Constantin's Posts

Nairaland Forum / Constantin's Profile / Constantin's Posts

(1) (2) (3) (4) (5) (6) (7) (8) (9) (of 9 pages)

Airbus, Boeing partner Nigerian airlines on new planes          World leading two aircraft manufacturing companies Airbus Industrie and The Boeing Company have arranged with the Federal Government to supply brand new aircraft to Nigerian airline operators. This is a way of injecting new aicraft into the nation’s aviation industry. JOHN OSADOLOR & WALE HAASTRUP The move which will see the lease-purchase of new aircraft by local operators is one of the safety valves being put in place by the Federal Government to improve safety in the country’s airspace and restore passengers’ confidence. This is being consummated under the Yamassoukrou Declaration. Under the declaration, African airlines can lease-purchase planes with 30 percent discount. Harold Demuren, director-general of the Nigerian Civil Aviation (NCAA), disclosed this development at the weekend in Ota, Ogun State while delivering a paper titiled: " Routine incidents and accidents in the aviation industry". The seminar was organised by the Nigerian Airspace Management Agency (NAMA) and the Ministry of Aviation for aviation correspondents and news editors. Though Demuren did not name the first airlines that would benefit from the scheme, the agreement would enable Nigerian operators some of which have recently been granted licences to operate international routes the opportunity of owning and operating dreamliners like Boeing 737-800, Boeing 777, Boeing 787 and Airbus A320. According to him, when the scheme takes off, "there would be no more aged aircraft in our airspace". These aircraft models are less than 10 years old in the market. The first generation of Boeing 777 was rolled out of the factory in 1997. Currently, the average age of the aircraft on the domestic route is 20 years. Demuren said the domestic airlines were being encouraged to adopt best engineering and operational practices that would enable them go into partnership with renowned foreign operators. "By doing this we can replicate the type of rewarding relationship between KLM and Kenya Airways in Nigeria," he said. Boeing is the world's leading aerospace company and the largest manufacturer of commercial jetliners and military aircraft combined. Its reach extends to customers in 145 countries around the world, and it is rated the number one U.S. exporter in terms of sales. Boeing has a long tradition of aerospace leadership and innovation and continues to expand its product line and services to meet emerging customer needs. Boeing broad range of capabilities includes creating new, more efficient members of commercial airplane family; integrating military platforms, defence systems and the warfighter through network-centric operations; creating advanced technology solutions that reach across business units; e-enabling airplanes and providing connectivity on moving platforms; and arranging financing solutions for our customers. Airbus's mission is to meet the needs of airlines and operators by producing the most modern and comprehensive aircraft family in the market, complemented by the highest standard of product support. Airbus fosters values of excellence and innovation among its culturally-diverse employees and considers its customers, contractors and suppliers to be partners working in the interests of safety, quality and performance. The company's philosophy is always to listen to its customers and to maintain its vision-the forward thinking which has placed Airbus at the forefront of the industry. Nothing is taken for granted. Airbus develops a clear empathy with its customers, encouraging a two-way flow of views, ideas and technical feedback on its aircraft in service around the world. Ultimately the reputation of Airbus stands or falls by its integrity. Airlines and their passengers know that an Airbus aircraft is the product of an honest company which builds the safest, most reliable and best performing aircraft possible. |

Omogenikky, as you are living in South Africa, I would like to know a few things. My friend told me that it is still a black and white country and that it is far fom being a rainbow nation. Is that true? Aren´t there any blacks who moved up the economic ladder? What about mixed marriages/couples between the races (blacks and Blacks from other countries or Blacks and Whites) which are quite common in so many other parts of Africa (like Angola, Cape verde, Ivory Coast, Gabon etc.)? What do you mean by a "tense" situation? (can you just give me example) Don´t you think that the horrible madness (apartheid) of the past slowly starts to drift into oblivion with the younger generation? and a last question: is the inequality and unemployment situation decreasing? Sorry for bambarding you with sooo many questions but if you could just answer a few, I would be more than happy,     |

Gaddafi Slams Nigeria for Handing over Taylor By Frank Kintum with agency report, 06.02.2006 The acceptance of Nigeria to hand over former Liberian President, Charles Taylor for war crimes trial by a United Nations Tribunal has been condemned by Libyan President, Muamar Gaddafi who described it as unacceptable precedent that threatened all African leaders. Nigeria deported Taylor on March 29 to Liberia, which promptly sent him to Sierra Leone where he awaits trial on 11 counts of war crimes and crimes against humanity for backing rebels during Sierra Leone's 1991-2001 civil war. The United Nations is seeking to move the trial to the International Criminal Court in the Hague amid security fears, but the process has been stalled as no third country has yet volunteered to act as Taylor's jailer if he is convicted. During the week, Liberian President, President Ellen Johnson-Sirleaf, had called on a European country to accept the task of jailing Taylor if convicted. According to Gaddafi, handing Taylor to the ICC would undermine Africa's credibility and seriously harm Nigeria, which could no longer be considered a haven. "This also means that every (African) head of state could meet a similar fate -- this sets a serious precedent," he said. Gaddafi has sought a leading role in African disputes, trying to mediate a peace deal in Darfur and sooth tensions between Sudan and Chad, and each time fiercely opposing outside intervention in the continent's affairs. "Taylor must stay in Nigeria without facing any trial and without being handed over to any tribunal because there is absolutely no right for that," the Libyan leader said. "When I talk about Taylor I might not agree with his policies but a principle should be applied," he added. Gaddafi was yesterday, addressing a gathering of heads of state of the Community of Sahel-Saharan States, including Johnson-Sirleaf, who supports moving Taylor's trial to the Hague. Nigeria had given Taylor asylum in 2003 as part of a deal to end Liberia's own 14-year civil war. President Olusegun Obasanjo later came under intense international pressure to deport Taylor to Sierra Leone to stand trial, but he insisted he would only hand over Taylor to an elected Liberian government if it made such a request. Johnson-Sirleaf, Liberia's first elected postwar president, asked Obasanjo in early March to hand over Taylor, but she wanted him sent to Sierra Leone. Nigeria and Liberia were at odds over what to do with Taylor for several weeks. At the time, human rights activists accused Nigeria of prevaricating, precisely because Obasanjo was reluctant to set a precedent of sending an African head of state to face trial. In the end, Taylor escaped from his asylum residence in Calabar, the Cross River State capital in circumstances yet to be fully explained, and was captured the following day trying to cross into Cameroon. Thereafter, he was flown to Liberia, where U.N. forces immediately transferred him to Sierra Leone. Taylor led an uprising in Liberia in 1989 that turned into a civil war that spilled across borders, killed a quarter of a million people and spawned a generation of child soldiers. Libya backed Taylor and supplied his forces with arms during the 1980s after he escaped from a jail in the United States. But since then the North African country has abandoned support for revolutionary movements and mended relations with the United States, which restored full diplomatic relations with Libya last month. |

my2cents, our conversation must have been based on misconceptions, i have misunderstood you, sorry. You have been much clearer now and pushed things into perspective. Of course, Nigeria should not stop but we are getting better than the Northern African countries which is good if you see how Africa is portrayed in Western media which tend to lump all African countries into a nutshell by saying "sub-saharan Africa", as if we were a single country inhabited by some incompetent sub-species of humankind. I HONESTLY AND DEARLY WANT THAT NIGERIA AS MOST OF THE MAJOR COUNTRIES WITHIN AFRICA WILL GET THEIR RIGHTFUL PLACE N THE CONCERT OF THE WORLD, IT IS HIGH TIME  |

my 2 cents, I have forgotton to say, come and visit this thread beacsue I will be adding photos every now and then,  |

No problem, my brother, I will keep on adding whenever i get new images. if you go, please don´t forget to take some more photos of construction sites, new building, roads etc. , post them on this web so that we all can see. PS: I feel a bit sad that my thread seems to meet so little interest, do we Nigerians really love our country or Africa?  |

my2 cents, as always full of negativity  , attitude like this doens´t surprise when Africa is not developping fast enough, , attitude like this doens´t surprise when Africa is not developping fast enough, Moreover, this table was conceived by[b] IWF AND WORLD BANK AND NEITHER BY ME NOR BY OBA[/b] Take at it a second look, please, and balance your remarks a bit more! Just saying indirectly that Nigeria is condemned to poverty for the next 500 years or so is not an answer to me, if that is an answer we can close down the section "business" because we are "poor" and "incompetent" |

, well, here I got a table to prove it. It is taken from the World Bank and IMF, Check out where Nigeria is positioned in 2005 and 2007 and remeber where we came from in 1999, |

sOUTH aFRICA IS A VERY BEAUTIFUL AND DEVELOPPED COUNTRY but they do not like "strangers" like other African a lot We Nigerians have a bad reputation in South Africa as most other African, too. A friend of mine has been to South Africa (internship for a market research comapny in the UK) and talked with a lot South africans regardless of colour and he was shocked at some of their attitudes and how they view the rest of the continent, (I do not want to enlarge on it in this forum as it is not the appropriate place to do it) , It is sad but South Africans regardless of their colour (black, white, Indian) do not regard themselves as Africans but as a "continent" within in the continent. |

My 2 cents, as promised here are a feww photos from Abuja   do you see all the cranes, i love theme especially when they are in Nigeria  [img]http://www.iaea.info/abuja/images/icc.jpg[/img] [img]http://www.iseg.giees.uncc.edu/abuja2006/images/abuja10.jpg[/img] [img]http://www.iseg.giees.uncc.edu/abuja2006/images/abuja11.jpg[/img]    Can someone verify if that thing has been built?  highways outside of Abuja     THIS IS ABUJA TOWER IT IS A NEW PROJECT:::IF IT GETS THROUGH THIS WILL BE HIGHER THAN CARLTON TOWER IN SOUTH AFRICA   my2 cents, I hope you will answer me, my brother. Do you think that Abuja looks nice? |

SA companies still edgy about Africa Neuma Grobbelaar Posted to the web on: 30 May 2006 SOUTH African companies are not less risk-averse than some of their European and American counterparts when doing business in Africa. This is one of the many surprising findings of the South African Institute of International Affairs’ three-year Business in Africa project, presented at an international conference on African private-sector development last week. T[b]he research, which was conducted in nine countries across the continent — Botswana, Egypt, Ghana, Kenya, Mali, Mozambique, Nigeria, Senegal and Zimbabwe — found that despite the perception that South African companies were moving aggressively into Africa, the percentage of foreign direct investment in the region was still marginal in comparison with overall South African investment going to Europe, the Americas and Asia. More than 80% of SA’s total foreign investment was still directed at these three markets.[/b] Analysis presented by Andrea Goldstein of the Organisation for Economic Co-operation and Development corroborated this finding. South African multinationals tend to invest much less in their immediate region than multinationals from other emerging markets. Taking SA’s foreign assets in Africa as the benchmark for measuring interest in Africa, in 2004 the region attracted only 4,9% of total South African investment (both stocks and flows). South African firms’ risk perception of doing business in Africa is thus quite closely aligned with that of the rest of the world. However, where South African companies do distinguish themselves is in their willingness to invest in a broad range of sectors, unlike Africa’s traditional investment partners who have focused on oil and mining. SA’s entry into telecommunications and retail in the region as the most visible manifestation of SA’s corporate presence has fuelled the perception that South Africans are everywhere and that the rest of Africa is a profitable outpost for South African business. Shoprite Checkers is now the largest retailer in Africa with more than 600 outlets in 16 countries. But because of Africa’s small markets and low disposable income, revenue earnings from Africa are still modest in comparison with its operations in SA. It is a mistake to assume that high returns on investments, up to 30% in some sectors in Africa, automatically translate into high earnings. For companies, one of Africa’s biggest hurdles in growing the market is the high level of poverty in individual markets and the small size of the formal sector. The case of telecoms is slightly different. MTN’s expansion into the region has been very profitable. The telecoms sector demonstrates the importance of innovation and adaptability and points to the underlying purchasing power that is present in the informal sector but is rarely reflected in the official economic data generated by African economies. However, the size of the informal sector, up to 60% and more in some economies, is also one of the biggest indicators of the constraints hampering the more robust development of Africa’s private sector. [/b]Informal trading and subsistence agriculture are often presented as the most appropriate solution to ensure the livelihood of many African families. But the reasons for the absence of a formal sector deserve closer scrutiny. The institute found that government played an important role in private-sector development, especially because of its dominance in many African countries. Government was also a significant source of formal employment. Herein lies the rub. [b]Red tape is one of the biggest hindrances to the development of a more enabling business environment in most countries studied. Overbearing bureaucracy and outdated rules and regulations hamper business activities, and open numerous avenues for bribes and rents. The harm is most strongly felt by domestic businesses that lack the resources and clout of foreign players in dealing with the government. From SA’s own experience, it is clear that foreign investors cannot be expected to demonstrate confidence in an economy if no domestic investment is taking place. The news is not all bad, however. South African companies have invested more than R200bn in the rest of Africa since 1994. But for Africa to attract a larger share of the investment necessary to boost economic growth and development, governments have to work harder to make it attractive for the private sector (both local and foreign) to invest. Two of the most striking findings of the report are, first, that political and economic governance are hugely important if the goal is a more diversified, mature and growing economy. Second, engagement between the public and private sector is essential in enabling the private sector to play a stronger role in the sustainable development of the continent. While there are many complex factors contributing to the weak state of Africa’s private sector, some low-cost interventions can reap immediate benefits. Governments providing a supportive framework will attract more investment into the economy from foreigners, and local players. It will also ensure that South African companies will be more confident in the continent’s prospects. ‖Grobbelaar heads the Business in Africa Programme of the South African Institute of International Affairs, based at Wits University. Source:http://www.businessday.co.za/articles/topstories.aspx?ID=BD4A208023 I ALMOST CRIED WHEN I READ THIS ARTICLE WHEN WILL AFRICA EVER CHANGE, OOOOO  ? ?              |

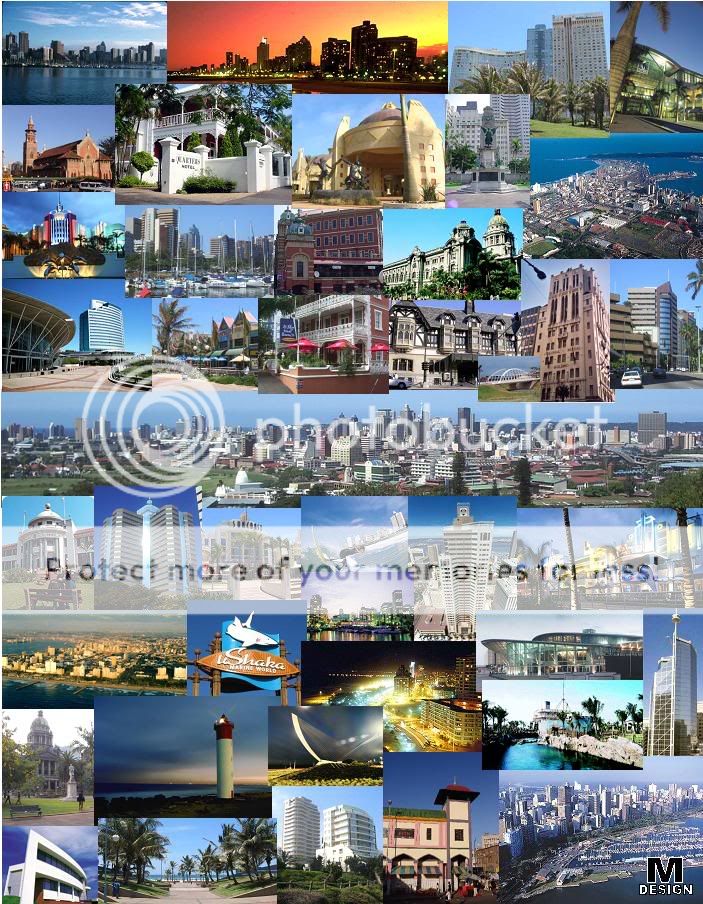

Yeah, these cities are A-L-L in Africa, which one do you like most? And why? What do city planners need to do in order to improve African cities? What does a major African city need in order to call itself a "city" in your eyes? I do hope that we can start a debate on these topics. I am a bit sad that we as Nigerians always like to talk about US and UK but never show a lot of interest in our continent as a whole. So please, let´s discuss these topics a bit more, because Nigeria is our homeland and Africa our continent, not Europe nor America (don´t get me wrong, this should not mean that talking of US and UK is not fine) My2cents, I will try to get some Naija pics , I diidn´t want to post ´em ´cos I thought that everybody knows Abuja and/or Lagos on this forum. , but if you want me to post Nigerian cities, I will try (give me some more time)  |

African Cities/City Skylines: Good Or Bad? I want to open a thread on Africa's urban development and its city skylines because a nice skyline also shows the viguour of an economy and moreover it can be of interest to (future) architects or marketing people among us or simply to those who show some interest in countries beyond Nigeria'ss borders,  [s]i won´t post lagos skyline photos ´because everyone knows our city[/s] THIS IS THE SKYLINE OF ABIDJAN (photos all before the crisis)   [img]http://www.azmibazar.ch/photo_gallery/ivorycoast/civ_plateau_jour2.jpg[/img]  [img]http://membres.lycos.fr/u10/photos/cote_ivoire/abidjan/Plateau_cathedral.jpg[/img] THIS IS NAIROBI [img]http://www.cs.helsinki.fi/u/stniemin/pics/kenya05/IMG_0865_Nairobi%20skyline.JPG[/img]    This is the skyline of Dar esalaam    this is DURBAN    [img]http://images.google.com/url?q=http://www.itscanada.ca/newsletters/March2004/SouthAfricaHighways.jpg[/img] this is CAPE TOWN   THIS IS KAMPALA (uganda)      t[b]his is our neigbour country and its capital Douala[/b] [img]http://usuarios.lycos.es/sokodjou/hpbimg/douala.jpg[/img]   [img]http://www.prc.cm/profil_cam/IMAGE/pt_douala.gif[/img] This is the capital of Ex-Zaire Congo Kinshsha [img]http://www.pageweb.cd/europcar/images%20europcar/kinshasa.jpg[/img]   |

Economy and Finance: Light at the end of the tunnel May 29th, 2006 The Nigerian economy has undergone a steady transformation since May 29 1999. The banking sub-sector also recently went through serious changes. Now the focus has shifted to the insurance sub-sector. BLESSING ANARO and BETHEL OBIOMA examine the trend since 1999.Source: http://www.businessdayonline.com/?c=53&a=6717 |

In the US, you are always like a shabby " dead man walking", if you don´t have any bucks you will die! This thing is not happening in the UK where you are well taken care of. Someone said that the British are stiff and fun-wreaking, no that is not true as far as the younger generation is concerned. I have got two good friends who are white British and we always have a lot of fun whenever we make our minds up to garther , Moreover, different nationalities in the UK live peacefully side by side which is not the case for the US where young people most of the times NEVER EVER gleefully mingle with each other. Infrastructure in the UK is worse than in Germany or France but still it is heaven if compared to the US where most of the outer city limits are woefully left to decay.  Moreover, Britain was a former mighty Empire and the US its lucrative colony and it is even still "positively" palpable throughout the UK if you display a certain alertness of mind. In America there is a horrifyingly yawning gap between a thin layer of people who joyously ponder on their new capital ventures in Asia or the UK and a vast majority of people who are already geared to dwell a drab-coloured - and sometimes perilous - day to day existence while having great pains to make both ends meet. Whereas in the UK you have got a very decent middle-class that can carelessly send their pampered kids for weekend trips to glittering Paris or the husbands can allow their stylish wives to jet over to sparkling Dubai (which is a favourite holiday destination here in the UK) in order to let their hair down for a couple of days by going on lovely shopping sprees to refreshingly swanky "theme park style malls", for example. Moreover, Britain was a former mighty Empire and the US its lucrative colony and it is even still "positively" palpable throughout the UK if you display a certain alertness of mind. In America there is a horrifyingly yawning gap between a thin layer of people who joyously ponder on their new capital ventures in Asia or the UK and a vast majority of people who are already geared to dwell a drab-coloured - and sometimes perilous - day to day existence while having great pains to make both ends meet. Whereas in the UK you have got a very decent middle-class that can carelessly send their pampered kids for weekend trips to glittering Paris or the husbands can allow their stylish wives to jet over to sparkling Dubai (which is a favourite holiday destination here in the UK) in order to let their hair down for a couple of days by going on lovely shopping sprees to refreshingly swanky "theme park style malls", for example. In the US one has to grumpily toil away the days in utter despair in order to sustain one´s head above the water whereas in the UK you can work relatively care-free and brighten up your weekends with some splendid spells in the sun abroad or somewhere else on the relatively and hsitorically versatile British Isles.  THE UK IS MY SECOND HOME AND I LOVE THIS PLACE      |

Old Glory, Well I am perfectly comfortable with the UK. I like the British, their way of life, their culture, London and yes even their food at times. All is quaint and full of history here in England. Ask rich Americans where they want to live? They will all say UK or Côte d´Azur in France. Europe is full of security and history and it is very compact. Highways in US are just around the big cities, in UK, France or Germany you have got multi-lane highways where you can easily drive around. american roads outside the big cities are awfully pot-holed and people are by and large so ignorant. They still think that there is a bridge which connects London and New York (Nigerians in the UK poke a lot of fun of Americans, you know  ) )In England you have got nice and trendy bars, fancy little shops and you can walk carelessly around town with your girlfriend or some relatives without the fear of being brutally knocked down or your purse being greedily snatched off by hungry people that fall through the American safety net. In America you just have the have and the have nots, nothing in between. It is almost like Nigeria! I love the UK which is my second home and I would not exchange it for anything in the world (but Nigeria, of course), and certainly not for the US.      1 Like 1 Share |

I prefer the UK (more Nigerians, lovely British people and I would die for the british accent  : it shows that you are sort of more "educated" and intelligent; American English: just 500 words and that´s it, in order to get along in the US). I deplore the weather in the UK, but I love London for its cosmopolitan touch. (why has someone be so insulting towards the Arabs and Indians : it shows that you are sort of more "educated" and intelligent; American English: just 500 words and that´s it, in order to get along in the US). I deplore the weather in the UK, but I love London for its cosmopolitan touch. (why has someone be so insulting towards the Arabs and Indians ) )  this is not nice, ooo this is not nice, ooo   Moreover, why do Nigerians only know two destinations in the world? Always UK and US. Man, the world has more to offer and explore.  1 Like |

Angola´s national football team . I keep my fingers crossed for them, Angola needs it after all these years of despair  I also want to show some of the projects Angola is undertaking,     building boom,  , To be continued, |

NOW I WANT TO SHOW YOU A FEW PICTURES ABOUT ANGOLA´S SCENERY This country is very varied and therefore has an enormous tourism potential ,   , some of the following pictures have been shot recently (2004/2005/2006) , some of the following pictures have been shot recently (2004/2005/2006)                           |

NOW I WILL SHOW YOU SOME PHOTOS OF ANGOLA´S OTHER CITIES, PROVINCES AND SMALLER TOWNS, I AM REALLY AMAZED HOW BEATIFUL IT WAS (it looks all like a mixture bwtween Portugal, Africa and Latin America to me), It must have been a very nice holiday feeling in the 70´s in Angola, everything looks so inviting and spotlessly clean, to my mind this is in Benguela            This is Lobito, another town in Angola         This is "Nova Lisboa"(New Lisbon) but it has been renamed and now it is called Huambo     [/b]     This is former " Sá da Bandeira" today its name is Lubango            Well, there are many other towns and provinces in Angola that look all like those I have presented to you but I do not ant to bore you stiff but these pictures are at least giving a small insight into how the country looked like before the war, |

I would like to open a thread on Angola which has unfortuntely been set back because of the nasty war but which has entered a period of boom during the past years. Investors are flocking to that once beautiful country and I think that the world will be surprised by Angola´s future because it really looks very bright (even outside of oil sector). Some people may wonder why I am interested in Angola as a Nigerian, but I have two good friends who come from this country , so I also dedicate this thread to them  I WILL START WITH SHOWING PICTURES ON ANGOLA BEFORE THE WAR THIS WAS HOW LUANDA LOOKED LIKE IN THE 70´S   this photo reminds me somehow of the old movies you see from Italy,      THEY HAD MALLS IN THE EARLY 70´S         lokk at the public gardens they had then,   the streets really lokk very latina   have a look, they had a autodrome in the 70´s and this one is till there,      this photo is from nowadays  , TO BE CONTINUED |

Hi Maxeen, Ist that you on the picture? You really look smashing! As to your question: Unfortunately, I do not live in Nigeria presently as I am still completing my PHD stdies in the UK, so I am not fully up-to-date with all the latest projects of our beloved country. But Obudu Ranch seems very nice and extraordinary in order to relax your mind in style. Will you be staying in Lagos? Or do you plan to travel throghout the country? Here is one website which might be of interest to you: http://www.wheretogoinlagos.com/  Hi Mongue Thanks for your reply. You have really gone into raptures while you were telling me aboutRio de Janeiro. So it is true that Brazil is such a wonderful melting pot. Is is comparable to the Jamaica or the French Antilles in its way of life? I was also pleaseanly suprised to hear that Yoruba culture still prevails. It is nice to know that. I have travelled to Asia and Dubai but never to Brazil or South Africa. But you really inspired me in your last posting. What about the rate of crime? And what can you do for enjoyment, apart from the sunny beaches? Are there any nice malls, discos/clubs or cool and snazzy bars/restaurants? What about infrastructure and the costs? Is there something like a metro or a well-functioning city bus sytem? Flights within Brazil: are they affordable? Sorry for bambarding you with so many questions but they really burn under my nails, hopefully you will reply to some of those  |

Qidig, you said :" (, )This is in addition to the $200 million dollar mega city project they have just commisioned a South African design firm to undertake in Yenagoa, (, )" Where did you hear from that? Has work already started and where can we get some more information (renders, articles photos etc.) on that project? Or is it just one more pipedream, , if not I would leap in joy like an untamed child!          |

Mongue, Bar Beach will take some more time to build beacause it is a huuuuggggeee project. By the way, which city did you like more: Rio de Janeiro or Cape Town? And why? thanks for your reply, |

Nigeria's Tourism Projects I have posted earlier about the huge project in Cross Rivers, now I have found two more 5-Star Meridien Ibom Hotel and Golf Course  Current status of construction: [img]http://www.akwaibomstategov.com/le'meridien3.jpg[/img] [img]http://www.akwaibomstategov.com/le'meridien.jpg[/img] The construction work for the five star Le Meridien Ibom Hotel and Golf Resort is in full progress. SBT Juul Africa is proud to have been appointed as Development Managers, Project Architects and Interior Designers of the exclusive USD 36 million development situated in Uyo, the capital of Akwa Ibom, with an economy centered on the lucrative oil and gas industry. Grandeur of space with impressive proportions. On 100 hectares of tropical gardens, the 160 room prestigious Ibom Hotel and Golf Estate has spectacular views throughout. There is grandeur of space with impressive proportions to the main public lobby, which incorporates Restaurant, Bar, luxury Retail facilities and scenic lift. The architectural scope includes exclusive chalets of presidential standard, business and conference facilities, pool area, water features and fully equipped Health Centre. The development will have a sustainable infrastructure - pump station, generator rooms, and sewerage plant and water tanks. Afro-Tech Interior Design with Nigerian flavour SBT Juul Africa were responsible for introducing the renowned Le Méridien Group as Hotel managers. The design of the interiors will be according to the high standards of the Group. It will combine contemporary elegance of international appeal with elements of Nigerian flavour in finishes, artwork and fabrics (the State is renowned for its art and raffia works). The Resort's 18 hole Ritson Design Golf Course is of tournament standards. The course, 3 practice putting greens and Golf Club have spectacular views of the surrounding landscape with the luxury Ibom Hotel visible from all areas. The proposed Marina at the river front will include cafes, craft kiosks, leisure boat cruises and rowing. Le Meridien African & Indian Ocean Managing Director Mr Hassan Ahdab visited the site under construction and was impressed with the beautiful serenity of the location and Golf Course setting. Proposed Bar Beach Waterfront, Lagos, Nigeria  Victoria and Alfred waterfront Cape Twosn are consultant and advisor to the Lagos State Government (2000-2001) in Nigeria doing pre-feasibility and feasibility studies for the development of coastal rehabilitation and waterfront project Bar Beach, Victoria Island, Lagos (total estimated development cost: US$400 Million). All the projects are private driven but if the bar beach project goes through it would be a mega boost for lagos with a lot of employment for myn people.   PS: I will keep adding to this thread if I find more news  |

Globacom eyes India as MTC buys Vmobile By Shina Badaru Lagos, Nigeria. April 16, 2006 Second national operator (SNO) Globacom Limited is to acquire stake in an Indian operator as part of its plans to explore beyond the Nigerian telecoms market. This is just as Vmobile put paid to industry speculations when it confirmed Sunday the sale of 65 per cent of the mobile cellular business to MTC Group of Kuwait. The MTC acquisition confirms Technology Times report of October 11, 2005 titled ‘Kuwait’s MTC bids to buy Vmobile, NITEL’ that detailed the Middle East mobile operator’s intense efforts to enter the fast-growth Nigerian market in an effort to become Africa’s leading telecoms player. It is a season of mega deals in the Nigerian telecoms sector with as both developments, happening around the same period, are significant for the growth of the market. MTC, through its wholly-owned subsidiary, Celtel, has finally realised its persistent ambition at gaining a foothold in the fast-growth Nigerian market. On the other hand, Globacom, a relatively new entrant into the Nigerian telecoms business, built from ground up by Nigerian businessman, Mike Adenuga Jr., has commenced the initial phase of its international exploration through the foray into the Indian telecoms market. Based on its plans, the SNO, which has no plans to set up a fresh telecoms business in India, wants to acquire an existing industry player before moving into the nation’s oil and banking sectors at a later date. Chief Operating Officer (COO), Globacom Limited, Mohammed Jameel was quoted by The Economic Times of India as saying that the SNO plans to invest some $700 million in India. It also hopes to explore new markets in Morocco, Ivory Coast, Cameroon, Ghana and Benin Republic. Globacom would employ some 150 Indians out of the 400 people planned to drive its expansion into global markets. The Indian newspaper estimates the value of Adenuga’s MA Group with interests in oil, banking and telecoms to be in the region of $5 billion. “We are a cash-rich company keen on foraying into India, as the telecom market here is booming. We are not averse to investing in call centres, banking and petroleum sectors in India. We have decided to make India the Asian hub for our manpower needs for telecom,” he says adding that, “we are looking at a strategic partnership with one of the existing telecom operators. Globacom is going to invest $500-700m in India.” He said the company is already in talks with some Indian operators for picking up equity stake, as well as for technology tie-ups. “The talks are in preliminary stages, but the response has been good,” he said, refusing to divulge names of companies. But the firm is not keen to put money in smaller operators as it will be difficult to get returns in future. “We are not eager to pick up equity in any small firm,” he adds. A team from Globacom is in India to identify manpower sourcing channels for fulfilling its requirements. “India is a reservoir of skilled and technically competent manpower in the telecom and retail sector. Manpower sourcing has been identified as a critical area by MA Group,” he added. "We are in talks with some big players in the field of telecommunication in India for entering into a strategic relationship. Talks are at initial stages. However, an announcement is expected in the next two to three months," according to Jameel. "The Indian telecom sector is slightly crowded. But, it has huge potential and requires significant investment to grow further," he adds. "Our subscriber base is expected to cross the 10 million- mark by the middle of the current year and total turnover to cross $1.25 billion," Jameel said. Meanwhile, Vmobile says it has finalised a conditional agreement with Celtel International to acquire 65 per cent controlling stake of the mobile cellular company for $1.5 billion. PR Manager, Vmobile, Emeka Oparah, says in a statement that “the remaining shareholders have an option to sell their shares to Celtel at a similar valuation at a later date.” With this, MTC has been able to establish enter the Nigerian market after a botched effort to acquire control of the Nigerian Telecommunications Limited (NITEL), through Holland-based Celtel, the sub-Saharan operator it bought in a $3.4 billion cash transaction finalised May last year. Under the terms of the acquisition, Celtel now operates as a separate legal entity within the MTC Group of Companies. It also left the existing Celtel management in place to continue to execute their growth plans for the business while leaving the Chairman, Mohamed Ibrahim to stay on as director of the post-acquisition Celtel. The Nigerian deal is part of the implementation of the international phase MTC’s “3x3x3" vision, which is an ambitious expansion strategy that will see the operator become a leading mobile and lifestyle services provider on the global stage by the end of the year 2011. MTC initiated the strategy in 2002 to become a global player in three stages: regional, international and global, with each stage completed in three years. Under this programme, it aims to reach a subscriber base of 20 million through a combination of acquisitions, partnerships and green-field opportunities, according to MTC. MTC had last year pulled out of the bid for NITEL to concentrate on the Vmobile deal over the huge debt burden of the company as well as the non-clarification on the valuable SAT-3 optical fibre asset of the public-owned company, among other issues. With MTC’s entry, it is also a contest of old rivals as the bid for Celtel had pitted MTC against rival pan African operator, the MTN Group of South Africa. MTN had then filed a futile court action when it was beaten to the acquisition deal by the Kuwaiti operator. MTC, the first mobile operator in the Middle East was founded in 1983 had a market capitalization exceeding $7 billion as at May 1, 2005. Its shareholder base is made of 75% public and 25% by the Kuwait government. It had reported in August last year that it now has 10.6 million subscribers across 18 countries including Kuwait, Jordan, Bahrain, Iraq and Lebanon. It had unveiled its ‘3X3X3’ strategy hoped to make it a global player and achieve 20 million customers by 2011 on a global level and entered into a branding partner agreement with Vodafone. I have found this article in the "Economic Times of India" which is a very serious newspaper in India Globacom to invest in Indian telecom sector PTI[ FRIDAY, APRIL 14, 2006 08:13:01 PM] MUMBAI: Nigeria based Globacom, a subsidiary of the $5 billion M A Group, on Friday said it would invest upto $800 million to foray into the Indian telecom sector. M A Group, having different business interests, is also open to enter into oil and banking sectors in India on a later date. It would appoint 400 workmen from India to carry out its global operations. "We are in talks with some big players in the field of telecommunication in India for entering into a strategic relationship. Talks are at initial stages. However, an announcement is expected in the next two to three months," Chief Operating Officer of the company M A Jameel said here. However, he made it clear that the company, to begin with, would look at acquiring equity stake in an existing telecom operator, instead of setting up a company on its own. "The Indian telecom sector is slightly crowded. But, it has huge potential and requires significant investment to grow further," he added. Since its inception in Nigeria two years back, Globacom has a base of over six million subscribers. "Our subscriber base is expected to cross the 10 million- mark by the middle of the current year and total turnover to cross $1.25 billion," Jameel said. Globacom has also plans to enter into Morocco, Ivory Coast, Cameroon Moreover, it would also foray into Ghana and Benin Republic. SOURCE: http://economictimes.indiatimes.com, how/1490798.cms FOR THOSE WHO WISH TO HAVE SOME MORE INFORMATION ON GLOBALCOM VISIT THEIR WEBSITE. http://www.gloworld.com/ |

Seun, you hit the nail on its head, you said it all nothing more to add! |

Sorry, that´s crab, English is the language that takes you everywhere nowadays and it was the only good thing about colonialism: establishment of the English language in Nigeria. Nowadays all Anglophone countries can easily communicate with each other and that is paramount. Moreover, I think that our country has a lot of more problems to solve (MORE ROADS, HOSPITALS, DECENT SOCIAL SYTEMS, MORE JOBS, DIVERSIFICATION OF THE ECONOMY, DECENTRALISATION, the list is endless!!!  ) instead of searching for a national language that will be difficult to find ) instead of searching for a national language that will be difficult to find |

May 3rd, 2006 Why are Nigerian companies doing poorly in Africa? A recent survey by African Business shows that no Nigerian company made top 40 in Africa. This poor showing has triggered a spate of concerns by Nigerians reports Adedapo Olawunmi The African business landscape is expanding and thriving. However it seems a handful of companies are dominating the scene. The curious thing is where Nigerian companies stand in the scheme of business on the continent. Many would expect that with Nigeria´s human and natural endowment companies in Nigeria will be at the forefront of business around the continent. This unfortunately is not the case. According to a survey published in the African business magazine, a continental business magazine, the largest Nigerian company going by stock market capitalisation, is not up in the best 40 in Africa. South African companies accounted for about 15 of Africa´s top 20 companies by stock market capitalisation, spanning across the finance, industrial, extractive, and retail sectors. Other countries with companies on the top 20 list are Egypt and Morocco. According to the survey by the magazine Nigerian Breweries Plc is Nigeria´s top company and the 44 the largest company in Africa in terms of stock market capitalisation. Other Nigerian companies on the list in are First Bank of Nigeria Plc is at 75 th position, with $1,226,480,646 in market capitalization, Union Bank Nigeria at 81st position with $1,164,829,732 9, Guinness Nigeria at 97t,h $868,002,114. At 103rd position is Intercontinental Bank $760,109,510, then Zenith Bank Nigeria at 104 $758,620,690. Nestle Nigeria occupies the 105th position $757,224,617, followed by UBA Nigeria at $109 [/b]703,295,019, [b]Nigerian Bottling Nigeria at $119 [/b]650,733,923, and G[b]uaranty Trust Bank Nigeria at $126 570,114,925. In another survey of top African banks by assets in US dollars, contained in Jeune Afrique, Africa Report for March 2006, the largest Nigerian bank by assets is Union Bank Plc with $3.23 billion in asset-base placed 23rd in Africa. Following Union Bank in the top 50 list are First Bank at 31 st position $2.28 billion, Zenith Bank at 47 $1.49 billion, and Guaranty Trust Bank at 49th position with $1.42 billion. Again South Africa dominated the top ten with four banks. Other countries with banks featuring on the top ten list were Libya, Morocco, Egypt and Algeria. T[b]he top ten banks are Standard Bank South Africa, $108,5 billion, ABSA Bank South Africa $61,4 billion, Nedcor Bank South Africa $57,7 billion, FirstRand Banking Group South Africa $57,0 billion, Investec Group South Africa $34,1 billion, National Bank of Egypt $21,4 billion, Libyan Arab Foreign Bank Libya $15,9 billion, Banque Misr Egypt $14,8 billion, Banque Exterieure D’Algerie $12,5 billion, Attijariwafa Bank Morocco $12,5 billion. [/b] Viewing Nigerian companies on the top companies, list, it is clear that the bulk of Nigerian companies with continental presence are in the finance sector. This indicates the weak position of the industrial sector in the Nigerian economy. Feelers are that this survey aptly describes the state of things in the organised private sector in Nigeria, but there seems to be positive indications towards change. According to Abunwanne, a businessman and member of the Nigerian business forum (NBF), an internet based forum for Nigerian professionals home and abroad, these listings more than anything highlight the full-extent of corruption, inefficiency of public sector enterprise and most of all the scale of capital flight from Nigeria. South Africa with similar natural resource wealth and one-third Nigeria’s population not only used that advantage to build world-leading local companies in those sectors but also channeled all that capital into building other sectors as well. Even countries with much less natural resource advantages, Egypt and Morocco show what happens when you manage your economy properly by encouraging capital accumulation, building infrastructure, investing in skills and nurturing a real entrepreneurial private sector that actually adds value and does not live off crony, overpriced government contracts or foreign exchange trading. However, he believes the Nigerian government seems to have woken up to these facts in the last few years, saying with more people of the calibre of Okonjo-Iweala, Soludo, Okereke-Onyiuke in government positions, there will be more Nigerian companies like Zenith Bank, UBA, Oando actually appearing not just as major African companies but major global corporations as well. Nonetheless, he opined that this of course depends on the sustainability of economic reform in light of political problems such as the third term uncertainty surrounding the current president, the general lack of resolve in prosecuting corruption, eliminating electoral manipulation and creating a more legitimate political system at all levels. To Nkem Ifejika, also of the NBF, the picture will appear even more dismal when one considers that most of these companies on list are not even of full Nigerian origin. She says on closer observation, the companies are actually colonial throw-back companies (Union Bank etc) or franchises (Guinness etc), hence she says that there is even more work to be done than first anticipated. Chris another member of the NBF, though aligns with Nkem’s reasoning, however sticks to the optimistic viewpoint and, says the actual positive movement towards economic independence will have Nigerians singing a different tune about Nigeria in the next ten years. Adamu Ibrahim, a Nigerian in diaspora and member of the NBF is also optimistic. He says ‘Nigeria had a late start but we are back in it, it isn’t a sprint it’s a marathon and the wave of change and momentum of economic reform and transition is developing a much needed force. He adds that things are changing, it might not be at the pace we all would like, but they are changing. All things being equal, in another ten years we would be having a different type of conversation where the issues will be of how Nigerian companies are these behemoths that African countries have to now think of adopting protectionist type policies against Nigeria. That, he sumises, will certainly be a better dialogue and a sign of improvement. Source: http://www.businessdayonline.com/news/53/ARTICLE/6239/2006-05-03.html      |

(1) (2) (3) (4) (5) (6) (7) (8) (9) (of 9 pages)

(Go Up)

| Sections: politics (1) business autos (1) jobs (1) career education (1) romance computers phones travel sports fashion health religion celebs tv-movies music-radio literature webmasters programming techmarket Links: (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Nairaland - Copyright © 2005 - 2024 Oluwaseun Osewa. All rights reserved. See How To Advertise. 199 |