Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:35am On Nov 05, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:35am On Nov 05, 2022 |

You are quite a clown and truly make me laugh LMAO. I was merely suggesting that there is no need to go and open an offshore account if you need to be converting frequently back to Naira for local expenses because it is not worth the effort involved. Secondly a bank telling you there is no dollars available at the moment does not mean there will be none later (USD spiked to 540 in 2015/6 and CBN flooded the market with USD and it crashed back down to N360 and stayed there for a number of years). Thirdly, I am perfectly aware that Dom accounts in Nigeria are widely known about. Finally, my bank has not had any issues providing me with FX in the 30 years I have banked with them. Labadi69:

Hahaha..wait until there is serious scarcity of dollars and see if you will still see your dollar savings waiting for you there in the dom account..and we are getting there.

Exchange control is actually the first policy the Central Bank enforces in a country that’s in a serious fx crisis. Only a fool converts all his money from Naira to usd and then keeps it all in a dom account.

Even now sef, many times man pikin go enter bank to withdraw dollars and the cashier go say dollar don finish. Come back next week. Or you will see them rationing dollars. Imagine wanting to withdraw money for your child’s school fees and hearing say your life savings dey lockdown?

Didn’t you read where I said ‘to and from your dom account in Naija’. For your mind, you go just think say all these ppl daft sha. Dem never hear about dom account? Hahaha

2 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:56pm On Nov 04, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:56pm On Nov 04, 2022 |

Diversification e.g. convert anything above your local expenses to FX. Some might suggest real estate. However FX is liquid but real estate is not. Thus it depends on one's convertibility needs in future. QuinModah:

What's the solution? |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:50pm On Nov 04, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:50pm On Nov 04, 2022 |

Open a Domiciliary account in Nigeria. Its quite simple and safe. Labadi69:

If you can open an account offshore, that’s the best traditional (old school) way. This is not easy for most people sha. Because of strict account opening regulations, especially for Nigerians. But nothing is impossible.

Bear in mind that you may pay fees/charges to maintain offshore current accounts and also when sending money to and fro your dom account in Naija. And this may end up eating into whatever gains you make.

Also, the interest rates for the USD in those accounts are poor when compared to what we get in Naija. Infact na just recently, the rates started increasing as the fed raised interest rates to curb inflation. You will be lucky if you get more than 0.5% for savings accounts and 2% for fixed deposits.

Lastly, many offshore accounts will ask for minimum of 100k USD and take forever to complete KYC for Nigerians (because of the country’s bad reputation).

All the best… |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 1:58pm On Nov 03, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 1:58pm On Nov 03, 2022 |

AngelicBeing:

Gbamsulotely, end of thread, the law of retributive justice always holding koboko to flog anyone, government or institutions that violates it, you can't plant maize and expect to reap cassava and you can't keep churning out Oluwole and burukutu economic policies and expect to Reap heavenly results  1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 1:17pm On Oct 31, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 1:17pm On Oct 31, 2022 |

Correct... the concept of diversification....  zamirikpo:

Just spread the risk.......buy some dollars, buy some treasury bills.......buy stocks if u like or invest more or expand ur business .

Nothing is certain in Nigeria.......anything can happen. I just bought fuel N230/litre 1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 1:16pm On Oct 31, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 1:16pm On Oct 31, 2022 |

Your assumption is correct!  IYGEAL:

There is always the 90-day tenor for TBs. I suppose if you bought the one for 360 day tenor and terminate at 90day, your TB will instead be calculated for 90-day. As you have already been paid the discount, your initial capital would have to be affected to reflect the discount for 90-day as against your initial 360-day TB.

I haven't been in this situation before, so my input is also an assumption. |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 1:25pm On Oct 27, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 1:25pm On Oct 27, 2022 |

Correct. Itsrm:

Look at the total subscription. Its lower than the amount offered across all tenors |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:27pm On Oct 26, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:27pm On Oct 26, 2022 |

7 Likes 1 Share

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:01pm On Oct 13, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:01pm On Oct 13, 2022 |

Its a little bizarre that there is currently little demand for TBills (amount offered/amount allotted) given current stop rates... efismikoko:

Today |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 3:57am On Oct 07, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 3:57am On Oct 07, 2022 |

Its a balanced and and good deal. I think you will find many have bought their bonds already hence no or little comments on current bond yields. Justcul:

Why is no one talking about the current FGN bond at 12.38 percent? Not a good deal? 1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:14am On Sep 23, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:14am On Sep 23, 2022 |

28 September, 2022. ezinwaJesu:

Abeg better people wey dey house, when is the next treasury bills auction. 1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:41pm On Aug 24, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:41pm On Aug 24, 2022 |

Kindly find below todays NTB auction results. 8 Likes

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 12:18pm On Aug 17, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 12:18pm On Aug 17, 2022 |

I have never heard of it. VeeVeeMyLuv:

BOSS how about kuda money? How thrustworthy is it? |

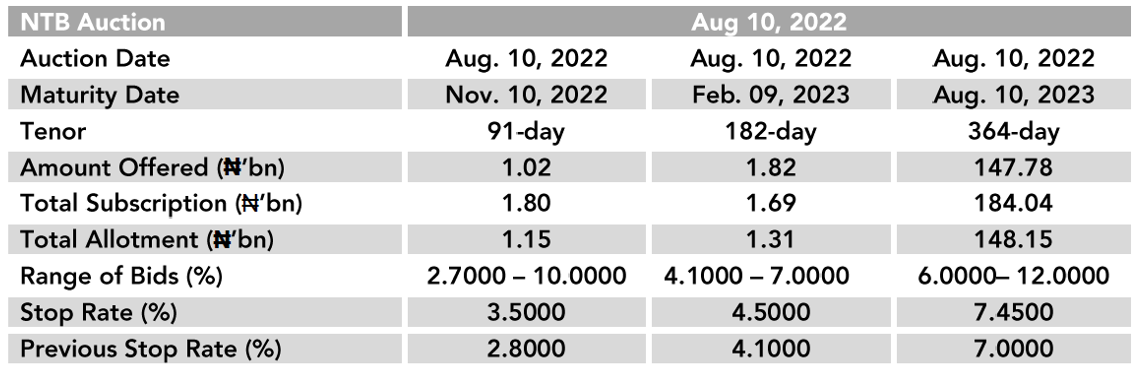

Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:37pm On Aug 10, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:37pm On Aug 10, 2022 |

Kindly find below todays NTB auction results 4 Likes

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:38pm On Jul 28, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:38pm On Jul 28, 2022 |

3 Likes 2 Shares

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 3:10am On Jul 28, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 3:10am On Jul 28, 2022 |

Good to hear from you. Greetings  Lazyyouth4u:

Hailings to all my people here o. Both the audio and the correct ones. I just say make I drop by jare. I don waka  2 Likes |

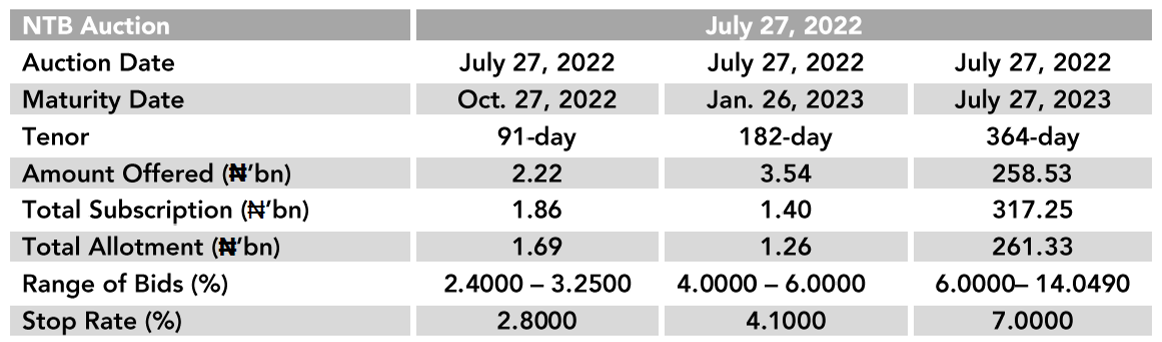

Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:26pm On Jul 27, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:26pm On Jul 27, 2022 |

Kindly find below todays NTB auction results. 7 Likes

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 9:42pm On Jul 25, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 9:42pm On Jul 25, 2022 |

No, I have not retired. I have equities too that provide diversification. ojesymsym:

Baba, you don retire?

You do not seem to be into equities, looks like you prefer fixed income.

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:37pm On Jul 25, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:37pm On Jul 25, 2022 |

RayRay06677:

Na una make naija broke, una no want politicians see money steal, congratulations snr man |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:56pm On Jul 25, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:56pm On Jul 25, 2022 |

Was expecting this on Friday 22 July but it dropped today.  skydiver01:

The 2026 FGN bond is due 22 July... I am now looking forward to it dropping on Friday  1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 2:24pm On Jul 23, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 2:24pm On Jul 23, 2022 |

2 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 2:28pm On Jul 22, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 2:28pm On Jul 22, 2022 |

AngelicBeing:

Gbamsulotely + those that shared it during Osun state elections + those who will continue to share it in subsequent elections, nonsense and CBN and Buhari  3 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:33pm On Jul 21, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:33pm On Jul 21, 2022 |

You are right. That's why I have been diversified for many years now.... since dollar was N155:$1. I hear dollar has hit N630  TotoNaRubber:

If you had kept all the investment you put in Fixed income asset in dollar from Jan 2020 till date, your capital will be 58 percent higher at 29% increase per annum compared to CBN's country hard paltry 13% max per annum

2 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:57pm On Jul 20, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:57pm On Jul 20, 2022 |

The 2026 FGN bond is due 22 July... I am now looking forward to it dropping on Friday  1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:52pm On Jul 20, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:52pm On Jul 20, 2022 |

1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:47pm On Jul 20, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 4:47pm On Jul 20, 2022 |

1 Like |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:13am On Jul 19, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:13am On Jul 19, 2022 |

N225b offered but only N124b raised... Interesting times ahead... just wondering.... In some ways, it could suggest investors are diversifying... which is good... skydiver01:

Kindly find below yesterdays bond auction results. 2 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:09am On Jul 19, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:09am On Jul 19, 2022 |

Yes rates wise but it was not oversubscribed which is unusual. bjtinz:

Slightly good news.. . . |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:06am On Jul 19, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 8:06am On Jul 19, 2022 |

Kindly find below yesterdays bond auction results. 1 Like

|

Investment / Re: Treasury Bills In Nigeria by skydiver01: 10:52pm On Jul 18, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 10:52pm On Jul 18, 2022 |

Wonders shall never end... Was expecting this to drop tomorrow but it dropped today....Wonderful... Happy Days... More FGN bond purchase (compounding) skydiver01:

On a different note, the coupon of the 2034 FGN bond is due today although I expect it to drop tomorrow. 3 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:57am On Jul 18, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 6:57am On Jul 18, 2022 |

On a different note, the coupon of the 2034 FGN bond is due today although I expect it to drop tomorrow. 2 Likes |

Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:54am On Jul 15, 2022 Investment / Re: Treasury Bills In Nigeria by skydiver01: 7:54am On Jul 15, 2022 |

Kindly find below the NTB auction results. spbabt:

Pls what are the figures of tbills for yesterday 13/07/2022 8 Likes

|

Actually, its not quarterly. Its every six months (bi-annual). Nevertheless, I agree with you.... we must be motivated.

Actually, its not quarterly. Its every six months (bi-annual). Nevertheless, I agree with you.... we must be motivated.