News And Technical Analysis From Instaforex - Business (7) - Nairaland

Nairaland Forum / Nairaland / General / Business / News And Technical Analysis From Instaforex (46326 Views)

Get Startup Bonus Of $500 To Trade From Instaforex / News And Technical Analysis From Superforex / News From Instaforex (2) (3) (4)

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) ... (23) (Reply) (Go Down)

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 12:52pm On Apr 13, 2017 |

Global macro overview for 13/04/2017 The Employment Change data from Australia released overnight were way better than expectations. The Employment Change for March was at the level of +60.9k while market participants expected +20k, prior was +2.8k, revised from -6.4k. The Unemployment Rate remained unchanged at the level of 5.09%, just as expected. The Full-Time Employment Change was at the level of +74.5k, while prior was +38.8k, revised from +27.1k. The Part Time Employment Change decreased -13.6k, the prior decrease was -35.9k, revised from -33.5k. In conclusion, Australia's employment surged in March, rising for the sixth consecutive month and confirming that the labor market was on a strong footing after a rocky 2016. Let's now take a look at the AUD/USD technical picture at the H4 timeframe. The data release from the Australian labor market has contributed to the intensification of demand that has managed to break out of the downward channel. Around the 61%Fibo at the level of 0.7600, the supply began to enter the market and the rally was capped. The stochastic oscillator still looks positively but it might be confronted with RSI retreat. The capitulation of the supply at the level of 0.7600 should bring the possibility of a further rally towards the next resistance - this time 78.6% at the level of 0.7635. The nearest support is seen at the level of 0.7568.  Read more: https://www.instaforex.com/forex_analysis/90515 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 1:56pm On Apr 18, 2017 |

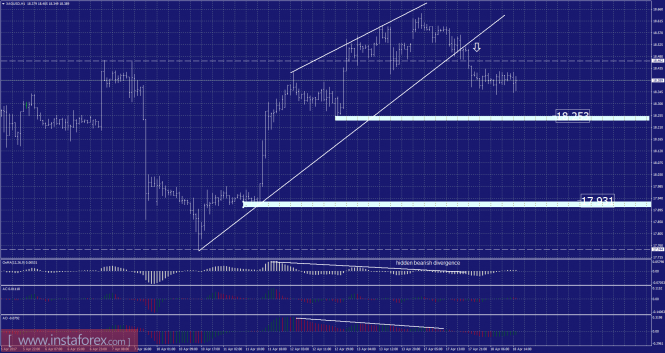

Analysis of Silver for April 18, 2017  Recently, the Silver has been trading sideways at the price of 18.40. According to the 1H time frame, I found that price has broken the upward channel, which is a sign that buying looks risky. There is also a hidden bearish divergence on the moving average oscillator, which is another sign of weakness. My advice is to watch for potential selling opportunities. Downward targets are set at the price of 18.25 and at the price of 17.95. Resistance levels: R1: 18.40 R2: 18.43 R3: 18.46 Support levels: S1: 18.35 S2: 18.33 S3: 18.30 Trading recommendations for today: watch for potential selling opportunities. Read more: https://www.instaforex.com/forex_analysis/90651 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:41pm On Apr 19, 2017 |

Fundamental analysis of NZD/USD for April 19, 2017 NZD/USD has been in a non-volatile bullish trend until the rejection today off the level of 0.7050. Yesterday, the GDT Price Index was published in New Zealand with a positive reading of 3.1% which previously was at 1.6%. After the GDT Price index had been revealed, NZD showed a good amount of bullish move towards the resistance at 0.7050. On the USD side, today we have Crude Oil Inventories report to be published which is expected to be at -1.0M versus the previous level -2.2M. If the USD report comes better than expected, then we might see USD gaining more strength over NZD in the coming days. Tomorrow, the CPI report will be released in New Zealand. The inflation rate is expected to rise to 0.8% which previously was at 0.4%. If these expectations are met, the volatility in this pair will increase tomorrow. Now let us have a look at the technical picture. The price is currently rejecting the resistance at 0.7050. If the price remains bearish with a daily close today, then we will be looking forward to further bearish move in the coming days with a target towards 0.6900. On the other hand, if the price breaks above 0.7050 with a daily close, then we will be bullish with a target towards 0.7130 and 0.7250 in the coming days.  Read more: https://www.instaforex.com/forex_analysis/90675 |

| Re: News And Technical Analysis From Instaforex by aiotaq: 6:40pm On Apr 19, 2017 |

This has help me alot on my invoicing each time want to sent an invoice to my clients. www.acuteinvoice.com |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 2:32pm On Apr 20, 2017 |

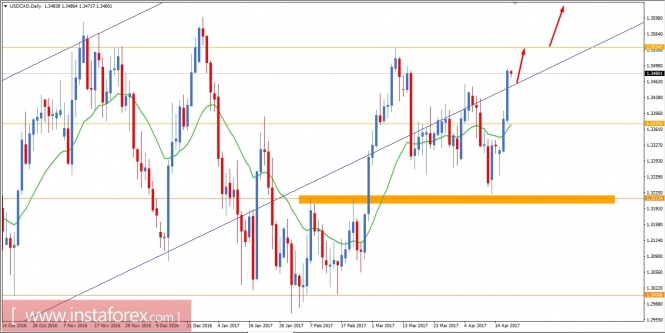

USD/CAD Fundamental Analysis April 20, 2017 USD/CAD is currently going through a good amount of volatility in the market. There had been bearish impulsive movement with a great pressure which was recently taken out by bullish impulsive moves. We have observed price exhaustions for several times in this pair and currently sentimental confusion going on in USD/CAD. Yesterday CAD Gov. Council Member Wilkins spoke about the key interest rates and monetary policy which did not provide any positive outcome for the currency, as a result USD gained a good amount of strength closing above 1.3450 yesterday. On the USD side, today market is expected to be quite volatile as important economic events like Philly Fed Manufacturing Index is going to be published which is expected to be at 25.6 which previously was at 32.8 and along with it Unemployment Claims report is going to be published which is expected to show an increase to 241K which previously was at 234K. If USD news comes positive today, we might see the pair climbing up much higher in the coming days. Now let us look at the technical view, the price has again managed to enter the channel area with a daily close above 1.3450. As of the bullish impulsive pressure and taking out the prior swing on the upside, it is expected that the price will move towards 1.3535-50 resistance area and if the resistance area is taken out with a daily close then we will be looking forward to further upside movement towards 1.40.  Read more: https://www.instaforex.com/forex_analysis/90727 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:34pm On Apr 21, 2017 |

AUD/JPY Fundamental Analysis April 21, 2017 AUD/JPY is going through a non-volatile bearish move. The pair is currently showing some bullish pressure upon the bounce off 81.50 level. Today, Japan presented Flash Manufacturing PMI which was at 52.8, stronger than the consensus of 52.5. Tertiary Industry Activity report was logged at 0.2% which was expected to be at 0.3%. On the other hand, Australia did not have any economic news today but on Wednesday NAB released Quarterly Business Conference which was unchanged at 6. Fundamentally JPY is stronger than AUD. The pair is expected to move more downward in the coming days. Now let us look at the pair from the technical view. The price has a bounce from 81.50 with a bullish engulfing price action. The non-volatile bearish trend is expected to continue. Currently, a bullish move towards 83.00 level is just around the corner. If we see any bullish rejection off that level, we will consider short positions with the nearest target towards 81.50 again and then 79.20 support level.  Read more: https://www.instaforex.com/forex_analysis/90809 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:36pm On Apr 24, 2017 |

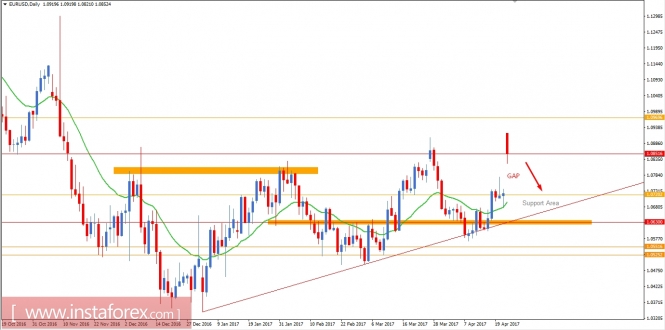

EUR/USD Fundamental Analysis April 24, 2017 After the French Election in the weekend EUR/USD has opened today with an over 150 pips GAP upwards. In the Election, currently Macron is leading with 23.9% votes where Le Pen is a bit behind at 21.4%. Any candidate reaching over 50% will be announced as a winner. Today we have EUR German Ifo Business Climate report is going to be published, it is expected to be at 112.4 which previously was at 112.3 and on the USD side today we have FOMC Member Kashkari's speech where he is going to discuss about key interest rates decisions and future monetary policies. As the market opened with a large upward GAP in this pair, a daily close today will indicate the upcoming move in this pair this week. Now let us look at the technical view, the price has opened today above 1.09 but bears have pressurized the price to fall back towards 1.0850. Currently, the price is residing just above 1.0850 and if we see a daily close below 1.0850 then we will be looking forward to selling with a target towards 1.0720. On the other hand, if the price remains above 1.0850 with a daily close then we will be looking forward to buy with a target towards 1.1010. As of the market gap in place, it is expected that the GAP will be filled up first before the price climb upwards again.  Read more: https://www.instaforex.com/forex_analysis/90848 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:41pm On Apr 25, 2017 |

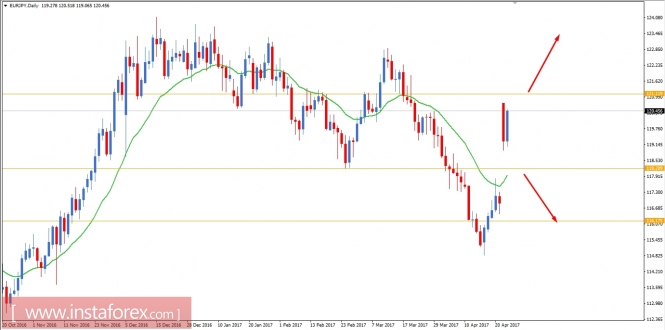

EUR/JPY Fundamental Analysis April 25, 2017 After the French Election Round 1 in the weekend, EUR/JPY started the week with a GAP of 390 pips. Though the price showed some bearish movement yesterday falling back to 119.25, today the bulls are trying to take over again. Today, despite having the Italian Bank Holiday due to the observance of the liberation day, EUR is stronger than JPY. On EUR side, Belgian NBB Business Climate report is going to be published later today which is expected to be at -1.4 which previously was at -1.6. If the news comes positive today, EUR is likely to gain more strength in the coming days. On the other side, Japan's SPPI report was published today which was better than expected at 0.8% instead of 0.7%. Nevertheless, JPY could not gain ground against the EUR pressure today. Overall, EUR is expected to climb much higher against JPY in the short term. Now let us consider he technical view. The price is currently residing in the mid-range of 118.20 to 121.10. If the price breaks above 121.10 with a daily close, then we will be planning buy positions with an upward target of 123.50 resistance level. Otherwise, if the price breaks below 118.20 with a daily close, then we will consider sell positions with a downward target towards 116.20 support level. Currently it would be better to be on the sidelines for this pair until the range is broken with a daily close on either side.  Read more: https://www.instaforex.com/forex_analysis/90936 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:08pm On Apr 26, 2017 |

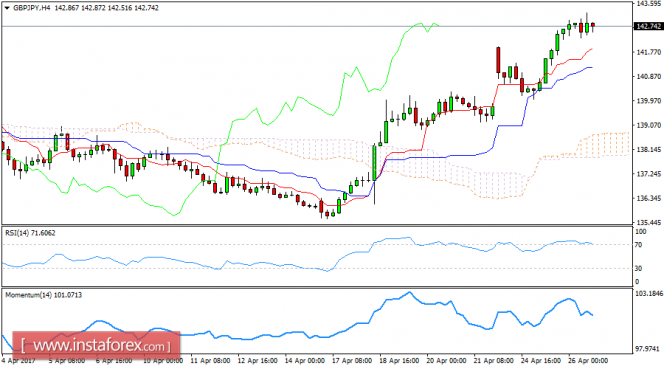

Daily analysis of GBP/JPY for April 26, 2017  Overview The GBP/JPY pair succeeded to gather the bullish momentum. The bullish attack will resume by surpassing 141.10 level, approaching from our target at 143.35. The continuation of the positive pressure might allow the price to open the way to more upward targets from 145.45 and higher to 148.45 top as a result of surpassing the current level which forms 23.6% Fibonacci retracement. In case 143.35 forms a solid barrier to the bullish rally, that will force the pair to trade sideways and limit the price between this barrier and 141.10 until gaining new bullish momentum. The expected trading range for today is between 142.20 and 145.40 Read more: https://www.instaforex.com/forex_analysis/90986 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:11pm On Apr 27, 2017 |

USD/CAD Fundamental Analysis April 27, 2017 USD/CAD has been quite volatile recently while USD seemed to be gaining well over CAD. Yesterday CAD had mixed result of Retail Sales report, where Core Retail Sales was published with a slight positive figure at -0.1% which was expected to be at -0.2% and Retail Sales was published negative at -0.6% which was expected to be at 0.0%. After the mixed economic reports yesterday, CAD showed some good gain today after bouncing off from 1.3590 resistance level. On the other hand, today USD have Core Durable Goods Orders report to be published which is expected to show a slightly decreased value at 0.4% which previously was at 0.5% and Unemployment Claims is expected to decrease at 241k which previously was at 244k. Any positive reports on the USD today is expected to push the price much higher in the coming days. Now let us look at the technical view, the price has dropped back inside the resistance level of 1.3590 after a false daily break yesterday. If we see a daily close below the 1.3590 level today then we will be looking forward to selling with a target towards 1.3260 support level. On the other hand, if the price close above 1.3590 with a daily close today then we will be looking forward to buying with an upward target towards 1.3650 to 1.3800 area.  Read more: https://www.instaforex.com/forex_analysis/91036 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:49pm On Apr 28, 2017 |

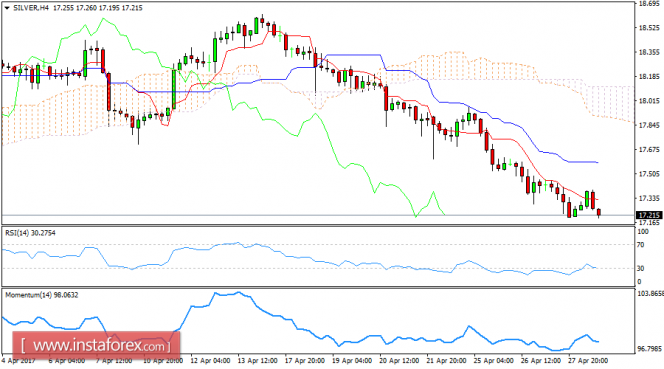

Daily analysis of Silver for April 28, 2017  Overview The silver price tests the 17.43 level that was broken previously, as the price is affected by stochastic positivity. Meanwhile, the EMA50 forms negative pressure that keeps the bearish trend scenario active for today. Therefore, we are waiting for bearish rebound on the intraday basis, and the main target is represented by visiting 16.56 levels. A breach of 17.43 followed by 17.60 levels will push the price to return to the main bullish trend again. The expected trading range for today is between the 17.10 support and the 17.45 resistance. Read more: https://www.instaforex.com/forex_analysis/91124 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:47pm On May 02, 2017 |

Fundamental Analysis of GBP/USD for May 2, 2017 GBP/USD has been in good bullish momentum since the break above 1.2800 area. This pair has been quite volatile after the break and is expected to be bullish all the way towards 1.3370 area. Today GBP had Manufacturing PMI report which was published with a positive figure at 57.3 which was expected to be at 54.0. On the other hand, USD Total Vehicle Sales report is going to be published today which is expected to be at 17.1M which previously was at 16.6M. GBP is currently quite stronger than USD as of the positive economic report today and if the USD report comes positive we might see a good amount of volatility in the pair as well. Now let us look at the technical view, the price is currently just above 1.2750 to 1.2800 support area. Yesterday bears were quite powerful than the bulls and as a result, the price closed at a new lower high. Currently, as of GBP positive economic report, today GBP is observed to have a good momentum on the upside but a daily close will decide the further move in this pair. Currently, as of 20 EMA is quite far from the currency price, it is expected that the price will reverse back down towards 1.2800 before making any further move up towards 1.3370 resistance level.  Read more: https://www.instaforex.com/forex_analysis/91228 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:00pm On May 03, 2017 |

Fundamental Analysis of USD/CAD for May 3, 2017 USD has been dominating CAD since the bounce off 1.3250 support level. On the USD front, ADP Non-Farm Employment report is due today, so the pair is expected to trade with some volatility. ADP Non-Farm Employment Change is expected to decrease at 178k which previously was at 263k. Besides, ISM Manufacturing Index report is also going to be published today which is expected to show a minor increase to 56.1 which previously was at 55.2. Apart from that, Crude Oil Inventories report is also going to be released which is expected to show a -3.3M fall which previously was at -3.6M. On the other side, Canada does not have any economic reports today, but tomorrow Canada's Trade Balance report is going to be posted which is expected to show a proficit value at 0.3B from the previous deficit of -1.0B. As USD has already gained a fresh impetus against CAD, the pair is expected to reverse downward to its mean before showing any further move. Now let us look at the pair from the technical view. The price has shown a good amount of bullish rejection yesterday. Currently the price is still showing some bullish rejection intraday. The pair is expected to reverse back to the mean of 20 EMA which is at horizontal support of the 1.3600 area. If the price moves down to 1.3600 and we see any bearish rejection at the level, we will consider buy positions with a target towards 1.40 in the coming days.  Read more: https://www.instaforex.com/forex_analysis/91280 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:56pm On May 12, 2017 |

AUD/USD bouncing up nicely, remain bullish Price has started to bounce up nicely from our buying level. The plan today is to remain bullish above major support at 0.7332 (Fibonacci extension, Elliott wave theory) and we expect a bounce above this level to at least 0.7426 resistance, (Fibonacci retracement, horizontal swing high resistance). Stochastic (55,5,3) has made a bullish exit meaning that a further rise can be expected. Correlation analysis: AUD/USD has a strong positive correlation with NZD/USD which means they usually move together. We are expecting a rise on AUD/USD and a rise on NZD/USD which goes well with the positive correlation expected. Buy above 0.7332. Stop loss at 0.7290. Take profit at 0.7426.  Read more: https://www.instaforex.com/forex_analysis/91687 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:57pm On May 15, 2017 |

Fundamental Analysis of USD/JPY for May 15, 2017 USD/JPY has been in a bullish non-volatile trend since the bounce off from 114.00-50 resistance area. Today, JPY had positive economic report of PPI which came in at 2.1% instead of the expected 1.8% gain. Prelim Machine Tool Orders also showed an increased figure at 34.7% which previously was at 22.8%. On the other hand, USD Empire Estate Manufacturing Report is due later today which is expected to be at 7.2 which previously was at 5.2 and NAHB Housing Market Index is expected to be unchanged at 68. Overall, JPY has an upper hand over USD today comparing the economic events, forecasts and results. JPY is expected to gain more ground in the coming trading days. Now let us look at the technical chart. The price is currently showing some bullish pressure after two days of bearish price action taking the price below 114.50 resistance area. Currently, the pair is trading with a bearish bias with a target towards 111.60 as the price remains below 114.50. On the other hand, if the price breaks above 114.50 with a daily close above it, then we will consider buy positions with a target towards 116.  Read more: https://www.instaforex.com/forex_analysis/91715 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:11pm On May 16, 2017 |

Fundamental Analysis of GBP/USD for May 16, 2017 GBP/USD has been in a volatile corrective structure after a break above 1.2800. For the recent 2 weeks, the price has been stalling between 1.2800 to 1.3000. Today, a good amount of volatility is expected in GBP because of the high impact economic news. Among them is UK CPI report which is expected to rise to 2.6% which previously was at 2.3%. PPI Input is expected to decrease to 0.1% which previously was at 0.4%. Besides, RPI is expected to increase to 3.4% which previously was at 3.1%. On the other hand, we have US Building Permits report which is expected to be unchanged at 1.27M, Housing Starts are expected to increase to 1.26M which previously was at 1.22M, Capacity Utilization report could show a slight increase to 76.3% which previously was at 76.1%. Eventually, Industrial Production report is expected to log a decrease to 0.4% in April from 0.5% in March. GBP has an upper hand over USD currently. However, due to high impact news from the UK and US today we might experience spikes in the market today. Now let us look at the technical chart. The price is currently in a corrective structure above 20 EMA and horizontal support area of 1.2750-1.2800. Due to yesterday's bullish rejection on the daily candle, now we expect the price to move down towards the support area of 1.2750-1.2800 and reject the sellers off the level and show some bullish move towards next resistance of 1.3370. On the other hand, if the price breaks below 1.2750 with a daily close, then we will consider sell positions with a target towards 1.2550, till then we are in a bullish bias.  Read more: https://www.instaforex.com/forex_analysis/91773 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:15pm On May 17, 2017 |

Fundamental Analysis of EUR/GBP for May 17, 2017 EUR/GBP is currently showing a bullish rejection after breaking above the 0.8550 resistance level. GBP is quite stronger than EUR in light of positive fundamental data published in the UK today. UK Average Earning Index came in as expected at 2.4% which previously was at 2.3%. Claimant Count Change decreased to 19.4k which previously was at 33.5k. Unemployment Rate was better than expected at 4.6% which was at 4.7% previously. On the other hand, the economic calendar contains positive reports from the eurozone. Italian Trade Balance report came in at 5.42B which was expected to be at 1.97B. Final CPI report was unchanged at 1.9% and Final Core CPI was also unchanged at 1.2%. Comparing the positive impact on both curencies, GBP has an upper hand over EUR in this pair. GBP is expected to advance further in this pair against EUR in the short run. Now let us look at the technical chart. The price has already rejected buyers in this pair after the UK presented positive Unemployment Rate report and Average Earning Index. Currently the price is expected to move down towards 0.8550. If the price breaks below 0.8550 with a daily close, then we will consider sell positions with a downward target at 0.8420. On the other hand, if the price rejects off the 0.8550 support level, it would be wise to plan buy positions with an upward target towards 0.8780 – 0.8800 resistance area.  Read more: https://www.instaforex.com/forex_analysis/91854 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:30pm On May 18, 2017 |

Fundamental Analysis of AUD/USD for May 18, 2017 Recently, AUD/USD has shown a good amount of bullish pressure after a bounce of 0.7330 support area. Today, AUD also had a good amount of bullish pressure after positive economic reports on Australia's Employment Change which were better than expected. The Employment Change report showed an increase of 37.4k which was expected to be at 4.5k. Besides, Unemployment Rate in Australia declined to 5.7% from 5.9% earlier, the forecast was made with a flat reading. The positive economic reports from Australia gave some boost to AUD. Nevertheless, it failed to keep it up, giving in to the USD pressure. On the USD side, today we have Unemployment Claims report which is expected to increase to 240k which previously was at 236k. Philly Fed Manufacturing Index is expected to decrease to 19.9 which previously was at 22.0. Australia has already presented strong data. On the other hand if US reports reveal negative figures, then we might see AUD gaining more against USD in the coming days. Now let us look at the technical chart. The price is currently showing indecision due to equal pressure from AUD and USD. Recently, AUD/USD has formed a Double Top Pattern where it is currently going to retest the Neckline of the pattern at 0.7500 level. The price is currently being hold by 20 EMA dynamic resistance. If that could not hold, the price is likely to reach 0.7500 horizontal resistance before the price continues its bearish trend again towards 0.7160 support level. As the price remains below 0.7500, the pair is set to follow the bearish bias. [Img]https://forex-images.instaforex.com/userfiles/20170518/analytics591d6d6b1e637.jpg [/img] Read more: https://www.instaforex.com/forex_analysis/91910 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 1:44pm On May 19, 2017 |

Fundamental Analysis of AUD/JPY for May 19, 2017 Recently, AUD/JPY has been in a volatile corrective structure. Yesterday, despite positive reports from Australia AUD could not dominate JPY. Australia released Employment Change report which showed an increase of 37.4k, much better than the forecast for moderate 4.5k growth. Besides, Unemployment Rate declined to 5.7% from 5.9%, analysts projected a flat reading. On the other hand, Japan had positive Prelim GDP at 0.5% which was expected to be at 0.4% and negative Prelim GDP Price Index at -0.8% which was expected to be at -0.7%. Amid mixed economic reports from Japan, JPY dominated AUD despite upbeat economic reports yesterday. This resulted in an indecision daily candle, but in the coming days AUD is expected to climb up higher against JPY. Now let us look at the technical chart. The price is currently under the important level of 82.90 while filling up the French Election GAP yesterday. At present, a bullish move is expected in this pair if the price closes above 82.90 with a daily close. We will target 84.50 as the first target and 86.10 as the second target for the bullish trade. The bais will keep the bullish bias until the price takes out 81.50 with a bearish daily candle.  Read more: https://www.instaforex.com/forex_analysis/91951 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:32pm On May 22, 2017 |

Fundamental Analysis of EUR/USD for May 22, 2017 EURUSD has been in non-volatile bullish trend after bouncing off from 1.0850. Today, this pair has shown a good amount of bullish pressure as the Eurogroup's meeting is taking place today among 19 member states of the eurozone. The meeting will co-ordinate their initiatives and decisions for the overall economic health in the eurozone. Currently, the meeting is unfolding well in favor of EUR and it is also reflected in the chart. On the USD side today, FOMC policymakers Harker and Kashkari are due to speak about an interest rate decision and further monetary policies. The pair is expected to trade with higher volatile during these events. If USD fails to gain over EUR today, then further bullish pressure in this pair will continue in the coming days. Now, let us look at the technical chart. The price has retraced towards 1.1160 area today before showing some bullish pressure. Currently, the pair is riding a strong bullish bias and it is expected to reach 1.1350 resistance in the coming days. Meanwhile we might see some corrective moves along the way though today the bullish pressure is quite impressive but the dynamic level of 20 EMA is quite far from the current price which indicated an upcoming retracement in this pair before heading much higher towards 1.1350.  Read more: https://www.instaforex.com/forex_analysis/92023 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:57pm On May 23, 2017 |

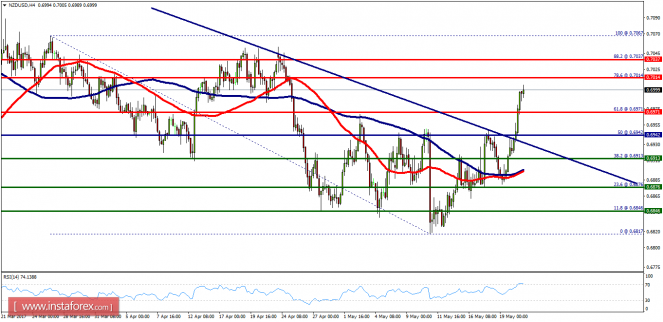

Technical analysis of NZD/USD for May 23, 2017  Overview: The NZD/USD pair continues to move upwards from the level of 0.6942. Yesterday, the pair rose from the level of 0.6942 (the level of 0.9866 coincides with a ratio of 50% Fibonacci retracement) to a top around 0.7000. Today, the first support level is seen at 0.6942 followed by 0.6913, while daily resistance 1 is seen at 0.7037. According to the previous events, the NZD/USD pair is still moving between the levels of 0.7037 and 0.6942; for that we expect a range of 95 pips (0.7037 - 0.6942). On the one-hour chart, immediate resistance is seen at 0.7014, which coincides with a ratio of 78.6% Fibonacci retracement. Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. The price is still above the moving average (100) and (50), Therefore, if the trend is able to break out through the first resistance level of 0.7073, we should see the pair climbing towards the double top at the level of 0.7067 to test it. It would also be wise to consider where to place stop loss; this should be set below the second support of 0.6913. Read more: https://www.instaforex.com/forex_analysis/92049 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:05pm On May 24, 2017 |

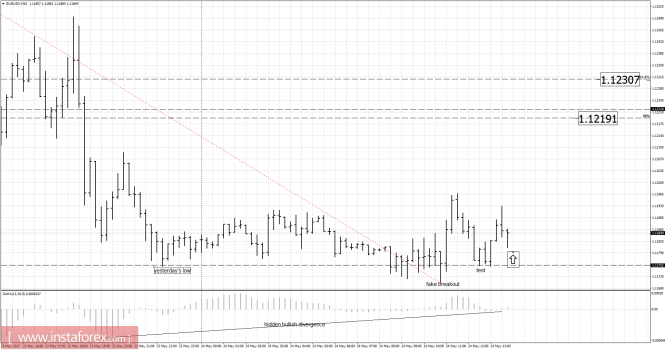

EUR/USD analysis for May 24, 2017  Recently, the EUR/USD has been trading downwards. As I expected, the price tested the level of 1.1170. Anyway, according to the 15M time frame, I found a fake breakout of yesterday's low at the price of 1.1175. There is also a hidden bullish divergence on the moving average oscillator, which is another sign of potential strength. I have placed Fibonacci retracement to find potential upward targets. I got Fibonacci retracement 50% at the price of 1.1220 and Fibonacci retracement 61.8% at the price of 1.1230. My advice is to watch for buying opportunities today. Resistance levels: R1: 1.1245 R2: 1.1265 R3: 1.1305 Support levels: S1: 1.1170 S2: 1.1150 S3: 1.1110 Trading recommendations for today: watch for potential buying opportunities. Read more: https://www.instaforex.com/forex_analysis/92119 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:21pm On May 25, 2017 |

Fundamental Analysis of AUD/USD for May 25, 2017 AUD/USD is currently trading with higher volatility on the break or retest of 0.7500-0.7550 area. Due to recent negative reports from Australia, the currency is expected to lose some ground against other currencies. Today, RBA Deputy Governor Debelle made a speech on key interest rates and future policy shifts of the country. His speech tends to be dovish, as a result AUD has been on the back foot. On the other hand, the US is due to release Unemployment Claims report later today which is expected to show an increase to 238k from 232k previously. Besides, Goods Trade Balance report is expected to show a slight decrease in deficit to -64.7B from a -64.8B deficit earlier. If the US economic reports today reveal positive figures, then we might see a further downward move in this pair in the coming days. Now let us look at the technical chart. The price is currently being rejected off the resistance of 0.7500 area. Amid higher volatility after a short-term bullish move towards 0.7500, we foresee a further downward move in this pair. Currently, we will be looking for a daily close below 0.7500 today. If that happens, we will expect the price to move down towards 0.7160 support level in the coming days. We will be in bearish bias until the price breaks above 0.7550 with a daily close.  Read more: https://www.instaforex.com/forex_analysis/92169 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 5:18pm On May 26, 2017 |

Fundamental analysis of USD/CHF for May 26, 2017 USD/CHF has been in a good bearish run since the bounce off the 1.0100 resistance area recently. Switzerland published a negative trade balance report on Tuesday which was at 1.97B versus the expected level at 2.87B. However, the Swiss currency is stronger against USD. Currently CHF is dominating USD in every dimension possible. On the USD side, today the G7 meeting is going on which is expected to bring some volatility to the market. Besides, the preliminary estimates of the GDP growth rate are expected to show an increase of 0.9% which previously was at 0.7%. The durable goods orders is expected to show a negative figure at -1.4% which previously was positive at 0.9%, and Prelim GDP Price Index is expected to be unchanged at 2.3%. If the USD reports fail to meet expectations today, CHF is expected to extend gains in the coming days. Now let us look at the technical view. The price has already broken below the event level at 0.9960 and currently it is in a non-volatile bearish trend with a target towards 0.9550 area. Some correction may be observed before the price reaches the ground at 0.9550 area. Counter players are currently weak in this market structure. We are in bearish bias in this pair and it will continue till the price breaks above 1.0100 area with a daily close.  Read more: https://www.instaforex.com/forex_analysis/92233 |

| Re: News And Technical Analysis From Instaforex by BluePulse: 6:03pm On May 26, 2017 |

Promote your business for free on BizKonekt [url]bizkonekt..com[/url] From the menu knob/icon, "drop a message" and you will receive a response. To promote your business is free!!! Every business needs the right connection to thrive. Every business needs the right promotion to float. Every business needs the right touch to blossom. www.bizkonekt..com gives you that for FREE!!! Cheers |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:41pm On May 30, 2017 |

Daily analysis of USDX for May 30, 2017 The index remained in sideways during the Memorial Day in the United States, capped by the 200 SMA at H1 chart. The bears are still strong across the greenback and we can expect some declines towards 96.90. However, if USDX manages to break above the 200 SMA, it's expected to see a rally that tests the resistance area of 98.11.  H1 chart's resistance levels: 97.41 / 98.11 H1 chart's support levels: 96.90 / 96.25 Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 96.90, take profit is at 96.25 and stop loss is at 97.56. Read more: https://www.instaforex.com/forex_analysis/92327 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 5:09pm On May 31, 2017 |

AUD/USD bouncing up nicely, remain bullish ] Price has started to bounce up really nicely. We remain bullish above 0.7441 support (Fibonacci retracement, horizontal swing low support, bullish divergence) for a push up to at least 0.7510 resistance (Fibonacci retracement, Fibonacci extension, horizontal overlap resistance). Stochastic (34,5,3) is seeing strong support above the 5.1% where stochastic is bouncing up nicely from and also sees bullish divergence versus price signalling that a bounce is impending. Buy above 0.7441. Stop loss at 0.7397. Take profit at 0.7510.  Read more: https://www.instaforex.com/forex_analysis/92417 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:04pm On Jun 01, 2017 |

Fundamental Analysis of EUR/AUD for June 1, 2017 EUR/AUD has been in a non-volatile bullish trend recently which has surpassed and retested 1.51 recently. Today, Australian AIG Manufacturing Index was released with a worse figure of 54.8 from 59.2 previously, Private Capital Expenditure showed a rise to 0.3% from -0.1% which has affected by the currency growth but Retail Sales report showed growth of 1.0%, much stronger than the forecast for a 0.3% rise. The Retail Sales report is seen as a gauge of consumer spending which has a positive impact. Nevertheless, some bearish pressure is observed in the pair currently. On the Euro side, today Spanish Manufacturing PMI is due later which is expected to show a rise to 54.9 from 54.5 previously, Italian Manufacturing PMI is expected to be roughly the same at 56.1 which was 56.2 earlier, French Final Manufacturing PMI is expected to be unchanged at 54.0 whereas German Final Manufacturing PMI is expected to be unchanged at 59.4 and Eurozone Final Manufacturing PMI is also expected to remain flat at 57.0. Though the reports from the eurozone have not been released yet, but the most of forecasts suggest flat readings, any positive changes in these fundamental data could enable growth of AUD and promote gains of EUR in the coming days. The market is currently in a bullish bias which is expected to remain steady until Australia presents some positive reports in the future. Now let us look at the technical chart. The price is currently in a non-volatile bullish trend which has recently broke above 1.5100 resistance level. Currently the price is expected to show some corrective moves along the way towards 1.5650 resistance. As the price remains above 1.4900, we will be in a bullish bias with a target towards 1.5650 until price breaks below 1.4900 with a daily close.  Read more: https://www.instaforex.com/forex_analysis/92437 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:08pm On Jun 02, 2017 |

Fundamental Analysis of AUD/JPY for June 2, 2017 AUD/JPY bearish trend seems to be quite intact as the break above 83.00 is now considered as a false break. As of the mixed economic reports on the Australian economic reports recently AUD is currently quite weaker than JPY. Today JPY has Monetary Base report to be published which is expected to have a minor fall to 19.6% which was at 19.8 previously and Consumer Confidence is expected to rise to 43.6 which was 43.2 previously. As of the recent JPY economic events like Capital Spending and Flash Manufacturing PMI, the economy has shown a good amount of growth in its figures which did reflect in the chart against AUD. On the AUD side, today HIA New Home Sales report is going to be published which is going to have a major impact as it is a leading indicator of economic health due to new home sales provides information about new purchases and sales of the products which does have direct effect on the economy and this time it is expected to provide a better figure which previously was at -1.1%. As of the current situation of the both currencies in this pair, JPY is expected to gain more against AUD in the coming days due to better economic reports on the Japanese side rather than mixed economic reports on the Australian economy. Now let us look at the technical view, the price has rejected quite well after the JPY economic reports showed better outcomes than the AUD reports recently. Currently, the price is below the resistance level of 83.00 and as the price remains below the level further bearish move is expected in this pair with the nearest target towards 81.50. If price breaks below 81.50 then we might see a further downward move with a much lower target towards 79.20 area. As the price remains below 83.00 we are in bearish bias until we see a daily close above the level.  Read more: https://www.instaforex.com/forex_analysis/92473 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:57pm On Jun 05, 2017 |

Technical analysis of GBP/JPY for June 05, 2017 [Img] https://forex-images.ifxdb.com/userfiles/20170605/GBPJPYM30.png[/img] GBP/JPY is under pressure. The pair retreated from 143.95 and broke below the 20-period and 50-period moving averages. The relative strength index is mixed to bearish. In addition, the key resistance at 143.05 should limit the upside potential. Hence, as long as this key level is not surpassed, look for another decline to 141.95 and even to 141.45 in extension. Graph Explanation: Black line shows the pivot point, present price above pivot point indicates the bullish position and below pivot points indicates the short position. Red lines shows the support levels and green line indicates the resistance levels. These levels can be used to enter and exit trades. At present, the pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short position is recommended with the first target at 141.95. A break below this target will move the pair further downwards to 141.45. The pivot point stands at 143.05. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 143.35 and the second one at 143.95. Strategy : SELL at dips, Stop Loss: 143.05, Take Profit: 141.95 Resistance levels: 141.95, 141.45, and 140.75 Support levels: 143.35,143.95, and 144.50 Read more: https://www.instaforex.com/forex_analysis/92553 |

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) ... (23) (Reply)

Femi Otedola And His Wife With Bill Gates / Photo: See The Lagos Taxi Driver That Uses POS / Chinese Man Speaking Complete Igbo To His Nigerian Customer In China(pics)

(Go Up)

| Sections: politics (1) business autos (1) jobs (1) career education (1) romance computers phones travel sports fashion health religion celebs tv-movies music-radio literature webmasters programming techmarket Links: (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Nairaland - Copyright © 2005 - 2024 Oluwaseun Osewa. All rights reserved. See How To Advertise. 125 |