| New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by dre11(m): 6:17am On Feb 11, 2023 |

The Central Bank of Nigeria may bow to mounting pressure and contract the printing of the redesigned N1,000, N500 and N200 notes to foreign contractors in the coming days in order to boost the circulation of the currency.

Saturday PUNCH gathered that this had become imperative as sources said the Nigerian Security Printing and Minting Plc, which had been responsible for the printing of the naira, appeared to lack the capacity to meet the demand for the new notes.

This is as the National Council of State advised the apex bank to print more naira notes or re-circulate the old notes, which it had mopped up from circulation, in order to ease the pressure on hapless Nigerians, who had been suffering from the scarcity of the new notes.

A top banker told one of our correspondents on Friday that information available to him indicated that the Mint had succeeded in printing N500bn worth of the new N1,000, N500 and N200 notes and might not have the capacity to do more than that at the moment.

The top banker, who spoke on condition of anonymity because of the sensitive nature of the subject and because he had not been authorised to speak officially on it, said, “It is obvious that what has been printed is not enough. How can you withdraw about N2.1tn from circulation and only print N500bn to replace that?

“Is it not obvious that the NSPMC does not have the capacity to print more than N500bn? With the Mint’s current capacity, to print N2tn will take about a year. Even the N500bn printed has been hijacked by politicians, especially governors. You heard one governor saying one of his colleagues was able to withdraw N500m.

“What the CBN is doing is to give us only 10 per cent of the worth of the old notes we deposit with it. For instance, if a bank takes N1bn to the CBN branch office in its area of operation, it will be given N100m new notes to distribute to its branches nationwide and load onto its ATMs.”

A former top official of the CBN, who spoke to Saturday PUNCH anonymously, echoed a similar sentiment that the Mint might not have the capacity to print more naira notes and that could be responsible for the scarcity of the notes.

The ex-CBN official said, “I think it is a matter of capacity on the part of the Mint. The NSPMC has been solely responsible for the printing of the local currency and its role wasn’t an issue before now because it periodically printed notes, which the CBN released into the system along with those already in circulation. Only mutilated notes were withdrawn by the apex bank and destroyed.

“As it is now, the CBN may have little or no choice but to contract the printing of the new N1,000, N500 and N200 notes to foreign contractors in order to make the new notes go round the country quickly and save the nation the embarrassment caused by the current scarcity and its attendant consequences.”

Efforts to get a response from the CBN through its Director of Corporate Communications, Osita Nwanisobi, were futile as calls made to his mobile telephone did not connect, while he had yet to respond to WhatsApp messages sent to him.

However, an official of the CBN, who pleaded that his identity should be concealed, said there was no problem with the supply of the new notes by the NSPMC, adding that it was a deliberate policy to print limited amounts in order to encourage Nigerians to embrace other means of transaction other than cash.

“We don’t have an issue with what the Mint is doing regarding the printing of the new naira notes. There is no problem with the mint’s capacity. The fund it has expended so far on the printing of the new N1,000, N500 and N200 notes is its budget for the fourth quarter of last year.”

When a telephone number listed on the website of the NSPMC was called on Friday, it rang out. A message sent to the same number had not been replied as of the time of filing this report.

The NSPMC stated on its website, “The MINT has been in charge of the production of local currency notes since they were introduced in 1965. It does this on behalf of the Central Bank of Nigeria.

“For decades, the MINT has produced Nigeria’s naira notes. The notes are among the most secure in the world, with features that are almost impossible to replicate outside of our production systems.”

The CBN had stated in December that it spent over N800bn between 2017 and 2021 to maintain the naira. The apex bank’s Deputy Governor, Financial System Stability, Aisha Ahmad, who appeared before the House of Representatives, added that the amount had spiked by N10bn annually and attributed over 90 per cent of the currency management cost to the production of naira notes.

Council advises Buhari

Meanwhile, the National Council of State on Friday in Abuja advised the President, Major General Muhammadu Buhari (retd.), and the Governor of the CBN, Godwin Emefiele, to either intensify the printing of new naira notes or re-circulate the old ones to ease the hardship being faced by Nigerians.

The country’s highest advisory organ also insisted that the general elections should hold as scheduled based on the readiness of the Independent National Electoral Commission and the Nigeria Police Force.

The Governor of Taraba State, Darius Ishaku, revealed this to State House correspondents at the end of the four-hour hybrid meeting of the council held at the Aso Rock Villa, Abuja.

Ishaku said, “What took more time was the monetary issue because of the hardship caused by money in circulation across all the whole states. In the beginning, people resisted it, even though it was good, but generally, it’s accepted.

“The primary complaint from all the states or most of the speakers is that of implementation. And so many views were proferred, particularly the CBN governor; he looked into making sure that the new money was available in quantum.

“There were suggestions to the effect that if the new money is not in circulation or printing is difficult, then the old money that hasn’t been changed could be re-circulated and pumped into circulation to ease the tension, particularly for the poor people in our society, who just need a little sum of money to buy their food, drugs and daily needs.”

On his part, the Minister of Justice and Attorney-General of the Federation, Abubakar Malami, said having been briefed by the Chairman of the Independent National Electoral Commission, the Inspector-General of Police and the Governor of the Central Bank of Nigeria, the council agreed that the February 25 and March 11 elections should hold as scheduled.

The AGF stated, “The two significant resolutions that were driven, arriving from the deliberations of the council, are one, that we are on course as far as elections are concerned and we are happy with the level of preparation by INEC and other institutions.

“Two, relating to the naira redesigned policy, the policy stands, but then the council agreed that there is a need for aggressive action on the part of the central bank as it relates to the implementation of the policy by way of ensuring adequate provision being made with regard to the supply of the naira in the system.”

He also argued that although the implementation of the February 10 deadline for the naira swap was currently in court, it did not stop the government from taking steps when necessary.

Malami said, “The matter with particular regard to the redesign of the currency is a judicial matter, having been taken to the Supreme Court by some of the governors. That matter is being considered for determination by the Supreme Court.

“But notwithstanding the fact that the matter is in court, it is not out of place for the parties, particularly the parties of interest, to consider and do the needful if the need arises, which may eventually translate into either the discontinuance, or the action, or perhaps filing of the terms of settlement or reconsideration.”

He added that after the CBN governor’s presentation, council members proffered solutions, which at the time of the briefing, were being “considered by the President with a comprehensive look of the judicial issues.”

When asked by our correspondent about the President’s response to the council’s suggestions, the Lagos State Governor, Babajide Sanwo-Olu, said it would be up to Buhari to decide soon.

Sanwo-Olu said, “Like it has been said, they were all advisory and notes were taken. And he (Buhari) retired back to his office. And I think with all the advice given; the executive knows what to do.

“I think as we move on, Mr President will make known his thoughts to the nation.”

The Senate President, Ahmed Lawan, who spoke with journalists shortly after the meeting, insisted that there was no need to rush in implementing the new naira policy.

He said other economies globally had transitioned into new notes within a year.

Lawan stated, “For us in the Senate, we initially felt that this policy was not a bad one.

“But we also feel that there is no need for the time limit. Allow the old and the new notes to co-exist until the old is phased out. What is wrong with that?

“Other countries have been doing the same thing. When Britain redesigned its currency, it took over a year to change and the validity of the old as a legal tender remained, so why ours? We are not cashless yet. That society is cashless already and they needed even more time.”

The meeting was the first this year and the last before the general elections.

Present at the meeting were former Heads of State, Generals Yakubu Gowon and Abdulsalami Abubakar; and former President Goodluck Jonathan.

Former President Olusegun Obasanjo joined the meeting virtually as only about 14 governors were present physically and virtually with some represented by their deputies.

Also present were Vice-President Yemi Osinbajo and two former Chief Justices of Nigeria, among others.

The Council of State is an organ of the Federal Government, which advises the executive on key policies.

It comprises the President as the chairman, the Vice President as deputy chairman, all living former Presidents and Heads of State, President of the Senate, Speaker of the House of Representatives, all the 36 state governors and the AGF.

Cash scarcity persists

In Abuja, all the banks along Airport Road did not dispense cash to customers on Friday through their Automated Teller Machines.

The banking halls were also filled to the brim with customers in queues to withdraw N5,000, which was the highest amount that the banks could pay over the counter.

At Stanbic IBTC, only in-house customers were granted access to the banking hall as the bank’s ATM was closed.

At Zenith Bank, security officials were made to perform the jobs of bankers, as they gave relevant forms at the gate to customers in order to reduce the pressure on the overcrowded halls.

When queried on the maximum withdrawal limit, officials of the banks said N5,000 was being paid in N50 bill.

On the old notes, an official who preferred anonymity, said banks were no longer disbursing them.

He added that the grace period of seven days was still in place for anyone who had not returned them to the bank, even though there were no new notes to swap.

One of our correspondents, who visited some banking halls and ATM galleries in the Lugbe area of Abuja, observed that the banks were not dispensing cash to customers over the counter.

The financial institutions claimed that they did not have cash to dispense to the multitude that besieged their outlets.

At the UBA banking hall, customers were seen depositing old notes. The banking halls and ATMs of Polaris Bank, Fidelity Bank and Wema Bank were not dispensing cash to customers over the counter.

Their ATM galleries were clustered by customers waiting to withdraw the new naira notes.

Bank branches monitored in the Ikeja area of Lagos recorded heavy turnout of desperate customers, who besieged the ATM galleries and banking halls.

Rowdy scenes were witnessed at UBA, First Bank, Union Bank and Zenith Bank on Oba Akran Road, Ikeja, and Ogba areas.

At the UBA branch in Ibafo, Ogun State, customers expressed relief that the lender had reopened after some days of closure following attacks on some bank branches in the state. They, however, lamented their inability to withdraw money without stress as the queue of ATM users spilled outside the gallery.

A bank manager on Victoria Island, Lagos, told Saturday PUNCH that the bullion van team had been in the CBN office in Marina since the early hours of the day and had not been given new notes, adding that there was no improvement in money supplied to the branch.

The manager said, “There is so much uncertainty. We have not heard from the CBN regarding the deadline for the old notes, which expires today (Friday). The Supreme Court order has complicated matters. Surprisingly, depositors, whom we had been appealing to before now, have been trooping to the banking hall to deposit their old notes.

“Since our branch is not in a residential area, the head office directed that some of the cash meant for us should be taken to our branches on the mainland and Ajah in order to reduce the pressure on those branches and prevent attacks by angry customers.”

Kano sues FG

Meanwhile, the Kano State Government has filed a suit against the Federal Government at the Supreme Court in respect of the naira redesign policy of the CBN.

In suit number: SC/CS/200/2023, the Attorney-General of the state, through his counsel, Sunusi Musa (SAN), asked the apex court to declare that the President could not unilaterally direct the CBN to recall the N200, N500 and N500 old bank notes without recourse to the Federal Executive Council and the National Economic Council.

The state prays for a mandatory order seeking the reversal of the policy for affecting the economic well-being of over 20 million Kano residents.

The applicant is also seeking a mandatory order compelling the Federal Government to reverse the naira redesign policy for allegedly failing to comply with the 1999 constitution as amended.

Ondo joins suit

Similarly, the Ondo State Government has filed a suit against the Federal Government at the Supreme Court over the policy.

It filed a separate application to join the suit earlier instituted by the Zamfara, Kaduna and Kogi state governments at the apex court on the deadline issued by CBN on the swapping of old naira notes for the new notes.

The Ondo State Government asked the apex court to stop the implementation of the policy.

In an originating summon filed and signed by the Commissioner for Justice and Attorney-General of the state, Mr Charles Titiloye, the government asked the Supreme Court to stop the implementation of the directive issued by the Federal Government through the CBN on limitation of daily cash withdrawal from banks, which it said had totally paralysed its activities and adversely affected economic and commercial activities in the state.

A statement issued by the Special Assistant to the Attorney-General, Kola Adeniyi, said, “The Ondo State Government contended that the guideline on daily maximum cash withdrawal made by the Federal Government is an infraction on the legal rights of the Ondo State Government and its citizens to access funds for the execution of developmental projects, small credit facilities to petty traders (who have no accounts in banks) and highly detrimental to daily commercial activities in the state.

“The Ondo State Government urged the Supreme Court to declare that the Federal Government cannot by directive issued through the Central Bank of Nigeria amend or vary an existing Act of the National Assembly, particularly Section 2 of the Money Laundering Act, which relates specifically to limitations on cash withdrawals for individual and corporate organisation to N5m and N10m, respectively. The updated guidelines issued by the CBN now place maximum withdrawals for individual and corporate organisations at N500,000 and N5m, respectively.

“The Ondo State Government is asking the Supreme Court to decide whether the guidelines issued by the Federal Government on the maximum daily cash withdrawal and the continuous suffering and hardship caused by the implementation of the said policy is not in conflict with the express provision of Section 2 of the Money Laundering Act, and sections 20, 39 and 42 of the Central Bank of Nigeria Act.

“The Ondo State Government averred that while it has more than 149 ministries, departments and agencies to run on a daily basis in a state with more than three million people, less than 500,000 people have bank accounts through which bank transfers can be made. Consequently, the policy of the Federal Government has totally paralysed the economy of the state.

“The Ondo State Government averred that the citizens of Ondo State now spend precious hours at bank ATMs waiting to collect the new naira notes, while citizens in the rural areas and villages without banks and Internet facilities had been shut out from receiving or transferring money to meet their daily economic needs.”

The government urged the apex court to intervene and stop further implementation of the policy.

Policy ill-timed – Ganduje

Meanwhile, Governor Abdullahi Ganduje of Kano State, on Thursday, met with bank managers, representatives of the CBN, security agencies and other stakeholders at an interactive session.

This was contained in a statement by the Chief Press Secretary to the Governor, Abba Anwar, on Friday.

The meeting, according to Anwar, took place at Africa House, Government House, Kano.

“The policy is a good one, but the implementation is poorly executed and ill-timed. The poor implementation is either a display of incapacity and/or as a sign of sabotage,” Anwar quoted Ganduje as saying.

The governor said the implementation of the policy was not aimed at economic development, but for destroying democracy and causing confusion.

Ganduje was quoted as saying, “Implementation of the policy is our major concern and problem. Not the policy itself. If you want to implement such a policy, there is a need for you to make public enlightenment and engagement with stakeholders before you arrive at the implementation stage.

“If you want to implement any policy as a leader, you need to take many things into consideration. People are suffering.

“You cannot successfully implement a policy without properly planning for it. You need strong institutions if you want to implement this kind of policy.”

He added, “Probably, the people targeted by the poor implementation of this policy are not even suffering like other citizens. https://punchng.com/new-note-crisis-cbn-may-print-naira-abroad-to-ease-cash-crunch/?amp 4 Likes 2 Shares

|

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Nobody: 6:21am On Feb 11, 2023 |

Hmmm... Another financial recklessness courtesy of the ever irresponsible CBN Governor, Godwin Emefiele.

His predecessors, Sanusi and Soludo were CBN governors that will be remembered for championing positive banking sector reforms. Emefiele will be remembered for supporting corruption in the banking sector through illegal charges & causing nationwide financial chaos for political reasons... 👏🏾👏🏾 32 Likes |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Nbote(m): 6:25am On Feb 11, 2023 |

A country that prints its money abroad, international passport booklet abroad and even the President's health abroad 47 Likes 1 Share |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Charleys: 6:33am On Feb 11, 2023 |

Nbote:

A country that prints its money abroad, international passport booklet abroad and even the President's health abroad I expected this from them, the one they have printed in the country, have you collected it? 90% of francophone countries (Nigeria's neighbours) print their currency abroad. It's more efficient and at least we have someone to blame when it's not printed right. Unlike in Nigeria where no one will be blamed for anything. 3 Likes 1 Share |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Nobody: 6:35am On Feb 11, 2023 |

Common toothpicks, Nigeria cannot produce na naira notes we go come produce Abi recolour. 10 Likes 1 Share |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Charleys: 6:37am On Feb 11, 2023 |

adler777:

Hmmm... Another financial recklessness courtesy of our ever irresponsible CBN Governor, Godwin Emefiele.

His predecessors, Sanusi and Soludo were CBN governors that will be remembered for championing positive banking sector reforms. Emefiele will be remembered for supporting corruption in the banking sector through illegal charges & causing nationwide financial chaos for political reasons... 👏🏾👏🏾 Blame Buhari the CBN act states that. “The CBN Governor can be removed by the President, Provided that the removal of the Governor shall be supported by two-thirds majority of the Senate praying that he be so removed. 5 Likes 2 Shares |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Zonefree(m): 6:38am On Feb 11, 2023 |

Why Nigeria rush go collect Independence  A country that depends on other countries for almost everything. 43 Likes 3 Shares |

|

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Nobody: 6:41am On Feb 11, 2023 |

Charleys:

Blame Buhari the CBN act states that.

“The CBN Governor can be removed by the President, Provided that the removal of the Governor shall be supported by two-thirds majority of the Senate praying that he be so removed. Yes, I blame Buhari, but we all know Buhari has nothing upstairs and it's the information being fed to him by the CBN governor that he's following... So it's primarily Emefiele's handiwork! 12 Likes |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Wiseandtrue(f): 6:43am On Feb 11, 2023 |

An independent country

Oh God! 3 Likes |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Bornbiafra: 6:48am On Feb 11, 2023 |

Charleys:

I expected this from them, the one they have printed in the country, have you collected it?

90% of francophone countries (Nigeria's neighbours) print their currency abroad.

It's more efficient and at least we have someone to blame when it's not printed right.

Unlike in Nigeria where no one will be blamed for anything. how is thier economy like....mugu...how much is 1000cefa 2 Likes 1 Share |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by WibusJaga: 6:51am On Feb 11, 2023 |

. Think, our #1 problem in this country is bad leadership in all levels of government. If we carry out an experiment & allow Oyinbo to re-colonise us for just one year, things will change. Seen many companies that soon as Nigerians took over from Oyinbo, everything started going haywire.  |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Parachoko: 7:05am On Feb 11, 2023 |

Some miscreants were supporting Emefiele before saying it is only Tilumbu the policy go affect  6 Likes |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Nobody: 12:38pm On Feb 11, 2023 |

5 Likes

|

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by inoki247: 12:38pm On Feb 11, 2023 |

Lol confused people....

U people wey dey reject old note continue oh u will start eating ur goods ur sef....

A country with Trial and Error naso dem lock border put all of us for massive suffering.... 11 Likes 1 Share |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Olachase(m): 12:38pm On Feb 11, 2023 |

Na people way day use zenith Bank I day pity now, bank no open, app no login, call customer care line no respond,

The only bank that function right now is Power BANK 😅 😅 7 Likes |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by kufre2010: 12:39pm On Feb 11, 2023 |

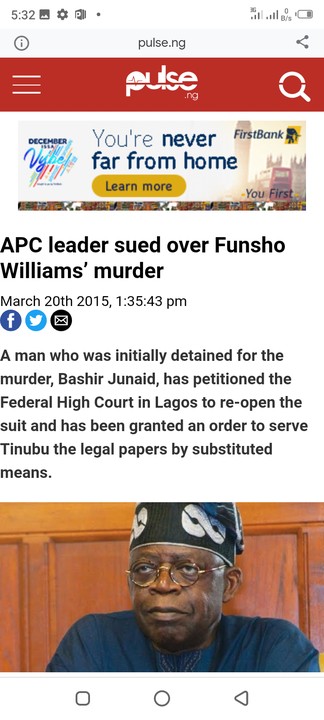

All these is to pacify Tinubu the chronic vote buyer. Tinubu can never win election without vote buying. That's what embezzlers do. He bought Inec, Supreme court, security, now he must buy vote by force.

|

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by potbelly(m): 12:39pm On Feb 11, 2023 |

Emefiele is just goofing left right and center... |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by bonechamberlain(m): 12:40pm On Feb 11, 2023 |

Nigeria cannot produce paper, common paper.  With all our forests and land. Smh This country wasn't made to work for it's citizens but for foreign powers and their few corrupt cronies called politicians. Only way for Nigeria to work is to vote Peter Obi, anything outside that, would be the same story and wailings.  2 Likes |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by faithfull18(f): 12:41pm On Feb 11, 2023 |

Hmmn, no comment. |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by drlateef: 12:41pm On Feb 11, 2023 |

Emefiele must go. Some of you don’t read news. He said they are on queue even for the printing abroad. Are we going to wait for weeks? Emefiele must go. 3 Likes |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Jahzrockballer(m): 12:42pm On Feb 11, 2023 |

anything to salvage the situation |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by josilcool(m): 12:43pm On Feb 11, 2023 |

Up till now CBN haven't decided on what do concerning this naira scarcity... May God help us 1 Like |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by baralatie(m): 12:43pm On Feb 11, 2023 |

No comment |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Whobedatte(m): 12:45pm On Feb 11, 2023 |

Why not Academy press who has knack for security printing ?

At least they have been printing for WAEC and neCO for many years |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by baralatie(m): 12:46pm On Feb 11, 2023 |

Whobedatte:

Why not Academy press who has knack for security printing ?

At least they have been printing for WALEX and neck for many years Money go loss As in the whole money to vamous 1 Like |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by yesloaded: 12:48pm On Feb 11, 2023 |

|

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by BluntCrazeMan: 12:49pm On Feb 11, 2023 |

Hmmmmm..

The Nonsense Had Taken A Very Bad Shape..

. 1 Like 1 Share |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by Ameoba300: 12:50pm On Feb 11, 2023 |

First it was our refineries that wasn't working, so they had to take our crude abroad to process and have us buy it back Now they're taking your currency notes abroad to print.

When you think this administration has broken every record of being a failure, they pop up and keep raising the bar of what failure should look like. 2 Likes 2 Shares |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by CodeTemplar: 12:51pm On Feb 11, 2023 |

Trashy policy. A very useless policy has no escape remedy. 1 Like |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by bigdammyj: 12:51pm On Feb 11, 2023 |

Whatever, they should just make it available. |

| Re: New Note Crisis: CBN May Print Naira Abroad To Ease Cash Crunch by bablon20(m): 12:52pm On Feb 11, 2023 |

Last minute embezzlement by Buhari government. 2 Likes |

With all our forests and land. Smh

With all our forests and land. Smh