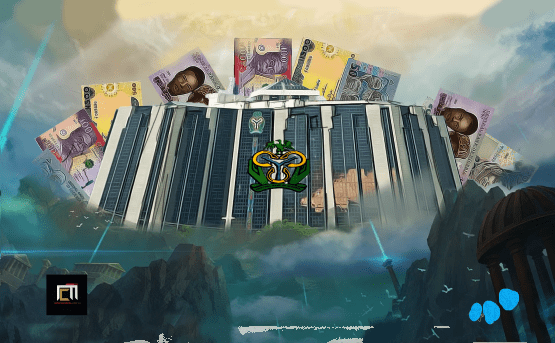

Cbn’s N100,00 Limit To Constrain Commercial Activities, Cause Dash For Cash - Business - Nairaland

Nairaland Forum / Nairaland / General / Business / Cbn’s N100,00 Limit To Constrain Commercial Activities, Cause Dash For Cash (557 Views)

CBN Increases Cash Withdrawal Limit To ₦500,000 Weekly / CBN Drops ATM Withdrawal Limit To N20k/Day / UBA Sets International Spending Limit To $20 Per Month (2) (3) (4)

| Cbn’s N100,00 Limit To Constrain Commercial Activities, Cause Dash For Cash by MCentral: 8:14pm On Dec 06, 2022 |

The Central Bank of Nigeria (CBN) circular to all Deposit Money Banks to limit the cash withdrawals by individuals in banks over the counter (OTC) to N100,000 a week, will constrain commercial activities and negatively impact mobile money operators, according to 3 analysts interviewed by MoneyCentral. They all spoke on condition of anonymity due to the sensitive nature of the matter. “I believe this would further constrain commerce and inadvertently undermine economic activities in the informal sector, which is largely a cash-based economy,” one analyst said. “Whilst there is a lot of merit in formalising the economy through a cashless policy, especially as it helps to enhance anti-money laundering and terrorist financing controls, there is need to put adequate measures in place to avert the immediate consequences on the people and the economy.” Point of Sales (POS), and ATM withdrawals is set at a maximum of N20,000 a day for a total of N100,000 a week. Only denominations of N200 and below shall be loaded into ATMs, according to the CBN. Withdrawals above these amounts will attract processing fees of 5% and 10% respectively. This is a fallout from the recent Naira redesign and cashless policy of the CBN. “Given the short implementation timeline of 09 January, 2023 there would be a “mad rush” at banks and ATms for cash withdrawals ahead of the effective date and this may also cause undue cash scarcity, especially as banks have limited volume of the new notes at this time and nobody would want to stockpile the old notes,” he said. The analysts said, banking penetration remains low and the electronic payment infrastructures are still relatively weak and require major investments to deepen penetration. For instance, PoS failure rate is still high and whilst telephone penetration is high, Internet penetration is still relatively low. “Unfortunately, the regulatory limit on mobile banking applications such as USSD is low for obvious security reasons and that is what is available to everyone, including those with features phones,” a second analyst said. “Likewise, erratic network reception and weak resolution mechanisms for resolving transaction failures undermine the adoption of electronic banking at the informal sector.” He added that most SMEs are hesitant at adopting electronic banking payments such as PoS due to the cost, which is an area the CBN needs to work with banks and other stakeholders such as switches. “In addition, it is important to consider the low literacy and poverty level in the country in adopting an holistic cashless policy, as these do not only affect the ability of some clusters, especially those in the rural areas, to adopt cashless policy but also the nature of their transactions.” For instance, there are some rural areas without network and these are farms and traditional markets where agricultural produce are being traded. “It takes hours to get to the nearest bank and this policy unfortunately also limits the value of transactions that can be done through the mobile money agents, thus it would create significant constraint to trade and broader productive activities in the rural areas,” a third analyst added. The policy would also undermine the viability of many mobile money agents, including those being powered by the Shared Agency for Network Infrastructure (SANEF) which was recently pioneered by the CBN and the Bankers Committee. “Many of the operators and aggregations like Paga, Opay amongst others would struggle with this new regulation,” he said. https://moneycentral.com.ng/exclusive/article/cbns-n10000-cash-limit-to-constrain-commercial-activities-analysts/  |

| Re: Cbn’s N100,00 Limit To Constrain Commercial Activities, Cause Dash For Cash by 2special(m): 8:18pm On Dec 06, 2022 |

The CBN governor determined to show the politicians shege since he was unable to contest in next year election. 3 Likes |

| Re: Cbn’s N100,00 Limit To Constrain Commercial Activities, Cause Dash For Cash by VeryWickedGoat: 8:54pm On Dec 06, 2022 |

Dash for cash wey the design don change? Next week you redash for recash. Waiting...

|

| Re: Cbn’s N100,00 Limit To Constrain Commercial Activities, Cause Dash For Cash by seanfer(m): 9:00pm On Dec 06, 2022 |

There’s a 5% charges incase you want to withdraw cash above the limit. The option is left for the customer to either use other electronic platforms or pay the charges. |

| Re: Cbn’s N100,00 Limit To Constrain Commercial Activities, Cause Dash For Cash by Hoelujohn: 9:02pm On Dec 06, 2022 |

Make people wey hoard dollars dey spend am for market. Una head go correct |

| Re: Cbn’s N100,00 Limit To Constrain Commercial Activities, Cause Dash For Cash by joyandfaith: 9:04pm On Dec 06, 2022 |

It is good policy. It would reduce bribery and vote buying. |

| Re: Cbn’s N100,00 Limit To Constrain Commercial Activities, Cause Dash For Cash by Tenshades(m): 9:28pm On Dec 06, 2022 |

joyandfaith: They will move to electronic vote buying 1 Like |

| Re: Cbn’s N100,00 Limit To Constrain Commercial Activities, Cause Dash For Cash by faceland: 12:21am On Dec 07, 2022 |

Brief recap of the new policy and the date of implementation. https://www.youtube.com/watch?v=L79n0tr9fWs |

(1) (Reply)

Does QNET Have A Physical Office In Nigeria? / Best Way To Grow And Make Money On Youtube 2023 / Naira Rates Against The Usd, Gbp, Euro Today October 16, 2023

(Go Up)

| Sections: politics (1) business autos (1) jobs (1) career education (1) romance computers phones travel sports fashion health religion celebs tv-movies music-radio literature webmasters programming techmarket Links: (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Nairaland - Copyright © 2005 - 2024 Oluwaseun Osewa. All rights reserved. See How To Advertise. 40 |