News And Technical Analysis From Instaforex - Business (15) - Nairaland

Nairaland Forum / Nairaland / General / Business / News And Technical Analysis From Instaforex (45854 Views)

Get Startup Bonus Of $500 To Trade From Instaforex / News And Technical Analysis From Superforex / News From Instaforex (2) (3) (4)

(1) (2) (3) ... (12) (13) (14) (15) (16) (17) (18) ... (23) (Reply) (Go Down)

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 6:52am On Aug 06, 2018 |

Elliott wave analysis of EUR/NZD for August 6, 2018  EUR/NZD failed to break clearly above resistance at 1.7205 once again, which is disappointing. As long as support at 1.7116 is able to protect the downside we will remain slightly bullish, but the failure to break clearly above resistance the 1.7205 - 1.7224 zone does raise the possibility of the alternate count, that a final dip closer to 1.7066 will be needed before wave ii/ finally completes and wave iii/ will be ready to take over. We will need a clear break above resistance at 1.7224 to confirm that wave iii/ is developing. R3: 1.7224 R2: 1.7180 S1: 1.7155 Pivot: 1.7137 S1: 1.7117 S2: 1.7094 S3: 1.7066 Trading recommendation: We remain long EUR at 1.7226 with our stop placed at 1.7110. If you are not long EUR yet, then wait for a clear break above 1.7224 before committing. Read more: https://www.instaforex.com/forex_analysis/121507 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 6:59am On Aug 07, 2018 |

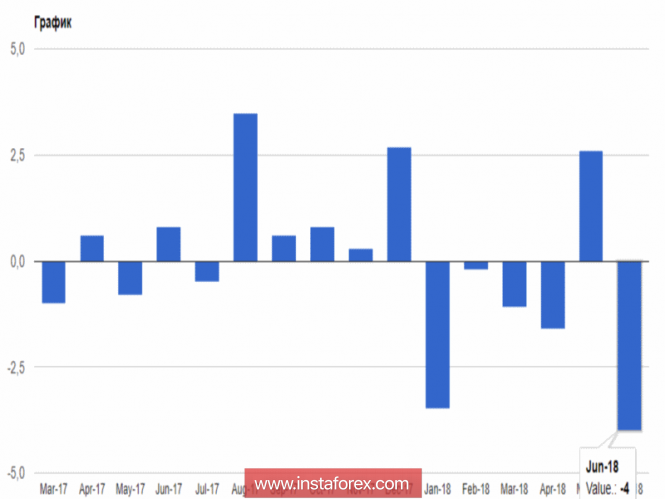

Trump's trade policy continues to work The euro continued to decline against the US dollar in the morning of Monday, August 6, amid the lack of important fundamental statistics, as well as expectations of further interest rate hikes in the United States. Data on the sharp decline in orders in Germany put pressure on risky assets. According to a report by the German Ministry of Economy, production orders in Germany declined sharply in June this year due to falling demand from countries outside the eurozone. This suggests that the current tensions in trade relations are already affecting the indicators, which will further exacerbate tensions between the US and the EU. As indicated in the report, orders in the manufacturing sector in Germany in June 2018 fell by 4.0% compared to May, while economists had forecast a decline in orders by 0.5%. The ministry confirmed the fact that the uncertainty of the prospects of trade policy played a key role. External orders in the German manufacturing sector in June fell by 4.7% compared to May, while domestic production orders decreased 2.8% compared to the previous month.  As I noted above, a particular decrease in orders was observed from countries that are not members of the eurozone. Here the figure fell by 5.9%. Compared to the same period of the previous year, orders in the German manufacturing sector decreased by 0.8%. As for the technical picture of the EUR/USD pair, then, most likely, the pressure on the euro will continue. The breakthrough of support of 1.1530 will lead to new large sales in risky assets, with an exit to the lows of the month in the area of 1.1480 and 1.1440. The only hope of buyers in the short term is a return to the resistance of 1.1565, which will lead to an upward correction in the area of 1.16 and 1.1630. The British pound continued to decline, ignoring the report on the volume of consumer lending in the UK, which in June this year has not changed compared to may. This shows that consumer spending will continue to grow in the future. According to the Bank of England, in June 2018, net consumer lending to consumers in June amounted to 5.4 billion pounds against 5.3 billion pounds in May. Credit cards in June amounted to 1.6 billion pounds. As for mortgage loans, the number was at the level of 65,619. As for the technical picture of the GBP/USD pair, the recovery prospects are also quite far. Brexit and uncertainty with a further increase in interest rates in the UK continue to weigh on the pound. The current main goal of the sellers of the pound is the lows of 1.2890 and 1.2815. If we talk about the prospects for an upward correction, then, apparently, it will be limited in the area of resistances 1.2960 and 1.3000. Read more: https://www.instaforex.com/forex_analysis/211213 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 6:41am On Aug 08, 2018 |

Elliott wave analysis of EUR/JPY for August 8, 2018  EUR/JPY has rallied nicely from the 128.48 low and is ready to test the short-term important resistance at 129.62. This resistance might be spiked, but likely only shortly and then cause a corrective decline to 129.00 before trying to push higher again. To confirm that wave ii/ completed with the 128.48 test, we need a clear break above 129.62 and upside acceleration towards important resistance at 131.15. A break above this resistance confirms our preferred scenario and calls for a rally towards 135.74 - 135.79 next. R3: 130.61 R2: 130.33 R1: 130.08 Pivot: 129.62 S1: 129.24 S2: 129.00 S3: 128.78 Trading recommendation: We are long EUR from 128.72. We will take half profit at 129.50 and keep our stop at 128.45 for the rest. Read more: https://www.instaforex.com/forex_analysis/121680 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 2:35pm On Aug 15, 2018 |

Analysis of Gold for August 15, 2018  Recently, Gold has been trading downwards. As I expected, the price tested the level of $1,184.20. According to the M30 time – frame, I found a broken bearish flag in the background, which is a sign that sellers are in control. My advice is to watch for potential selling opportunities on the rallies. The downward target is set at the price of $1,179.00. Resistance levels: R1: $1,197.00 R2: $1,201.07 R3: $1,204.00 Support levels: S1: $1,190.65 S2: $1,187.80 S3: $1,184.00 Trading recommendations for today: watch for potential selling opportunities. Read more: https://www.instaforex.com/forex_analysis/122119 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 6:55am On Aug 16, 2018 |

Elliott wave analysis of EUR/NZD for August 16, 2018  A break above resistance at 1.7355 is still needed to confirm that red wave ii has completed and red wave iii to above 1.7484 is developing. Short-term, we see support at 1.7262 and again at 1.7238. The later will ideally be able to protect the downside for the break above 1.7355 towards 1.7484 and above, with the next important targets seen at 1.7924 and 1.8369. R3: 1.7484 R2: 1.7417 R1: 1.7355 Pivot: 1.7299 S1: 1.7270 S2: 1.7243 S3: 1.7220 Trading recommendation: We are long EUR from 1.7245 with our stop placed at 1.7215. Read more: https://www.instaforex.com/forex_analysis/122146 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 7:26am On Aug 17, 2018 |

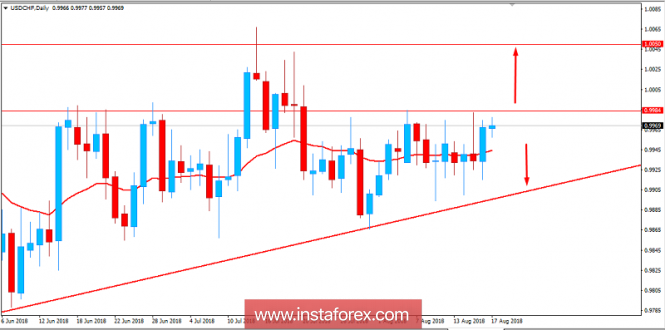

Fundamental Analysis of USD/CHF for August 17, 2018 USD/CHF has been quite volatile and corrective recently which is heading towards the resistance area of 0.9980 with certain bullish pressure. CHF has been struggling recently with the economic reports, whereas USD has been performing better than expected which leads the bullish pressure to continue with certain squeeze on the upside. Recently, CHF PPI report has been published with a decrease to 0.1% from the previous value of 0.2% which was expected to increase to 0.3%. The worse economic results did empower USD to gain good momentum over CHF, whereas ahead of the upcoming CHF Trade Balance report, certain volatility may remain in the market. On the USD side, Retail Sales report has recently been published with an increase to 0.5% from the previous value of 0.2% which was expected to decrease to 0.1% and Core Retail Sales also has increased to 0.6% from the previous value of 0.2% which was expected to be at 0.3%. The positive economic results did provide the needed boost for the currency, whereas CHF was struggling to impress the market sentiment. Today, USD Prelim UoM Consumer Sentiment report is going to be published which is expected to increase to 98.1 from the previous figure of 97.9 and CB Leading Index is expected to decrease to 0.4% from the previous value of 0.5%. As of the current scenario, ahead of the CHF Trade Balance next week, USD is expected to remain consistent with the gains having better economic results backing it. As USD manages to publish better reports, further gain on the bullish side is expected in this pair. Now let us look at the technical view. The price is currently residing at the edge of the 0.9980 area from where a daily close above it is expected to inject further bullish momentum in the pair which is more likely as of the current price formation. As the price closes above 0.9980 with a daily close, further bullish momentum with target towards the 1.0050 area is expected. On the other hand, if the price fails to break above 0.9980, certain bearish pressure is expected which will continue the bullish squeeze further in the coming days. SUPPORT: 0.9850 RESISTANCE: 0.9980, 1.0050 BIAS: BULLISH MOMENTUM: VOLATILE  Read more: https://www.instaforex.com/forex_analysis/122208 |

| Re: News And Technical Analysis From Instaforex by horlajumokhe(f): 3:36pm On Aug 17, 2018 |

Hello instaforex I need the link to the terms and conditions of the no deposit bonus. Please reply |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 4:10pm On Aug 17, 2018 |

horlajumokhe: You may find the agreement in the section "For traders" - "InstaForex bonuses" - "InstaForex bonuses": https://secure.instaforex.com/en/agreement/startupbonus?agree=true |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 7:19am On Aug 20, 2018 |

AUD/USD Reversed Off Resistance, Prepare For Further Drop! AUD/USD reversed off its resistance at 0.7320 (100% & 61.8% Fibonacci extension, 38.2% & 23.6% Fibonacci retracement, horizontal overlap resistance) where it is expected to drop further to its support at 0.7245 (61.8% Fibonacci retracement). Stochastic (55, 5, 3) reversed off its resistance at 97% where a corresponding drop is expected. AUD/USD reversed off its resistance where we expect to see a further drop. Sell below 0.7320. Stop loss at 0.7245. Take profit at 0.7364.  Read more: https://www.instaforex.com/forex_analysis/122277 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 5:38am On Aug 23, 2018 |

Elliott wave analysis of EUR/JPY for August 23, 2018  EUR/JPY still has not broken important short-term resistance at 128.48, but then it has not started to move strongly lower as we normally should expect at the completion of an expanded flat. Therefore we are shifting our preferred count in favor of wave C and II having completed with the test of 124.86 and wave III now in its infancy. Under this count EUR/JPY should make a small downward correction towards 127.23 - 127.33 area in red wave iv and then move higher towards the 128.92 - 129.32 area in red wave v. This will complete black wave i/ and should set the stage for a corrective decline in wave ii/ towards the 125.76 - 126.44 area before the next impulsive rally higher. That said, the possibility of a final dip closer to 124.62 remains possible, but time is running out fast. R3: 128.92 R2: 128.48 R1: 128.24 Pivot: 127.93 S1: 127.72 S2: 127.50 S3: 127.33 Trading recommendation: We are 50% long EUR from 126.26 with our stop placed at 126.84. We will take profit on the final 50% at 128.75. Read more: https://www.instaforex.com/forex_analysis/122481 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 6:42am On Aug 28, 2018 |

Elliott wave analysis of EUR/JPY for August 28, 2018  The correction turned out much smaller thane expected and was likely only a red sub-wave iv correction and not the start of the correction in black wave ii/ as we where looking for. This means the rally of red wave iv is red wave v and the ideal target for this wave is seen at 130.38, where the red wave v will be equal in length to the red wave i. Once the impulsive rally from 124.89 finds its peak, a correction to at least 127.64 should be expected. In the short-term, a break below minor support at 129.58 will indicate that the black wave i/ has completed and the black wave ii/ is developing. R3: 130.60 R2: 130.38 R1: 129.95 Pivot: 129.58 S1: 129.21 S2: 128.78 S3: 128.42 Trading recommendation: Our stop at 129.80 was hit for a 50 pips loss. We will resell EUR at 130.35 or upon a break below 129.58 with a stop placed at 131.35. Read more: https://www.instaforex.com/forex_analysis/122674 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 11:23am On Aug 29, 2018 |

EUR/AUD Reversed Off Resistance, Prepare For Further Drop EUR/AUD reversed off its resistance at 1.5954(61.8% Fibonacci extension, 76.4% Fibonacci retracement, horizontal swing high resistance) where it is expected to drop further to its support at 1.5734 (61.8% Fibonacci retracement, horizontal overlap support). Stochastic (89, 5, 3) reversed off its resistance at 97% where a corresponding drop is expected. EUR/AUD reversed off its resistance where we expect to see a further drop. Sell below 1.5954. Stop loss at 1.6066. Take profit at 1.5734.  Read more: https://www.instaforex.eu/forex_analysis/122790 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:11am On Aug 30, 2018 |

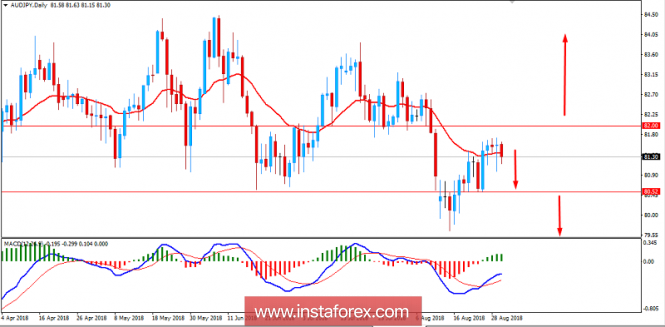

Fundamental Analysis of AUD/JPY for August 30, 2018 AUD/JPY has been quite volatile and corrective recently after breaking above 80.50 area with a daily close. Despite downbeat economic reports from Australia today, the currency has not yet weakened enough to give in to JPY. Today Australia's Private Capital Expenditure report was published with a significant decrease to -2.5% from the previous positive value of 1.2% which was expected to be at 0.6% and Building Approvals also showed a significant decrease to -5.2% from the previous positive value of 6.8% which was expected to be at -2.2%. On the JPY side, the Japanese currency was struggling to gain momentum recently due to indecisive results from the economic reports, but today Japan's Retail Sales report came in beyond expectations, while decreasing from 1.7% to 1.5% but performing better than 1.3% which lead JPY to gain impulsive momentum over AUD in the process. Meanwhile, AUD performed worse amid high impact economic reports like Private Capital Expenditure and Building Approvals that is expected to hurt upcoming gains for the currency. On the other hand, JPY is likely to regain momentum until Australia presents positive economic reports to justify its further gains in the pair for the future. Now let us look at the technical view. The price is currently quite impulsive with the bearish pressure which led to certain downward momentum in the volatile and corrective phase of the market. The dynamic level is being breached currently whereas a daily close with such bearish pressure is expected to inject further bearish momentum with a target towards 80.50 and lower in the coming days. On the other hand, a daily close above 82.00 is expected to provide the required momentum for the pair as a counter move against the ongoing bearish trend. As the price remains below 82.00 area, the bearish bias is expected to continue. SUPPORT: 80.50, 78.50 RESISTANCE: 82.00, 85.00 BIAS: BEARISH MOMENTUM: VOLATILE  Read more: https://www.instaforex.eu/forex_analysis/122858 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 7:58am On Aug 31, 2018 |

AUD/USD Testing Support, Prepare For Bounce AUD/USD is approaching its support at 0.7243 (61.8% Fibonacci extension, 76.4% Fibonacci retracement, horizontal overlap support) where the price is expected to bounce up to its resistance at 0.7311 (50% Fibonacci retracement, horizontal pullback resistance). Stochastic (55, 5, 3) is testing its support at 3.8% where a corresponding bounce is expected. AUD/USD is testing its support where we expect to see a bounce. Buy above 0.7243. Stop loss at 0.7203. Take profit at 0.7311.  Read more: https://www.instaforex.eu/forex_analysis/122920 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 7:31am On Sep 03, 2018 |

EUR/JPY Approaching Support, Prepare For Bounce EUR/JPY is approaching its support at 128.56 (100% Fibonacci extension, 38.2% Fibonacci retracement, horizontal overlap support) where it could potentially bounce to its resistance at 129.81 (50% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) is approaching its support at 1.7% where a corresponding bounce could occur. EUR/JPY is approaching its support where we expect to see a bounce. Buy above 128.56. Stop loss at 127.86. Take profit at 129.81.  Read more: https://www.instaforex.eu/forex_analysis/123004 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 7:31am On Sep 04, 2018 |

NZD/USD Testing Support, Prepare For Bounce NZD/USD is approaching its support at 0.6590 (61.8% Fibonacci extension, 76.4% Fibonacci retracement, horizontal overlap support) where the price is expected to bounce up to its resistance at 0.6637 (38.2% Fibonacci retracement, horizontal pullback resistance). Stochastic (89, 5, 3) is testing its support at 2.5% where a corresponding bounce is expected. NZD/USD is testing its support where we expect to see a bounce. Buy above 0.6590. Stop loss at 0.6570. Take profit at 0.6637.  Read more: https://www.instaforex.eu/forex_analysis/123096 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:01am On Sep 05, 2018 |

Elliott wave analysis of EUR/JPY for September 5, 2018  There was no time for a bounce back to 129.85 before the final decline towards the 38.2% corrective target at 128.22. EUR/JPY retested short-term important resistance at 129.14 and then dropped off towards the 38.2% corrective target. It did not quite make it to the low of 128.22, but bottomed at 128.30, which is sufficient to complete red wave (2) and set the stage for a new impulsive rally towards 130.87 on the way higher to 131.99 and ultimately above the February peak at 137.50. Support is now seen at 129.14, which ideally will be able to protect the downside for a break above 129.85 confirming a retest of 130.87 on the way higher. R3: 130.87 R2: 130.22 R1: 129.85 Pivot: 129.50 S1: 127.14 S2: 128.91 S3: 128.55 Trading recommendation: We are long EUR from 129.10 and we will move our stop higher to 128.25. If you are not long EUR, buy near support at 129.14 and use the same stop at 128.25. Read more: https://www.instaforex.eu/forex_analysis/123167 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 6:20am On Sep 06, 2018 |

Germany and the UK refuse the key requirements for Brexit The British pound and the euro rose sharply against the US dollar after news came that Germany and the United Kingdom abandoned the major requirements for Brexit. The source of the message is Bloomberg. If this information is reliable, rejection of the major requirements will help achieve the EU-UK trade agreement and prevent serious consequences of Brexit. It should be noted that the UK's withdrawal from the EU is scheduled for March 2019. The data released in the first half of the day did not support the European currency, although they were quite positive. According to the report of the research company IHS Markit, the index of supply managers PMI for the German services sector in August this year was 55 points against the preliminary estimate of 55.2 points. The Compound PMI in August came in at 55.6 points. The index of supply managers PMI for the euro area services sector in August reached 54.4 points against 54.2 points in July this year. The Compound PMI of the eurozone in August rose to 54.5 points against 54.3 points in July, while economists expected growth to 54.4 points. The data on the US foreign trade deficit in July this year demonstrated again its most significant monthly growth, and exerted pressure on the US dollar. Evaluating the report, the blockade measures on the part of the White House failed to bring significant change in the deficit. According to experts, the main reason for the growth of the deficit was the slowdown in the growth of other countries' economies, which showed a negative impact on the export of American goods. The US Commerce Department said that the trade deficit in goods and services in July rose by 9.5% compared to June and amounted to 50.08 billion US dollars. As noted above, the growth was due to exports, which decreased by 1% compared to the previous month. While imports grew by 0.9%. Economists predicted that the deficit would be $ 50.3 billion. As for the technical picture of the EUR/USD pair, the buyers coped with the task and returned to the 1.1600 resistance level which was lost yesterday, maintaining the upside potential in the risky assets which was mentioned in the morning review. This situation may lead to the trend resumption, a correction on which has been observed since August 28. The main task for the near future will be the breakthrough of resistance 1.1650, which will lead to the demolition of a number of stop orders and a test of 1.1690 level. The services data released in the first half of the day in Great Britain had supported the British pound. According to the report, PMI's supply managers index for the UK services sector increased to 54.3 points in August this year, while this index was at the level of 53.5 points in July. Economists had expected PMI for the UK service sector to be 53.9 in August.  * The presented market analysis is informative and does not constitute a guide to the transaction. Read more: https://www.instaforex.com/forex_analysis/213473 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:30am On Sep 07, 2018 |

AUD/JPY Testing Support, Prepare For Bounce AUD/JPY is approaching its support at 79.18 (61.8% Fibonacci extension x2, 61.8% Fibonacci retracement, horizontal overlap support) where the price is expected to bounce up to its resistance at 80.68 (61.8% Fibonacci retracement, horizontal pullback resistance). Stochastic (55, 5, 3) is approaching its support at 3.7% where a corresponding bounce is expected. AUD/JPY is testing its support where we expect to see a bounce. Buy above 79.18. Stop loss at 78.45. Take profit at 80.68.  Read more: https://www.instaforex.com/forex_analysis/123331 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:18am On Sep 10, 2018 |

Elliott wave analysis of EUR/NZD for September 10, 2018  We continue to look for more upside pressure towards the next sub-target at 1.7820. Longer term resistance at 1.7820 only should prove to be a temporary cap as more upside towards strong resistance at 1.8369 remains expected. Support is now seen at 1.7683 and again at 1.7638 only a break below the later, we confirm more sideways consolidation, and a dip to 1.7605 before the next strong push higher. R3: 1.7820 R2: 1.7750 R1: 1.7734 Pivot: 1,7701 S1: 1.7683 S2: 1.7638 S3: 1.7605 Trading recommendation: We are long EUR from 1.7330 with our stop placed at 1.7565, Upon a break above 1.7734 we will move our stop higher to 1.7595. Read more: https://www.mt5.com/forex_analysis/quickview/123400 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 5:59am On Sep 11, 2018 |

GBP/USD Testing Resistance, Prepare For Reversal GBP/USD is testing its resistance at 1.3033 (100% & 61.8% Fibonacci extension, 50% & 23.6% Fibonacci retracement, horizontal swing high resistance) where a reversal to its support at 1.2924 (50% Fibonacci retracement, horizontal swing low support) is expected. Stochastic (89, 5, 3) has reversed off near its resistance at 98% where a corresponding drop is expected. GBP/USD is testing its resistance where we expect to see a reversal. Sell below 1.3033. Stop loss at 1.3097. Take profit at 0.8891 1.2924.  Read more: https://www.instaforex.com/forex_analysis/123480 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 5:52am On Sep 12, 2018 |

CAD/JPY Reversed Off Resistance, Prepare For Further Drop CAD/JPY reversed off its resistance at 85.45 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap resistance) where it is expected to drop further to its support at (50% Fibonacci retracement). Stochastic (55, 5, 3) reversed off its resistance at 98% where a corresponding drop is expected. A bearish divergence has also been identified that contributes to our bearish bias. CAD/JPY reversed off its resistance where we expect to see a further drop. Sell below 85.45. Stop loss at 85.97. Take profit at 84.70.  Read more: https://www.instaforex.com/forex_analysis/123560 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:02am On Sep 13, 2018 |

EUR/USD Approaching Resistance, Prepare For A Reversal EUR/USD is approaching its resistance at 1.1656 (100% & 61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap resistance) where it is expected to reverse down to its support at (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 97% where a corresponding reversal is expected. EUR/USD is approaching its resistance where we expect to see a reversal. Sell below 1.1656. Stop loss 1.1694. Take profit at 1.1567.  Read more: https://www.instaforex.com/forex_analysis/123660 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:46am On Sep 14, 2018 |

NZD/JPY Approaching Resistance, Prepare For A Reversal NZDJPY is approaching its resistance at 74.11 (61.8% Fibonacci extensionx2, 61.8%, 38.2% & 23.6% Fibonacci retracement, horizontal overlap resistance) where it is expected to reverse down to its support at 73.19 (50% Fibonacci retracement, horizontal overlap support). Stochastic (89, 5, 3) is approaching its resistance at 98% where a corresponding reversal is expected. NZDJPY is approaching its resistance where we expect to see a reversal. Sell below 74.11. Stop loss 74.50. Take profit at 73.19.  Read more: https://www.instaforex.com/forex_analysis/123742 |

| Re: News And Technical Analysis From Instaforex by ReppingLocals(f): 10:23am On Sep 14, 2018 |

STOP!!! Wasting money on IC Market Live Pay Less. Get One-On-One Professional & Practical Training/Coaching on: FOREX Currency Trading and Binary Option Home and Office Training Schedules. 24hrs Online Support Get Premium Entry Signals to Trade as you learn. Clients From Lagos Only. Other States can learn Online. Contact us: Call/WhatsApp @+234*8*1*4*1*1*9*5*9*9*9 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:34am On Sep 17, 2018 |

XAU/USD Bounced Off Support, Prepare For A Further Rise XAU/USD bounced nicely off its support at 1,193(100% Fibonacci extension, 76.4% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 1,204 (61.8% Fibonacci retracement). Stochastic (55, 5, 3) is bounced off its support at 5.6% where a corresponding rise could occur. XAU/USD bounced nicely off its support where we expect to see a further rise. Buy above 1,193. Stop loss at 1186. Take profit at 1,204.  Read more: https://www.instaforex.com/forex_analysis/123810 |

| Re: News And Technical Analysis From Instaforex by ThisPrecious: 9:27pm On Sep 18, 2018 |

This was a wonderful article. I found something online that helped me understand Gold Futures and how to invest - https://www.isogtek.com/gold-futures-futures-contracts-gold-options/ |

(1) (2) (3) ... (12) (13) (14) (15) (16) (17) (18) ... (23) (Reply)

ICPC Arrests Osun FCMB Manager Over New Naira Notes Policy Violation / What Valuable Item Can 1 Million Naira Really Buy In Nigeria? / Forbes 2015 Billionaires List Released. 5 Nigerians Made The List

(Go Up)

| Sections: politics (1) business autos (1) jobs (1) career education (1) romance computers phones travel sports fashion health religion celebs tv-movies music-radio literature webmasters programming techmarket Links: (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Nairaland - Copyright © 2005 - 2024 Oluwaseun Osewa. All rights reserved. See How To Advertise. 97 |