Celebrities / Re: Mercy Johnson-okojie Represents Rashida Bello, Kogi First Lady At An Event by Adesiji77: 10:57pm On Apr 02, 2017 Celebrities / Re: Mercy Johnson-okojie Represents Rashida Bello, Kogi First Lady At An Event by Adesiji77: 10:57pm On Apr 02, 2017 |

Ishilove:

She's wearing a body shaper/waist trainer Lol. Funny that some ladies may be "killing" themselves now to have her body shape.... 1 Like |

TV/Movies / Re: What Movie Are You Watching Now? by Adesiji77: 9:44pm On Apr 02, 2017 TV/Movies / Re: What Movie Are You Watching Now? by Adesiji77: 9:44pm On Apr 02, 2017 |

Split... |

TV/Movies / Re: What Movie Are You Watching Now? by Adesiji77: 5:08pm On Apr 02, 2017 TV/Movies / Re: What Movie Are You Watching Now? by Adesiji77: 5:08pm On Apr 02, 2017 |

Just watched "A United Kingdom"  |

Foreign Affairs / Re: American Politics Lounge - Donald Trump Is US President-Elect ! by Adesiji77: 10:46am On Apr 02, 2017 Foreign Affairs / Re: American Politics Lounge - Donald Trump Is US President-Elect ! by Adesiji77: 10:46am On Apr 02, 2017 |

|

Politics / Re: Hameed Ali Explains Why Customs Will Implement Anti Senate Import Duty by Adesiji77: 10:05am On Apr 02, 2017 Politics / Re: Hameed Ali Explains Why Customs Will Implement Anti Senate Import Duty by Adesiji77: 10:05am On Apr 02, 2017 |

Here we go again... |

Business / Re: ‘this Is Why The Naira Fell Despite CBN Intervention’ – ABCON by Adesiji77: 8:46am On Apr 02, 2017 Business / Re: ‘this Is Why The Naira Fell Despite CBN Intervention’ – ABCON by Adesiji77: 8:46am On Apr 02, 2017 |

|

Religion / Re: Stephanie Otobo's Mother's House & Shop (Photos) by Adesiji77: 6:56am On Apr 02, 2017 Religion / Re: Stephanie Otobo's Mother's House & Shop (Photos) by Adesiji77: 6:56am On Apr 02, 2017 |

You know when you call somebody a man of God, he can go to any length. So I don’t want the man of God to go to any length, to do any evil prayer because when we heard of it that time, this pastors’ association (South-South chapter of the Christian Association of Nigeria) praying all their sorts of things. Enough said!  2 Likes 2 Shares |

Romance / Re: My Naija Lexicon: “booing Or Boo-ing?” by Adesiji77: 10:33pm On Apr 01, 2017 Romance / Re: My Naija Lexicon: “booing Or Boo-ing?” by Adesiji77: 10:33pm On Apr 01, 2017 |

End times... |

TV/Movies / Re: What Movie Are You Watching Now? by Adesiji77: 10:17pm On Apr 01, 2017 TV/Movies / Re: What Movie Are You Watching Now? by Adesiji77: 10:17pm On Apr 01, 2017 |

"Moana"......again  The soundtrack is awesome, especially "Where You Are" |

Travel / Re: UK Deports 23 Nigerians Over Immigration Offences by Adesiji77: 1:37pm On Mar 31, 2017 Travel / Re: UK Deports 23 Nigerians Over Immigration Offences by Adesiji77: 1:37pm On Mar 31, 2017 |

Back to.... |

Business / CBN Approves $10k Per Week FX Sale To Bdc’s by Adesiji77: 1:21pm On Mar 31, 2017 Business / CBN Approves $10k Per Week FX Sale To Bdc’s by Adesiji77: 1:21pm On Mar 31, 2017 |

Nairametrics| The Central Bank of Nigeria (CBN) has slightly modified its forex operations with Bureau de Change (BDCs) operators in the country. According to Reuters, the CBN claims that the modifications are geared towards ensuring forex availability in the market.

The first of these modifications involve the sale of dollars to the BDCs twice a week instead of the weekly affair that was hitherto in place.

Secondly, the CBN will also increase the amount of dollars it offers to each BDC, from the current $8,000 up to $10,000.

Thirdly, a new rate will be set for the sale of USD to the BDCs, as well as a cap on how much the BDCs sell to the public. The new rates, the apex bank said, will be released next week.

This announcement by the CBN comes about a week after the President of the Association of Bureau de Change Operators in Nigeria (ABCON), Aminu Gwadabe, cried out over the unfair competition the BDCs were facing from both the parallel market and the commercial banks.

While the former was already selling at a lower rate than the CBN sells to the BDCs, the latter were offered a wide profit margin, a privilege the BDCs were not granted. However, it seems that the CBN is taking steps to correct the situation with its earlier adjustment of the exchange rate as sales to banks is now N357/$ while sale from banks to the public is capped at N360/$1. http://nairametrics.com/cbn-approves-10k-per-week-fx-sale-to-bdcs/

|

Politics / Re: Central Bank Governor Finally Resigns Due To Personal Reasons by Adesiji77: 8:52am On Mar 31, 2017 Politics / Re: Central Bank Governor Finally Resigns Due To Personal Reasons by Adesiji77: 8:52am On Mar 31, 2017 |

tolugar:

This is nairaland.

Not

Accraland or Ghanaland I wonder o  |

Education / Re: These Are Not Just Facts! These Are Awesome Facts! by Adesiji77: 8:51am On Mar 31, 2017 Education / Re: These Are Not Just Facts! These Are Awesome Facts! by Adesiji77: 8:51am On Mar 31, 2017 |

|

Foreign Affairs / Re: American Politics Lounge - Donald Trump Is US President-Elect ! by Adesiji77: 6:11am On Mar 31, 2017 Foreign Affairs / Re: American Politics Lounge - Donald Trump Is US President-Elect ! by Adesiji77: 6:11am On Mar 31, 2017 |

2 Likes |

Foreign Affairs / Re: American Politics Lounge - Donald Trump Is US President-Elect ! by Adesiji77: 5:54am On Mar 31, 2017 Foreign Affairs / Re: American Politics Lounge - Donald Trump Is US President-Elect ! by Adesiji77: 5:54am On Mar 31, 2017 |

3 Likes |

Religion / Re: Top 12 Offenses Christians Commit In Church by Adesiji77: 11:05pm On Mar 30, 2017 Religion / Re: Top 12 Offenses Christians Commit In Church by Adesiji77: 11:05pm On Mar 30, 2017 |

1 Like |

Business / Re: CBN To Allocate Forex To Banks Based On The Size Of Their Shareholder’s Funds by Adesiji77: 10:51pm On Mar 30, 2017 Business / Re: CBN To Allocate Forex To Banks Based On The Size Of Their Shareholder’s Funds by Adesiji77: 10:51pm On Mar 30, 2017 |

|

Family / Re: Married Kenyan Woman Stuck With Boyfriend While Having Sex (Photos, Video) by Adesiji77: 9:30pm On Mar 30, 2017 Family / Re: Married Kenyan Woman Stuck With Boyfriend While Having Sex (Photos, Video) by Adesiji77: 9:30pm On Mar 30, 2017 |

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Adesiji77: 9:20pm On Mar 30, 2017 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Adesiji77: 9:20pm On Mar 30, 2017 |

locodemy:

companies or banks that refused to release results tomorrow is likely to declare loss when the result will be released.They may likely post the Q1 at the same time to do the damage control.

What if CBN is yet to approve their results? That is another factor to consider though I noticed your emphasis on "likely"  |

Business / Re: CBN To Allocate Forex To Banks Based On The Size Of Their Shareholder’s Funds by Adesiji77: 9:04pm On Mar 30, 2017 Business / Re: CBN To Allocate Forex To Banks Based On The Size Of Their Shareholder’s Funds by Adesiji77: 9:04pm On Mar 30, 2017 |

kaboninc:

Do you work for Nairametrics? No sir |

Business / CBN To Allocate Forex To Banks Based On The Size Of Their Shareholder’s Funds by Adesiji77: 5:35pm On Mar 30, 2017 Business / CBN To Allocate Forex To Banks Based On The Size Of Their Shareholder’s Funds by Adesiji77: 5:35pm On Mar 30, 2017 |

Nairametrics| The Central Bank of Nigeria now allocates foreign exchange (FX) to banks based on the size of their unimpaired shareholders’ funds – the value of shareholder investment in a bank.

In a circular released by the CBN, which was not yet made public, the CBN announced a Special Wholesale Forwards Intervention not exceeding 60 days, with the following conditions (excerpts)

-US$100.00 million would be on offer

-Deposit Money Banks (DMBs) with unimpaired shareholders’ funds of N350 billion and above are limited to a maximum bid of 12.5% of the amount on offer

-DMBs with unimpaired shareholders’ funds between N200 billion and N350 billion are limited to a maximum bid of 10% of the amount on offer

-DMBs with unimpaired shareholders’ funds between N75 billion and N200 billion are limited to a maximum bid of 3.5% of the amount on offer, while DMBs with unimpaired shareholders’ funds below N75 billion are limited to a maximum bid of 1% of the amount on offer.

-Merchant banks are limited to a maximum bid of 1% of the amount on offer

The apex bank has somewhat conveniently decided not to apply Clause 2.43 of its Revised Guidelines For the Nigerian Inter-bank Forex Market, which it released in June 2016. In the rule, The CBN may, at its discretion, intervene in the FX market through the sale of FX to Authorised Dealers (wholesale) or to end-users through Authorised Dealers (retail) via a multiple-price book building process using the FMDQ-Thomson Reuters FX Auction Systems, or any other system approved by the CBN.

Crony CBN?

This move by the CBN segregate banks into 4 categories (starting from the largest) based on the size of their shareholders’ funds. It inadvertently favors the biggest banks – Zenith bank, First Bank, GTB, Access bank and UBA, as they will receive more FX allocations, while it adversely affects the smaller banks, including foreign-owned banks because they will receive less allocations.

Zenith bank, the former employer of Godwin Emefiele, has N730.4bn in shareholders’ funds; FBN holdings had 9 months unaudited shareholder funds of N622 billion; GTB, according to its 2016 audited financial statements had N496bn in shareholders’ fund; Access Bank had N449 billion and UBA N436 billion as at December 2016.

Going by this metric, as much as 50% of the total FX allocations in the system could potentially go to the top 4 banks. This could be significant for commercial bank profits considering how much Tier 1 banks have made from forex revaluation and fees in 2016 alone.

Poignant to note that the circular also emphasizes the word UNIMPAIRED. Assuming an impairment of 30% of shareholders’ funds, for mathematical rigour, Zenith, GT bank and First Bank would have been the only ones qualified for the maximum amount.

A tier 2 bank such as FCMB for example with shareholders’ funds of N170 billion as at December 2016 would qualify for just 3.5% of the offer. Same with Stanbic IBTC which had shareholder funds of N137 billion as at December 2016. Yet these banks may have several customers who need foreign exchange.

Critics of this latest move by the CBN insinuates a clear case of favoritism for Tier 1 banks, particularly Zenith Bank, the former employer of Godwin Emefiele. Recall, Nairametrics exclusively reported that Zenith bank, was considering raising additional capital of N100bn, but shelved the capital-raise plan when the MD was unable to explain to analysts and investors in its earnings call, why this extra capital was needed. Does this mean that the bank has suffered significant impairments, and was trying to shore up its capital in anticipation of this new CBN FX Intervention? Was Zenith bank forewarned of this intervention by Emefiele who was its former MD?

Wider Implications

This new FX intervention isn’t as clear as day, and it throws up some issues and implications: Will this be the norm going forward? Does it mean that the CBN will no longer disburse FX based on the needs of bank customers, as it had been doing prior to this latest intervention? Does it now emphasize banks over and above the actual number of customers that a bank has?

Finally, and more importantly’ is this intervention is meant to reduce the number of players in the FX game by channeling FX users to the few dominant banks, thereby achieving tighter control of the FX market?

This could have potential consequences. For example, it may lead to a scramble for more capital by the smaller banks, so that they can keep up their FX allotments and maintain their customers by extension. As smaller banks become unable to meet FX demands from their customers due to their reduced allotments, they will begin to lose customers to the larger banks, leading to a loss in business and revenue for them. http://nairametrics.com/exclusive-%E2%80%8Bcbn-to-allocate-forex-to-banks-based-on-the-size-of-their-shareholders-funds/ |

Business / Re: Two CBN Directors Arrested For Forex Manipulation by Adesiji77: 8:48am On Mar 30, 2017 Business / Re: Two CBN Directors Arrested For Forex Manipulation by Adesiji77: 8:48am On Mar 30, 2017 |

Lalasticlala, food is ready!  9 Likes 1 Share |

Business / Re: We’ll Push Dollar To N305—CBN Boasts by Adesiji77: 8:05am On Mar 30, 2017 Business / Re: We’ll Push Dollar To N305—CBN Boasts by Adesiji77: 8:05am On Mar 30, 2017 |

CBN is really serious about bankrupting speculators. If current trend is sustained, some of them may go back to their villages.

With this information, few people would be bold enough to buy at the parallel market NOW.

Bad market indeed for speculators... 1 Like 1 Share |

Jobs/Vacancies / Re: How Do I Tactfully Reject A Job Offer. by Adesiji77: 6:20am On Mar 30, 2017 Jobs/Vacancies / Re: How Do I Tactfully Reject A Job Offer. by Adesiji77: 6:20am On Mar 30, 2017 |

I decided to ask the HR how much my pay would be and he told me 80k. I immediately felt like crying. OP, are you for real? You took up a job without getting a formal "offer of employment"? 7 Likes |

Business / Re: Development Bank Of Nigeria Granted Operational Licence By CBN by Adesiji77: 10:00pm On Mar 29, 2017 Business / Re: Development Bank Of Nigeria Granted Operational Licence By CBN by Adesiji77: 10:00pm On Mar 29, 2017 |

vedaxcool:

Nice, hopefully the credit facilities will get to the intended beneficiaries. Gbam! |

Foreign Affairs / Re: Brexit: Theresa May To Officially Trigger Article 50 Today by Adesiji77: 1:29pm On Mar 29, 2017 Foreign Affairs / Re: Brexit: Theresa May To Officially Trigger Article 50 Today by Adesiji77: 1:29pm On Mar 29, 2017 |

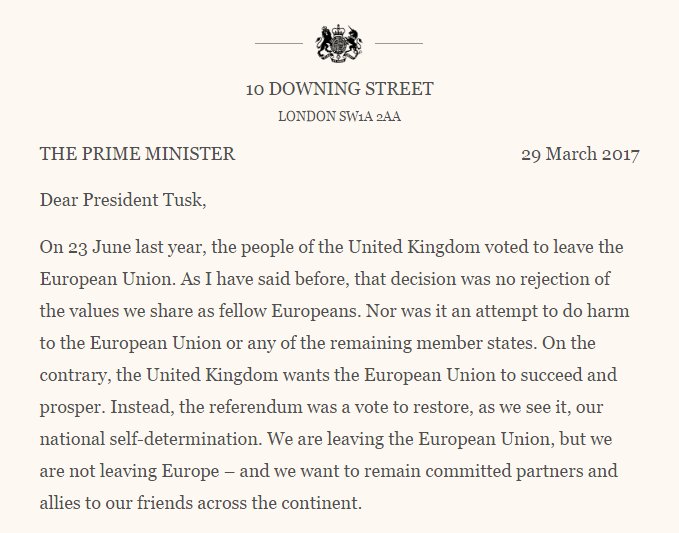

@FT: Here is Theresa May's letter to European Council president Donald Tusk and clues for the Brexit talks that lie ahead Ok @Truth234  2 Likes 3 Shares

|

Foreign Affairs / Re: Brexit: Theresa May To Officially Trigger Article 50 Today by Adesiji77: 12:58pm On Mar 29, 2017 Foreign Affairs / Re: Brexit: Theresa May To Officially Trigger Article 50 Today by Adesiji77: 12:58pm On Mar 29, 2017 |

@SkyNewsBreak: Prime Minister Theresa May has triggered Article 50 to begin the formal two-year negotiating process for the UK to leave the European Union

cc: Truth234 1 Like 1 Share |

|

Business / Re: CBN Introduces New FX Rate For Bdcs by Adesiji77: 3:19pm On Mar 28, 2017 Business / Re: CBN Introduces New FX Rate For Bdcs by Adesiji77: 3:19pm On Mar 28, 2017 |

Speculator's nightmare.... 3 Likes 1 Share |

Business / Re: 5 Banks’ Exposure To Oil & Gas Sector Hits N2.2trn by Adesiji77: 7:47am On Mar 28, 2017 Business / Re: 5 Banks’ Exposure To Oil & Gas Sector Hits N2.2trn by Adesiji77: 7:47am On Mar 28, 2017 |

ednut1:

Eyah. As usual Amcon will use public funds to save the banks. Nonsense. The debtors will den refuse to pay amcon. Bt they have private jets, import white oloshos, have numerous gwagons and Rolls Royce etc. Iranu abasha   Like....

|

Business / Re: 5 Banks’ Exposure To Oil & Gas Sector Hits N2.2trn by Adesiji77: 7:38am On Mar 28, 2017 Business / Re: 5 Banks’ Exposure To Oil & Gas Sector Hits N2.2trn by Adesiji77: 7:38am On Mar 28, 2017 |

A ticking time bomb unless the situation is addressed.... |

Phones / Re: Samsung Reveals Plans To Sell Refurbished Galaxy Note7s by Adesiji77: 7:37am On Mar 28, 2017 Phones / Re: Samsung Reveals Plans To Sell Refurbished Galaxy Note7s by Adesiji77: 7:37am On Mar 28, 2017 |

Demand likely to be high in Nigeria in spite of its story... |