| Re: Treasury Bills In Nigeria by needful: 1:50pm On Jan 21, 2020 |

9jatriot:

25k vs 256k? This difference is too much na, abi na typo.

Real. I posted the calculation here and someone chatted me privately about it. |

| Re: Treasury Bills In Nigeria by emmanuelewumi(m): 1:53pm On Jan 21, 2020 |

needful:

Bond @ 1% whereas stanbic is 0.0007% Okay, Stanbic IBTC Stockbrokers is the best when it comes to bond investments |

| Re: Treasury Bills In Nigeria by Jejebabaa: 2:00pm On Jan 21, 2020 |

emmanuelewumi:

Oando made a mistake by being too optimistic. The company bought the asset of Conoco Phillips at about $1.4 billion when COP was living Nigeria. They bought the asset when crude oil was selling at around $100 per barrel, not quite long after the purchase by Oando.

The issue between Saudi, OPEC and Shale Oil producers, this imbroglio made the price of crude oil to go down to as low as $20 per barrel due to price war between OPEC cartel and Shale Oil guys in North America.

This disruption, adversely affected the projection of Oando. Oando made a record loss after tax of over N220 billion in corporate Nigeria around 2017.

@ Jejebaba please correct me if I am wrong. You are a professional in that sector You are right sir and even Warren Buffet made a similar mistake by buying ConocoPhillips in USA as well. But he was lucky to sell at a marginal profit when it rose. Investing in oil and gas is risky considering all these environmentalist of going green. Most IOC's are also divesting from the sector by selling their assets in USA and canada especially. Just last week, Schlumberger booked a loss of 10 billion dollars for the year 2019. In all God help Nigeria that is fully dependent on oil and gas. Yhe industry ain't finding it funny anymore sir. 4 Likes |

| Re: Treasury Bills In Nigeria by emmanuelewumi(m): 2:05pm On Jan 21, 2020 |

Jejebabaa:

You are right sir and even Warren Buffet made a similar mistake by buying ConocoPhillips in USA as well. But he was lucky to sell at a marginal profit when it rose. Investing in oil and gas is risky considering all these environmentalist of going green. Most IOC's are also divesting from the sector by selling their assets in USA and canada especially. Just last week, Schlumberger booked a loss of 10 billion dollars for the year 2019.

In all God help Nigeria that is fully dependent on oil and gas. Yhe industry ain't finding it funny anymore sir. Thank you very much for the insight. |

| Re: Treasury Bills In Nigeria by Jejebabaa: 2:16pm On Jan 21, 2020 |

emmanuelewumi:

Thank you very much for the insight. You welcome sir. |

| Re: Treasury Bills In Nigeria by Nobody: 2:26pm On Jan 21, 2020 |

needful:

Bro run away from Afriinvest. They are outrageous with their charges. Imagine charging a brokerage fee of N256000 for an investment of 27m. Thanks to Ukah who opened my eyes and stopped me. I finally port to Stanbic brokers who charged me a total of N25000 for the same 27m. Pls run as fast as u can. Quite scary but too late, i asked last week here about them and I got no answer, i assumed its golden. All the same, as long as i have enough for my fees and capital intact then am fine for now. Thanks for the information as it will guide my future investment. 1 Like |

| Re: Treasury Bills In Nigeria by isangjohnson: 2:31pm On Jan 21, 2020 |

Please do they have any branch in Kaduna?

I want to check their short term investment platform. |

| Re: Treasury Bills In Nigeria by Nobody: 2:34pm On Jan 21, 2020 |

isangjohnson:

Please do they have any branch in Kaduna?

I want to check their short term investment platform. meet them online, closest office to me is ph, been dealing online with one awesome agent. Taiwo |

| Re: Treasury Bills In Nigeria by isangjohnson: 2:38pm On Jan 21, 2020 |

Thanks |

| Re: Treasury Bills In Nigeria by Tyche(m): 2:43pm On Jan 21, 2020 |

Poanan:

Even if you use four seals, you have to communicate the seal numbers to customers. That is the reason na |

| Re: Treasury Bills In Nigeria by Frank0001(m): 4:33pm On Jan 21, 2020 |

jobark:

if the figures branded by ALAT Wema Bank are anything to go by (10% PA with interested paid every month giving room for compounding) I see it as a very viable option which will allow you maintain fantastic liquidity and security (holding period is 30 days).

it will likely serve as my transition account as i wait for better opportunities

Demo on the App shows a daily return of N246.58 for 1Million Naira

Monthly return: Average - N7,397.40

This falls around 8.8% PA, I guess larger sums may attract more %

Please can you confirm if wema ALAT truly pays at month end if you invest ₦1M as protrayed in the screenshot you uploaded? |

| Re: Treasury Bills In Nigeria by isangjohnson: 5:01pm On Jan 21, 2020 |

A friend told me today about MBA FOREX LTD and I asked him, is it regulated by SEC?

He said yes. I'm yet to sight the certificate.

Does anyone here know anything about it? |

| Re: Treasury Bills In Nigeria by 9jatriot(m): 5:24pm On Jan 21, 2020 |

For those trying to make sense of what CBN is trying to achieve in all their abracadabra, maybe this can help. ACAN:

TIME WILL TELL

In a move that resembles that of Mr. Magic, the CBN crashed interest rate on bank deposits to the low single-digit level.

A 50million naira 30 days fixed deposit for example now attracts only a maximum of 4 percent as against an average of 10 percent as of November last year.

To achieve this fete, the CBN simply tinkered with the loan to deposit ratio for banks by moving it up. It also restricted some active players from participating in the debt market (treasury bills and bonds).

As a result, the last treasury bill auction by CBN attracted only 5.1% as against an average of 13% last year.

Advantages:

-Lower deposit rates should usher in lower lending rates from banks to manufacturers etc, which is the primary desire of the government.

-The stock market which has been in the doldrums for upwards of three years has witnessed a positive resurgence due to the inverse relationship that exists between low-interest rate and capital market. When the interest rates on deposits become unattractive, investors are then willing to take on the extra risk of putting money in the stock market for better yield.

Disadvantages:

-There is significant value erosion in putting money in the banks since the interest rate offered currently is less than the inflation rate which stands at about 12%.

- The exchange rate may come under pressure as a result of investors moving there deposited funds out of banks to buy FX.

-Foreign portfolio investment (FPI), especially in our debt market, will decrease because foreign investors will find low-interest rates unattractive for arbitrage. This will consequently decrease FX inflows into the economy.

- The bank's profit earnings in 2020 may take a significant haircut because of lower margins and depositors fleeing to other investment destinations.

Take Away:

-There is a positive confluence of opinion on CBN’s move at this time stemming from the general outcry by manufacturers and others whose businesses have

been stifled by high-interest rates.

-The CBN will continue to hope that crude oil prices remain stable or higher, else, defending the currency may become a challenge.

Finally, by playing around with the macroeconomic variables, the CBN seems to have succeeded for now in lowering the interest rate. If sustained, this can have a positive impact on the GDP growth and also bring back life into the economic value chain.

Time will tell........

https://investdataltd..com/2020/01/time-will-tell.html 2 Likes |

| Re: Treasury Bills In Nigeria by jobark: 5:29pm On Jan 21, 2020 |

Frank0001:

Please can you confirm if wema ALAT truly pays at month end if you invest ₦1M as protrayed in the screenshot you uploaded? I will be balancing my books for 2019 by the end of this Month as a block, most or all my investments will be maturing this January, I intend to channel a chunk of my funds to ALAT (8.8% PA) before February as i have decided to be on the sidelines and watch how things go for Q1 2020. I will keep you informed as it plays out. 1 Like |

| Re: Treasury Bills In Nigeria by emmanuelewumi(m): 5:34pm On Jan 21, 2020 |

isangjohnson:

A friend told me today about MBA FOREX LTD and I asked him, is it regulated by SEC?

He said yes. I'm yet to sight the certificate.

Does anyone here know anything about it? SEC does not regulate such 3 Likes |

| Re: Treasury Bills In Nigeria by Nobody: 5:56pm On Jan 21, 2020 |

jobark:

I will be balancing my books for 2019 by the end of this Month as a block, most or all my investments will be maturing this January, I intend to channel a chunk of my funds to ALAT (8.8% PA) before February as i have decided to be on the sidelines and watch how things go for Q1 2020. I will keep you informed as it plays out. Can you buy dollars on alat, is it possible to transfer the purchased dollar to another Dom açcount? Is wema bank reputable? |

| Re: Treasury Bills In Nigeria by Nobody: 5:58pm On Jan 21, 2020 |

I was at first bank today to do another investment on treasury bills as d one I did last has expired. I found out the interest rate has dropped drastically and no more option of 182 days, except 1 year. I had to leave without investing. What exactly is the problem with treasury bills? I'm really looking for something to invest in. Something safe and secure as treasury bills. It has been of great help to me. I can't do without investing |

| Re: Treasury Bills In Nigeria by healthserve(m): 6:07pm On Jan 21, 2020 |

LadyBeee:

I was at first bank today to do another investment on treasury bills as d one I did last has expired. I found out the interest rate has dropped drastically and no more option of 182 days, except 1 year. I had to leave without investing. What exactly is the problem with treasury bills? I'm really looking for something to invest in. Something safe and secure as treasury bills. It has been of great help to me. I can't do without investing Why not read the last 10 to 20 pages. You'll get answers within 2 Likes |

| Re: Treasury Bills In Nigeria by Frank0001(m): 7:03pm On Jan 21, 2020 |

jobark:

I will be balancing my books for 2019 by the end of this Month as a block, most or all my investments will be maturing this January, I intend to channel a chunk of my funds to ALAT (8.8% PA) before February as i have decided to be on the sidelines and watch how things go for Q1 2020. I will keep you informed as it plays out. Alright just keep us updated. |

| Re: Treasury Bills In Nigeria by udysweet(f): 7:35pm On Jan 21, 2020 |

healthserve:

Why not read the last 10 to 20 pages. You'll get answers within chai that's plenty work o. I'm also here to look at other alternatives to investing idle funds |

| Re: Treasury Bills In Nigeria by healthserve(m): 7:36pm On Jan 21, 2020 |

udysweet:

chai that's plenty work o. I'm also here to look at other alternatives to investing idle funds Trust me I'm just a disturber here o. Ask the gurus in the house. I'm just a spectator here and don't know much |

| Re: Treasury Bills In Nigeria by ojesymsym: 8:06pm On Jan 21, 2020 |

2 Likes |

| Re: Treasury Bills In Nigeria by C505: 8:13pm On Jan 21, 2020 |

healthserve:

Lol. Dude, how you dey. I'm sure that's a scam proposal too. Continue wasting your existence. Don't put your life to meaningful use. Ode. If your fada had invested in a cocoa farm instead of your worthless education by now he would have been reaping steady returns... Way much more than your worthless existence, you Son of a wh0re

Keep seeking my fall like my real life is anything on here. Oode. My intellect and success will drive you madd. Go find meaningful use for the rest of your lame existence and prove me wrong that you're not a waste of sperm

I'm done been civil with your sorry arse. If only your mum had aborted you using the cowrie your fada let on the side table, we won't be suffering the lunatic displays of your wasted life. Eediot

[/b]FYI no one has ever fought me online or real life and won the war. None. [b] Omo see one of the 7 ancient generals who never lost a battle 1 Like |

| Re: Treasury Bills In Nigeria by odimbannamdi(m): 8:36pm On Jan 21, 2020 |

9jatriot:

For those trying to make sense of what CBN is trying to achieve in all their abracadabra, maybe this can help.

Nice read indeed. How were you able to quote a post in another thread entirely? Please teach me |

| Re: Treasury Bills In Nigeria by richforever123: 8:45pm On Jan 21, 2020 |

isangjohnson:

A friend told me today about MBA FOREX LTD and I asked him, is it regulated by SEC?

He said yes. I'm yet to sight the certificate.

Does anyone here know anything about it? SEC can never regulate such |

| Re: Treasury Bills In Nigeria by richforever123: 8:48pm On Jan 21, 2020 |

LadyBeee:

I was at first bank today to do another investment on treasury bills as d one I did last has expired. I found out the interest rate has dropped drastically and no more option of 182 days, except 1 year. I had to leave without investing. What exactly is the problem with treasury bills? I'm really looking for something to invest in. Something safe and secure as treasury bills. It has been of great help to me. I can't do without investing Since it is a lot of work let me help you summarize Wema Bank ALAT offers around 8% and you can compound monthly Here is another from Unity Bank: https://www.unitybankng.com/products/single/high-yield-interest-deposit-accountFGN Bonds offers 14% for 10 years, but you can sell in the secondary market Mutual funds index is around 7% Best Regards RICH Forever 2 Likes |

| Re: Treasury Bills In Nigeria by emmanuelewumi(m): 8:54pm On Jan 21, 2020 |

richforever123:

Since it is a lot of work let me help you summarize

Wema Bank ALAT offers around 8% and you can compound monthly

Here is another from Unity Bank: https://www.unitybankng.com/products/single/high-yield-interest-deposit-account

FGN Bonds offers 14% for 10 years, but you can sell in the secondary market

Mutual funds index is around 7%

Best Regards

RICH Forever Becareful of Unity Bank, it is a bank that is operating with a negative shareholders fund of N250 billion. When a bank or microfinance bank offers you an interest that is far higher than the industry average you need to be very vigilant. It is a desperate ploy to get depositors funds 12 Likes |

| Re: Treasury Bills In Nigeria by Nobody: 9:27pm On Jan 21, 2020 |

|

| Re: Treasury Bills In Nigeria by Guestuser: 10:29pm On Jan 21, 2020 |

healthserve:

Lol. Dude, how you dey. I'm sure that's a scam proposal too. Continue wasting your existence. Don't put your life to meaningful use. Ode. If your fada had invested in a cocoa farm instead of your worthless education by now he would have been reaping steady returns... Way much more than your worthless existence, you Son of a wh0re

Keep seeking my fall like my real life is anything on here. Oode. My intellect and success will drive you madd. Go find meaningful use for the rest of your lame existence and prove me wrong that you're not a waste of sperm

I'm done been civil with your sorry arse. If only your mum had aborted you using the cowrie your fada let on the side table, we won't be suffering the lunatic displays of your wasted life. Eediot

FYI no one has ever fought me online or real life and won the war. None. mynd44 Lalasticlala OAM4J Dominique justwise |

| Re: Treasury Bills In Nigeria by OgogoroFreak(m): 11:29pm On Jan 21, 2020 |

odimbannamdi:

Nice read indeed.

How were you able to quote a post in another thread entirely? Please teach me Lol.. You can click "quote" on that thread, then copy everything on there and post on this thread after adding your comment. |

| Re: Treasury Bills In Nigeria by freeman67: 7:37am On Jan 22, 2020 |

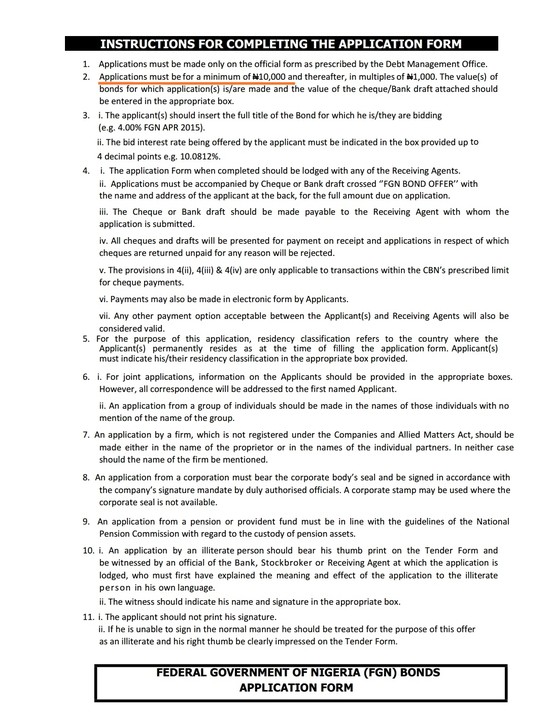

I am just seeing on the back page of the FGN Bond tender form that the minimum required is N10,000. Also I am seeing a space for bid rate when already there is a rate attached to the bond. Why is it like that?

So if we are to bid separately as stated what percentage is likely to fly?

|

| Re: Treasury Bills In Nigeria by odimbannamdi(m): 7:39am On Jan 22, 2020 |

OgogoroFreak:

Lol.. You can click "quote" on that thread, then copy everything on there and post on this thread after adding your comment. I know about this method. More of a "manual" method. I thought there was something else he did. Thanks, all the same, sir. |