| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by TheUnsure: 5:55pm On Aug 02, 2023 |

Please how do I solve the issue of transcript for evaluation of credentials. I don’t have a copy of my transcript, Unilag does not issue transcripts to individuals. I’m tryin to use CES and it says to upload transcript, what do I do please? |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by aestake: 6:26pm On Aug 02, 2023 |

Tricia14:

Hello house, pls I have many questions to ask about Canada but allow me to start with this:

In USA, loan is everything. Most of them carry school loan and pay till old age; some to buy car which can be paid for 5yrs; to buy house which can be paid more than 20yrs and even carry loan just to go for vacation. And these loans are transferred to their children to complete payment when they are dead.

And I read, that the average American can only safe $5k in a yr which will not be enough for anything. Pls, is Canada like that?

Thanks for your answers. Yep or do you have all the cash now? |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Enculer2: 7:01pm On Aug 02, 2023 |

Tricia14:

Hello house, pls I have many questions to ask about Canada but allow me to start with this:

In USA, loan is everything. Most of them carry school loan and pay till old age; some to buy car which can be paid for 5yrs; to buy house which can be paid more than 20yrs and even carry loan just to go for vacation. And these loans are transferred to their children to complete payment when they are dead.

And I read, that the average American can only safe $5k in a yr which will not be enough for anything. Pls, is Canada like that?

Thanks for your answers. Your question is a very good one. We shall find out from the experts on here if Canada is like that. I will find out myself as a new immigrant after living in France and in the UK. I think it is important to watch your inflows and outflows. Invest and then spend the remainder rather than spend and then invest the remainder. I personally would not advise people to take loans to go on vacation. 6 Likes |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by ednut1(m): 7:04pm On Aug 02, 2023 |

Tricia14:

Hello house, pls I have many questions to ask about Canada but allow me to start with this:

In USA, loan is everything. Most of them carry school loan and pay till old age; some to buy car which can be paid for 5yrs; to buy house which can be paid more than 20yrs and even carry loan just to go for vacation. And these loans are transferred to their children to complete payment when they are dead.

And I read, that the average American can only safe $5k in a yr which will not be enough for anything. Pls, is Canada like that?

Thanks for your answers. as an immigrant are you coming with student loans  No. There are courses like nursing where you can get grants to go study it. There are courses you can do to enter tech, there is apprenticeship for blue collar job where you get paid to learn. So students loans does not apply to most immigrants. The people with huge student loans are usually people in medical field and their future income will sort that out. There are cars of 3k to 5k dollars one can buy with cash you must not drive 2022 benz or bmw. If you dont buy a house via mortgage you will still pay rent till you die true or false  . You dont have to finish paying the mortgage you can see it and make profits. House of 150k dols ten years ago will probably be worth 300k today depending on the area. The average immigrant in usa or Canada is not saving 5k dols a year. There are Multiple hustles to do. Shikena 13 Likes 1 Share |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Enculer2: 7:22pm On Aug 02, 2023 |

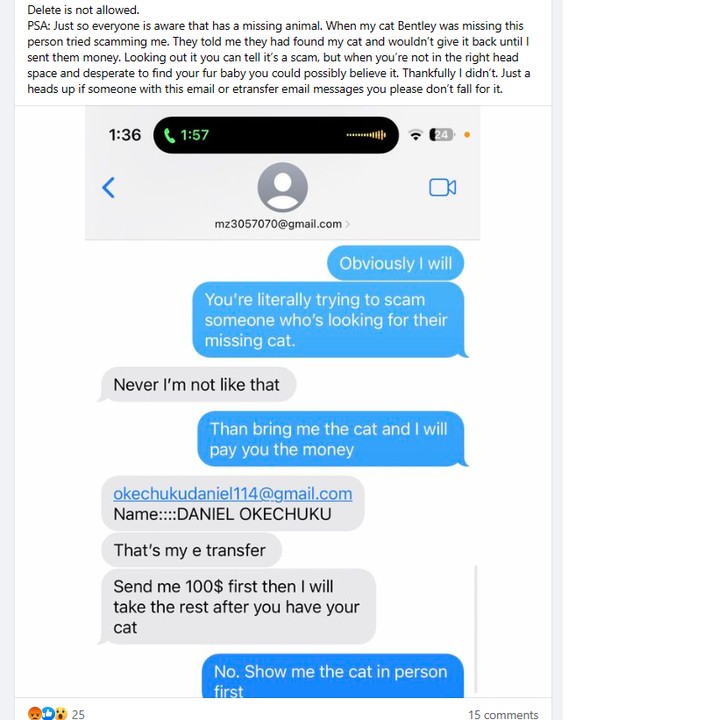

Nigerians never disappoint. This one tried to scam people in a nice community in Canada. The poor lady was looking for her lost cat. Definitely steer clear. people like these make foreigners have trust issues when dealing with Nigerians. Note the email and beware. people like these must have scammed Nigerians of hard earned money and have taken their trade to Canada.

For every quality Nigerian you have, you probably have 10 dubious ones looking to cheat, steal and destroy.

|

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by lanresz(m): 7:46pm On Aug 02, 2023 |

This is sad. The good thing is that there are a lot of good Nigerians. I hope we get to the stage where the dubious ones are very few and less than one in eleven. Enculer2:

Nigerians never disappoint. This one tried to scam people in a nice community in Canada. The poor lady was looking for her lost cat. Definitely steer clear. people like these make foreigners have trust issues when dealing with Nigerians. Note the email and beware. people like these must have scammed Nigerians of hard earned money and have taken their trade to Canada.

For every quality Nigerian you have, you probably have 10 dubious ones looking to cheat, steal and destroy. 2 Likes |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Enculer2: 7:57pm On Aug 02, 2023 |

lanresz:

This is sad. The good thing is that there are a lot of good Nigerians. I hope we get to the stage where the dubious ones are very few and less than one in eleven.

I truly hope so. Meanwhile Candian President has split from his wife. |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Enculer2: 7:58pm On Aug 02, 2023 |

Canadian Prime Minister Justin Trudeau announces split from wife Sophie after 18 years of marriage and three children together - saying the decision was made after 'many meaningful and difficult conversations

|

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Officialarhnie(f): 9:31pm On Aug 02, 2023 |

ednut1:

your documentation will be done at your first point of entry which is usually Toronto Okay thanks |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Kenn55: 9:49pm On Aug 02, 2023 |

Tricia14:

Hello house, pls I have many questions to ask about Canada but allow me to start with this:

In USA, loan is everything. Most of them carry school loan and pay till old age; some to buy car which can be paid for 5yrs; to buy house which can be paid more than 20yrs and even carry loan just to go for vacation. And these loans are transferred to their children to complete payment when they are dead.

And I read, that the average American can only safe $5k in a yr which will not be enough for anything. Pls, is Canada like that?

Thanks for your answers. All the western world countries are almost the same except for little variations here and there. They are all credit societies where large chunk of their economy is driven by consumer spending. However you have the choice to stay out of loans. For example, If you don't have money to go to school, then you don't have to study courses that would keep you heavily indebted since you will be taking loan to study. You can study in demand courses in colleges with grant rather than go to a high ranking university to study with loans. You can decide to drive a 15 year old car and pay for it in cash rather than going for a brand new or fairly new car with loan. You can even keep renting instead of buying a house on mortgage if you hate loans so much but that doesn't make sense since houses are assets and not liabilities. Even though you owe money on a house, you can sell it and make profit when the time is right. Note that an average oyibo doesn't care much about debt the way we do cos that is how they live from beginning and it's part of their lifestyle as built by their system. You talked about savings but note that these western countries are not built for savings but spending. Like I said before, it is the bedrock of their economy. Besides, the structure of their society coupled with fairly good governance makes savings not to be a big deal. Why do people need savings? In case of emergency. What are the do or die emergencies? Loss of job, health, accidents, loss of shelter,life etc. The oyibo model is insure instead of savings. This is why insurance is one of the biggest industries in North America. In this place, your insurance is your savings while in places like Nigeria, your savings is your insurance because of the model our society is run. You see the difference. Why would an average oyibo be bothered much about savings when he has insured against all possible emergencies? Life, employment, health,home,car,accident and even pet sef dey get insurance. These insurance coverages cost money but because of their mentality, they embrace it but majority of us Africans will see it as a waste and instead save those money in the bank and that would form part of our "savings". So when you read an average oyibo have little or no savings, that is the truth but it doesn't tell the full story. You asked a valid question but you need to understand how the society is built in order to properly navigate it. The choice to embrace the oyibo model or our Nigerian model or a little mixture of both is left for you. 36 Likes 11 Shares |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Cannymission: 11:20pm On Aug 02, 2023 |

Hello, pls is this applicable for an international student? I'm presently having issues to pay up my 2nd semester school fees as a result of the recent foreign exchange policies back in 9ja. Or just in case if anyone knows any financing firm that gives out loan to int'l student. I need your help guys. Thanks. AirBay:

Just a note here, it's not possible to use a student loan to make a down payment for a house. The loan is not paid to the student's account, it is paid directly to the school and in batch payments.

What people use for down payment is the grant. The grant depends on your course, family size and your net income from last tax year. I have a friend who got a total grant of $36k (family of

4). The $36k he got included grant from canada govt, province and school grant. His total fees was around $19k for a 2years course. 36k is enough for down payment for a 3bed town house in most of the province except ON. Also this 36k is not paid once, it's in batches across the 2years.

I did a top course last year and got a grant of $6k, it was just a 3months top up course. I was new in canada and have 0 income from previous year, so I qualified for some grants, same for my friend. Best time to get grants is when you're new in canada with small income, so you get a lot of benefits that are for low income earners. Once you start earning above 20k per year, grant go decrease o

If someone collects a loan and does not go to the school, there are implications, such individual must return the full amount that has been paid within 1month I think, this is stated clearly on studentaid Websites.

Also students now have up to 1year grace after the completion of their studies to start payments, in total students have 9years to pay back. Some people pay as low as $50 per month depending on the loan amount. 2 Likes 1 Share |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by oluayebenz: 11:40pm On Aug 02, 2023 |

Tricia14:

Hello house, pls I have many questions to ask about Canada but allow me to start with this:

In USA, loan is everything. Most of them carry school loan and pay till old age; some to buy car which can be paid for 5yrs; to buy house which can be paid more than 20yrs and even carry loan just to go for vacation. And these loans are transferred to their children to complete payment when they are dead.

And I read, that the average American can only safe $5k in a yr which will not be enough for anything. Pls, is Canada like that?

Thanks for your answers. YES USA is even better. In short, mostly all the western countries are like that. That's their way of life |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Abaasit4real(m): 12:00am On Aug 03, 2023 |

I’m a cyber security analyst in the uk with a year of uk experience, I wish to relocate to Canada. Please can anyone advise me if it’s worth it and the best way to go about it. I’m also less than 25. |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Enculer2: 12:10am On Aug 03, 2023 |

Abaasit4real:

I’m a cyber security analyst in the uk with a year of uk experience, I wish to relocate to Canada. Please can anyone advise me if it’s worth it and the best way to go about it. I’m also less than 25. It is important to state the reasons why you want to leave the UK. You also have to state clearly why you want to move to Canada and what your long term goals are. That way, people with plenty of years of experience in Canada can advise. No one can answer whether it is worth it or not better than you. |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Shikena(m): 12:59am On Aug 03, 2023 |

|

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by aestake: 2:04am On Aug 03, 2023 |

Enculer2:

Canadian Prime Minister Justin Trudeau announces split from wife Sophie after 18 years of marriage and three children together - saying the decision was made after 'many meaningful and difficult conversations

A prime minister couldn't keep his woman. Who am I?  2 Likes |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by sirabbey(m): 2:26am On Aug 03, 2023 |

Officialarhnie:

Hello everyone,

I’m asking for a friend that is relocating to Canada with her family this month.

They are moving to Alberta. Please is it compulsory to stop at Toronto first before continuing to Alberta ? No. Your first port of entry can be YYC airport in Calgary or YEG in Edmonton. All you need to do is to book KLM as your preferred flight as they go from Lagos to Amsterdam and then to YYC or YEG. No need to stop over in Toronto. 1 Like |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by ednut1(m): 2:39am On Aug 03, 2023 |

aestake:

A prime minister couldn't keep his woman. Who am I?  maybe he wants to try out the 2slgbtia 😁 |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Enculer2: 3:49am On Aug 03, 2023 |

aestake:

A prime minister couldn't keep his woman. Who am I?  Rumours have it that he likes the D! |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Oge2dey: 6:16am On Aug 03, 2023 |

You can reach out privately. This is a family house. We have not really decided on the rent yet but we will definitely be reasonable to support new immigrants. InDancer:

How much is it?

|

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Tcrown2020(f): 7:28am On Aug 03, 2023 |

Kenn55:

All the western world countries are almost the same except for little variations here and there.

They are all credit societies where large chunk of their economy is driven by consumer spending.

However you have the choice to stay out of loans. For example, If you don't have money to go to school, then you don't have to study courses that would keep you heavily indebted since you will be taking loan to study. You can study in demand courses in colleges with grant rather than go to a high ranking university to study with loans. You can decide to drive a 15 year old car and pay for it in cash rather than going for a brand new or fairly new car with loan.

You can even keep renting instead of buying a house on mortgage if you hate loans so much but that doesn't make sense since houses are assets and not liabilities. Even though you owe money on a house, you can sell it and make profit when the time is right.

Note that an average oyibo doesn't care much about debt the way we do cos that is how they live from beginning and it's part of their lifestyle as built by their system.

You talked about savings but note that these western countries are not built for savings but spending. Like I said before, it is the bedrock of their economy. Besides, the structure of their society coupled with fairly good governance makes savings not to be a big deal.

Why do people need savings? In case of emergency. What are the do or die emergencies? Loss of job, health, accidents, loss of shelter,life etc. The oyibo model is insure instead of savings. This is why insurance is one of the biggest industries in North America.

In this place, your insurance is your savings while in places like Nigeria, your savings is your insurance because of the model our society is run. You see the difference.

Why would an average oyibo be bothered much about savings when he has insured against all possible emergencies? Life, employment, health,home,car,accident and even pet sef dey get insurance. These insurance coverages cost money but because of their mentality, they embrace it but majority of us Africans will see it as a waste and instead save those money in the bank and that would form part of our "savings".

So when you read an average oyibo have little or no savings, that is the truth but it doesn't tell the full story.

You asked a valid question but you need to understand how the society is built in order to properly navigate it. The choice to embrace the oyibo model or our Nigerian model or a little mixture of both is left for you. Thanks This is quite enlightening. I am an insurance person |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by House34: 7:30am On Aug 03, 2023 |

Shikena:

Thanks for always providing our folks some free education here. It is okay to be against japa or to simply have preference for staying put in Naija but don't tell yourself lies to justify your decision. Many immigrants, including Nigerians, are living debt free and have more than enough in savings, that's why they are able to not just send tens of thousands of dollars home every blessed year lots of them also visit Nigeria frequently, announced or unannounced

Mr ten of thousands...how much have you send home this month,and how many time you travel to nigeria this year ...you have no mortage or children? 4 Likes |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Nobody: 8:48am On Aug 03, 2023 |

Kenn55:

All the western world countries are almost the same except for little variations here and there.

They are all credit societies where large chunk of their economy is driven by consumer spending.

However you have the choice to stay out of loans. For example, If you don't have money to go to school, then you don't have to study courses that would keep you heavily indebted since you will be taking loan to study. You can study in demand courses in colleges with grant rather than go to a high ranking university to study with loans. You can decide to drive a 15 year old car and pay for it in cash rather than going for a brand new or fairly new car with loan.

You can even keep renting instead of buying a house on mortgage if you hate loans so much but that doesn't make sense since houses are assets and not liabilities. Even though you owe money on a house, you can sell it and make profit when the time is right.

Note that an average oyibo doesn't care much about debt the way we do cos that is how they live from beginning and it's part of their lifestyle as built by their system.

You talked about savings but note that these western countries are not built for savings but spending. Like I said before, it is the bedrock of their economy. Besides, the structure of their society coupled with fairly good governance makes savings not to be a big deal.

Why do people need savings? In case of emergency. What are the do or die emergencies? Loss of job, health, accidents, loss of shelter,life etc. The oyibo model is insure instead of savings. This is why insurance is one of the biggest industries in North America.

In this place, your insurance is your savings while in places like Nigeria, your savings is your insurance because of the model our society is run. You see the difference.

Why would an average oyibo be bothered much about savings when he has insured against all possible emergencies? Life, employment, health,home,car,accident and even pet sef dey get insurance. These insurance coverages cost money but because of their mentality, they embrace it but majority of us Africans will see it as a waste and instead save those money in the bank and that would form part of our "savings".

So when you read an average oyibo have little or no savings, that is the truth but it doesn't tell the full story.

You asked a valid question but you need to understand how the society is built in order to properly navigate it. The choice to embrace the oyibo model or our Nigerian model or a little mixture of both is left for you. You'd make a good lecturer. Perfect explanation. 7 Likes |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Tricia14: 9:54am On Aug 03, 2023 |

Kenn55:

All the western world countries are almost the same except for little variations here and there.

They are all credit societies where large chunk of their economy is driven by consumer spending.

However you have the choice to stay out of loans. For example, If you don't have money to go to school, then you don't have to study courses that would keep you heavily indebted since you will be taking loan to study. You can study in demand courses in colleges with grant rather than go to a high ranking university to study with loans. You can decide to drive a 15 year old car and pay for it in cash rather than going for a brand new or fairly new car with loan.

You can even keep renting instead of buying a house on mortgage if you hate loans so much but that doesn't make sense since houses are assets and not liabilities. Even though you owe money on a house, you can sell it and make profit when the time is right.

Note that an average oyibo doesn't care much about debt the way we do cos that is how they live from beginning and it's part of their lifestyle as built by their system.

You talked about savings but note that these western countries are not built for savings but spending. Like I said before, it is the bedrock of their economy. Besides, the structure of their society coupled with fairly good governance makes savings not to be a big deal.

Why do people need savings? In case of emergency. What are the do or die emergencies? Loss of job, health, accidents, loss of shelter,life etc. The oyibo model is insure instead of savings. This is why insurance is one of the biggest industries in North America.

In this place, your insurance is your savings while in places like Nigeria, your savings is your insurance because of the model our society is run. You see the difference.

Why would an average oyibo be bothered much about savings when he has insured against all possible emergencies? Life, employment, health,home,car,accident and even pet sef dey get insurance. These insurance coverages cost money but because of their mentality, they embrace it but majority of us Africans will see it as a waste and instead save those money in the bank and that would form part of our "savings".

So when you read an average oyibo have little or no savings, that is the truth but it doesn't tell the full story.

You asked a valid question but you need to understand how the society is built in order to properly navigate it. The choice to embrace the oyibo model or our Nigerian model or a little mixture of both is left for you. Thank you, this explanation is helpful. |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Abaasit4real(m): 1:39pm On Aug 03, 2023 |

Enculer2:

It is important to state the reasons why you want to leave the UK. You also have to state clearly why you want to move to Canada and what your long term goals are. That way, people with plenty of years of experience in Canada can advise.

No one can answer whether it is worth it or not better than you.

Thank you very much. I want to leave the UK because I feel the pay isn’t fair enough. I’m also interested in having permanent residence as soon as possible too. |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Shikena(m): 1:45pm On Aug 03, 2023 |

House34:

Mr ten of thousands...how much have you send home this month,and how many time you travel to nigeria this year ...you have no mortage or children? I will dignify your sarcasm with a response. 1 - I don't send a fixed amount monthly. I have an aged parent at home who comes here every other year for 3 months minimum. 2 - I travel to Nigeria 2 times a year. I was unable to travel home for 7 good years until I fully settled down. I have businesses to handle. I started out by expanding my mother's retail business and all my ventures grew from an existing but rapidly expanding customer base. The rest is history despite Nigeria's challenges. I still send money home for investment projects. 3 - I have mortgages and I have children. I actually started out as a real estate agent after I got my papers here. It's a part time thing for me for several years now. Just take time to immerse & understand the system. My first mortgage is in a AirBnB allowed location & rental is allowed, it's almost paid off as it's a small apartment. Its income will start contributing to my bigger mortgage in a couple of years. Without mortgage you will still rent anyways? Lastly, my integrity has proven to be my greatest asset here and in Nigeria. It has fetched me millions. That's what many of our people lack. Being "fast" and being smart are not the same. I don't do "fast" or "sharp" deals and I don't listen to "stories". 22 Likes 2 Shares |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by ednut1(m): 2:04pm On Aug 03, 2023 |

Abaasit4real:

Thank you very much. I want to leave the UK because I feel the pay isn’t fair enough. I’m also interested in having permanent residence as soon as possible too. the pay is not enough and you want PR. You have answered the question you asked. Go to express entry thread to see the steps. |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by olabanji88(m): 4:43pm On Aug 03, 2023 |

Please I need clarification what's the meaning of full sponsored visa in canada

I have an agent planning to help me with one for a fee and she said I would be having multiple options of employment I would pick one and she would start work permits process for 3 years that I can later convert to pr later on

I have gone across all the threads I haven't seen anything of that sort

I have been pressing her for the type of jobs I would be getting

She is insisting I make payment first before I get any further info

Please clarification on this what are things I need to request for

The signs I need to check for if this is not a scam |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by Nobody: 4:47pm On Aug 03, 2023 |

olabanji88:

Please I need clarification what's the meaning of full sponsored visa in canada

I have an agent planning to help me with one for a fee and she said I would be having multiple options of employment I would pick one and she would start work permits process for 3 years that I can later convert to pr later on

I have gone across all the threads I haven't seen anything of that sort

I have been pressing her for the type of jobs I would be getting

She is insisting I make payment first before I get any further info

Please clarification on this what are things I need to request for

The signs I need to check for if this is not a scam You don’t need any signs as all you’ve stated points straight to fraud. This is a scam. I only hope you listen. All the best. 4 Likes 1 Share |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by SayNo2SmallPrik: 5:46pm On Aug 03, 2023 |

olabanji88:

Please I need clarification what's the meaning of full sponsored visa in canada

I have an agent planning to help me with one for a fee and she said I would be having multiple options of employment I would pick one and she would start work permits process for 3 years that I can later convert to pr later on

I have gone across all the threads I haven't seen anything of that sort

I have been pressing her for the type of jobs I would be getting

She is insisting I make payment first before I get any further info

Please clarification on this what are things I need to request for

The signs I need to check for if this is not a scam Dey play.. and she dey naija, she sef no fit pick from 3 employment 😆 3 Likes |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by MayorOfEdmonton: 6:21pm On Aug 03, 2023 |

olabanji88:

Please I need clarification what's the meaning of full sponsored visa in canada

I have gone across all the threads I haven't seen anything of that sort

I have been pressing her for the type of jobs I would be getting

She is insisting I make payment first before I get any further info

Please clarification on this what are things I need to request for

The signs I need to check for if this is not a scam A good place to start will be typing "full sponsored visa" on IRCC website and see the options you get. Most likely you won't find any valuable information as I don't think there's a visa category like that. Second, it's extremely difficult dou not impossible to get a job from outside Canada as the company will need to issue LMIA. And most companies here will rather avoid that and recycle job ads. Especially if you are not a do-it-all tech wizard. Whatever she's offering... do a research on the cic official website to see the requirements yourself. Nigeria is too hard to dash agent money dis period. All the best! |

| Re: Living In Canada/Life As A Canadian Immigrant Part 2 by ednut1(m): 11:32pm On Aug 03, 2023 |

olabanji88:

Please I need clarification what's the meaning of full sponsored visa in canada

I have an agent planning to help me with one for a fee and she said I would be having multiple options of employment I would pick one and she would start work permits process for 3 years that I can later convert to pr later on

I have gone across all the threads I haven't seen anything of that sort

I have been pressing her for the type of jobs I would be getting

She is insisting I make payment first before I get any further info

Please clarification on this what are things I need to request for

The signs I need to check for if this is not a scam scam scam scam |

No. There are courses like nursing where you can get grants to go study it. There are courses you can do to enter tech, there is apprenticeship for blue collar job where you get paid to learn. So students loans does not apply to most immigrants. The people with huge student loans are usually people in medical field and their future income will sort that out.

No. There are courses like nursing where you can get grants to go study it. There are courses you can do to enter tech, there is apprenticeship for blue collar job where you get paid to learn. So students loans does not apply to most immigrants. The people with huge student loans are usually people in medical field and their future income will sort that out. . You dont have to finish paying the mortgage you can see it and make profits. House of 150k dols ten years ago will probably be worth 300k today depending on the area.

. You dont have to finish paying the mortgage you can see it and make profits. House of 150k dols ten years ago will probably be worth 300k today depending on the area.