| Re: Forex Trade Alerts - Season 10 by Nobody: 8:51am On Sep 18, 2012 |

infofirst:

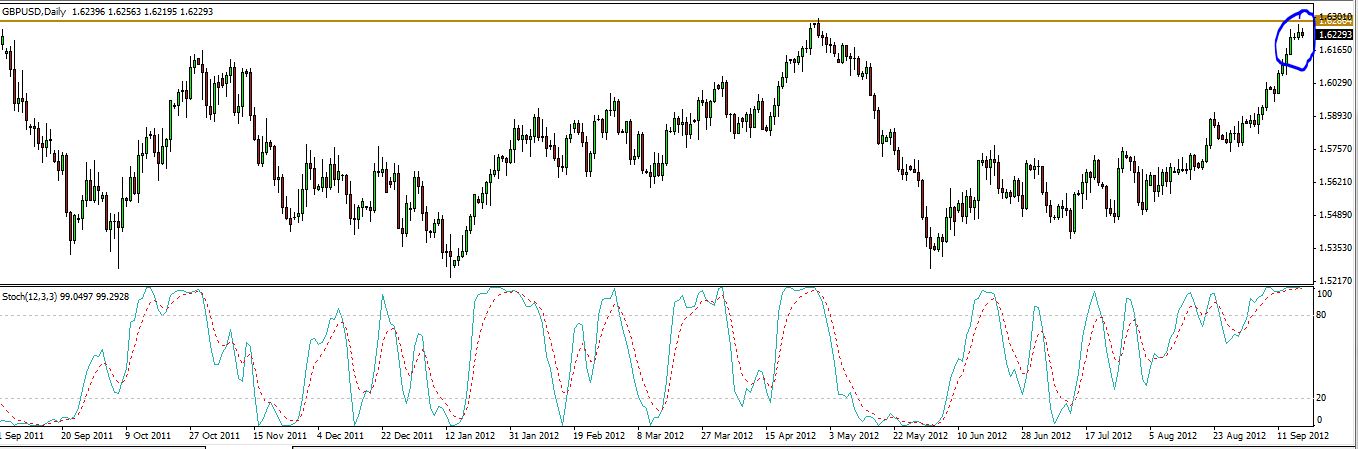

Gu need to finish her mission atleast 1.6297/6303 Mama n the fall like that of wall of Jericho, lol Interest rates minutes might just do it. Let's just say I'm stalking the morrafuka, the area in blue is of significant interest to me 1.6310

|

| Re: Forex Trade Alerts - Season 10 by Toks2008(m): 8:57am On Sep 18, 2012 |

Prof Amu:

If u wish to take position in anything related to euro, I suggest u stay on the fence for or u take the fast-in, fast-out approach, at least for the next 3hrs. As the is big news to be released from germany and it has 3 bulls head effect on the market. After the news, we can then knw the effect on the market. Thanks. Nevertheless, the news no matter how strong will always drive price action in the direction of the current 4hr/daily chart trend. The trend is the most important aspect of forex trading so as long as you trade in the trend direction using good mm, you are good to go news or no news. Nevertheless, i expect the news to drive euro far down as we are likely to see a down pull down for a retest of supp 12989 but i will chill out first at supp 13064 with 40pips and wait for a possible re-bounce. |

| Re: Forex Trade Alerts - Season 10 by infofirst(m): 9:16am On Sep 18, 2012 |

raycolz_84:

*singing* the walls of jericho fell than down flat....  lolz |

| Re: Forex Trade Alerts - Season 10 by infofirst(m): 9:33am On Sep 18, 2012 |

naijababe:

Interest rates minutes might just do it. Let's just say I'm stalking the morrafuka, the area in blue is of significant interest to me 1.6310 Na the main main point to watch be that for me too oh |

| Re: Forex Trade Alerts - Season 10 by endfx1(m): 9:46am On Sep 18, 2012 |

Toks2008:

Thanks. Nevertheless, the news no matter how strong will always drive price action in the direction of the current 4hr/daily chart trend. The trend is the most important aspect of forex trading so as long as you trade in the trend direction using good mm, you are good to go news or no news.

Nevertheless, i expect the news to drive euro far down as we are likely to see a down pull down for a retest of supp 12989 but i will chill out first at supp 13064 with 40pips and wait for a possible re-bounce. WORD |

| Re: Forex Trade Alerts - Season 10 by Pro02: 9:57am On Sep 18, 2012 |

You need L.R?

Am selling @ 175/lr

Face2face transaction preferred

Call 07063829063 |

| Re: Forex Trade Alerts - Season 10 by lordaustin(m): 10:08am On Sep 18, 2012 |

Pro02: You need L.R?

Am selling @ 175/lr

Face2face transaction preferred

Call 07063829063 where are you? |

| Re: Forex Trade Alerts - Season 10 by infofirst(m): 10:17am On Sep 18, 2012 |

lordaustin:

where are you? How is earning sip doing now man, still paying? |

| Re: Forex Trade Alerts - Season 10 by Pro02: 10:29am On Sep 18, 2012 |

lordaustin:

where are you? Abule-egba LAgos Where r u? |

| Re: Forex Trade Alerts - Season 10 by bond777(m): 10:34am On Sep 18, 2012 |

Toks2008:

Thanks. Nevertheless, the news no matter how strong will always drive price action in the direction of the current 4hr/daily chart trend. The trend is the most important aspect of forex trading so as long as you trade in the trend direction using good mm, you are good to go news or no news.

Nevertheless, i expect the news to drive euro far down as we are likely to see a down pull down for a retest of supp 12989 but i will chill out first at supp 13064 with 40pips and wait for a possible re-bounce. Oga some news change trends. News move de market as shown and proved last week. But i believe EU is going down cos of de doji on de daily charts but however de news can rubbish any doji that's y every focused trader use stop loss. Cheers  |

| Re: Forex Trade Alerts - Season 10 by Optimisticgondy(m): 11:08am On Sep 18, 2012 |

Pro02: You need L.R?

Am selling @ 175/lr

Face2face transaction preferred

Call 07063829063 when instantgoldng sells at N170? |

| Re: Forex Trade Alerts - Season 10 by lordaustin(m): 11:10am On Sep 18, 2012 |

and epay @ 169 |

| Re: Forex Trade Alerts - Season 10 by rozayx5(m): 11:18am On Sep 18, 2012 |

|

| Re: Forex Trade Alerts - Season 10 by Pro02: 11:29am On Sep 18, 2012 |

Ok

168/lr |

| Re: Forex Trade Alerts - Season 10 by Toks2008(m): 11:45am On Sep 18, 2012 |

Toks2008:

Thanks. Nevertheless, the news no matter how strong will always drive price action in the direction of the current 4hr/daily chart trend. The trend is the most important aspect of forex trading so as long as you trade in the trend direction using good mm, you are good to go news or no news.

Nevertheless, i expect the news to drive euro far down as we are likely to see a down pull down for a retest of supp 12989 but i will chill out first at supp 13064 with 40pips and wait for a possible re-bounce. Nice pips banked. Traders can sell euro down to 12993. Trade with care and use good mm as we may see random motion coming up. Happy pipping |

| Re: Forex Trade Alerts - Season 10 by rozayx5(m): 11:54am On Sep 18, 2012 |

|

| Re: Forex Trade Alerts - Season 10 by bendazum: 11:55am On Sep 18, 2012 |

After a long time research I've discovered a better way of trading FX and that is based on daily chart patterns and 'figures'.Based on that I entered a SELL trade on AU at 1.0445.Am looking to enter another sell @ 1.2950 on EU if sell conditions continue.I hope you guys get the picture now.My target usually is 300 pips unless conditions say otherwise.Happy pipping. |

| Re: Forex Trade Alerts - Season 10 by honeric01(m): 12:04pm On Sep 18, 2012 |

bendazum: After a long time research I've discovered a better way of trading FX and that is based on daily chart patterns and 'figures'.Based on that I entered a SELL trade on AU at 1.0445.Am looking to enter another sell @ 1.2950 on EU if sell conditions continue.I hope you guys get the picture now.My target usually is 300 pips unless conditions say otherwise.Happy pipping. Medium termer you are.  |

| Re: Forex Trade Alerts - Season 10 by JAkpayen(m): 12:32pm On Sep 18, 2012 |

Thanks honeric01 for the info.

Please does anyone know what time is the highlighted will happen?

|

| Re: Forex Trade Alerts - Season 10 by honeric01(m): 12:36pm On Sep 18, 2012 |

JAkpayen: Thanks honeric01 for the info.

Please does anyone know what time is the highlighted will happen? You're welcome, any response from them yet? As for your request, it should be between 1:30am and 9am.. so just stay tuned. |

| Re: Forex Trade Alerts - Season 10 by JAkpayen(m): 12:40pm On Sep 18, 2012 |

honeric01:

You're welcome, any response from them yet?

As for your request, it should be between 1:30am and 9am.. so just stay tuned. I'll update ASAP if they get to me, but nothing yet for now. I just want to know the time because BOJ action may see a rallying of JPY pairs. |

| Re: Forex Trade Alerts - Season 10 by infofirst(m): 12:49pm On Sep 18, 2012 |

honeric01:

You're welcome, any response from them yet?

As for your request, it should be between 1:30am and 9am.. so just stay tuned. Boss,we no dey see your daily call again for those 5 or 6 pairs there about and the daily scenario things. |

| Re: Forex Trade Alerts - Season 10 by Nobody: 1:03pm On Sep 18, 2012 |

JAkpayen:

I'll update ASAP if they get to me, but nothing yet for now.

I just want to know the time because BOJ action may see a rallying of JPY pairs. Of course we are all expecting that rally. The BOJ is concerned about the strength of the YEN and will do their own QE. The best thing to do will be to set buy stops 20pips away from high of today across a few jpy pairs, maybe 2 and set a TP of 250pips on each. Thats what I will be doing though. If things go as we expect, then one may wake up with a shed load of pips! New member here but long time stalker  |

| Re: Forex Trade Alerts - Season 10 by Nobody: 1:07pm On Sep 18, 2012 |

|

| Re: Forex Trade Alerts - Season 10 by Nobody: 1:12pm On Sep 18, 2012 |

|

| Re: Forex Trade Alerts - Season 10 by honeric01(m): 1:12pm On Sep 18, 2012 |

JAkpayen:

I'll update ASAP if they get to me, but nothing yet for now.

I just want to know the time because BOJ action may see a rallying of JPY pairs. Did you include me as reference? i was told by him that they have series of request but that i should tell my "recommendees" to "differentiate" their application with my reference. if you do that, you'd be responded to on time. |

| Re: Forex Trade Alerts - Season 10 by honeric01(m): 1:13pm On Sep 18, 2012 |

infofirst:

Boss,we no dey see your daily call again for those 5 or 6 pairs there about and the daily scenario things. Bro, been kinda busy with some things and not really "fully" into trading for some time now.. LR also caused it. |

| Re: Forex Trade Alerts - Season 10 by Toks2008(m): 1:16pm On Sep 18, 2012 |

Toks2008:

Nice pips banked.

Traders can sell euro down to 12993. Trade with care and use good mm as we may see random motion coming up.

Happy pipping i think we should chill out at 13043 and wait for a possible pullback. 12988 still looks very green but im trying to avoid bumping into any crazy supp levels. |

| Re: Forex Trade Alerts - Season 10 by rozayx5(m): 1:37pm On Sep 18, 2012 |

Piponomics:

What did they do again please? was a temporary server error they have restored it  at least am out, next time will always check the next update date on their blog ;Dbefore requesting a withdrawal to avoid what happened last time |

| Re: Forex Trade Alerts - Season 10 by Nobody: 1:42pm On Sep 18, 2012 |

rozayx5:

was a temporary server error

they have restored it

at least am out, next time will always check the next update date on their blog ;Dbefore requesting a withdrawal to avoid what happened last time Am always scared when I see bad reviews of LR. I move as much as 10k through my accounts atimes that's why. I still prefer using it and having your money in less than 24hours, than waiting for 5 days for the same. |

| Re: Forex Trade Alerts - Season 10 by infofirst(m): 1:45pm On Sep 18, 2012 |

honeric01:

Bro, been kinda busy with some things and not really "fully" into trading for some time now..

LR also caused it. sowi n plz get back stronger |

| Re: Forex Trade Alerts - Season 10 by Nobody: 1:52pm On Sep 18, 2012 |

An interesting diversion. [size=14pt]How to learn to look after ourselves.[/size]

Many western governments are technically bankrupt and I can not see how pensions in their current format can survive for much longer & therefore I believe it is crucial that people are aware of the potential problem and take POSITIVE ACTION now & learn how to look after themselves.

This is not intended to be scaremongering. This is simply pointing out a potential major problem and I will offer suggestions of how to make extra money and invite experts from non forex fields to offer their advice as well.

I have one aim with this new section of the website, that is to help as many people as possible become financially wealthy, astute & secure.

Most people receive little or no financial education and simply repeat the same old mistakes whilst helping the rich, financially literate become more wealthy.

Those at the top of the financial food chain are positioning themselves now to take advantage of the current financial melt down that we are living through.

Unlike many of you who may be concerned or even down right scared as to what you are going to do protect yourselves, these guys already know how they aim to become even richer at the little guys expense. This is NOT by accident.

William T. Harris, U.S. Commissioner of Education, 1889 one of the creators of the US education system had this to say:

“Our schools have been scientifically designed to prevent over-education from happening. The average American [should be] content with their humble role in life, because they’re not tempted to think about any other role.”

In other words the education system was created to create “worker bees”, intelligent & literate enough to work in factories and operate machinery but NOT to join the financial elite. Little has changed in the last 120 years in my experience. My children still leave school with no idea of even how to write a cheque, let alone the intracacies of APR, compound interest trades etc

In the WIC We will show you how to protect and grow your wealth despite the fact that we are currently living through what could become THE biggest financial crash of all time.

Also the steps you need to take to become successful. The step by step strategy you need to plan your future. How to follow that plan & then offer you a whole range of “shop windows” where you can take this new found skill and apply it to the type of income generating methods that suit your pocket, your personality & your goals.

If I turn out to be wrong and everything in the pension garden comes up smelling of roses then you will have lost nothing and hopefully gained extra income anyway!

In the words of Bob Dylan, “The times they are a changing.”

Its only a few 100 years ago that most of our ancestors were working in the fields.

Along came mechanization of farming & the industrial revolution was born.

In 1998 Google was founded and began its meteoric rise from a garage. It is now one of the richest, most well known and used companies on the planet.

In 2004 Mark Zuckerberg started work on Facebook which recently floated for $100 Billion just 8 years later.

In 1903 the Wright Brothers made the first powered, piloted flight in history, less than 70 years later and man was on the moon.

In 2011 Richard Branson with his private company, Virgin Galactic is very near to offering space flights to the paying public!

Times change and in the last 100 years, at an incredible rate. Those who are willing to open their minds to the possibility of change and more importantly TAKE ACTION will be the ones who will benefit the most.

The financial world is a very scary place right now especially for the majority of people who have little or no financial education or business experience.

Financial advisers are still chanting the same old mantra of “put all your money in the stock market in a diversified portfolio.”

As a former financial adviser, I believe that this is THE worst possible advice.

Why? The financial system is broken. The level of corporate greed and corruption has been exposed and yet these same fat cat clowns are still running the show. They make money from other peoples ignorance & misery.

Doomsday Scenario: A possible major recession will see many, many companies go to the wall & with it your stock or pension portfolio. Already pensioners are seeing their lump sums shrinking and savers are receiving little or no interest on their nest eggs.

More and more people will lose their jobs and their homes. If this happens greater numbers of people will need to live on welfare and yet most western governments are bankrupt. The official figures for unemployment in the Eurozone group of 17 countries is currently over 17 MILLION & countries like Spain and Greece have 50% youths who have no work.

Politicians and governments lie. I know you are shocked In the USA the official unemployment rate is 8.2% as of June 2012. However in 1994 the then government removed (the figures were looking bad) the long term unemployed. These people are known as “discouraged workers” – if they were added back into the figures the rate would be over 20% today!

Another of the the big lies is inflation. In the Uk at the moment June 2012 the official government figures state that the rate is 2.8% and it will go down next year. At the same time energy prices alone have risen an average of 20% this year and a business associate of mine has just been told his contract will be increased by 50% next year.

How can those two figures be accurate? They are not. Governments lie and manipulate figures.

Inflation is destroying the value of all of our money. If the true rate of inflation is 12% and your savings are earning 2% it does not take a mathematician to see that their value will be wiped out in just a few short years.

Even if we (hopefully) avoid this doomsday scenario, the financial world has changed forever.

If you wish to thrive & survive in the coming months and years you need to learn to think & plan differently. Relying on governments is not the solution. Consider new & alternative ways of making money and then know what to do with it when you have it.

2012: Many friends & members of Forex Mentor Pro are becoming seriously worried about their financial future & especially their retirement. Many governments have or are about to move the goal posts and change the age of pension entitlement from 65 to 67 years of age (this will be replicated around the world and will not stop there). Nor will this gradual shifting be enough, there is even the danger of some governments defaulting on their pension obligations, they simply do not have the money. Many people have contributed for over 40 years and had a “contract” with the government to enable them to retire with a reasonable income, often supplemented by private pension payments.

Those who have private pensions (80% of people do not or do not pay nearly enough – the average private pension pot in the USA & UK for example is less than $75000) have seen recent stock market falls, galloping inflation and almost non existant interest on savings decimate this side of the equation as well.

A friend of mine, Frank (not his real name) is from Holland. He has been paying an extra 1.9% of his gross salary to the government for the last 25 years so he can retire at 62. This adds up to well over $100.000 when you add compounding. Everything Frank has is geared to this date, he will be mortgage & debt free, he has already bought a boat and is planning to fulful his dream of sailing around the world.

This year his government have changed the rules and now he can not claim these additional benefits for another 5 years. As Frank says “not only have they broken the contract and stolen my money it also feels like they took 5 years of my life.”

Frank & I are the same age. In contrast I am doing rather well. I don’t say this to brag, but simply to point out that many conventional investments, savings and state pensions are becoming obsolete, a thing of the past. I started to change my thinking 10 years ago when I semi retired aged 40 & with four young kids. I had been successful in creating and building businesses from scratch, the first when I was only 21 & with neither money nor family experience behind me. By the time I hit the big 4 0 I was able to sell my third business and semi retire and that was despite a major financial crash in my early 30′s when a messy divorce and bad business decision meant I lost almost everything and had to start again. During this period I was getting up at 4.00 am to drive a truck for less than minimum wage.

A New Century, New Thinking

2000 A new century dawns and the previous year I decided to semi retire aged 40. I had been creating, building & running businesses since I was 21. I had also bought and sold lots of property and built my own 5 bedroom detached house at a fraction of the normal cost and with huge tax savings. I had accumulated a decent amount of money & assets. I was sick of working 70 hour weeks, the 140 mile daily round trip on clogged up motorways, the hassle, the labour laws & all the other energy sapping, non profitable paperwork mountains that the government seemed to delight in creating. I was permanently tired & usually in a bad mood on the rare occasion I saw my 4 young kids. Time to change for the better.

My wife & I ( I will write in the 1st person from now on as its easier, but most financial things I recount are she & I together) spent the next 18 months buying & refurbishing houses to rent out and create extra income. Then we cancelled the private pension plan, sold the business, house, cars the lot and emigrated to the Canary Islands.

Friends and colleagues were convinced I had lost the plot. Who in there right minds builds a business to that level and walks away? I discovered later that they were betting on how soon I would pack my bags and come back to “reality.”

I define this time as to be my financial epiphany, when I started to think & act differently to the herd. This was to be of immense help when the economic collapse finally arrived around 2008. The old way of thinking is finished. If you want to protect your financial future you need to think differently. The old days of paying the top rates of tax and handing the balance over to a financial adviser are not for me.

In the last 30 to 40 years everybody has been advised to save money and or invest in the stock market. To put your money in a pension plan. Put your money in a 401k. If everybody is doing that and stock markets continue to dive then lots and lots of people are going to be in for a major shock short term and especially the long-term. Handing over money to some financial adviser to look after to me is not the solution.

Often these advisers have less life experience & earn less than their clients and they only have one mantra “You need a diversified stock portfolio.” Had you followed my lead and invested in yet more gold in January 2011 you would currently be up around 20%. Most financial adviser either do not know any better or because they do not earn commission on things like gold & silver, they continue to push the same old format.

I speak from experience. In my early 30’s and after a difficult financial period in my life I went from driving a truck for less than minimum wage to being a financial adviser for one of the big UK banks. A two week training course, with multiple choice questions (get an answer wrong and go back and change it) and I was in a bank the following Monday advising clients. I know things have moved on since then BUT the advice is still flawed.

On the subject of flawed systems lets talk about the biggest ponzi scheme on the planet, government pensions. These are simply unsustainable. The current pension crisis is not going to go away. If you are anything less than 40 years of age the chances of the pension arrangement existing in its current format by the time you come to retire is very slim.

Equally if you’re in your 40s now then I can see the retirement age by the time you do come to retire being upwards of 75 years of age. Already some European countries have moved the goal posts for the retirement age from 65 to 67. The bottom line is that the world population in most western countries is getting older which means there will be more people claiming on the system. More people expecting (quite rightly, as that is the “contract” they had with their governments) to take out their share. More people needing health care and yet there will be fewer people contributing.

In the USA for example when the pension system was created there were 44 workers paying into the fund for every retiree. Now that figure is nearer two to one, not helped by the baby boomers who are retiring now and in the next few years.

The system clearly can not continue to work in its current format, if at all. The bottom line is you need to think for yourself. You need to think now of how to provide for you & your family both in terms of your general financial future and especially when it comes to the subject of retirement. You will have heard the comment that there is a huge transfer of wealth in progress right now. To take advantage you need to learn to think and ACT differently NOW. |