| Re: MBA Investors Forum by SQLmastar(m): 5:25pm On Aug 08, 2020 |

Ilaje1:

This company doesn't look responsible whatsoever. All the lines on their website and their social media accounts don't work. For those using online account, how long does it take to get money in your account after making the withdraw. Not the company but the online team. My branch operations went smoothly. Try sending a mail to support@mbatrades.com (they should respond on time). As for getting your money, a couple of investors have made withdrawal requests and were credited in a day or two. @adebek, pls throw more light 1 Like |

| Re: MBA Investors Forum by AlmondRPG47(m): 5:27pm On Aug 08, 2020 |

Bro, being too serious all the time kills faster than coro! There's nothing in this life to be too serious about jare... After making all the millions, one day you go die leave am...someone else will come to enjoy it! We're all working for someone else in this life! Flash83:

Hahahaha you play too much

5 Likes |

| Re: MBA Investors Forum by AlmondRPG47(m): 5:30pm On Aug 08, 2020 |

19 months!!! Wish I've joined earlier...that's my only regret! captainking:

Mumu analysis... Do you want me to show you my own alert?? If I had this your silly mentality.. I would not have invested 19months ago when I joined MBA...

Smh.. 7 Likes |

| Re: MBA Investors Forum by AlmondRPG47(m): 5:32pm On Aug 08, 2020 |

Congratulations...let's lick MBA's ass together! Let those doubting Thomas out there continue to get jealous! formular2002:

No dulling, No noisemaking.

Its all about MBA.

15TH ROI in the bag.

Oooiiiiinnnnnn. MBA is doing well 6 Likes |

| Re: MBA Investors Forum by Maximart(m): 5:49pm On Aug 08, 2020 |

Can u link or introduce me to any business I can start with 100k  1 Like |

| Re: MBA Investors Forum by AlmondRPG47(m): 6:02pm On Aug 08, 2020 |

Buy and sell! Focus on foodstuff with very high demand! Where do you stay? Maximart:

Can u link or introduce me to any business I can start with 100k |

| Re: MBA Investors Forum by SQLmastar(m): 6:15pm On Aug 08, 2020 |

Rahmanjargo:

Hello my fellow investors. Can i make a deposit of 2 Million naira using the MBA website platform?

Please urgent answers is needed Yes you can but it may not go through initially. I had friends who had issues making deposit. They sent a mail to support and a payment link was sent ( 2k transfer charges apply). If you are not the patient type, I suggest to walk into the nearest branch and invest. OR contact @airsay. He will bring the lekki branch to your doorsteps...  3 Likes 1 Share |

| Re: MBA Investors Forum by fxjones(m): 6:21pm On Aug 08, 2020 |

captainking:

Mumu analysis... Do you want me to show you my own alert?? If I had this your silly mentality.. I would not have invested 19months ago when I joined MBA...

Smh.. Leave the greedy folks, thinking mba is trading forex pure ponzi 1 Like |

| Re: MBA Investors Forum by 50nizzy: 7:57pm On Aug 08, 2020 |

|

| Re: MBA Investors Forum by Nobody: 7:58pm On Aug 08, 2020 |

SQLmastar:

Yes you can but it may not go through initially. I had friends who had issues making deposit. They sent a mail to support and a payment link was sent (2k transfer charges apply).

If you are not the patient type, I suggest to walk into the nearest branch and invest.

OR contact @airsay. He will bring the lekki branch to your doorsteps...  Doorsteps? Naaaaah. They don't even need to leave their beds. 3 Likes |

| Re: MBA Investors Forum by 50nizzy: 8:24pm On Aug 08, 2020 |

fxjones:

Leave the greedy folks, thinking mba is trading forex pure ponzi

Return of Insanity --- The gods are not to Blame. This time around the Madness has affected your ability to read properly. The man you quoted has been with MBA Close to 2 years. He is the Captain and King here. (check page 1 of this thread.) He was only addressing a FOOL like you in that post you quoted. This your rant against MBA is not new, it runs in your bloodline. Your forefathers challenged the gods and demanded for weather report before they would farm. They told the King that the planting season then was a Scam / Ponzi Scheme organized by the gods. Now the gods have just visited their Iniquity on you by sending you ROI (Return of Insanity) now you cant read properly. Shame on You. You are Warned Steer Clear of this Thread or be Roasted Alive.

12 Likes 2 Shares |

| Re: MBA Investors Forum by 50nizzy: 8:30pm On Aug 08, 2020 |

I Just noticed that Idiot FxManager viewing this Thread.

Well, he has been dealt with before, and if he tries to mount a come back, no problem, bring it on.

Fire dey wait for you here. 7 Likes |

| Re: MBA Investors Forum by fxjones(m): 9:00pm On Aug 08, 2020 |

50nizzy:

I Just noticed that Idiot FxManager viewing this Thread.

Well, he has been dealt with before, and if he tries to mount a come back, no problem, bring it on.

Fire dey wait for you here. With this plan investors are guaranteed[i][/i] a monthly ROI for 12 Months..... anyone offering guarantee on an investment that is full of speculative uncertainty is nothing but a scam running ponzi, MBA is able to survive this long because of the various percentage it offers accross the board, mark this date when there is massive panic the big boys will stop rolling over and demand their capital, then you guys who are the small investors will be roasted alive begging for mercy.......... a dog heading to his early grave always ignore the sound of the horn..... Sadly, investors are often slow to admit that they’ve fallen victim to a Ponzi scheme. Besides the understandable anguish of being perceived as both foolish and greedy, many fear that public exposure will create a crisis of confidence that could create a run on the promoter and make matters worse. Clinging to even the smallest fragment of hope, investors have been known to go to enormous lengths to protect the promoter in the hopes that they can recover some money. When it comes to investing, it is advisable to exercise great caution and look out for any of the following warning signs: 1. Abnormally high investment returns The most obvious sign of any investment skulduggery is the promise of an abnormally high investment return. While Ponzi schemes may take a variety of forms, they all follow the same intrinsic theme: investors are promised they will make a much higher return than can be achieved through any conventional investment opportunity. When analysing investment opportunities, remember the adage: if it’s too good to be true, it probably is. 2. Guaranteed returns The words ‘guaranteed returns’ are designed to trigger both deep-seated investor greed and the willing belief that this is a ‘sure-fire thing’. However, when it comes to investing, no return is ever guaranteed and even the most modest investment carries some risk. Greed is your greatest enemy when investing. Be highly suspicious of anyone who offers you a guaranteed return on your investment. 3. Consistently high performance By their very nature, the investment markets rise and fall over time, and your returns in any reputable investment will reflect these market fluctuations. Be sceptical of any investment that promises consistently positive returns regardless of overall market conditions. 4. Vague business model If you don’t understand the business model after a five-minute explanation, stay away. The investment’s business model should be easy to understand and, as an investor, one should be clear where and how returns are generated. Fraudsters are notorious for using complicated verbal constructs such as ‘hedge future trading’, ‘high yield investment’ and ‘offshore investment program’ to intimidate would-be investors. These are smoke-and-mirror tactics used to confuse and bully investors. As Warren Buffett is famous for saying: “Never invest in a business you can’t understand.” 5. The need for more investors The survival of any Ponzi scheme is dependent on its ability to continually attract new investors. Without an ongoing stream of new investors, the fraudster is unable to pay the previous investors, and the whole scheme will unravel. If you are pressured into finding new investors or offered rewards for introducing new investors, alarm bells should be reverberating. 6. Pressure to reinvest Ponzi schemes will collapse without regular income or if too many investors withdraw their funds. To remain afloat, the promoter will offer investors higher returns if they don’t cash out or if they reinvest their money. While on paper investors believe their investments are gaining incomparable ground, the truth is that most Ponzi schemes don’t make any investments on behalf of their investors at all. If you’re pressured or rewarded for reinvesting, be alarmed. 7. The pressure to act now Ponzi fraudsters are also notorious for creating a false sense of urgency by leading the investor to believe the deal is only valid for a limited time. The investment opportunity is often shrouded in secrecy, and the investor is pressured to ‘act now’ while the ‘once-in-a-lifetime’ window of opportunity stands obscurely and suspiciously ajar. The pressure to invest within a certain period is foreign to sound investing principles and should be considered a red flag. 8. Credibility through association A Ponzi scheme promoter generally creates an air of exclusivity by luring would-be investors into his inner circle of family and friends. By proximity to those who are close to the fraudster, the investor’s fears are allayed – after all, foxes never prey near their dens and thieves don’t rob from their own homes. This is a powerful psychological tactic used by fraudsters to build credibility through association with reputable people who are known to them. Remember, Bernie Madoff managed to deceive those nearest and dearest to him, including his sons. 7 Likes |

| Re: MBA Investors Forum by dogtails(m): 9:52pm On Aug 08, 2020 |

fxjones:

With this plan investors are guaranteed[i][/i] a monthly ROI for 12 Months..... anyone offering guarantee on an investment that is full of speculative uncertainty is nothing but a scam running ponzi, MBA is able to survive this long because of the various percentage it offers accross the board, mark this date when there is massive panic the big boys will stop rolling over and demand their capital, then you guys who are the small investors will be roasted alive begging for mercy.......... a dog heading to his early grave always ignore the sound of the horn.....

Sadly, investors are often slow to admit that they’ve fallen victim to a Ponzi scheme. Besides the understandable anguish of being perceived as both foolish and greedy, many fear that public exposure will create a crisis of confidence that could create a run on the promoter and make matters worse. Clinging to even the smallest fragment of hope, investors have been known to go to enormous lengths to protect the promoter in the hopes that they can recover some money.

When it comes to investing, it is advisable to exercise great caution and look out for any of the following warning signs:

1. Abnormally high investment returns

The most obvious sign of any investment skulduggery is the promise of an abnormally high investment return. While Ponzi schemes may take a variety of forms, they all follow the same intrinsic theme: investors are promised they will make a much higher return than can be achieved through any conventional investment opportunity. When analysing investment opportunities, remember the adage: if it’s too good to be true, it probably is.

2. Guaranteed returns

The words ‘guaranteed returns’ are designed to trigger both deep-seated investor greed and the willing belief that this is a ‘sure-fire thing’. However, when it comes to investing, no return is ever guaranteed and even the most modest investment carries some risk. Greed is your greatest enemy when investing. Be highly suspicious of anyone who offers you a guaranteed return on your investment.

3. Consistently high performance

By their very nature, the investment markets rise and fall over time, and your returns in any reputable investment will reflect these market fluctuations. Be sceptical of any investment that promises consistently positive returns regardless of overall market conditions.

4. Vague business model

If you don’t understand the business model after a five-minute explanation, stay away. The investment’s business model should be easy to understand and, as an investor, one should be clear where and how returns are generated. Fraudsters are notorious for using complicated verbal constructs such as ‘hedge future trading’, ‘high yield investment’ and ‘offshore investment program’ to intimidate would-be investors. These are smoke-and-mirror tactics used to confuse and bully investors. As Warren Buffett is famous for saying: “Never invest in a business you can’t understand.”

5. The need for more investors

The survival of any Ponzi scheme is dependent on its ability to continually attract new investors. Without an ongoing stream of new investors, the fraudster is unable to pay the previous investors, and the whole scheme will unravel. If you are pressured into finding new investors or offered rewards for introducing new investors, alarm bells should be reverberating.

6. Pressure to reinvest

Ponzi schemes will collapse without regular income or if too many investors withdraw their funds. To remain afloat, the promoter will offer investors higher returns if they don’t cash out or if they reinvest their money. While on paper investors believe their investments are gaining incomparable ground, the truth is that most Ponzi schemes don’t make any investments on behalf of their investors at all. If you’re pressured or rewarded for reinvesting, be alarmed.

7. The pressure to act now

Ponzi fraudsters are also notorious for creating a false sense of urgency by leading the investor to believe the deal is only valid for a limited time. The investment opportunity is often shrouded in secrecy, and the investor is pressured to ‘act now’ while the ‘once-in-a-lifetime’ window of opportunity stands obscurely and suspiciously ajar. The pressure to invest within a certain period is foreign to sound investing principles and should be considered a red flag.

8. Credibility through association

A Ponzi scheme promoter generally creates an air of exclusivity by luring would-be investors into his inner circle of family and friends. By proximity to those who are close to the fraudster, the investor’s fears are allayed – after all, foxes never prey near their dens and thieves don’t rob from their own homes. This is a powerful psychological tactic used by fraudsters to build credibility through association with reputable people who are known to them. Remember, Bernie Madoff managed to deceive those nearest and dearest to him, including his sons.

k 1 Like |

| Re: MBA Investors Forum by ifeanyija(m): 9:59pm On Aug 08, 2020 |

fxjones:

With this plan investors are guaranteed[i][/i] a monthly ROI for 12 Months..... anyone offering guarantee on an investment that is full of speculative uncertainty is nothing but a scam running ponzi, MBA is able to survive this long because of the various percentage it offers accross the board, mark this date when there is massive panic the big boys will stop rolling over and demand their capital, then you guys who are the small investors will be roasted alive begging for mercy.......... a dog heading to his early grave always ignore the sound of the horn.....

Sadly, investors are often slow to admit that they’ve fallen victim to a Ponzi scheme. Besides the understandable anguish of being perceived as both foolish and greedy, many fear that public exposure will create a crisis of confidence that could create a run on the promoter and make matters worse. Clinging to even the smallest fragment of hope, investors have been known to go to enormous lengths to protect the promoter in the hopes that they can recover some money.

When it comes to investing, it is advisable to exercise great caution and look out for any of the following warning signs:

1. Abnormally high investment returns

The most obvious sign of any investment skulduggery is the promise of an abnormally high investment return. While Ponzi schemes may take a variety of forms, they all follow the same intrinsic theme: investors are promised they will make a much higher return than can be achieved through any conventional investment opportunity. When analysing investment opportunities, remember the adage: if it’s too good to be true, it probably is.

2. Guaranteed returns

The words ‘guaranteed returns’ are designed to trigger both deep-seated investor greed and the willing belief that this is a ‘sure-fire thing’. However, when it comes to investing, no return is ever guaranteed and even the most modest investment carries some risk. Greed is your greatest enemy when investing. Be highly suspicious of anyone who offers you a guaranteed return on your investment.

3. Consistently high performance

By their very nature, the investment markets rise and fall over time, and your returns in any reputable investment will reflect these market fluctuations. Be sceptical of any investment that promises consistently positive returns regardless of overall market conditions.

4. Vague business model

If you don’t understand the business model after a five-minute explanation, stay away. The investment’s business model should be easy to understand and, as an investor, one should be clear where and how returns are generated. Fraudsters are notorious for using complicated verbal constructs such as ‘hedge future trading’, ‘high yield investment’ and ‘offshore investment program’ to intimidate would-be investors. These are smoke-and-mirror tactics used to confuse and bully investors. As Warren Buffett is famous for saying: “Never invest in a business you can’t understand.”

5. The need for more investors

The survival of any Ponzi scheme is dependent on its ability to continually attract new investors. Without an ongoing stream of new investors, the fraudster is unable to pay the previous investors, and the whole scheme will unravel. If you are pressured into finding new investors or offered rewards for introducing new investors, alarm bells should be reverberating.

6. Pressure to reinvest

Ponzi schemes will collapse without regular income or if too many investors withdraw their funds. To remain afloat, the promoter will offer investors higher returns if they don’t cash out or if they reinvest their money. While on paper investors believe their investments are gaining incomparable ground, the truth is that most Ponzi schemes don’t make any investments on behalf of their investors at all. If you’re pressured or rewarded for reinvesting, be alarmed.

7. The pressure to act now

Ponzi fraudsters are also notorious for creating a false sense of urgency by leading the investor to believe the deal is only valid for a limited time. The investment opportunity is often shrouded in secrecy, and the investor is pressured to ‘act now’ while the ‘once-in-a-lifetime’ window of opportunity stands obscurely and suspiciously ajar. The pressure to invest within a certain period is foreign to sound investing principles and should be considered a red flag.

8. Credibility through association

A Ponzi scheme promoter generally creates an air of exclusivity by luring would-be investors into his inner circle of family and friends. By proximity to those who are close to the fraudster, the investor’s fears are allayed – after all, foxes never prey near their dens and thieves don’t rob from their own homes. This is a powerful psychological tactic used by fraudsters to build credibility through association with reputable people who are known to them. Remember, Bernie Madoff managed to deceive those nearest and dearest to him, including his sons.

financial adviser 2 Likes |

| Re: MBA Investors Forum by Dotunayo: 11:07pm On Aug 08, 2020 |

Do you want to learn forex basics for free? Are you tired of losing money on forex? Do you need a good mentor?....search no more contact-07039200887 via whatsapp |

| Re: MBA Investors Forum by 50nizzy: 11:43pm On Aug 08, 2020 |

fxjones:

With this plan investors are guaranteed[i][/i] a monthly ROI for 12 Months.....

Fxjones and FxManager are one and the same. ( Siamese twins). You are such a stupid coward trying to mount a come back here hiding under a useless name. Go and hide your face in shame, Idiot. Why didn't you use your normal blue color for this your copy and paste Long Epistle ? Still trying to hide your identity ? (Yahoo boy). You cant fool anyone here, we know who you are. (A Beast looking for who to devour in the Ponzi scheme without office that you have been promoting unsuccessfully.) Nobody here needs your Fraudulent financial advice. Go and advise your family. Broke ass nigga. 9 Likes 1 Share |

| Re: MBA Investors Forum by akinonigbinde: 12:07am On Aug 09, 2020 |

. |

| Re: MBA Investors Forum by akinonigbinde: 12:13am On Aug 09, 2020 |

I think the broke dude needs help. Perhaps he had tried running from family members to friends to raise money to join the MBA family that are so liquid enough to throw away their SPARE MONEY or better still dash MBA but all to no avail, hence the pull it down by all means syndrome.

Fxjones, fxManager or fxBroke. If MBA is a ponzi scheme, we prefer it that way. At least it's our money not yours. On this thread, we are allergic to poverty and insolvency.

You smelly pauper. Go and capitalize, better still merge and let us know the difference, Perhaps we can contribute to help realize your dream of being an investor in MBA a reality. 7 Likes |

| Re: MBA Investors Forum by 50nizzy: 2:00am On Aug 09, 2020 |

akinonigbinde:

I think the broke dude needs help. Perhaps he had tried running from family members to friends to raise money to join the MBA family that are so liquid enough to throw away their SPARE MONEY or better still dash MBA but all to no avail, hence the pull it down by all means syndrome.

Fxjones, fxManager or fxBroke. If MBA is a ponzi scheme, we prefer it that way. At least it's our money not yours. On this thread, we are allergic to poverty and insolvency.

You smelly pauper. Go and capitalize, better still merge and let us know the difference, Perhaps we can contribute to help realize your dream of being an investor in MBA a reality. That was how his village people were contributing cocoyam and cassava to his forefathers that refused to farm and challenged the gods. He is here repeating the sad history of his ancestors. Please no contribution for him, we must not encourage his stupidity All the cocoyam and cassava contributions his ancestors got never motivated them to start planting. they still accused the gods of running a Ponzi Scheme. Bros Leave him, let him rot in his misery. 6 Likes 1 Share |

| Re: MBA Investors Forum by cutieme(m): 2:38am On Aug 09, 2020 |

airsaylongcom:

Sure. Note that you will be paying directly to MBA'S account and not mine. And you should have a Nigerian Bank account where you will transfer the money from and receive your ROI in. You'd also need to provide a Government ID (preferably Nigerian Government ID although we have accepted UAE Resident Card on a few occasions). ok, I have my national I'd card then Emirates id,what's the next step? |

| Re: MBA Investors Forum by Nobody: 8:03am On Aug 09, 2020 |

cutieme:

ok, I have my national I'd card then Emirates id,what's the next step? Chat me up on Telegram |

| Re: MBA Investors Forum by Nobody: 8:18am On Aug 09, 2020 |

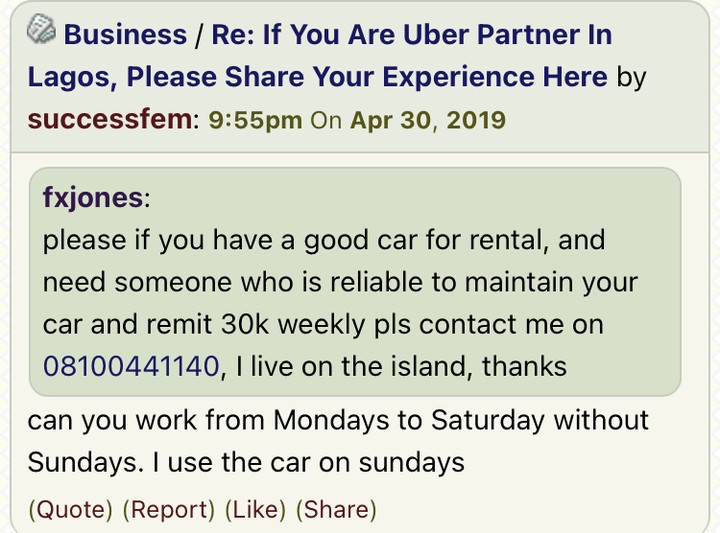

As at April last year someone was begging to be a ride-hailing app driver and one year after he's forming Forex expert. A lot must have changed for him.

His product is offering 20% per annum...lol. For a business that if I do real digging we may find out that it's unregistered 11 Likes 2 Shares

|

| Re: MBA Investors Forum by Moda1: 8:23am On Aug 09, 2020 |

Did u see me complain over my account rather said i hv not received my MOU till now , 40 days after account opening. I hv visited the branch which they said printer is not working and was promised that i will get it next day unfailingly but nothing received. I hv called d account officer severally that he can send it to my email or i can come in last week Friday to pick up , he said the lawyers in was sacked , next he said the lawyers in charge travelled that I shouldnt come . I was confused as it's abnormal hence my coming online to seek assistance from the guy representing MBA here to assist and possibly invest for me later this month. So u jumping on my post shows ur an asslicker without reading my post and decided to picked d part i said its a flimsy reason that was given to me ofcourse it is . AlmondRPG47:

It pains me to see investors come online to complain. I'm an investor of over 4 months with two accounts for myself and wife operating at the 10% ROI level. Following the children investment clarification by Airsalongcom, I have opened accounts for my four children as well. I've had ROI delays in the past, and my account officer was super helpful...they're there to help you fix your problems!

So, why should investors come online to complain when their account officers are there for them. Those complaining the customer care lines aren't connecting...they've their account officers too! The branches are also there for you to walk in! It sickens me to see some people disrespect the efforts of hardworking account officers and the company!

2 Likes |

| Re: MBA Investors Forum by careytommy37(m): 8:26am On Aug 09, 2020 |

airsaylongcom:

As at April last year someone was begging to be a ride-hailing app driver and one year after he's forming Forex expert. A lot must have changed for him.

His product is offering 20% per annum...lol. For a business that if I do real digging we may find out that it's unregistered Oga ignore the detractors. We know his type, chicken little always screaming the sky is falling 2 Likes |

| Re: MBA Investors Forum by Flash83: 8:28am On Aug 09, 2020 |

Bro nobody is representing MBA here. Please be guided. Moda1:

Did u see me complain over my account rather said i hv not received my MOU till now , 40 days after account opening. I hv visited the branch which they said printer is not working and was promised that i will get it next day unfailingly but nothing received. I hv called d account officer severally that he can send it to my email or i can come in last week Friday to pick up , he said the lawyers in was sacked , next he said the lawyers in charge travelled that I shouldnt come . I was confused as it's abnormal hence my coming online to seek assistance from the guy representing MBA here to assist and possibly invest for me later this month. So u jumping on my post shows ur an asslicker without reading my post and decided to picked d part i said its a flimsy reason that was given to me ofcourse it is . 1 Like |

| Re: MBA Investors Forum by Flash83: 8:29am On Aug 09, 2020 |

What a world we live in. Your guess is as good as mine. airsaylongcom:

As at April last year someone was begging to be a ride-hailing app driver and one year after he's forming Forex expert. A lot must have changed for him.

His product is offering 20% per annum...lol. For a business that if I do real digging we may find out that it's unregistered 4 Likes |

| Re: MBA Investors Forum by Nobody: 8:30am On Aug 09, 2020 |

Moda1:

Did u see me complain over my account rather said i hv not received my MOU till now , 40 days after account opening. I hv visited the branch which they said printer is not working and was promised that i will get it next day unfailingly but nothing received. I hv called d account officer severally that he can send it to my email or i can come in last week Friday to pick up , he said the lawyers in was sacked , next he said the lawyers in charge travelled that I shouldnt come . I was confused as it's abnormal hence my coming online to seek assistance from the guy representing MBA here to assist and possibly invest for me later this month. So u jumping on my post shows ur an asslicker without reading my post and decided to picked d part i said its a flimsy reason that was given to me ofcourse it is . You know there are better ways to resolve a 40day delayed Business Agreement. I would have stepped in and assured you of your BA tomorrow morning. But I'd rather pass. Your style of resolving issues says a lot about you. 1 Like |

| Re: MBA Investors Forum by ifeanyija(m): 8:30am On Aug 09, 2020 |

Moda1:

Did u see me complain over my account rather said i hv not received my MOU till now , 40 days after account opening. I hv visited the branch which they said printer is not working and was promised that i will get it next day unfailingly but nothing received. I hv called d account officer severally that he can send it to my email or i can come in last week Friday to pick up , he said the lawyers in was sacked , next he said the lawyers in charge travelled that I shouldnt come . I was confused as it's abnormal hence my coming online to seek assistance from the guy representing MBA here to assist and possibly invest for me later this month. So u jumping on my post shows ur an asslicker without reading my post and decided to picked d part i said its a flimsy reason that was given to me ofcourse it is . what do u even need mou for? Mmm didn't issue mou yet millions invested there. Forget mou and enjoy ur ROI from a genuine company. If your account officer said u shud wait then wait stop coming here to complain. I did my roll over twice without mou, I was called for it but I told the account officer to keep it for me, that's not my problem since he always do the roll over and topup for me without going to the office. Also note, always ensure u send airtime sometimes to ur account officer at least, not every time u will be disturbing them. That's the secret. 11 Likes |

| Re: MBA Investors Forum by AlmondRPG47(m): 8:31am On Aug 09, 2020 |

OK, let's agree MBA is a ponzi scheme...so, I'm officially a ponzi scheme lover today! Oga fx(Jones/manager/broker etc), why you de take hydrochlorothiazide for our coro na? Abi na you get the money? Na our money, and we love to put am inside MBA ponzi, wetin be your own? Based on my calculated projections, I would have over 300M in cumulative ROIs received in the next 36 months...and every day is counting fast! Be there and shouting fowl! fxjones:

With this plan investors are guaranteed[i][/i] a monthly ROI for 12 Months..... anyone offering guarantee on an investment that is full of speculative uncertainty is nothing but a scam running ponzi, MBA is able to survive this long because of the various percentage it offers accross the board, mark this date when there is massive panic the big boys will stop rolling over and demand their capital, then you guys who are the small investors will be roasted alive begging for mercy.......... a dog heading to his early grave always ignore the sound of the horn.....

Sadly, investors are often slow to admit that they’ve fallen victim to a Ponzi scheme. Besides the understandable anguish of being perceived as both foolish and greedy, many fear that public exposure will create a crisis of confidence that could create a run on the promoter and make matters worse. Clinging to even the smallest fragment of hope, investors have been known to go to enormous lengths to protect the promoter in the hopes that they can recover some money.

When it comes to investing, it is advisable to exercise great caution and look out for any of the following warning signs:

1. Abnormally high investment returns

The most obvious sign of any investment skulduggery is the promise of an abnormally high investment return. While Ponzi schemes may take a variety of forms, they all follow the same intrinsic theme: investors are promised they will make a much higher return than can be achieved through any conventional investment opportunity. When analysing investment opportunities, remember the adage: if it’s too good to be true, it probably is.

2. Guaranteed returns

The words ‘guaranteed returns’ are designed to trigger both deep-seated investor greed and the willing belief that this is a ‘sure-fire thing’. However, when it comes to investing, no return is ever guaranteed and even the most modest investment carries some risk. Greed is your greatest enemy when investing. Be highly suspicious of anyone who offers you a guaranteed return on your investment.

3. Consistently high performance

By their very nature, the investment markets rise and fall over time, and your returns in any reputable investment will reflect these market fluctuations. Be sceptical of any investment that promises consistently positive returns regardless of overall market conditions.

4. Vague business model

If you don’t understand the business model after a five-minute explanation, stay away. The investment’s business model should be easy to understand and, as an investor, one should be clear where and how returns are generated. Fraudsters are notorious for using complicated verbal constructs such as ‘hedge future trading’, ‘high yield investment’ and ‘offshore investment program’ to intimidate would-be investors. These are smoke-and-mirror tactics used to confuse and bully investors. As Warren Buffett is famous for saying: “Never invest in a business you can’t understand.”

5. The need for more investors

The survival of any Ponzi scheme is dependent on its ability to continually attract new investors. Without an ongoing stream of new investors, the fraudster is unable to pay the previous investors, and the whole scheme will unravel. If you are pressured into finding new investors or offered rewards for introducing new investors, alarm bells should be reverberating.

6. Pressure to reinvest

Ponzi schemes will collapse without regular income or if too many investors withdraw their funds. To remain afloat, the promoter will offer investors higher returns if they don’t cash out or if they reinvest their money. While on paper investors believe their investments are gaining incomparable ground, the truth is that most Ponzi schemes don’t make any investments on behalf of their investors at all. If you’re pressured or rewarded for reinvesting, be alarmed.

7. The pressure to act now

Ponzi fraudsters are also notorious for creating a false sense of urgency by leading the investor to believe the deal is only valid for a limited time. The investment opportunity is often shrouded in secrecy, and the investor is pressured to ‘act now’ while the ‘once-in-a-lifetime’ window of opportunity stands obscurely and suspiciously ajar. The pressure to invest within a certain period is foreign to sound investing principles and should be considered a red flag.

8. Credibility through association

A Ponzi scheme promoter generally creates an air of exclusivity by luring would-be investors into his inner circle of family and friends. By proximity to those who are close to the fraudster, the investor’s fears are allayed – after all, foxes never prey near their dens and thieves don’t rob from their own homes. This is a powerful psychological tactic used by fraudsters to build credibility through association with reputable people who are known to them. Remember, Bernie Madoff managed to deceive those nearest and dearest to him, including his sons.

4 Likes |

| Re: MBA Investors Forum by Rahmanjargo(m): 8:45am On Aug 09, 2020 |

Please what's the next step i have to take now?

I imitated a deposit of 1.7million. Should i click on pay?

|

| Re: MBA Investors Forum by Rahmanjargo(m): 8:46am On Aug 09, 2020 |

ucosuagwu:

I did online. Hi bro sorry for I'm disturbing you What's the next step i should take now?.should i click on pay?

|