Investment / Re: Treasury Bills In Nigeria by skydiver01: 3:41am On Oct 23, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 3:41am On Oct 23, 2023 |

😂😂😂 oluayebenz:

Please don't start....

I'm not feeling fine 🚶🚶🚶 3 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:02am On Oct 15, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:02am On Oct 15, 2023 |

Correct. Just like the below (FGN Bond 2036)  emmanuelewumi:

An investor who invested N20 million to buy 1 million units of Dangote Sugar shares in January 2023 would have earned a dividend of N1.5 million in May 2023.

After the announcement of the merger of Dangote Sugar, NASCON and Dangote Rice to form Dangote Foods, the share price of Dangote Sugar rose to N55.

If he sold all his shares in August and bought 9100 units of FGN 2050 bond, he would be earning about N8 million from the Investment in 2024 till 2050.

That is how income investors move their Investments from one asset class to another.

I am very sure that Dangote Foods will get to over N160 per share before the end of 2024. BUA foods is already over N200 per share 1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:36pm On Sep 25, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:36pm On Sep 25, 2023 |

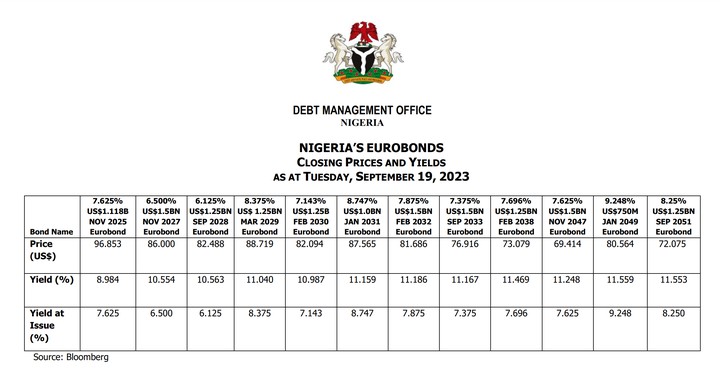

What is wrong with Seplat and Access Bank Eurobonds? Even if you have reservations over FGN Eurobonds. Wotowotoman:

Eurobonds?

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:36am On Sep 25, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:36am On Sep 25, 2023 |

Below is one example. Wotowotoman:

What fx denominated securities can the average Nigerian living in Nigeria invest in? Very few options available…. 1 Like 1 Share

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:41am On Sep 24, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:41am On Sep 24, 2023 |

One way is to collect you Naira dividends or bond coupons and buy fx ($, £, €, etc). Which can be invested in fx denominated securities or just save it after conversion in your domiciliary account. milliondollarma:

How do one save or invest in dollars?. 2 Likes 1 Share |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:24am On Sep 15, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:24am On Sep 15, 2023 |

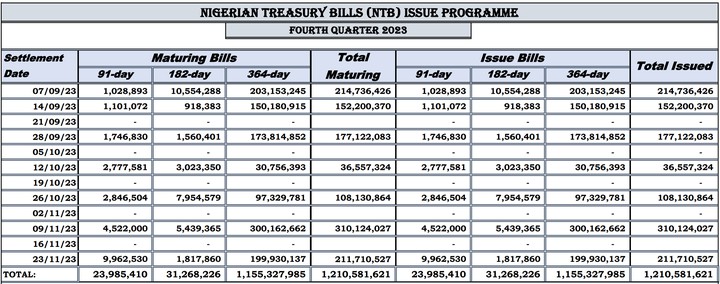

The last TBill auction was two days ago (13 Sept 2023). The next one is expected in two weeks (27 Sept 2023) as shown in the 4th quarter schedule below. cutedharmee:

Good day everyone. Pls when is the next treasury bill Investment Sir's/Ma's 2 Likes

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 9:01pm On Aug 23, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 9:01pm On Aug 23, 2023 |

I did not bid. teejay5:

Pls av u been debited? |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 9:00pm On Aug 23, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 9:00pm On Aug 23, 2023 |

You will be debited tomorrow or Friday teejay5:

Pls av u been debited? |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:22pm On Aug 23, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:22pm On Aug 23, 2023 |

NTB auction results today. 364 days rate went up. 2 Likes

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:30am On Aug 22, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:30am On Aug 22, 2023 |

I imagine tomorrow 23 August 2023 teejay5:

Good morning house,pls wen is d next treasury bill investment. |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:30am On Aug 11, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:30am On Aug 11, 2023 |

Kindly find below the NTB auction results for 8 August 2023. Rates going down again  wow, look at the 364 days... 8 to 1 demand ratio. 3 Likes

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:55pm On Jul 26, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:55pm On Jul 26, 2023 |

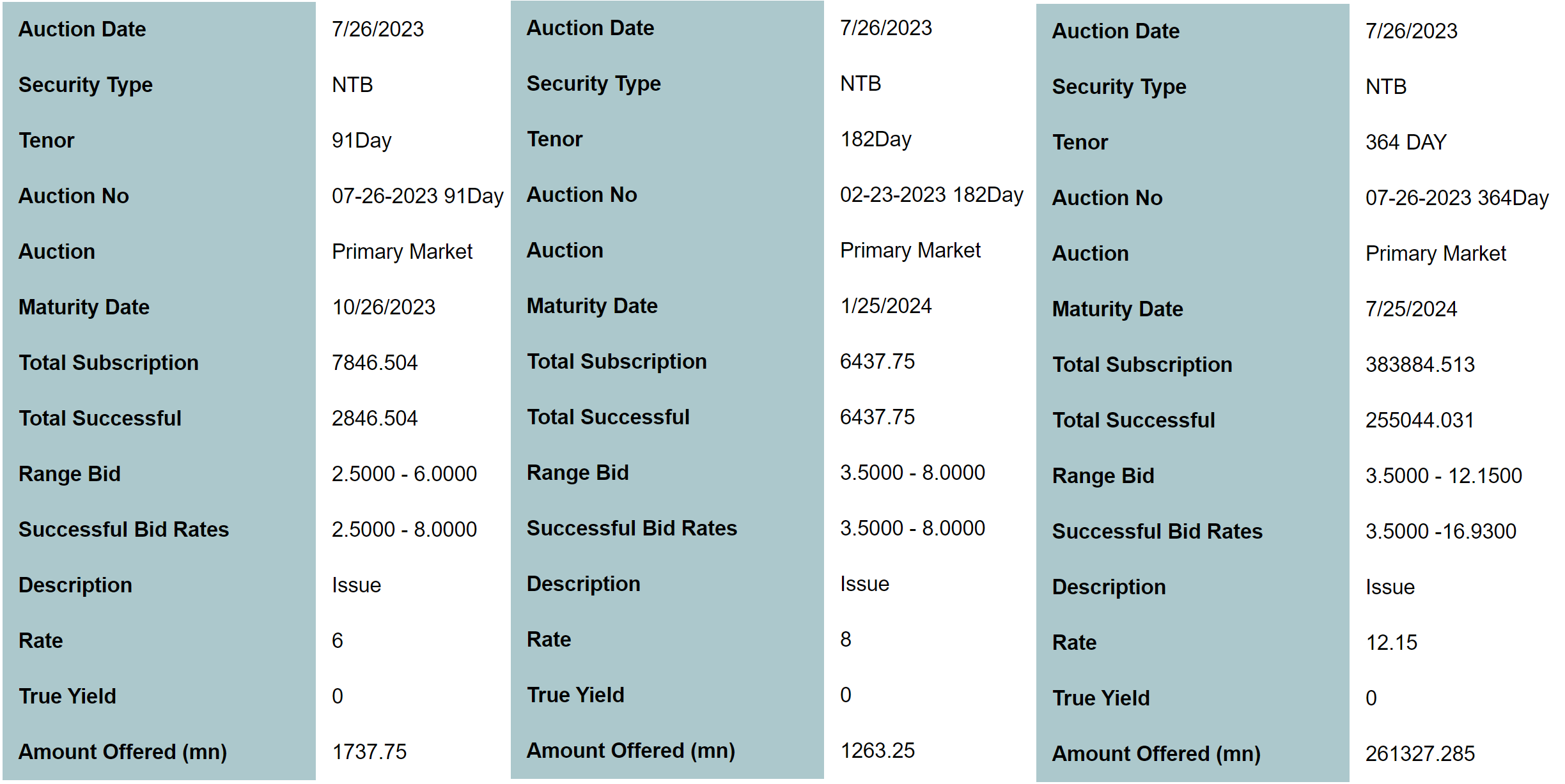

Kindly find below todays NTB auction results. Rates going up again  4 Likes

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:57am On Jul 25, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:57am On Jul 25, 2023 |

Received. Happy Days  skydiver01:

The 2026 FGN bond is due today. So I expect it to drop on Tuesday  |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:27am On Jul 25, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:27am On Jul 25, 2023 |

IYGEALPlease I would like to know, if one buys FGN Bonds from SC, will such investment be shown or CSCS? Most probably not Also, is it possible to automatically reinvest the coupons, or they get paid into one's bank account? I imagine not because bond prices change over time. Besides, you can reinvest the coupons yourself when received. Thus, the coupons simply gets paid into your account Finally, is the bank (SC) also the medium through which one sells at the 'secondary' market in case of need for liquidity? Yes Thanks in advance. 1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:15am On Jul 22, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:15am On Jul 22, 2023 |

The 2026 FGN bond is due today. So I expect it to drop on Tuesday  |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 12:15pm On Jul 21, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 12:15pm On Jul 21, 2023 |

I am sure it will arrive. If not today then Monday... Some custodians take longer to process the payments. Nakedman:

Yet to get mine. Stanbic bank |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 10:53am On Jul 21, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 10:53am On Jul 21, 2023 |

Yes I did two days ago on the 19th as expected (see below).  Nakedman:

Did you get payment yet,? |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:14am On Jul 18, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:14am On Jul 18, 2023 |

The 2034 FGN bond is due today. So I expect it to drop tomorrow or the day after  |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:07am On Jul 16, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:07am On Jul 16, 2023 |

Quite right!!  freeman67:

Standard Chartered Bank Mobile App. |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:31pm On Jul 14, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:31pm On Jul 14, 2023 |

1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 3:46am On Jul 14, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 3:46am On Jul 14, 2023 |

Kindly find below NTB auction results for 12 July, 2023 2 Likes 1 Share

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:01am On Jul 02, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:01am On Jul 02, 2023 |

Kindly find below the NTB Auction results for 30 June, 2023. 3 Likes

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:27pm On Jun 15, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:27pm On Jun 15, 2023 |

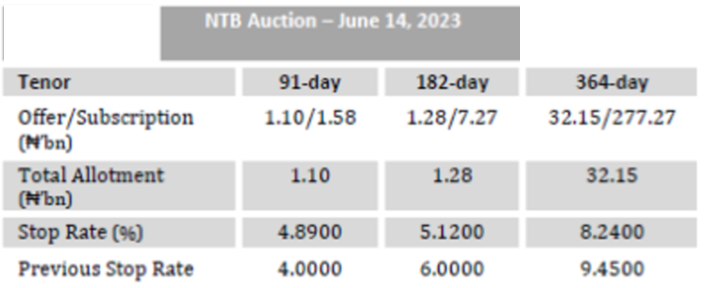

Yes there was. feelamong:

I thot there was an Auction yesterday 14th of June 2023? 2 Likes

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 12:14am On Jun 05, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 12:14am On Jun 05, 2023 |

7th June, 2023 cutedharmee:

Happy Sunday Sir's/Ma's

Pls when is the next TB auction 2 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:36am On Jun 01, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:36am On Jun 01, 2023 |

Which investments are you particularly referring to? TBills? Foodempire:

With the current price of fuel, rates should go up to at least 17%. How can we cushion the effect of subsidy removal with the meagre interest we receive on investments? I bought 5k worth of fuel today and kept checking my dashboard to see the gauge, eventually I switched off the AC, I say to my self I need to work harder so as to earn more, it's well. 2 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:25am On Jun 01, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:25am On Jun 01, 2023 |

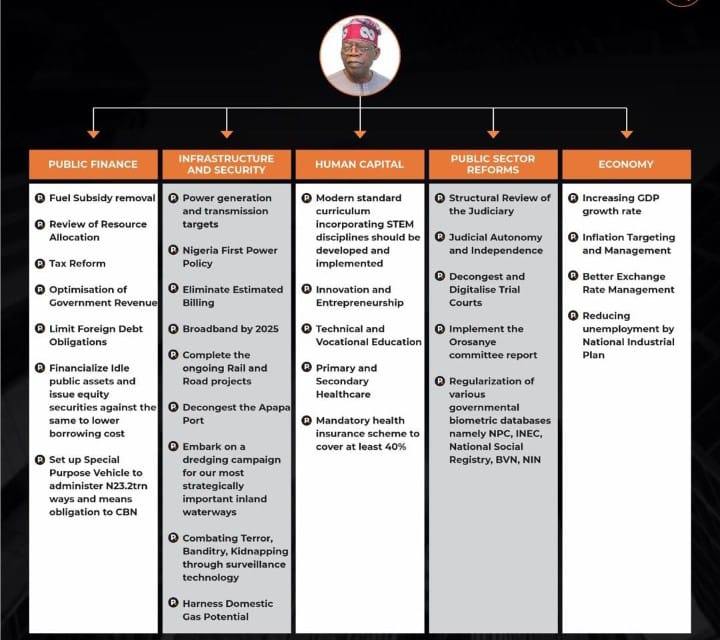

In the short-term, economic hardship/difficulties/challenges will be experienced by many. However, in the long-term, things could very well improve if the BAT blueprint below is anything to go by (IF they get implemented). Else, consider the other advisory steps below as alternatives for coping with the fuel price hike  Edicoco:

Experts in the house, I need an explanation to how this fuel price hike will affect the economy. Obviously there will be inflation, but what is the implication on the economy. 2 Likes

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:02am On May 26, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:02am On May 26, 2023 |

Kindly find below NTB auction results for 24 May 2023. 1 Like

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:52am On May 26, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:52am On May 26, 2023 |

Look at it or think about it in this way. The yield to maturity is the equivalent coupon rate of a bond at the bond's current price (purchase or sale). Remembering that the coupon rate was set when the bond was originally issued @N100 per unit. Primary markets allow for new bond issuances as well as bond re-openings. Nevertheless, the higher the bond price the lower the yield to maturity and vice versa. IYGEAL:

Yea, that's what I was seeing online too.

I no come too understand am  1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:50am On May 25, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 5:50am On May 25, 2023 |

Ignore the 2024. It is not being offered by your bank or broker because there is no FGN bond that sells for N1. The others (2025 & 2026) are available for purchase from your bank or broker. IYGEAL:

Good evening fellow investors,

Please I would like to be taught, like a high school student, what these figures, percentages and names mean in practical terms.

Maybe I have been misinterpreting them. I have read the literal meanings online but I want practical examples as regards our local market. For instance, there is a huge disparity in figures between the 2024 and 2025 bonds here in terms of ASK PRICE and YIELD TO MATURITY. 3 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 12:05pm On May 12, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 12:05pm On May 12, 2023 |

Correct plus the interest for the first 2 years is rolled over (added to that of) the remaining 8 years. Apitch:

Moratorium simply means a period of grace before payment(interest or repayment) begins.

in this case, if I'm not getting it wrong, you would not receive any payment after 2 years of investment before the interest starts coming in and then the bulk capital(principal) at the end of the tenure(10yrs)

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 3:47am On May 11, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 3:47am On May 11, 2023 |

Kindly find below yesterday's NTB auction results. 4 Likes 1 Share

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 10:35am On Apr 28, 2023 Investment / Re: Treasury Bills In Nigeria by skydiver01: 10:35am On Apr 28, 2023 |

On point! 👍😉 ahiboilandgas:

you just don't send in bids for biding sake you have to be strategic and know when to strike to get the good rates !you have to study the markets as you study price movement in oil and gas ! Over 800bn was place as bids this already 800 percent over subcribtion rate must fall! so where did this 800 bn come from ( first question) suddenly from the last bids that was around 140bn ( 102 percent) ! any time you hear FAAC has shared money to 3 teirs of govt and there is a treasury bills auction same time rate must fall cos the systems is filled with this new inflow and make banks and pension firm and other to bid ( salaries are paid ( pension firms get inflow from it, HMO also get, insurance firms, govt supply and contractors) also when a large bond or CP is maturing into the system ,or when Govt pay contractors. This hits the systems and this new money must find new investments Windows short and long term .always bids in the middle of the month where there no Faac inflows you will get better rates of you bank don't play abracadabra. You can also buy in secondary markets where you see the available rate .good luck but you have into increase the luck by been strategic . |

wow, look at the 364 days... 8 to 1 demand ratio.

wow, look at the 364 days... 8 to 1 demand ratio.

all I know is there was ~N653b subscribing for the one year bills two days ago... But your point is taken.

all I know is there was ~N653b subscribing for the one year bills two days ago... But your point is taken.