News And Technical Analysis From Instaforex - Business (10) - Nairaland

Nairaland Forum / Nairaland / General / Business / News And Technical Analysis From Instaforex (45824 Views)

Get Startup Bonus Of $500 To Trade From Instaforex / News And Technical Analysis From Superforex / News From Instaforex (2) (3) (4)

(1) (2) (3) ... (7) (8) (9) (10) (11) (12) (13) ... (23) (Reply) (Go Down)

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 12:15pm On Dec 13, 2017 |

The US will raise interest rates today The US dollar tried to strengthen its position against the euro and the pound ahead of the important decision by the Fed regarding interest rates. As many experts expect, the Federal Reserve System will tighten the terms of monetary policy today, as the economy and inflationary pressure continue to show growth. Yesterday, the data increased again according to the budget deficit of the US government in November 2017 due to the fact that expenditures exceeded tax revenues. According to the US Treasury, the budget deficit rose to $139 billion in November this year, from $137 billion in November 2016. The Congressional Budget Office expected the deficit to came in at $134 billion. Government revenues in November grew by 4 percent. Further discussion related to tax reform was mentioned on this indicator. Despite the fact that the final version of the tax reform has not yet been submitted and approved, many expect successful negotiations on its current course. The main issue is related to the corporate tax rate, which is proposed to reduce by 22% or 21%, and in some cases up to 20% from the current 35%. Thus, the US government can not count the taxes for 1.4 trillion dollars. It is expected that this report will be submitted already this Friday and put to a vote in both chambers next week. As noted above, the focus for today will be on the Fed's decision. Most likely, the Central Bank will raise interest rates today for the third time this year and will provide hints about the further tightening of the monetary policy next year.  As for the technical picture of EUR/USD, the bulls managed to win back the decline of euro yesterday during the second half of the day and returned to the intermediate level of support at 1.1740. While the trade is going above this range, a further upward trend for the euro can be considered with an update of 1.1775 and an exit to the weekly highs around 1.1810. Traders of the British pound are in a state of confusion and waiting for new signals to solve the problem with Brexit. It can be recalled last week that the parties reached some progress in the negotiations, and currently expects that EU leaders will allow the UK to proceed to the next stage of the negotiations, which consists of the discussion about interim agreement on the transition period. Also, the UK needs to develop and agree on new principles for the future trade agreement. Remember, many countries recently expressed their disapproval, about being connected with the granting of the special status to the UK trading partner during the period of the Brexit procedure. * The presented market analysis is informative and does not constitute a guide to the transaction. Read more: https://www.instaforex.com/forex_analysis/195733 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 12:47pm On Dec 14, 2017 |

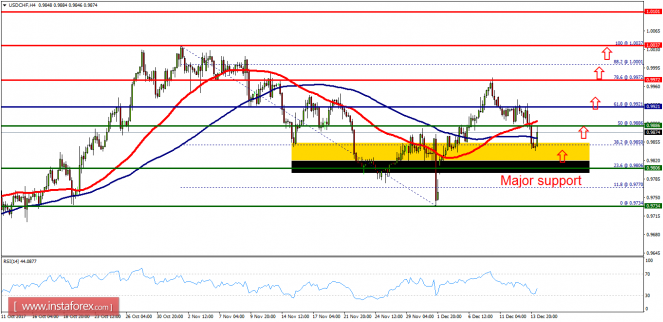

Technical analysis of USD/CHF for December 14, 2017  Overview: Pivot point : 0.9921. The USD/CHF pair didn't make any significant movements for that the price is still moving around the area of 0.9806 and 0.9921. Besides, it should be noted that the bias remains bullish in the nearest term testing 1.0037 or higher. The USD/CHF pair continues to move upwards from the level of 0.9806. Last week, the pair rose from the level of 0.9806 to the top around the area of 0.9921 (pivot). Today, the first resistance level is seen at 0.9972 followed by 1.0037, while daily support 1 is seen at 0.9886. According to the previous events, the USD/CHF pair is still moving between the levels of 0.9886 and 1.0037; for that, we expect a range of 150 pips. If the USD/CHF pair fails to break through the support level of 0.9886, the market will rise further to 0.9972. This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to climb higher towards at least 1.0037 with a view to testing the double top. Briefly, the major support is seen at the price of 0.9806. So, it will be very useful to buy above the spot of 0.9806 with the targets of 0.9921 and 1.0037. On the other hand, if a breakout takes place at the support level of 0.9800, then this scenario may become invalidated. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. Read more: https://www.instaforex.com/forex_analysis/105517 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:00am On Dec 15, 2017 |

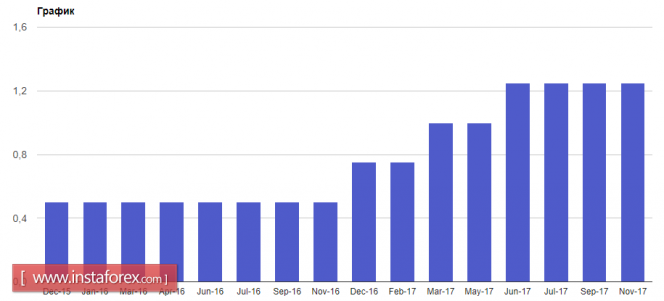

Fundamental Analysis of AUD/JPY for December 15, 2017 AUD has been dominating over JPY this week in light of upbeat high impact economic reports, supporting the gains. Recently, Australia's Employment Change report was published with a significant increase to 61.6k from the previous figure of 7.8k which was expected to increase to 18.1k and Unemployment Rate remained unchanged at 5.4% as expected. The positive economic report from Australia helped the currency to gain momentum, so the aussie has trimmed earlier losses against JPY. On the other hand, JPY has been showing a mixed dynamic amid economic reports released this week that resulted in weak bearish pressure in the pair. Today, Japan's Tenkan Manufacturing Index report was published with an increase to 25 from the previous figure of 22 which was expected to be at 24 and Tenkan Non-Manufacturing Index was published unchanged which was expected to increase to 24. The mixed economic reports quite confused the market sentiment, but AUD seems to have taken over quite well and is expected to climb even higher in the coming days. As for the current scenario, AUD is expected to gain further against JPY in the short term quite well unless any high impact positive economic report from Japan injects some volatility and bearish pressure in the market. Now let us look at the technical chart. The price is currently residing above the support area of 84.40 to 85.40 and dynamic level of 20 EMA after some correction and volatility inside the area. As the price remains above the support area, the bullish bias is expected to continue with target towards 87.40 resistance area.  Read more: https://www.instaforex.com/forex_analysis/105577 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 10:08am On Dec 18, 2017 |

AUD/USD reversing perfectly, time to start selling The price touched our selling level and reversed perfectly. We remain bearish below our selling area major resistance at 0.7698 (Fibonacci retracement, horizontal swing high resistance) for a further drop down to at least 0.7537 support (Fibonacci retracement, horizontal overlap support). Stop loss is at 0.7751 (Multiple Fibonacci retracements, horizontal pullback resistance). Stochastic (34,3,1) is seeing major resistance below our 97% and is reversing nicely below this level. Sell below 0.7698. Stop loss is at 0.7751. Take profit is at 0.7537.  Read more: https://www.instaforex.com/forex_analysis/105640 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:19pm On Dec 19, 2017 |

Global macro overview for 19/12/2017 During the Asian session, the global investors got acquainted with meeting minutes from the December Reserve Bank of Australia meeting, where, as expected, the main interest rate was maintained at 1.5%. In the minutes, investors can find hawkish accents regarding the prospects for the Australian labor market and generally favorable conditions in the economy, which should contribute to the increase in wage pressure and inflation. It is worth to notice, that recently the RBA has decided to remove the phrase saying that "inflation will most likely remain low for some time" from the recent meeting minutes. In addition, the bank is still convinced that the low level of interest rates is support for the economic climate and ensures sustainable economic growth and the return of inflation to the target in the medium term. Although there are no interest rate hikes on the horizon, the notes supported slightly the Australian Dollar. Let's now take a look at the AUD/NZD technical picture at the H4 time frame. The markets still corrects the last drops. The current upward correction from 0.7500 has exceeded the maximum correction in the total downward impulse from 0.8123, which in technical terms supports the demand side of this pair. The nearest resistance in the form of converging average EMA 100- and 200-periodic D1 scale is at the level of 0.7698. Exit above the round level of 0.77 should lead to a continuation of increases in the area of 0.7750. The 50-period average EMA on a daily basis determines support at 0.7645.  Read more: https://www.instaforex.com/forex_analysis/105829 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 11:01am On Dec 20, 2017 |

Fundamental Analysis of USD/CAD for December 20, 2017 USD/CAD is currently trading below the resistance area of 1.29 after recent impulsive bullish pressure. The price has been trapped inside the corrective range of 1.27 to 1.29 for a few months. Meanwhile, bulls have been the most dominant side with consistent gains. Recently due to the Federal Funds Rate hike, USD gained good momentum over CAD, so that the price is expected to move much higher in the coming days. Nevertheless, any positive economic report from Canada this month may help to offset the impulsive bullish pressure. Today, Canada's Wholesale Sales report is expected to show an increase to 0.5% from the previous value of 1.2% which is expected to have a minimal impact on the CAD progress in the coming days. On the USD side, today Existing Home Sales report is going to be published which is expected to increase to 5.53M from the previous figure of 5.48M and Crude Oil Inventories is expected to show less deficit to -3.6M from the previous figure of -5.1M. Additionally, on Thursday (tomorrow) US Final GDP report is going to be published which is expected to be unchanged at 3.3%. Besides, Canada's CPI is expected to increase to 0.2% from the previous value of 0.1% and Core Retail Sales is expected to increase to 0.4% from the previous value of 0.3%. As for the current scenario, the pair is likely to trade with higher volatility by tomorrow. So, we can have some decent understanding about the upcoming directional movement in the pair. Though USD has already have the upper hand over CAD, any positive economic report from Canada tomorrow may lead to strong CAD resilience inside the corrective range area. Now let us look at the technical chart. The price has recently rejected off the resistance level of 1.29 which led to further bearish pressure which is currently visible today. The pair is trading above the dynamic level of 20 EMA inside the corrective range between 1.27 and 1.29. As the price remains below 1.29 with a daily close, the bearish bias is expected to continue to push the price towards 1.27 in the coming days. In any case, if the price breaks above 1.2900, the bullish pressure is expected to strengthen and push the price higher towards 1.30 and later towards 1.3250 resistance area in the future.  Read more: https://www.instaforex.com/forex_analysis/105897 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:20pm On Dec 21, 2017 |

EUR/USD analysis for December 21, 2017  Recently, the EUR/USD pair has been trading sideways at the price of 1.1860. Anyway, according to the 30M time – frame, I found a broken rising wedge forrmation inside of a lager broadening wegde formation, which is a sign that buying looks risky. My advice is to watch for potential selling opportunities. I have placed Fibonacci retracement to find potential downward targets. I got FR 38.2% at the price of 1.1840, FR 50% at the price of 1.1820 and FR 61.8% at the price of 1.1800. Resistance levels: R1: 1.1905 R2: 1.1940 R3: 1.1980 Support levels: S1: 1.1835 S2: 1.1795 S3: 1.1760 Trading recommendations for today: watch for potential selling opportunities. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. Read more: https://www.instaforex.com/forex_analysis/106025 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:57am On Dec 22, 2017 |

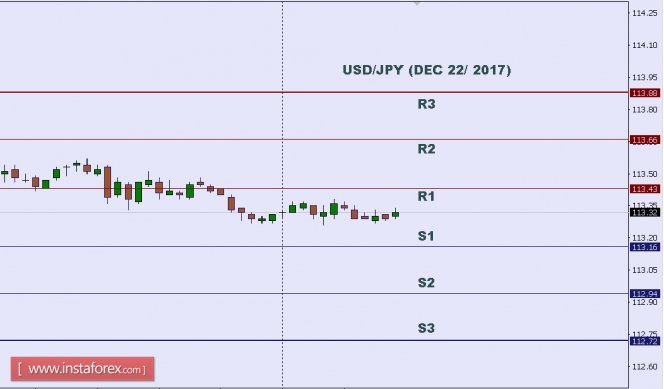

Technical analysis of USD/JPY for Dec 22, 2017  In Asia, today Japan will not release any Economic Data, but the US will release some Economic Data such as Revised UoM Inflation Expectations, Revised UoM Consumer Sentiment, New Home Sales, Personal Income m/m, Personal Spending m/m, Durable Goods Orders m/m, Core PCE Price Index m/m, and Core Durable Goods Orders m/m. So, there is a probability the USD/JPY will move with a low to medium volatility during this day. TODAY'S TECHNICAL LEVEL: Resistance. 3: 113.88. Resistance. 2: 113.66. Resistance. 1: 113.43. Support. 1: 113.16. Support. 2: 112.94. Support. 3: 112.72. Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. Read more: https://www.instaforex.com/forex_analysis/106067 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:57am On Dec 27, 2017 |

Fundamental Analysis of USD/CAD for December 27, 2017 USD/CAD is currently quite bearish, having 1.27 support level cleared with a daily close which opened the doors for the price to proceed much downward in the coming days. CAD has been quite positive with the gains recently despite a lack of any economic reports or events to support its recent gains, but it seems like the weakness of USD is the working factor in this case. USD has been quite weaker recently amid mixed economic reports which made the US currency lose ground against other rival currencies. Today, US CB Consumer Confidence report is going to be published which is expected to decrease to 128.2 from the previous figure of 129.5 and Pending Home Sales is expected to be negative at -0.4% from the previous value of 3.5%. The economic reports from the US are quite negatively forecasted. If that happens, then CAD is going to dominate further in the coming days until the US comes up with any positive economic reports or events to help it regain the momentum it has lost recently. Now let us look at the technical chart. The price is currently hovering below the 1.2700 event level which held the price earlier. However, this time the price had a break with a daily close below the level which indicates that the price is going to proceed much lower towards 1.2450 in the coming days. As the price remains below 1.27 with a daily close, the bearish bias is expected to continue further.  Read more: https://www.instaforex.com/forex_analysis/106258 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:39am On Dec 28, 2017 |

Technical analysis of USD/CHF for December 28, 2017  USD/CHF is expected to trade with a bearish outlook. The pair is clearly reversing down, capped by its falling 20-period and 50-period moving averages. The recent bearish breakout of a key horizontal level at 0.9885 should open the downside path toward 0.9810. Last but not least, the relative strength index is badly directed and calls for a new pullback. To conclude, as long as 0.9875 isn't surpassed, look for further downsides to 0.9810 and 0.9795 in extension. Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot points indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades. Strategy: SELL, Stop Loss: 0.9875, Take Profit: 0.9810 Resistance levels: 0.9900, 0.9915, and 0.9935 Support levels: 0.9810, 0.9795, and 0.9750 *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. Read more: https://www.instaforex.com/forex_analysis/106356 |

| Re: News And Technical Analysis From Instaforex by saidubaba: 9:22am On Dec 28, 2017 |

All this technical analysis, how can one benefit and earn better as a Nigerin |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:34am On Dec 29, 2017 |

saidubaba: you have to open an InstaForex trading account so as to be able to trade forex. |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:36am On Dec 29, 2017 |

Burning Forecast 29/12/2017 Burning Forecast 29/12/2017 EURUSD: Buy from kickbacks. The euro was on the growth trend in the final days of 2017. A break above 1.1900 and the consolidation above this level is a strong signal for growth. At the moment, the course is testing the next important resistance of 1.1960 - and, if successful, a target of 1.2080 - a peak of the year. Purchases are possible, but we must bear in mind that on the first trading day of January, and generally during the first week, there is a high probability of strong gaps and sudden unpredictable movements. Therefore, we are buying the euro from 1.1900. Merry Christmas and Happy New Year! [Img]https://forex-images.ifxdb.com/userfiles/20171229/analytics5a45e68403637.jpg [/img] |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:21am On Jan 02, 2018 |

AUD/JPY testing major resistance, time to go short Price is testing major resistance at 88.09 (Fibonacci retracement, horizontal swing high resistance) and we expect a strong drop from this level towards 86.69 support (Fibonacci retracement, horizontal support). Stochastic (55,3,1) is seeing major resistance at 99% and is starting to drop nicely signalling a further drop could be expected. Sell below 88.09. Stop loss at 88.71. Take profit at 86.69.  |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 10:49am On Jan 03, 2018 |

Trade review for January 3 by simplified wave analysis Overview and forecast for EUR / USD The graph of the European currency in the main pair against the dollar after the correction period resumed its growth. The quotes of the pair reached a critical point again, which divides the two main options for the future scenario. In the first case, the current stretched plane of large scale will be continued further. An alternative option involves pre-shaping the correction at a higher wave level. Today is probably the end of the rise of the past days. Turning is not expected above the resistance zone levels. At the beginning of the course of the price down can be calculated in the second half of the day. The lower limit of the daily course of the pair is the settlement support. The boundaries of the resistance zones: - 1.2080 / 1.2110 The boundaries of the support zone: - 1.2000 / 1.1970 [Img]https://forex-images.ifxdb.com/userfiles/20180103/analytics5a4c87c51255b.jpg [/img] Overview and forecast for USD / CAD The direction of the short-term trend on the chart of the major pair of the Canadian dollar is set by the upward wave of September 8 last year. During the last 2 months, the price is adjusted, forming a wave zigzag. The preliminary calculation of the target zone gives, as the nearest landmark of the completion of the wave, the mid-hundred, and twenty-fifth price pattern. Today, the formation of a corrective rollback is likely. The flute nature of price fluctuations will become dominant. The swing upwards limits the calculated resistance zone. Then you should wait for a return to the main course of the movement and a new section for strengthening the Canadian currency. The boundaries of the resistance zones: - 1.2580 / 1.2610 The boundaries of the support zones: - 1.2500 / 1.2470  Explanations to the figures: For simplified wave analysis, the simplest type of wave is used in the form of a zigzag, combining 3 parts (A; B; C). Of these waves, all kinds of correction are composed and most of the impulses. At each time frame, the last, incomplete wave is analyzed. The areas marked on the graphs are indicated by the calculation areas, where the probability of a change in the direction of motion is significantly increased. Arrows indicate the wave counting according to the technique used by the author. The solid background of the arrows indicates the structure formed, the dotted one indicates the expected wave motion. Attention: The wave algorithm does not take into account the duration of the tool movements in time. The forecast is not a trading signal! To conduct a trade transaction, you need to confirm the signals of your trading systems. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. Read more: https://www.instaforex.com/forex_analysis/196967 |

| Re: News And Technical Analysis From Instaforex by lovetrust(m): 11:51am On Jan 03, 2018 |

Forex trading is legal in many countries including Nigeria. But I must warn you; its the most risky investment you can run. You will definitely lose your money especially as a retail trader. If Anybody debunks my claims here... Let him or her give us his investor's (read only)/password and his login for us to see his statement of performance. You will then agree with me that forex trading is not recommended for retail traders(those trading with less than 100,000 USD on leverage)..... Plz stay clear from forex trading. I traded very actively for over 3years with more than 50 licensed brokers. Read over 100books on forex trading and several trainings,workshops, seminars etc. If you must invest, go for govt backed investment. Happy new year |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 3:43pm On Jan 04, 2018 |

Wave analysis of the GBP / USD currency pair for January 4, 2018 [Img] https://forex-images.ifxdb.com/userfiles/20180104/analytics5a4dda1ee1037.gif[/img] Analysis of wave counting: On the whole, it is expected that the breakdown of the level of the 36th figure led to a fairly dynamic decline in the price of the pair GBP / USD at the beginning of yesterday's European session by almost 120 percentage points from the previously reached maximum (1.3610). Thus, the emerging wave situation allows us to assume (with some stretch) that the currency pair has completed the formation of the third wave and has already designated the beginning of the 4th wave, in the 5th, a, B, C, C, (C). In this case, in the case of a downward movement to 1.3300, the 2nd wave, in the 5th, a, B, C, C, (C), significantly complicates its internal wave structure. The objectives of building the downward wave: 1.3480 - 11.4% by Fibonacci 1.3291 - 23.6% by Fibonacci 1.3200 The objectives for the construction of an upward wave: 1.3600 - 1.3700 General conclusions and trade recommendations: The construction of the upward trend section continues. It is now possible to resume the increase in quotes within the wave 5, 5, a, B, C, C, (C) with targets that are about 36 and 37 figures. The overbought indicators allow the probability of complicating the wave 2, 5, a, B, C, C, (C). *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. Read more: https://www.instaforex.com/forex_analysis/197061 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 1:51pm On Jan 05, 2018 |

Technical analysis of USD/JPY for Jan 05, 2018  Japan will release the Monetary Base y/y and the US will reveal some Economic Data such as Factory Orders m/m, ISM Non-Manufacturing PMI, Trade Balance, Unemployment Rate, Non-Farm Employment Change, and Average Hourly Earnings m/m . So there is a probability the USD/JPY pairwill move with medium to high volatility during this day. TODAY'S TECHNICAL LEVEL: Resistance. 3: 113.34. Resistance. 2: 113.12. Resistance. 1: 112.90. Support. 1: 112.62. Support. 2: 112.40. Support. 3: 112.18. Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. Read more: https://www.instaforex.com/forex_analysis/106788 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:24am On Jan 08, 2018 |

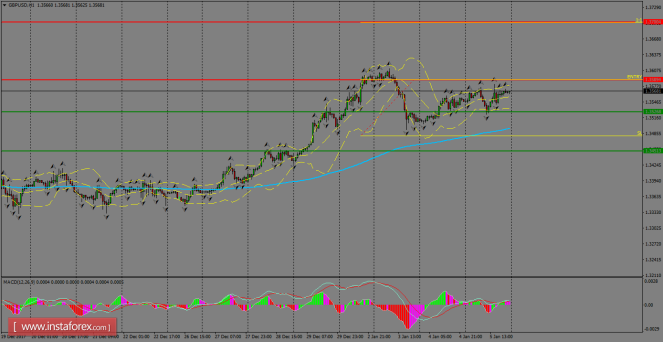

Daily analysis of GBP/USD for January 08, 2018 GBP/USD hadn't a major reaction to the US NFP outcome on Friday, as it remains trading in a tight range across the board. Currently, the pair is being supported by the 1.3526 level, which should give enough momentum in order to strengthen the bullish bias and it will help to push it to test the resistance zone of 1.3700. MACD indicator remains in favor of the bulls.  H1 chart's resistance levels: 1.3589 / 1.3700 H1 chart's support levels: 1.3526 / 1.3451 Trading recommendations for today: Based on the H1 chart, buy (long) orders only if the GBP/USD pair breaks a bullish candlestick; the resistance level is at 1.3589, take profit is at 1.3700 and stop loss is at 1.3480. Read more: https://www.instaforex.com/forex_analysis/106858 |

| Re: News And Technical Analysis From Instaforex by plato091: 11:56am On Jan 08, 2018 |

Please can you help me out, i have instaforex trading account but i don't know how to login my trading account details in mt4. My whatsapp 08089961895 |

| Re: News And Technical Analysis From Instaforex by Tundoo: 3:28pm On Jan 08, 2018 |

lovetrust: There is something I have noticed, I might be wrong but I have noticed that not too many people in the country here are into forex trading. This might be due to the fact that many do not buy the idea of anything online and they might consider this as another scam. I totally agree with the fact that forex can be a risky game, but if we make out good plans and stick to it, it might just work out well for us. But if things don't go well, we might as well take a break. |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:50am On Jan 09, 2018 |

Technical analysis of USD/JPY for Jan 09, 2018  In Asia, Japan will release the Consumer Confidence and Average Cash Earnings y/y data, and the US will release some Economic Data such as IBD/TIPP Economic Optimism, JOLTS Job Openings, and NFIB Small Business Index. So, there is a probability the USD/JPY will move with a low to medium volatility during this day. TODAY'S TECHNICAL LEVEL: Resistance. 3: 113.16. Resistance. 2: 112.96. Resistance. 1: 112.74. Support. 1: 113.46. Support. 2: 112.23. Support. 3: 112.01. Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. Read more: https://www.instaforex.com/forex_analysis/106964 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:02am On Jan 10, 2018 |

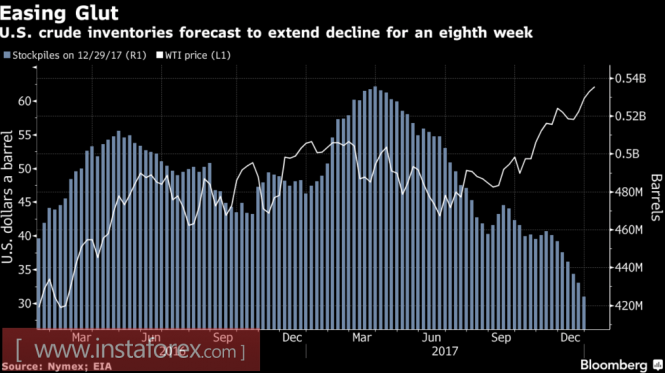

Brent: "Bears" threw a towel into the ring Frosts in the northeastern United States, the continuing decline in US oil reserves, the anti-government strikes in Iran, the high level of compliance with contractual obligations by OPEC members, and the weakness of the dollar pushed the quotations of Brent and WTI to the area of three-year highs. However, some of black gold's advantages, in particular, problems with supplies in the North Sea and in Libya, have already been played. Tehran has not reduced production and the US currency is beginning to win back part of the losses incurred at the turn of 2017-2018 decline. These circumstances require that the "bulls" have evidence that they are able to retain both varieties at current levels. According to the consensus forecast of Bloomberg experts, by the week ending in January 5, oil reserves in the United States have already decreased by 1.5 million barrels. If this is the case, the figure will drop 8 five consecutive days and will reach a minimum mark since the beginning of 2015. At the same time, the number of drilling rigs, according to the latest report of Baker Hughes, unexpectedly decreased by 5. It seems that the rate that shale oil producers will increase its own activity as WTI moved above $ 60 per barrel, was not justified. However, this threat made Iran's oil minister say that OPEC does not want Brent to go far from $ 60. Dynamics of WTI and US oil reserves  Source: Bloomberg. Tehran is forced to use this rhetoric as part of the "bullish" news for black gold comes from it. The country, which accounts for about 4% of world production (3.8 million bpd), cannot afford to live in the face of the growing risks of an anti-government coup. It indeed has retained its previous production levels but who knows what will happen tomorrow. The situation is aggravated by the conflict between Iran and Saudi Arabia over Yemen as well as rumors that Donald Trump will not confirm the terms of the nuclear deal with Tehran. The renewal of sanctions is fraught with a reduction in world production and rising prices. The world demand plays an important role in the current Brent and WTI rally. According to IMF forecasts, the global GDP will grow by 3.6% in 2018. At the same time the increase in consumption of black gold increased to 5 million bpd from 2015 to 2017. However, at the time when the North Sea grade was quoted at $ 100 per barrel or higher, it did not reach +1 million bpd. The continuation of the northern oil campaign will have an impact not only on demand, but also on inflation. Accelerated growth in consumer prices in the US will contribute to the aggressive monetary restriction of the Fed, which will strengthen the position of the dollar. Currently, the US currency has an undisclosed potential. First, the market ignored the factor of tax reform and it is quite capable of winning it back. Second, the divergence in the monetary policy of the Fed and its main competitors continues to work in favor of the USD index. Technically, if the "bulls" for Brent manage to keep the positions won, then the risks of continuing the rally in the direction of the target by 200% on the AB = CD pattern will increase. On the contrary, falling prices below $ 66.95 per barrel will open the door for correction. Brent, daily chart  |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:05am On Jan 10, 2018 |

plato091: As a beginner please go to the following link: https://www.ifxid.com/getting_started. In the Training Video section you will find educational materials dedicated to understanding the uniqueness of how to work with InstaForex, trading theories, technical indicators, FAQs on Forex trading composed of questions that clients often ask, Opening Demo accounts, Forex Glossary pages consists of existing trading terms and their explanations. You can familiarize yourself with the information on the educational page http://education.ifxid.com/ |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:23am On Jan 11, 2018 |

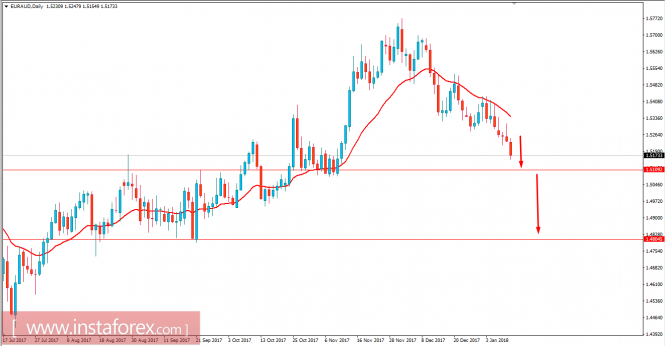

Fundamental Analysis of EUR/AUD for January 11, 2018 EUR/AUD has been impulsively bearish recently after bouncing off the 1.5400 price area and dynamic level of 20 EMA. AUD has been quite positive with the economic reports which helped the currency to gain momentum over EUR which is struggling to make an impact on the bullish growth. Today AUD Retail Sales report was published with a significant increase to 1.2% from the previous value of 0.5% which was expected to decrease to 0.4%. The increase in Retail Sales helped the currency to gain impulsive momentum over EUR which is expected to continue further in the coming days. On the other hand, today EUR Italian Retail Sales report is going to be published which is expected to increase to 0.8% from the previous negative value of -1.0%, Industrial Production report is expected to increase to 0.8% from the previous value of 0.2% and ECB Monetary Meeting Accounts report is going to be published today as well which is expected to be quite neutral in nature. Despite having a good forecast for the upcoming economic reports of EUR today, AUD has been quite impulsive with the gains already which would be pretty tough for EUR to recover from. As of the current scenario, AUD is expected to gain more momentum in the coming days taking the price much lower. Now let us look at the technical view. The price has been bearish since it bounced off the dynamic level rejecting it for several times before it finally started to be impulsive with the gains. There has been a lot of corrections along the way but due to today's positive economic reports, AUD gained the momentum which is required to dominate EUR for the coming days. As the price remains below 1.5400 and dynamic level of 20 EMA with a daily close the bearish bias is expected to continue further.  |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 2:16pm On Jan 12, 2018 |

USD/JPY analysis for January 12, 2018  Recently, the USD/JPY pair has been trading downwards. As I expected, the price tested the level of 110.97. According to the 30M time – frame, I found a broken bearish pennant, which is a sign that sellers are in control. Another sign of weakness is the breakout of yesterday's low at the prrice of 111.04. My advice is to watch for potential selling opportunities. The downward target is set at the price of 110.60. Resistance levels: R1: 111.75 R2: 112.25 R3: 112.60 Support levels: S1: 110.90 S2: 110.55 S3: 110.05 Trading recommendations for today: watch for potential selling opportunities. Read more: https://www.instaforex.com/forex_analysis/107308 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 1:04pm On Jan 19, 2018 |

AUD/JPY testing major resistance, prepare for a drop The price is testing major resistance at 88.98 (Fibonacci extension, horizontal swing high resistance, bearish harmonic formation) and we expect to see a strong reaction off this level to push the price down towards 88.41 support (Fibonacci retracement, horizontal overlap support). Stochastic (34,5,3) is seeing major resistance below 96% where further bearish momentum is expected. Sell below 88.98. Stop loss at 89.22. Take profit at 88.41.  Read more: https://www.instaforex.com/forex_analysis/107791 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:00am On Jan 22, 2018 |

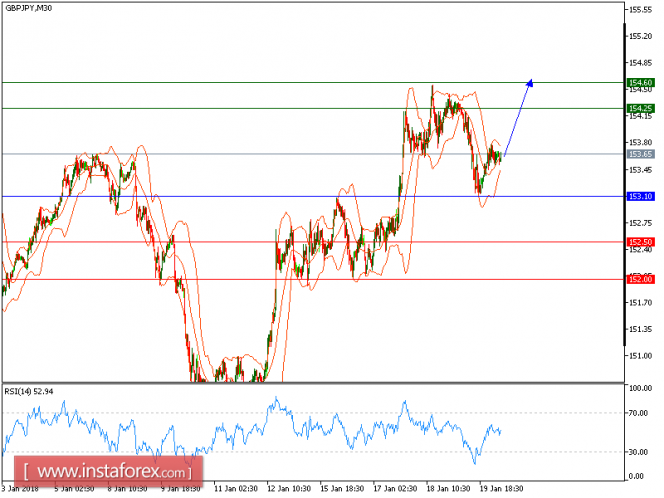

Technical analysis of GBP/JPY for January 22, 2018  GBP/JPY is expected to trade with a bullish outlook. The pair bounced off its horizontal level at 153.10, which acts as a strong support role, and should limit any downside room. In addition, the relative strength index has broken above its neutrality area at 50 and is mixed to bullish now. Therefore, as long as 153.10 holds on the downside, likely advance to 154.25 and 154.60 in extension. Alternatively, if the price moves in the direction opposite to the forecast, a short position is recommended below 153.10 with the target at 152.50 Strategy: BUY, stop loss at 153.10, take profit at 154.25 Chart Explanation: the black line shows the pivot point. The price above the pivot point indicates long positions; and when it is below the pivot point, it indicates short positions. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades. Resistance levels: 154.25, 154.60, and 155.00. Support levels: 152.50, 152.00, and 151.45 Read more: https://www.instaforex.com/forex_analysis/107901 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 1:45pm On Jan 23, 2018 |

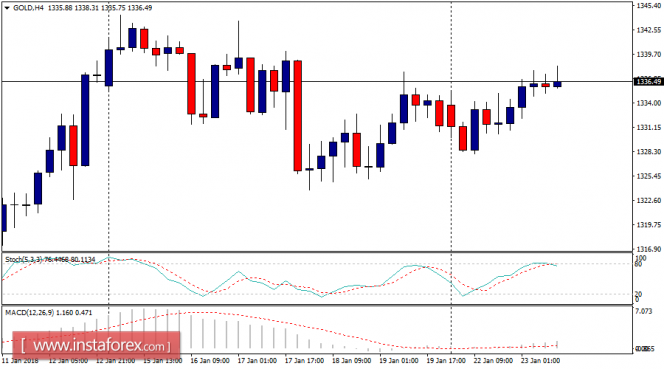

Daily analysis of Gold for January 23, 2018  Overview Gold price begins today's trading with a calm bullish bias after retesting the previously breached resistance of the bullish flag pattern. This price action supports our bullish outlook for the short term. We believe that the way is open to visit 1,357.50 that represents our next main target. Therefore, we are waiting for more rise today. Please note that breaching the mentioned level will extend price gains to reach 1,375.00 followed by 1,404.00, while holding above 1,321.40 represents the key condition to achieve the expected targets. The expected trading range for today is between 1,325.00 support and 1,350.00 resistance. Read more: https://www.instaforex.com/forex_analysis/108056 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 11:09am On Jan 24, 2018 |

USD/CHF right on major support, prepare for a bounce The price is now testing major support at 0.9569 (Fibonacci extension, horizontal swing low support) and we expect a bounce above this level to push the price up to at least 0.9699 resistance (Fibonacci retracement, horizontal pullback resistance). Stochastic (21,5,3) is seeing major support above 3.7% where a corresponding bounce could occur. Buy above 0.9569. Stop loss at 0.9501. Take profit at 0.9699.  Read more: https://www.instaforex.com/forex_analysis/108095 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:57am On Jan 25, 2018 |

NZD/USD approaching major support, prepare to buy Price is approaching major support at 0.7312 (Fibonacci retracement, horizontal overlap support, long term ascending support) and a bounce could occur at this level to push price up to at least 0.7436 resistance (major swing high resistance, Fibonacci extension). RSI (34) sees a long term ascending support line, which since November 2017 has been holding up our bullish momentum really well. Buy above 0.7312. Stop loss at 0.7256. Take profit at 0.7436.  |

(1) (2) (3) ... (7) (8) (9) (10) (11) (12) (13) ... (23) (Reply)

Meet The Female CEOs Leading Nine Nigerian Banks (Photos) / ICPC Arrests Osun FCMB Manager Over New Naira Notes Policy Violation / Forbes 2015 Billionaires List Released. 5 Nigerians Made The List

(Go Up)

| Sections: politics (1) business autos (1) jobs (1) career education (1) romance computers phones travel sports fashion health religion celebs tv-movies music-radio literature webmasters programming techmarket Links: (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Nairaland - Copyright © 2005 - 2024 Oluwaseun Osewa. All rights reserved. See How To Advertise. 148 |