| Debt Servicing Rises, Gulps 72% Of FG Revenues by adenigga(m): 2:41am On Jul 15, 2021 |

• Debt servicing to revenue ratio jumped from 54.66% in 2019 to 72% in 2020

• Ratio high because of indiscipline, we may lose infrastructure to creditors – Utomi

The Federal Government made a total of N3.25tn in 2020, according to a review of the budget performance of the 2020 Appropriation Act.

The review also showed that the Federal Government spent a total of N2.34tn on debt servicing within the year.

This means that 72 per cent of the government’s revenue was spent of debt servicing. It also puts the government’s debt servicing to revenue ratio at 72 per cent.

In 2019, The Federal Government made a total revenue of N3.86tn. Within the year, debt servicing gulped N2.11tn. This puts the Federal Government’s debt servicing to revenue ratio in 2019 at 54.66 per cent.

This means that between 2019 and 2020, the Federal Government’s debt servicing to revenue ratio jumped from 54.66 per cent to 72 per cent.

As of March 31, the Debt Management Office put Nigeria’s total debt at N33.11tn. Out of this figure, N20.64tn (62.33 per cent) was owed to domestic creditors while N12.47tn (37.67 per cent) was owed to foreign creditors.

Of the domestic debt profile, N16.51tn belong to the Federal Government while N4.12tn belong to the 36 states of the federation and the Federal Capital Territory Administration.

The N12.47tn foreign debt was not broken into federal and subnational segments. However, historically, about 86 per cent of Nigeria’s foreign debt usually belong to the Federal Government.

Although the Federal Government consistently argues that its debt to Gross Domestic Product is low, economists and experts say that it is better to use the debt servicing to revenue ratio to measure a country’s indebtedness.

This is because the debt servicing to revenue ratio measures a country’s capacity to repay its loans.

Although the Federal Government had projected a revenue of N5.84tn for 2020, actual revenue was N3.25tn. It also projected to spend N2.68tn on debt servicing.

As in the years before, a greater percentage of the country’s revenues came from oil in 2020. Oil revenue contributed N1.41tn, non-oil sources contributed N1.26tn, while independent funding sources contributed N578.45bn.

As of March 31, the Debt Management Office put Nigeria’s total debt at N33.11tn. Out of this figure, N20.64tn (62.33 per cent) was owed to domestic creditors while N12.47tn (37.67 per cent) was owed to foreign creditors.

Of the domestic debt profile, N16.51tn belong to the Federal Government while N4.12tn belong to the 36 states of the federation and the Federal Capital Territory Administration.

The N12.47tn foreign debt was not broken into federal and subnational segments. However, historically, about 86 per cent of Nigeria’s foreign debt usually belong to the Federal Government.

Although the Federal Government consistently argues that its debt to Gross Domestic Product is low, economists and experts say that it is better to use the debt servicing to revenue ratio to measure a country’s indebtedness.

This is because the debt servicing to revenue ratio measures a country’s capacity to repay its loans.

Although the Federal Government had projected a revenue of N5.84tn for 2020, actual revenue was N3.25tn. It also projected to spend N2.68tn on debt servicing.

As in the years before, a greater percentage of the country’s revenues came from oil in 2020. Oil revenue contributed N1.41tn, non-oil sources contributed N1.26tn, while independent funding sources contributed N578.45bn.

In 2020, the Federal Government spent N3.17tn on personnel and overhead costs, two segments of the nation’s recurrent expenditure.

The government spent N1.57tn on capital expenditure. Total expenditure for the year was N9.75tn, with the nation borrowing a total of N2.06tn as domestic borrowing in the year.

In 2019, Nigeria made N3.86tn as revenue. Oil revenue contributed N1.620tn; non-oil revenue contributed N1.69tn, while independent funding contributed N547.270bn.

The Federal Government spent N2.37tn on overhead and personnel cost within the year and N1.17tn on capital expenditure. Total debt servicing gulped N2.11tn of government revenue. Total expenditure for the year was N8.29tn, and total borrowing was N912.82bn.

In 2018, the Federal Government generated N3.48tn as revenue. Revenue from oil contributed N1.96tn; non-oil contributed N1.12tn, and independent funding was N395.2bn.

Overhead and personnel cost gulped N2.05tn, while N736.51bn was spent capital projects. Total debt servicing gulped N2.09tn of government revenue. This put debt servicing to revenue ratio at 60.06 per cent. Expenditure for the year totalled N6.27tn, and total borrowing for the year was N1.74tn.

According to the budget office, in 2020, the Federal Government continued to meet its non-discretionary expenditures even as budget implementation continued to be affected by poor revenue outcomes.

The office said that the performance of the economy during the fourth quarter of 2020 was encouraging, considering developments in the global economy and the performance of other economies.

However, it said, it was important to accelerate efforts towards improving the growth record and revenue performance.

The office added that enhancing revenue collection in 2021 was key to the successful implementation of the 2021 budget.

In its fourth quarter 2020 budget implementation document, the office said, “Efforts to moderate the growth in recurrent expenditure and particularly personnel and recurrent debt in 2021 is critical even as effective implementation of the COVID-19 containment measure continues to be paramount.

“The Federal Government has reiterated its commitment to improved openness, transparency and accountability in budget preparation, implementation, monitoring and evaluation and feedback.

“In view of this, strict adherence to budget implementation guidelines and the governance framework on monitoring of capital budget implementation will continue to be followed.

“Efforts would also be geared towards fostering efficiency in budget implementation, while ensuring effective project management in 2021.”

Political economist and former presidential candidate, Prof. Pat Utomi, attributed the high debt servicing ratio to lack of discipline in public administration in Nigeria.

He said, “We are permanently fire-fighting. We have no long-term vision for our country. So, politicians tend to act ‘for this moment, for this tenure’. They don’t often think about what will happen in five years or ten years; that is why we have these kinds of borrowing.

“As far as most politicians are concerned, the problem will come when they are gone. So, it becomes a problem for those who have to deal with it. What has been done in the past is using fiscal responsibility laws.

“There are states in the US that have balanced budget law that says you can’t spend beyond what you earn. Obviously, that can limit the flexibility of growing the economy and all of that but there should be certain guidelines.”

Utomi said that the nation had built a big government, which is a huge cost for a poor country. And since the government has to maintain expenditures in light of falling revenue, the government would continue to borrow more, he added.

He raised the alarm regarding the consequences of failing on loan repayment.

Utomi said, “The consequence is huge. For instance, we are seeing some countries being taken over by China due to inability to pay debt.

“We may wake up one day and find out that one of our infrastructures like Apapa ports belongs to a foreign government due to our borrowing.

“There must be a dramatic trimming of costs in the country and a dramatic push for production. Right now, we are driven by revenue from crude oil. The outcome will be disastrous if nothing is done.

“If we don’t have any money to pay salary, for maybe five years, because the entire money is used to service debt, there may be one to two years without salary for civil servants. It is not new, it had happened. If that becomes a norm nationwide, there will be more violence, crime, hunger, and instability.

“In the short run, we need an open debt conversation and strategies. In the long run, we need to restructure our system.”

The Chief Executive, Economic Associates, Dr Ayo Teriba, said that high debt servicing to revenue ratio was not good.

He said for a country of 200 million people, money was needed to be invested in the populace.

Teriba said if the main share of government’s revenue goes to servicing debt, then the nation was falling into a debt trap.

He said, “Now what is the solution? What can Nigeria do to change the situation? First you have to understand the problem; you can’t completely blame the government for the revenue shortfall; particularly for last year.

“This is because there was a global pandemic, whose ripple effect depressed not just global economic prices but domestic economic activities, which pushed the domestic economy into a recession.

“Therefore, the government should manage the pandemic effectively; it will go and the revenue will grow back after the pandemic passes.”

Teriba believes that the quality of government debt is poor.

He said, “The Nigerian government borrows in the worst possible way and in a very outdated manner. This causes a backlash to the government. Because Nigeria’s debts are not linked to any assets, we just go to the treasury bill market and borrow, at any rate that anybody wants to give you.

“There are many other countries who borrow more than what Nigeria is borrowing and don’t have any problem paying back. They borrow intelligently and efficiently, in a way that their debts service themselves.

“A more efficient way of borrowing is for the Federal Government to migrate all the debts to asset-linked debts. This means structuring the borrowing transaction like investments. There must be an underlying asset to which borrowers can use to recover the principal they gave the country plus profit.”

Teriba added that the nation should focus on equity, and if equity investments were focused on, it would reduce debt servicing burden on the nation, as there was no pay back or service clause on equity.

He added, “Finally, it is not just debt and equity you can get from assets; you can get revenue from assets, by leasing or selling these national assets, just like what the British government has been doing.

“So, what the Federal Government should diversify is not the economy or exports; it is its debt or financial portfolio.”

A professor of economics at the Olabisi Onabanjo University Ago-Iwoye, Ogun, Sheriffdeen Tella, said, “The first thing the government has to do is to stop borrowing, and start looking for ways of generating wealth, instead of thinking they can only generate money from borrowing.

“They should also think about how to improve tax collection because it would also assist. They also need to approach creditors for debt suspension for some time so that revenue generated can be used for more development instead of debt servicing.

“If this renegotiation is done, the government can improve the economy, which will lead to job creation, more employment and taxes.”

He added, “The government can also raise funds from domestic sources to offset some debts or for infrastructure that would generate funds to pay debt.

“Nigerians should be worried about the cost of debt servicing because it is already affecting us. We get money from oil but we are using it to service debt so there is no development or economic advancement.”

The country was in a serious problem, which is affecting everybody, Tella added. Source: https://punchng.com/Debt-servicing-rises-gulps-72%-of-FG-revenues 1 Share

|

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by Sunnybay7: 4:34am On Jul 15, 2021 |

The presidency is aggressively destroying every sector of the economy. 71 Likes 1 Share |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by gabolak(m): 4:36am On Jul 15, 2021 |

And they continue to borrow money 36 Likes 1 Share |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by bcomputer101: 5:46am On Jul 15, 2021 |

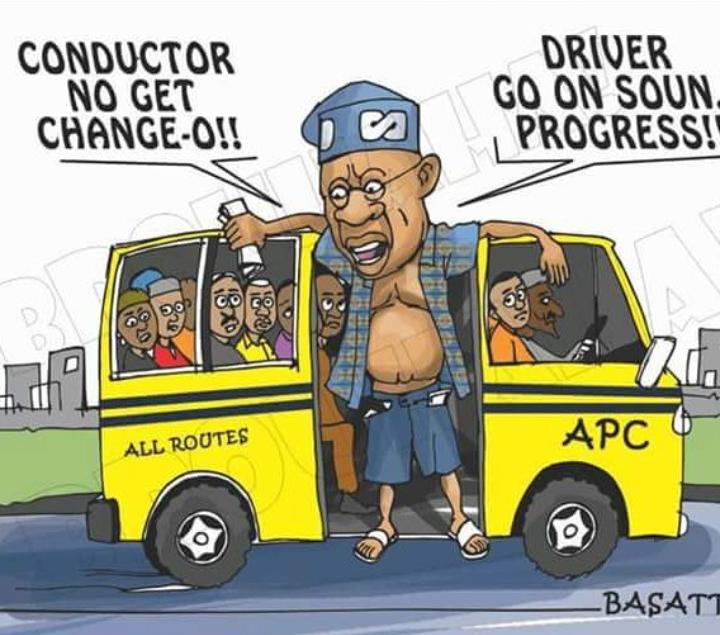

It shall not be well with Tinubu. He sold to us a brain infested mannequin.

And this failure still have additional 2years to use ooo...

This is the worst economic team Nigeria will be experiencing.

My secondary school economic teacher can perform better that this present Minister of Finance and CBN governor 71 Likes 1 Share |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by Naijanascam: 5:53am On Jul 15, 2021 |

Let the borrowing continue....,..... whenever the finance minister appears in the news is all about defending or about to borrow more as if she is winning an olympic gold

Let the borrowing continue 31 Likes 2 Shares |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by PrinceOfLagos: 5:55am On Jul 15, 2021 |

Buhari really messed up this country

The sad part is that he still got 2 years to go 58 Likes 2 Shares |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by BigDawsNet: 5:56am On Jul 15, 2021 |

You citizens are owning 250k now it's rising to 300k before the end of the year... I will advice you as a Nigerian Cititzen not to pay your own debt now.. Wait till end of buhari tenure...by Den it should be 700k in debt for each nigerian den u can pay successfully If you like don't pay...The Chinese will take you away  24 Likes 3 Shares |

|

|

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by ChiefSosa(m): 6:00am On Jul 15, 2021 |

sodorf:

God help this nation. God is busy, he has other sensible things to do with his time. 34 Likes 3 Shares |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by Seniorwriter(m): 6:00am On Jul 15, 2021 |

They still have a deficit of 28% to attain....Clueless terrorists infested administration. PrinceOfLagos:

Buhari really messed up this country

The sad part is that he still got 2 years to go Naijanascam:

Let the borrowing continue....,..... whenever the finance minister appears in the news is all about defending or about to borrow more as if she is winning an olympic gold

Let the borrowing continue An administration that is clueless about her DEBT to INCOME ratio because of incompetence still keeps borrowing in a country that is 90% dependent on import rather than export policies and implementations. SMH. Yankee101:

Buhaii buhari

When he's done with nigeria nothing will be left

They pay you N5 for every $1 you transfer to nigeria, that's how broke and desperate the country is That charge policy is a fraud on its own reason some Nigerian freelancers prefer other digital payment options...Nigeria's Financial institutions are plain manipulative and like to extort @every given opportunity. BTW @Yankee101 but why didn't you respond to my reply....isn't that a red flag to healthy negotiations staying mute to a nego convo? I noticed that so many Online Remote Working Nigerians fail in reply ethics. I hope you are not towing such line... Yankee101:

Maybe you're emphasizing your own shortcomings

Go back and check the tread.

My shortcomings? as to asking you to clearly state the conditions for your proposals!? You proposed a job yet you can't tell me what it entails but you are asking me how my approach would be and all what not. Do suppose a cart before the horse?! @Seniorwriter 3 Likes 1 Share |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by Yankee101: 6:01am On Jul 15, 2021 |

Buhaii buhari

When he's done with nigeria nothing will be left

They pay you N5 for every $1 you transfer to nigeria, that's how broke and desperate the country is 4 Likes |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by moriss33(m): 6:01am On Jul 15, 2021 |

Hehehe |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by adenigga(m): 6:02am On Jul 15, 2021 |

bcomputer101:

It shall not be well with Tinubu. He sold to us a brain infested mannequin.

This is the worst economic team Nigeria will be experiencing.

My secondary school economic teacher can perform better that this present Minister of Finance and CBN governor Amen!!!! JAGABAN, The Bad products seller...... 5 Likes

|

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by misterjosh(m): 6:03am On Jul 15, 2021 |

The damage these crop of leaders will leave behind will be too much 2 Likes |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by omoyankee3(m): 6:03am On Jul 15, 2021 |

This is really bad.....

If crude oil prices falls to $50/barrel (and stays there), then 100% of revenue would have to be used to service debt.

If it falls below $50, then Nigeria would need to borrow money to service its debt OR default on loans and public infrastructures become properties of foreign entities. 12 Likes 1 Share |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by layzie: 6:04am On Jul 15, 2021 |

And there is another proposal on Lawan's table for more borrowing which ofcourse he won't question.

Madam finance minister will just come out to be arguing and justifying these serious facts with people wey no be her mate.

This govt has failed us economically, from FEC to NASS. U listen to to the President and u re wondering whether he actually knows that it is his job to improve the economy and create jobs, after 6years in charge all u hear is complains. U listen to the finance minister and u re wondering, what is she talking about. You listen to Lawan and u wonder whether he is aware that he is in the Senate to represent his village and act in the interest of the common man and not the party.

It is well with us in this country. 17 Likes 2 Shares |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by tesseract: 6:05am On Jul 15, 2021 |

And one f00lish guy was defending the government's excessive borrowing claiming Lagos state can repay back the loans at once and I marvelled at his ignorance. 15 Likes |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by Franking: 6:05am On Jul 15, 2021 |

Sai baba. We are all in the mess together whether u are BMC or not. |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by nokspos: 6:06am On Jul 15, 2021 |

This country will soon become a family house where everybody leaves eventually but comes back once in a while for a visit 12 Likes 1 Share |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by Doyou2019: 6:07am On Jul 15, 2021 |

Sunnybay7:

The presidency is aggressively destroying every sector of the economy. No wonder the whole country has gone sour. 4 Likes |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by Uniswap: 6:08am On Jul 15, 2021 |

The country is headed for a serious financial crisis

70 percent. Dam

Better convert all your naira to stable crypto or usd

In the next few years 1usd will be 1k naira 4 Likes |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by richiemcgold: 6:08am On Jul 15, 2021 |

if this Nigeria under buhari is a business entity, it would've folded up by now. 9 Likes |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by Uniswap: 6:09am On Jul 15, 2021 |

richiemcgold:

if this Nigeria under buhari is a business entity, it would've folded up by now. They borrow so much to loot and marry foreign women 6 Likes |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by Doyou2019: 6:09am On Jul 15, 2021 |

Sunnybay7:

The presidency is aggressively destroying every sector of the economy. No wonder the whole country has gone sour. This is a crime against Nigerians trying ceaselessly to make ends meet. Treason!!! 5 Likes |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by MANDIPUTIN: 6:09am On Jul 15, 2021 |

Just imagine a man who earn 100K every month but uses 72k to settle the interest to the loan he borrowed from the bank. How can he survived with his children & wives.

Nigeria debt to revenue ratio is alarming.

How will the next President who will take Over from Buhari manage this mountain debts? 9 Likes |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by englishmart(m): 6:10am On Jul 15, 2021 |

Nigeria is rudderless

#bantilosha 1 Like |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by Jerryherd: 6:14am On Jul 15, 2021 |

Nigeria is in deep mess Imagine earning ₦10,000 every month as salary and 7000 already goes to sokoloan and other loan . 9 Likes

|

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by omowolewa: 6:16am On Jul 15, 2021 |

Humm |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by SmartPolician: 6:22am On Jul 15, 2021 |

The Federal Government made a total of N3.25tn in 2020, according to a review of the budget performance of the 2020 Appropriation Act. The review also showed that the Federal Government spent a total of N2.34tn on debt servicing within the year.

This means that 72 per cent of the government’s revenue was spent of debt servicing. It also puts the government’s debt servicing to revenue ratio at 72 per cent.

I only pity Buhari's successor because he will spend the first four years of his administration servicing debt.

Even Ahmed Lawan said that it's okay for the federal government to keep borrowing money to finance every infrastructure.

Meanwhile, nobody is talking about reducing the cost of governance. These people are plunging our children's children into debts they know nothing about. 12 Likes |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by oluseyiforjesus(m): 6:22am On Jul 15, 2021 |

Ok |

| Re: Debt Servicing Rises, Gulps 72% Of FG Revenues by arejibadz(m): 6:22am On Jul 15, 2021 |

3 idiots 3 Likes |