming, most don't have a choice, those are the available cheapest channels to them, I am speaking from experience, The CBN and our Nigerian banks are not really helping matters... So na so flutterwave and Cos be blocking dollars from reaching Nigerian banks thereby causing the Naira to crash against the greenback? But I think most of the problems are from Nigerian banks, I have a lot of dollars in my forex trading account but I'm not allowed to do bank withdrawal of dollars even though I have a domiciliary account linked and from which account I transferred the money I used to start trading in the first place. It is same story if you want to withdraw dollars from Binance. Nigerian banks will convert the dollars into Naira, so that means Binance gets to keep my dollars while sending Naira into my account. You can't even transfer dollars from your domiciliary account into another account these days. 2 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by RepoMan007: 4:01am On Jan 19 |

“The World Bank said for 2023, our diaspora remittance was about $20 billion. We estimate that more than 90 percent of that did not get to Nigeria, they are being externalized. We have spoken to loads of Nigerians almost everywhere, in the US, UK, etc. They told us how they send remittance. They use Apps, and we have tried some of those Apps, they use parallel market rates. So, you take $1,000 in New York, and tap on your phone that you are sending $1,000 to someone, a Fintech, they pay the Naira equivalent in Nigeria without bringing the dollars, unless of course if the source of the money is illicit.” As long the fintechs are able to obtain Naira to settle their dollar sellers, they are Nigerian fintechs and so the money is Nigerian remittance. Let CBN stop.using all their printed cash to pay idle workers and let them start buying from these fintech apps directly with some of our printed cash. Overall that will mean more naira in circulation chasing fewer goods and thus inflation. 1 Like |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by planetx: 4:04am On Jan 19 |

LOVEALAIGBO:

Well i for one send money straight into the domiciliary account of the beneficiary and they can withdraw it either in pounds or dollars. Are you sure they can withdraw in pounds or dollars from Nigerian banks? |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by RepoMan007: 4:05am On Jan 19 |

pacespot:

So na so flutterwave and Cos be blocking dollars from reaching Nigerian banks thereby causing the Naira to crash against the greenback?

But I think most of the problems are from Nigerian banks, I have a lot of dollars in my forex trading account but I'm not allowed to do bank withdrawal of dollars even though I have a domiciliary account linked and from which account I transferred the money I used to start trading in the first place. It is same story if you want to withdraw dollars from Binance. Nigerian banks will convert the dollars into Naira, so that means Binance gets to keep my dollars while sending Naira into my account. You can't even transfer dollars from your domiciliary account into another account these days. So dollars goes to govt who subsidizes the sales to pilgrimage goers, fake hair buyers and wine importers among other wasteful things. One question though, the fintechs settling Nigerians abroad in exchange for dollars, which currency are they crediting those Nigerians with? If Naira, are they printing or stealing it? 2 Likes |

| Re: 90% Of 2023 Diaspora Remittances Didn’t Get To Nigeria — Oyedele by grandstar(m): 4:12am On Jan 19 |

FreeStuffsNG:

"We have spoken to loads of Nigerians almost everywhere, in the US, UK, etc. They told us how they send remittance. They use Apps, and we have tried some of those Apps, they use parallel market rates. So, you take $1,000 in New York, and tap on your phone that you are sending $1,000 to someone, a Fintech, they pay the Naira equivalent in Nigeria without bringing the dollars, unless of course if the source of the money is illicit.”

If the forex doesn't land in Nigeria then it's wrong of World Bank to classify such funds as diaspora remittances. To qualify as diaspora remittances then the fund must leave the foreign country and land in our own financial system. What predominates does not quantify as remittance because the foreign currencies remain in the overseas account of the operators of those apps who mostly open and operate their bank accounts from illicit funds havens like the British Virgin Islands, Bahamas, Ireland, Mauritius etc. So while you send $1000 from US, you get paid in naira here but your $1000 lands in a bank account in British Virgin Islands! That's not a diaspora remittance in Nigeria!

Those app platforms are the real wall blocking the remaining 90% of the total diaspora funds from getting into our banking system. If our financial regulatory control laws don't reach those fintechs, our tax laws should. FG must go after them and their collaborators here in Nigeria.

May God bless Nigeria for ever! Check my signature for free stuffs! Leave the Fintechs alone. It's a lame excuse. Common sense dictates the Naira paid out to the recepient is backed by forex. The grammar of it entering or not entering the country is semantics. It's the equivalent of saying the global forex market does not affect the value of your currency because it is electronically traded and involves a lot of leverage, that it is a Kalo Kalo market.⁰00⁰ The government must sit up and do its job. The CBN needs to increase interest rates to tame inflation which will instantly arrest the weekly slide of the Naira. This will restore confidence in the local currency and start an appreciation of it. Next, it might be best the government pegs the Naira at the official market and defends that rate, which will reduce the gap between the official plate and the black market to between 2-3%. The official rate should slightly devalued so it can be a rate the CBN can easily defend and also make the country's products and services competitive. Remittances sent through apps should be paid in Naira. If the Naira rate is stable, most people will be fine with it. 2 Likes 1 Share |