| Re: Living In The UK: Property,Mortgage And Related by Solumtoya: 6:05pm On Jul 08, 2023 |

Lexusgs430:

The next thing for you to do now........ Divide your mortgage payment by 4, over pay your mortgage by one week or more if you can afford it..........

This singular move, would shave years off your length of payment......... 🤣😂

Congratulations.........

RENT MONEY IS DEAD MONEY........ 😜🤑 Not all Mortgages permit this. And even those that permit it often have a maximum limit for overpayments. So, read the terms before overpaying to avoid heavy fines. But yeah, the concept makes sense. Overpayment goes to the Principal and drastically reduces the Mortgage tenure |

| Re: Living In The UK: Property,Mortgage And Related by babythug(f): 7:19am On Jul 09, 2023 |

Ticha:

1. Check the rules in your area. Parts of Wales (Cardiff especially and the Valleys), Scotland (Glasgow, Edinburgh), Cornwall, Devon and London have a ban on short term lets in varying degrees. You will even need planning permission in certain areas which takes months and some serious dosh spent to get. Neighbours will rat you out so ensure you have your Ts crossed!

2. It can be a rented property but make sure you have clearance from the landlord and in writing where possible. A normal BTL mortgage expressly forbids using the property as a short let or as a residential property. Some landlords don’t care and some do – so be upfront with the landlord so they can decide for themselves if they’re happy for you to run a short let

3. It can be your own property but a. if you have bought with a residential mortgage, you will be breaching the terms (na who know go open ya yansh). If you have bought with a specialist short term let mortgage, then you will be breaching the terms by living there as well. Some lenders (Halifax for example) offer a residential mortgage where you can also use the house for short lets for short periods of time thus allowing people to rent out their homes when they go on holiday etc rather than as a proper business.

4. Interest rates for short term let mortgages are way higher than regular BTL or residential interest rates. Deposits are also higher -most lenders want between 35-50% deposit. Most lenders class it as commercial lending so the mortgage term is usually also short (between 10 to 15 years max)

5. To be profitable, you may have to be in locations that may not really be family friendly – city centres, near airports or event centres, touristy areas. These areas will also have competition, so you then have to spend money to up your game. Luxury does not usually equal profit

6. If you live in the house and run STL from it, you will benefit from the government rent a room tax free scheme.

7. People are less likely to misbehave and be shady if you live there and just rent out rooms but then you’re sharing bathrooms, toilets, kitchens and shared spaces with strangers daily – think of family safety.

Pitfalls

1. You need to either have a good cleaning crew or be open to spending a good chunk of your time on cleaning otherwise the reviews will kill your business pretty quickly

2. Location, location, location is key – which again ties into the above

3. Most residential flats expressly prohibit short term lets and where they allow it, other flats will also be STLs so there will be competition.

4. On average, you need to be booked for at least 20 days every month to break even. Expenses to think about off the bat - all the house bills are paid by you, updating furniture and fittings as the wear and tear is a lot higher, higher cleaning expenditure, fees to booking platforms (Airbnb takes an average of 18% of all bookings, booking.com takes 15%, VRBO takes 15%), linen and laundry costs (at every booking), providing and replacing toiletries and tea stuff then rent or mortgage.

5. You are not guaranteed a booking. People will cancel last minute. You will have to reduce prices to keep it competitive. There will be down periods – usually December to March that your expenses will keep running when your bookings are down.

6. The booking portals can shut you down at any time and sometimes for frivolous reasons. Airbnb is very good at this. They can also withhold payments to you and refund customers without your approval and there’ll be nothing you can do about it.

7. Neighbours will intensely dislike you – guests are not usually very considerate. They will park anyhow, party, thrash the property, make noise and you will be called out to break up issues.

8. It can easily become a full time job without the commensurate full time pay unless you outsource it and then that eats into your profits.

9. Reviews even when malicious can make or break you.

We turned our family home into an Airbnb when we first left the UK. We restricted bookings to a minimum of 3 nights. It was a larger home (5 bedroom) and could sleep 12 people, so we got large bookings and were able to charge accordingly (£300 a night and fixed so if it was 1 person or 12 people, you paid the same price. Otherwise, people book for 2/3 and sneak the reast in)

2 bookings was break even for us. So we aimed for a min of 3 bookings a month. Even though we didn’t target tourists (it was near a military base, close to a motorway, a speedway and a nuclear power plant), Nov to March was absolutely brutal! So, we targeted contractors and track racers, those would wake, head off to work, come back, drink, sleep and repeat and they were filthy! OMG! The cleaner always had to take rubbish to the tip -which cost money as well.

Christmas and NY were always booked so we often upped the charge for that time to cover us till March. There is a large number of retirees (67% of the population of the town) so their families would book and stay at ours when they came to see, visit or bury their family member.

There’s was always something to be repaired after every booking. People would put the heating on in the summer and just leave it on all day. Our cleaner lived 2 doors away and would hand over keys so they knew she was nearby, people still tried to have parties, sneak people in, hide broken stuff.

Guests will message at all hours of the day for basic things even when we had a comprehensive house manual detailing every single thing. I can’t find the thermostat for the heating – it’s on the wall by the controls. The lights won’t dim – use the dimmer nau! I’ve forgotten the pin to get in (it’s always the last 4 digits of the booking person’s phone number and they can change the guest one to any 4-digit number), I’ve locked myself out (just use the 4-digit pin that you set! It’s a digital lock o! I can unlock remotely but still!), your spoons are not shiny enough, could you please buy round pasta bowls? Can you get me cots? My baby will only sleep in a cot (we don’t provide cots and it’s detailed in our listing and the booking rules), your bedsheets are not Egyptian cotton, I only sleep on cotton sheets – ogbeni carry your favourite sheets follow body o

You will have your customer service face and voice on 24/7. Knowing what I know now, I’ll take Mon- Fri lodgers over short term let guests if I am not doing it full time.

PS - You can check prices and availability in your given area by checking calendars of hosts on Airbnb or VRBO by month (booked dates will be greyed out), open dates will show prices. Play round with weeks (7 days discounts), months (long term booking discount), check how lax their rules are - strictly no refunds or usually means bookings are generally slow. It is more difficult to do that on booking.com so to check viability for booking.com, use the search function and check which cheap hotel chains are in the area - Travel lodge etc as those will be your direct competition

I thoroughly enjoyed reading this!!!! 😁😀 3 Likes |

| Re: Living In The UK: Property,Mortgage And Related by lightnlife: 10:47pm On Jul 21, 2023 |

Thanks for sharing your experience. Whilst you're exploring other countries and waiting to naturalise/re-relocate, have you been saving in a LISA account for mortgage purposes? If yes, what happens if you don't eventually buy the property in the UK and leave? Also, how has it been renting over the last 5/6 years? After Thought 1It seems myriad of immigrants in the UK are just waiting to either get ILR or naturalise before exploring other countries for permanent residency. I reckon I'm on that list too.😊 Given this reality, I was analyzing a few things around mortgage savings (LISA) and rent. So, I currently pay £1100 pcm as rent, that's about £13200 per annum. If I continue to rent till I get ILR or naturalise (4/5 years from now - ceteris paribus), I might be paying an average of £14000 per annum on rent. Meaning I'd have paid over £70,000 as rent with 5 - 6 years. Meanwhile, this 70k or some part of it could also have been used to start a mortgage plan. However, as I'm not certain on my next relocation plan, I'm unable to commit to a mortgage. Question: If I start a mortgage plan and eventually leave the country after getting ILR or citizenship, can I sell the property? If yes, that's the modality for such? With regards to LISA, if I eventually decide not to buy a house and leave to another country with a LISA savings of 50K (bonus inclusive), how much dem go give me? Would I better off saving the funds in another account outside of LISA, knowing I'm not interested in buying a property in the UK? Lastly, is owning a house in the UK better off than renting in the long run? I have a property in Nigeria and mehn maintenance is draining - financially and mentally. Thanks Mroriginal:

Just to avoid repeating what the others have said, it might also be best to hold and spend a little time visiting those countries you guys are considering to live whenever on annual leave or planned short breaks. Just a sample case of Australia - you cant say you are scared of crawling things in Australia if you haven't even been there. Also, Buying a property you might not even like in a place you don't even like/considering leaving might not be the best idea. Although some say its easy to rent out your place while living in another country, i have heard cases of how much of a headache it can be. We are probably on the same boat - a family of 4, however we are planning to leave after naturalization next year. All we do now is just travel to places we would like to live and move when fully ready.

( |

| Re: Living In The UK: Property,Mortgage And Related by ukay2: 5:38am On Jul 22, 2023 |

lightnlife:

Thanks for sharing your experience.

Whilst you're exploring other countries and waiting to naturalise/re-relocate, have you been saving in a LISA account for mortgage purposes? If yes, what happens if you don't eventually buy the property in the UK and leave? Also, how has it been renting over the last 5/6 years?

After Thought 1

It seems myriad of immigrants in the UK are just waiting to either get ILR or naturalise before exploring other countries for permanent residency. I reckon I'm on that list too.😊

Given this reality, I was analyzing a few things around mortgage savings (LISA) and rent.

So, I currently pay £1100 pcm as rent, that's about £13200 per annum. If I continue to rent till I get ILR or naturalise (4/5 years from now - ceteris paribus), I might be paying an average of £14000 per annum on rent. Meaning I'd have paid over £70,000 as rent with 5 - 6 years. Meanwhile, this 70k or some part of it could also have been used to start a mortgage plan. However, as I'm not certain on my next relocation plan, I'm unable to commit to a mortgage.

Question: If I start a mortgage plan and eventually leave the country after getting ILR or citizenship, can I sell the property? If yes, that's the modality for such?

With regards to LISA, if I eventually decide not to buy a house and leave to another country with a LISA savings of 50K (bonus inclusive), how much dem go give me? Would I better off saving the funds in another account outside of LISA, knowing I'm not interested in buying a property in the UK?

Lastly, is owning a house in the UK better off than renting in the long run? I have a property in Nigeria and mehn maintenance is draining - financially and mentally.

Thanks

Buy a good property instead of renting.....rent money is a dead money according to Lexusgs430. You can sell the house if you are leaving the UK and there's high probability of selling the house at higher price. I know a house that was bought at £317,000 in 2017 and it's currently in the market for £400,000 as the owner has relocated to Poland. Who knows, the UK may even favour you the more, before you finish getting the British citizenship self  3 Likes |

| Re: Living In The UK: Property,Mortgage And Related by justwise(m): 9:09am On Jul 22, 2023 |

ukay2:

Should one go for 2years fixed rate at 6% or 5 years fixed rate at 5.5% now, please. If you can afford it go for 5yrs and have rest of mind. I was in your position couple of years ago and i wanted to fix for 5yrs at 2.3% but my mortgage broker suggested 2yrs that interest rate will drop after covid. I went with his suggestion. By the time my mortgage is due for renewal interest rate was 5.5% and he emailed me asking me to pay £150 to help me renew it, i totally ignored him, i called my lender and spoke with them and i was asked to wait and watch the market before jumping to renew. As i monitor the market and exploring other lenders the interest rate keep going up, i called the bank again 2months to the end of my fixed term and i was given 6.5%(i was overpaying my £120 monthly), angrily i allowed the mortgage to automatically rollover to variable but sadly at the rate of 7.5%. I paid that for one month and decided to do myself, logged in to my mortgage account to explore how to fix it, guess what? i was given 3.99% with options of 5 and 10yrs fix, i went for 5yrs. My biggest prob was not following my instinct right from the beginning of the process, i did so much research, watch YouTube videos, news about mortgage market and effect on mortgage after covid but my mortgage broker insisted otherwise. Big lesson learned, in my next project i will do things differently. 16 Likes 1 Share |

| Re: Living In The UK: Property,Mortgage And Related by ukay2: 1:31pm On Jul 22, 2023 |

justwise:

If you can afford it go for 5yrs and have rest of mind.

I was in your position couple of years ago and i wanted to fix for 5yrs at 2.3% but my mortgage broker suggested 2yrs that interest rate will drop after covid. I went with his suggestion.

By the time my mortgage is due for renewal interest rate was 5.5% and he emailed me asking me to pay £150 to help me renew it, i totally ignored him, i called my lender and spoke with them and i was asked to wait and watch the market before jumping to renew.

As i monitor the market and exploring other lenders the interest rate keep going up, i called the bank again 2months to the end of my fixed term and i was given 6.5%(i was overpaying my £120 monthly), angrily i allowed the mortgage to automatically rollover to variable but sadly at the rate of 7.5%.

I paid that for one month and decided to do myself, logged in to my mortgage account to explore how to fix it, guess what? i was given 3.99% with options of 5 and 10yrs fix, i went for 5yrs.

My biggest prob was not following my instinct right from the beginning of the process, i did so much research, watch YouTube videos, news about mortgage market and effect on mortgage after covid but my mortgage broker insisted otherwise.

Big lesson learned, in my next project i will do things differently.

Thank you Justwise for this. I was giving 6% fixed for 2 years and 5.5% fixed for 5 years at my AIP a few weeks ago. I am likely going for the 5 years fixed when l apply for the mortgage. I am just thinking now the UK inflation rate is coming down, maybe the rates may start coming down soon if the inflation rates keep coming down. Hopefully, with the inflation rate coming down, Bank of England may not continue to increase the lending rate going forward. |

| Re: Living In The UK: Property,Mortgage And Related by solveabode(m): 1:55pm On Jul 23, 2023 |

Good day to you all.

Please I need your advice. I am a first time buyer and on skilled worker visa of 5years but not up to a year in the UK.

My bank has offered me mortgage promise of £140k with 5% deposit. I have seen a property of 100k I likes and submitted every documents to the agent in charge of the property but the agent is insisting that I am not eligible to buy the property because the 5% deposit is too low. Meanwhile, the lender has not said such.

Your opinion is highly needed.

Thank you |

| Re: Living In The UK: Property,Mortgage And Related by Zahra29: 2:27pm On Jul 23, 2023 |

solveabode:

Good day to you all.

Please I need your advice. I am a first time buyer and on skilled worker visa of 5years but not up to a year in the UK.

[b]My bank has offered me mortgage promise [/b]of £140k with 5% deposit. I have seen a property of 100k I likes and submitted every documents to the agent in charge of the property but the agent is insisting that I am not eligible to buy the property because the 5% deposit is too low. Meanwhile, the lender has not said such.

Your opinion is highly needed.

Thank you Do you mean an Agreement in Principle (AIP/DIP) or a formal offer from the lender? The estate agent is wary because the affordability checks on a higher LTV purchase are more stringent, especially with the recent interest rate hikes. If it is an AIP, then this is only indicative and may change when the underwriters conduct their in-depth checks, which may result in a lower borrowing amount being offered by the lender. In addition, a property can be down valued by the lender and the estate agent likely wants reassurance that you have enough savings to cover the difference if needed. Essentially you might need to show the agent proof of funds significantly higher than the 5% deposit to reassure them that you have a decent enough buffer to continue the purchase if the lender offers you less than 95%, or the property is down valued( as well as enough to cover all the legal and other costs involved in buying a house) 2 Likes |

| Re: Living In The UK: Property,Mortgage And Related by lightnlife: 2:27pm On Jul 23, 2023 |

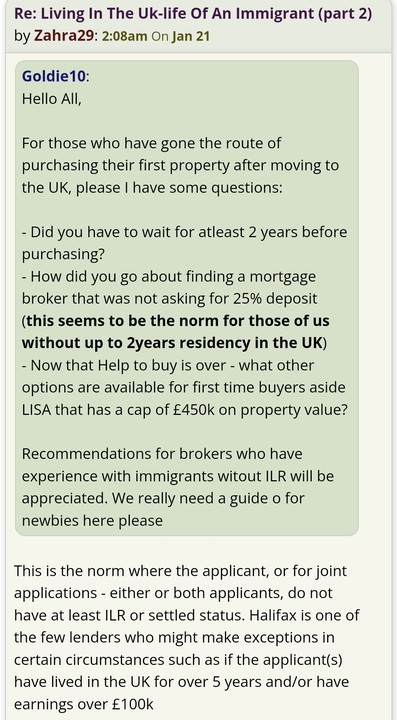

The five deposit offer doesn't often apply to immigrants without ILR or citizenship. Some lenders/brokers will only accept 10 percent for immigrants that have been around for up to two years. Others will require up to 25 percent. See the attached screenshot. Edit 1: Quoted Zahra29 in the screenshot but she already replied you about the same time I posted 😂 solveabode:

Good day to you all.

Please I need your advice. I am a first time buyer and on skilled worker visa of 5years but not up to a year in the UK.

My bank has offered me mortgage promise of £140k with 5% deposit. I have seen a property of 100k I likes and submitted every documents to the agent in charge of the property but the agent is insisting that I am not eligible to buy the property because the 5% deposit is too low. Meanwhile, the lender has not said such.

Your opinion is highly needed.

Thank you 1 Like

|

| Re: Living In The UK: Property,Mortgage And Related by ukay2: 7:15pm On Jul 23, 2023 |

Zahra29:

Do you mean an Agreement in Principle (AIP/DIP) or a formal offer from the lender?

The estate agent is wary because the affordability checks on a higher LTV purchase are more stringent, especially with the recent interest rate hikes. If it is an AIP, then this is only indicative and may change when the underwriters conduct their in-depth checks, which may result in a lower borrowing amount being offered by the lender. In addition, a property can be down valued by the lender and the estate agent likely wants reassurance that you have enough savings to cover the difference if needed.

Essentially you might need to show the agent proof of funds significantly higher than the 5% deposit to reassure them that you have a decent enough buffer to continue the purchase if the lender offers you less than 95%, or the property is down valued( as well as enough to cover all the legal and other costs involved in buying a house)

If the lender down values a property, like a house of £400k and the lender down value it to £380k, should l go with the lender valuation and ask the seller to sell at the lender's valuation report, because l believe the actual valuation should be that of the lender. Your opinion please |

| Re: Living In The UK: Property,Mortgage And Related by Zahra29: 8:17pm On Jul 23, 2023 |

ukay2:

If the lender down values a property, like a house of £400k and the lender down value it to £380k, should l go with the lender valuation and ask the seller to sell at the lender's valuation report, because l believe the actual valuation should be that of the lender.

Your opinion please Yes definitely, these would be strong grounds to negotiate a reduction in the price with the vendor. It's only a request and the vendor can decide not to drop their price, however given the current market I imagine they would want to hold onto their buyer and will at least offer to meet you part way. 2 Likes |

| Re: Living In The UK: Property,Mortgage And Related by ukay2: 8:34pm On Jul 23, 2023 |

Zahra29:

Yes definitely, these would be strong grounds to negotiate a reduction in the price with the vendor. It's only a request and the vendor can decide not to drop their price, however given the current market I imagine they would want to hold onto their buyer and will at least offer to meet you part way. Same thoughts...seemingly a buyer's market now. Thank you. |

| Re: Living In The UK: Property,Mortgage And Related by solveabode(m): 8:52am On Aug 03, 2023 |

Thank you very much. You are quite right cos that was what happened when I proceed with the lender. I was told I will need 25% deposit. Zahra29:

Do you mean an Agreement in Principle (AIP/DIP) or a formal offer from the lender?

The estate agent is wary because the affordability checks on a higher LTV purchase are more stringent, especially with the recent interest rate hikes. If it is an AIP, then this is only indicative and may change when the underwriters conduct their in-depth checks, which may result in a lower borrowing amount being offered by the lender. In addition, a property can be down valued by the lender and the estate agent likely wants reassurance that you have enough savings to cover the difference if needed.

Essentially you might need to show the agent proof of funds significantly higher than the 5% deposit to reassure them that you have a decent enough buffer to continue the purchase if the lender offers you less than 95%, or the property is down valued( as well as enough to cover all the legal and other costs involved in buying a house)

|

| Re: Living In The UK: Property,Mortgage And Related by Stevepop: 9:51pm On Aug 03, 2023 |

Hi everyone, I just need someone to allay my fears and worries as I've been refreshing my mail every seconds. We are currently in the process of buying an apartment. Our deposit is in a LISA account and the source is savings from salary and ajo/esusu/thrift. Coincidentally, the day we made reservation was when i came across a post on facebook group that some solicitors reject savings from thrift due to AML (and I think it's simply because some of the solicitors are rigid or simply do not understand the concept) while some are flexible about the whole thing. I've been on panic mode and really worried. Our solicitors have asked for proof of funds which I've supplied, I also explained all required inflows and attached the ajo agreement, hoping that would suffice, but haven't heard anything back from them (though I sent it 24 hours ago  ). Just wanted to ask if anyone used savings from Ajo for house purchase (as I'm guessing it should be a common thing with Nigerians here). How did you go about it? and did you encounter any issues? Thanks in advance. |

| Re: Living In The UK: Property,Mortgage And Related by Zahra29: 1:40am On Aug 04, 2023 |

Stevepop:

Hi everyone, I just need someone to allay my fears and worries as I've been refreshing my mail every seconds.

We are currently in the process of buying an apartment. Our deposit is in a LISA account and the source is savings from salary and ajo/esusu/thrift. Coincidentally, the day we made reservation was when i came across a post on facebook group that some solicitors reject savings from thrift due to AML (and I think it's simply because some of the solicitors are rigid or simply do not understand the concept) while some are flexible about the whole thing. I've been on panic mode and really worried. Our solicitors have asked for proof of funds which I've supplied, I also explained all required inflows and attached the ajo agreement, hoping that would suffice, but haven't heard anything back from them (though I sent it 24 hours ago  ). ).

Just wanted to ask if anyone used savings from Ajo for house purchase (as I'm guessing it should be a common thing with Nigerians here). How did you go about it? and did you encounter any issues?

Thanks in advance. These days there are more formal ajo type arrangements (originally brought into the UK by the windrush generation - called "pardner) i.e. rotating savings clubs/peer to peer lending companies e.g. Stepladder that people use when raising the deposit for a house. It's hard to say. It mainly depends on the lender. They might view it as a loan or a gifted deposit. Some are strict on gifted deposits, only accepting gifts from family members, others are more flexible but may want to check the ID of the gifter, and typically ask for a gifted deposit letter. 1 Like |

| Re: Living In The UK: Property,Mortgage And Related by Stevepop: 7:17am On Aug 04, 2023 |

Zahra29:

These days there are more formal ajo type arrangements (originally brought into the UK by the windrush generation - called "pardner) i.e. rotating savings clubs/peer to peer lending companies e.g. Stepladder that people use when raising the deposit for a house.

It's hard to say. It mainly depends on the lender. They might view it as a loan or a gifted deposit. Some are strict on gifted deposits, only accepting gifts from family members, others are more flexible but may want to check the ID of the gifter, and typically ask for a gifted deposit letter. Thanks for this. Let's see what the solicitor comes back with  , if I had known that it's not widely acceptable, would have explored other alternative saving options. |

| Re: Living In The UK: Property,Mortgage And Related by ukay2: 11:00pm On Aug 04, 2023 |

Stevepop:

Thanks for this. Let's see what the solicitor comes back with  , if I had known that it's not widely acceptable, would have explored other alternative saving options. , if I had known that it's not widely acceptable, would have explored other alternative saving options. When was the last time the ajo monies enter your own account? |

| Re: Living In The UK: Property,Mortgage And Related by SamReinvented: 11:07am On Aug 05, 2023 |

2 Likes |

| Re: Living In The UK: Property,Mortgage And Related by gmacnoms(m): 11:59am On Aug 05, 2023 |

1 Like |

| Re: Living In The UK: Property,Mortgage And Related by Solumtoya: 5:56pm On Aug 05, 2023 |

1 Like |

| Re: Living In The UK: Property,Mortgage And Related by ukay2: 6:04pm On Aug 05, 2023 |

Solumtoya:

Carry us along o. If you see any Lender that accepts 5% deposits for visa holders earning less than £100k, let us know Don't worry you'll soon get....small small My Mortgage was accepted last week by Halifax...doing solicitor documentation now. Deposit was 15% for £390k 4 bed detached house. 7 Likes 1 Share |

| Re: Living In The UK: Property,Mortgage And Related by OfferAccepted: 6:19pm On Aug 05, 2023 |

Solumtoya:

Carry us along o. If you see any Lender that accepts 5% deposits for visa holders earning less than £100k, let us know We got a mortgage offer last month from Barclays. Like I have been hailing our broker. He is a genius 👏 We on a Tier 4 student visa and part of the deposit came from a family abroad (Nigeria). Barclays would do 10% deposit for anyone on a visa. Same as Skipton Building Society (they changed their policy from LTV 75% to 90% last month). Cheers! 9 Likes 2 Shares |

| Re: Living In The UK: Property,Mortgage And Related by lightnlife: 9:30pm On Aug 05, 2023 |

Happy Weekend! Just had a discussion with a friend and it'll be nice to get more informed input. Is it advisable for a first timer to get an apartment instead of a semi/detached house? Essentially, pricing/affordability is responsible for this apartment consideration over a semi/detached structure. For context, the average newly built 2/3bed semi/detached house here starts at 400,000. But the apartment costs (2/3 beds, newly built) starts at 250,000. Apparently, it'll take a shorter time to raise the deposit for an apartment and the need to get more value for rent over time. Another consideration is leaving the current location, due to pricey properties, to somewhere with lower rates and similar opportunities in terms of work. Some areas have full house (newly built) for 250K.  What are your thoughts please? |

| Re: Living In The UK: Property,Mortgage And Related by lightnlife: 9:35pm On Aug 05, 2023 |

Congrats. Best wishes with the outstanding processes.  If I may ask, which area is the property located? The average cost for a 4-bed here is 500K, meaning I need about 75K for deposit.  ukay2:

Don't worry you'll soon get....small small

My Mortgage was accepted last week by Halifax...doing solicitor documentation now.

Deposit was 15% for £390k 4 bed detached house. |

| Re: Living In The UK: Property,Mortgage And Related by ukay2: 10:09pm On Aug 05, 2023 |

lightnlife:

Congrats. Best wishes with the outstanding processes.

If I may ask, which area is the property located? The average cost for a 4-bed here is 500K, meaning I need about 75K for deposit.

2016 built house in South East England. The house was valued at £440k, offered £390k and after several weeks of discussions, seller accepted the offer. Hopefully to complete the process in 4-6 weeks time. 3 Likes |

| Re: Living In The UK: Property,Mortgage And Related by ukay2: 10:22pm On Aug 05, 2023 |

lightnlife:

Happy Weekend!

Just had a discussion with a friend and it'll be nice to get more informed input.

Is it advisable for a first timer to get an apartment instead of a semi/detached house?

Essentially, pricing/affordability is responsible for this apartment consideration over a semi/detached structure. For context, the average newly built 2/3bed semi/detached house here starts at 400,000. But the apartment costs (2/3 beds, newly built) starts at 250,000. Apparently, it'll take a shorter time to raise the deposit for an apartment and the need to get more value for rent over time.

Another consideration is leaving the current location, due to pricey properties, to somewhere with lower rates and similar opportunities in terms of work. Some areas have full house (newly built) for 250K.

What are your thoughts please?

Affordability is the main thing... Also anywhere you want to stay for a long time will also matters... Best thing is to get into property ladder as soon as possible if you don't want to be paying your landlord's mortgage |

| Re: Living In The UK: Property,Mortgage And Related by Lexusgs430: 10:38pm On Aug 05, 2023 |

lightnlife:

Happy Weekend!

Just had a discussion with a friend and it'll be nice to get more informed input.

Is it advisable for a first timer to get an apartment instead of a semi/detached house?

Essentially, pricing/affordability is responsible for this apartment consideration over a semi/detached structure. For context, the average newly built 2/3bed semi/detached house here starts at 400,000. But the apartment costs (2/3 beds, newly built) starts at 250,000. Apparently, it'll take a shorter time to raise the deposit for an apartment and the need to get more value for rent over time.

Another consideration is leaving the current location, due to pricey properties, to somewhere with lower rates and similar opportunities in terms of work. Some areas have full house (newly built) for 250K.

What are your thoughts please?

Don't forget leasehold vs freehold dilemma & ongoing service charges...........🤣😜 |

| Re: Living In The UK: Property,Mortgage And Related by ukay2: 10:43pm On Aug 05, 2023 |

Lexusgs430:

Don't forget leasehold vs freehold dilemma & ongoing service charges...........🤣😜 I go for freehold.... |

| Re: Living In The UK: Property,Mortgage And Related by Lexusgs430: 10:45pm On Aug 05, 2023 |

ukay2:

I go for freehold.... It was for the other person, considering an apartment......... |

| Re: Living In The UK: Property,Mortgage And Related by ukay2: 11:07pm On Aug 05, 2023 |

Lexusgs430:

It was for the other person, considering an apartment......... Ooh |

| Re: Living In The UK: Property,Mortgage And Related by Zahra29: 1:28am On Aug 06, 2023 |

ukay2:

2016 built house in South East England.

The house was valued at £440k, offered £390k and after several weeks of discussions, seller accepted the offer. Hopefully to complete the process in 4-6 weeks time. Congrats! Sounds like it's moving along very quickly. Is this the property that your lender down valued? Did they say why? |

| Re: Living In The UK: Property,Mortgage And Related by deept(m): 4:42am On Aug 06, 2023 |

Lexusgs430:

Don't forget leasehold vs freehold dilemma & ongoing service charges...........🤣😜 @lightnlife Plus management company wahala.... |

).

). , if I had known that it's not widely acceptable, would have explored other alternative saving options.

, if I had known that it's not widely acceptable, would have explored other alternative saving options.