Politics / Navy Arrests Over 14 Crude Oil Vessels In Four Months – Official by dre11(m): 10:09am On Apr 26 Politics / Navy Arrests Over 14 Crude Oil Vessels In Four Months – Official by dre11(m): 10:09am On Apr 26 |

Governor Siminalayi Fubara of Rivers State said the state government will continue to support the Nigerian Navy to achieve its mandate of fighting criminalities in the waterways, and oil theft.

Governor Fubara said this in a meeting with the Chief of Naval Staff, Emmanuel Ogalla, and other top naval officers at the Government House in Port Harcourt, the state capital, on Thursday.

This is contained in a statement sent to PREMIUM TIMES by Nelson Chukwudi, the chief press secretary to Governor Fubara.

The governor told the visiting delegation that the country was facing myriads of challenges, including insecurity and criminal activities that threaten the national economy, which should not be overlooked.

“The success of the Nigerian Navy in our State, in the areas of oil theft, is because the State Government has given you all the necessary support.

“We have also maintained good relationships with the communities to make sure that whatever it is that is required for these operations to be successful were granted. I am happy to be associated with these very laudable achievements.”

“So, I have to say that I am happy that the Chief of Naval Staff, today, is commending the success of the exercise. He is commending the doggedness of the men in fighting oil theft, not just in the Niger Delta, but particularly in our State.

“I want to assure you that we will continue to give them the support, and discourage any act that would be a sabotage to the economy of our State,” Mr Fubara said.

Arrest of 14 crude oil vessel

In his remarks during the meeting, the Chief of Naval Staff, Mr Ogalla, acknowledged the support of the Rivers State Government and informed Governor Fubara of the achievements recorded by the Nigerian Navy in the area.

Mr Ogalla thanked the state government for donating two model schools in the state for the Navy for training of personnel. He also told Mr Fubara that a set of former civilians will be graduating on Saturday at the Navy Basic Training School in Onne.

Speaking further, Mr Ogalla said the Navy is relocating its training command headquarters to the state.

Reeling out its achievements in the state, the chief of naval staff said over 14 vessels carrying crude oil have been arrested in the state in four months.

“We are happy to report, today, that the erstwhile location of Headquarters of Naval Training Command, Lagos, is moving to that particular school location in Eleme, tomorrow.

“Over 14 large crude carrying vessels have been arrested within that period. Most of them are at various levels of investigation. We have also arrested several barges and other companies and organisations that are involved in oil theft.” https://www.premiumtimesng.com/news/top-news/689208-navy-arrests-over-14-crude-oil-vessels-in-four-months-official.html 2 Likes

|

Politics / NNPC Signs Deal To Build Another 100,000bpd Refining Plant Within PH Refinery by dre11(m): 8:52am On Apr 26 Politics / NNPC Signs Deal To Build Another 100,000bpd Refining Plant Within PH Refinery by dre11(m): 8:52am On Apr 26 |

*Fuel queues worsen in Abuja, environs, NNPC says issue resolvedThe Nigerian National Petroleum Company Limited (NNPC) yesterday signed a contract with African Refinery Port Harcourt Limited (ARPHL) to build a 100,000bpd refinery within the Port Harcourt Refinery and Petrochemical Complex in Rivers state. The national oil company disclosed the deal on its social media handle, indicating that the Executive Director, Downstream of the NNPC, Dapo Segun signed on its behalf. On its website, ARPHL described itself as the special purpose vehicle incorporated for the specific purpose of co-locating the 100,000bpd crude oil refinery in Nigeria.

It stated that in line with the strategic plan of the Ministry of Petroleum Resources, the NNPC in 2016 advertised a Request for Proposal (RFP) , seeking bids for private investors to transfer brownfield crude oil refineries to the existing refinery sites in Kaduna, Port Harcourt and Warri. According to the firm, this was aimed at increasing Nigeria’s national refining capacity in the shortest possible time frame. ARPHL said it submitted a comprehensive proposal and solution to NNPC by the deadline and applied for the Port Harcourt collocation opportunity along with 11 other investors.

It stated that by virtue of having the “most complete package”, it was declared the winning bidder for the Port Harcourt co-location project. However, the value of the contract was not stated.“Under the aforementioned MoU, we entered into an agreement with NNPC, whereby ARPHL will own and operate the 100,000 bpd refinery on 46 hectares of vacant land adjacent the PHRC ’s refinery complex, where we will benefit from direct crude supply from NNPC and access to other shared services, e.g. security, electricity, water, storage, jetty,” it added.

However, a source told THISDAY that it did not make sense that the Port Harcourt refinery, which had been under rehabilitation for years had yet to begin operation and another deal was being signed to build an additional one.Recall that part of the $1.5 billion facility to repair the Port Harcourt plant was taken from Afreximbank at the time, a debt which the NNPC is supposed to be servicing.In December last year, the company announced the ‘mechanical completion’ of phase 1 of the 210,000bpd Port Harcourt refinery. Since then, it has not started refining crude oil.

“NNPC Ltd.’s move to boost local refining capacity witnessed a boost today with the signing of share subscription agreement between NNPC Limited and African Refinery Port Harcourt Limited for the co-location of a 100,000bpd capacity refinery within the PHRC complex.“The signing of the agreement is a significant step towards setting in motion the process of building a new refinery which, when fully operational, will supply Premium Motor Spirit (PMS), Automotive Gas Oil (AGO), Aviation Turbine Kerosene (ATK), Liquefied Petroleum Gas (LPG), and other petroleum products to the local and international markets and provide employment opportunities for Nigerians,” the NNPC said in the announcement.

Meanwhile, several filling stations remained shut in Abuja and its environs yesterday as the petrol supply crisis which began a few days ago, worsened.Aside Abuja, Nasarawa, Niger, other states close to the federal capital were impacted by the supply challenge, leaving commuters stranded.Motorists besieged the few filling stations, including NNPC, resulting in long queues on Obasanjo Way, Zone 1, Conoil as well as Total filling stations opposite the NNPC headquarters in Abuja.

It was the same story at in Zuba, Niger State at AYM Shafa, NNPC outlet on Arab Road, Kubwa, Nyanya, Nasarawa State, among others. The situation was the same at stations owned by AA Rano, Mobil, NIPCO and Ardova Plc.While the few open filling stations were selling for as high as N680 per litre and N700, at the roadside black market, the product sold for up to N1,000 per litre.But in a reaction, the NNPC stated that the problem arose from logistics issues, assuring that it had been resolved.

“The Nigerian National Petroleum Company Limited (NNPC Ltd) wishes to clarify that the tightness in the supply of PMS currently being experienced in some areas across the country is as a result of logistics issues and that they have been resolved.“It also wishes to reiterate that the prices of petroleum products are not changing. It urges Nigerians to avoid panic buying as there is a sufficiency of products in the country,” Chief Corporate Communications Officer, Olufemi Soneye, said in a statement. https://www.thisdaylive.com/index.php/2024/04/26/nnpc-signs-deal-to-build-another-100000bpd-refining-plant-within-port-harcourt-refinery 3 Likes 1 Share

|

Politics / $2.1bn Reserve Depletion: CBN Sold Only $581m To Market — Bloomberg by dre11(m): 1:50pm On Apr 24 Politics / $2.1bn Reserve Depletion: CBN Sold Only $581m To Market — Bloomberg by dre11(m): 1:50pm On Apr 24 |

Nigeria’s external reserves shed $2.16 billion in the past month, falling to a seven-year low of $32.29 billion on April 15, 2024, from $34.45 billion on March 18, 2024, according to CBN data.

A recent Bloomberg report suggested that Nigeria is burning through its foreign exchange reserves at a rate not seen in four years, raising concerns that the central bank is depleting its dollar holdings to support the naira after pledging it would allow the currency to float more freely.

Liquid reserves declined 5.6% since March 18, when the naira started its rebound from record-low levels against the dollar to $31.7 billion as of April 12, according to Bloomberg’s calculations based on the latest available data from the CBN, that’s the biggest decline in a similar period since April 2020, according to data compiled by Bloomberg.

How naira has performed since January

At the beginning of the year, the naira went down to about N1,900 to a dollar. However, the naira has been gaining strength lately and has gone up to about N1,100 to a dollar.

The central bank said last month that it had cleared a backlog of overdue dollar purchase agreements estimated at $7 billion since the beginning of the year.

Nigeria still has a sizable cushion of foreign exchange reserves, buoyed by a rally in oil prices and inflows from multi-lateral loans. Gross reserves of around $32.6 billion cover about six months’ worth of imports, according to the International Monetary Fund.

What the FMDQ data revealed

Data from the FMDQ Securities Exchange, which tracks trading activity at the Nigerian Autonomous Foreign Exchange Market (NAFEM), showed that the central bank has only sold $581 million in the official market.

That leaves the CBN’s sales accounting for only 3.2 per cent of the total market turnover of $17.9 billion in the same period.

The data also showed that the CBN bought dollars from the banks on two occasions within the period. One was a $50 million transaction on March 28 and the other $30 million on March 27, bringing it to a total of $80 million.

When the apex bank’s $80 million sales to Bureau de Change operators this year (since lifting a three-year-old ban) is factored in alongside the $581 million sold at the official market, the total CBN interventions come to $661 million.

In comparison, Nigeria’s external reserves shed $2.16 billion in the past month. That figure is, however, more than double the combined interventions of the CBN in the market

The data from NAFEM shows the reserve drop did not flow into FX sales.

According to data from the CBN, out of the $6.11 billion in total outflows made during this period, $3.07 billion was spent on servicing external debt.

Cardoso explains depletion

Speaking on the sideline of the just concluded Spring meeting of the International Monetary Fund/World Bank in Washington DC, CBN Governor Olayemi Cardoso said the depleting external reserve is mostly due to factors such as debt repayments, other obligations and also due to the ordinary course of business.

He said: ‘What is important to us is that there is sufficient liquidity in the market. $1 billion is out now, sometimes it is $600, $700 million as the case may be, and that will continue.

“What you see with respect to the shifts in our reserves, is a shift that you will find in any country’s reserves situation, where for example, debts are due and certain payments need to be made: they are made because that is also part of keeping your credibility intact.” https://dailytrust.com/2-1bn-reserve-depletion-cbn-sold-only-581m-to-market-report/ 7 Likes 1 Share

|

Crime / Re: Travelers Defeat Zamfara Bandits, Kill One, Retrieve 2 AK-47 Rifles by dre11(m): 1:28pm On Apr 24 Crime / Re: Travelers Defeat Zamfara Bandits, Kill One, Retrieve 2 AK-47 Rifles by dre11(m): 1:28pm On Apr 24 |

|

Politics / Fubara Reshuffles Cabinet, Redeploys Two Wike’s Loyalists by dre11(m): 1:19pm On Apr 24 Politics / Fubara Reshuffles Cabinet, Redeploys Two Wike’s Loyalists by dre11(m): 1:19pm On Apr 24 |

Fubara redeploys Wike’s loyalists from finance, justice ministries in cabinet reshuffleSiminalayi Fubara, governor of Rivers, has redeployed two commissioners in his cabinet in a major shake-up since he took the mantle of leadership of the state.

Tammy Danagogo, secretary to the state government (SSG), announced the development in a statement issued on Tuesday.

Fubara redeployed Zacchaeus Adangor, attorney-general and commissioner for justice, to the ministry of special duties.

The governor also deployed Isaac Kamalu, commissioner for finance, to the ministry of employment generation and economic empowerment.

Danagogo said the commissioners are to hand over to the permanent secretaries in their outgoing ministries, adding that deployment is with immediate effect.

Both commissioners are loyalists of Nyesom Wike, the immediate former governor of Rivers and incumbent minister of the federal capital territory (FCT).

Last year, the commissioners resigned from their positions following the political feud between Wike and Fubara.

They were later reinstated after Wike and Fubara signed a peace accord facilitated by President Bola Tinubu.

Wike and Fubara are locked in a struggle for control of Rivers’ political structure.

The political crisis led to the defection of 27 state house of assembly members, who are loyal to Wike, from the Peoples Democratic Party (PDP) to the All Progressives Congress (APC).

The lawmakers have been threatening the govenor with impeachment.

The lawmakers have vetoed the governor in at least three bills after he refused his assent. https://www.thecable.ng/fubara-redeploys-wikes-loyalists-from-finance-justice-ministries-in-cabinet-reshuffle/amp/ 10 Likes 1 Share

|

Politics / Lagos To Roll Out 2,000 CNG Buses, 231 Electric Vehicles In June by dre11(m): 5:58pm On Apr 23 Politics / Lagos To Roll Out 2,000 CNG Buses, 231 Electric Vehicles In June by dre11(m): 5:58pm On Apr 23 |

The Lagos State government on Tuesday hinted that it has commenced moves to introduce about 2, 000 Compressed Natural Gas, CNG, buses into the state before the end of 2024.

Commissioner for Transportation, Mr Oluwaseun Osiyemi disclosed this at the commencement of the 2024 ministerial briefing on the activities of the ministry in the administration of Governor Bababjide Sanwo-Olu, held at Alausa, Ikeja, Lagos.

Osiyemi also said the state government is set to launch about 231 electric vehicles by the end of June, 2024.

According to Osiyemi, the state government is already engaging a private company on the acquisition of the CNG buses which will be distributed in two phases of 1,000, scheduled to be introduced by the end of 2024.

He explained that measure was part of efforts to alleviate the effects of fuel subsidy removal by the Federal Government on the residents.

“We are also looking at introducing about 231 electric vehicles on our road to complement the existing fleet of vehicles, using diesel and petrol,” Osiyemi stated.

The Commissioner added that the initiative was targeted at delivering cheaper, safer and more climate-friendly energy to residents and Nigerians in general.

https://leadership.ng/lagos-to-roll-out-2000-cng-buses-231-electric-vehicles-in-june/ 16 Likes 2 Shares

|

Politics / Dangote Refinery To Curtail W’Africa’s Reliance On Imported Petrol By 290,000 Bp by dre11(m): 10:56am On Apr 22 Politics / Dangote Refinery To Curtail W’Africa’s Reliance On Imported Petrol By 290,000 Bp by dre11(m): 10:56am On Apr 22 |

Emmanuel Addeh in Abuja

S&P Global Commodity Insights has projected that when the 650,000 Dangote refinery finally ramps up refining activities, it could massively reduce West Africa’s reliance on import of petrol from Europe by as much as 290,000 bpd, thereby becoming a dominant supplier in the sub-region.S&P analysts, who spoke during a panel discussion themed: “Exploring West Africa’s Oil Product Flows in a Changing Refining Landscape”, agreed that although delayed, the $19 billion facility in Lagos will before 2026, significantly change the fuels supply landscape in West Africa.

The panel featured Joel Hanley, Matthew Tracey-Cook, Kelly Norways and Elza Turner, all analysts and contributors at S&P Global.Also, S&P said that Nigeria has recently cut the maximum sulphur content for gas oil imports from 3,000 parts per million to below 500ppm, thereby significantly stifling import of the product from Europe to Nigeria.

“Once Nigeria sees Dangote reach a steady state capacity, that could mean some 327,000 barrels per day gasoline (petrol) supply and 244,000 barrels per day of diesel or gas oil. In practice, how that splits between the domestic market and the export market remains to be seen.

“There’s a significant amount of pressure from the Nigerian government for significant volumes of that supply to flow to the domestic market to try and solve this cost of living crisis and prevent significant pay-outs that need to be made onto importing those large volumes.“ But in reality, when we see that start to scale up is still subject to debate. Dangote have been espousing some pretty punchy timelines.

“They’ve most recently been saying that they’re looking to produce gasoline by May latest, but in reality, our analysts expect that that would be something like the fourth quarter of this year and in a more realistic timeline.

“Once we see the refinery ramp up, that could mean that West African gasoline imports or the import reliance that they have at the moment could drop by as much as 290,000 barrels per day between 2023 and 2026. So really, this could become quite a dominant supplier in the West African market, subject to when we start to see those barrels hit the market in Nigeria and the local region,” said Norways, Downstream Sector Oil analyst at S&P.S&P described the ongoing level of downstream activities in the downstream as a ‘flux’, stressing that the Dangote refinery may also reduce the amount of cargo that often sit off the coast of West Africa.

“ If you’ve ever been to Lagos, you see these enormous queues of refined products tankers waiting there. Now, one thing that I think people thought might relieve some of the pressure and, as I said, redress the imbalance somewhat would be the Dangote refinery

“And it’s finally got going, not fully up to speed perhaps, but we started to see a cargo coming out, which is exciting,” stated Hanley, a Director at S&P.Hanley stated that while the ramp-up is important, it was also important for the firm to look at ‘where the money is.’

“ As you said, there’s pressure from the Nigerian government because, of course, they would like this much-vaunted, long-awaited, Waiting for Godot kind of refinery to supply the local market and take some of the pressure off.“But if the international markets are prepared to pay up for that product, then it’s going to be tricky. It’s a very tricky balance to decide where that flow will go,” Hanley added.

With the upcoming Port Harcourt and the Warri refineries, about four major refineries in South Africa, the new refinery in Ghana and Angola’s ongoing three plants, Turner, a Contributor at S&P, stated that the sub-region was undergoing quite a massive change in the refinery landscape. “They (Angola) ‘re building three new refineries. There are all sorts of other projects in Africa. Over the years, there have been indications of Russian companies interested in building some of these refineries. There has been hardly any update in the recent years about those.“

But we have a lot of upgrade programmes in Africa, and quite a few refineries are involved in building new secondary units,” Turner said.Another analyst at the firm, Tracey-Cook, noted that: “Russia has completely cut off exports to West Africa, which saw some other regions that we haven’t previously seen exporting take some space in the total export pool”.“So the Mediterranean, specifically Spain, has been taking a larger role in Europe, exporting gasoline into Nigeria in particular,” Tracey-Cook said.The much-awaited Dangote refinery last week announced a price reduction of diesel to N1,000 per litre from N1,200 previously and has refuted insinuations that the slash in price was attributable to the high sulphur content of its products. https://www.thisdaylive.com/index.php/2024/04/22/sp-dangote-refinery-may-curtail-wafricas-reliance-on-imported-petrol-by-290000-bpdNlfpmod |

Politics / Withdraw Offensive Remark Against Northern Elders, Marafa Tells Matawalle by dre11(m): 8:38pm On Apr 21 Politics / Withdraw Offensive Remark Against Northern Elders, Marafa Tells Matawalle by dre11(m): 8:38pm On Apr 21 |

A leading and founding member of the All Progressives Congress (APC) and coordinator of the Tinubu/Shettima 2023 Presidential Campaign in Zamfara State, Senator Kabiru Marafa,… A leading and founding member of the All Progressives Congress (APC) and coordinator of the Tinubu/Shettima 2023 Presidential Campaign in Zamfara State, Senator Kabiru Marafa, has countered the Minister of State for Defence, Mr Bello Matawalle, stating that Northern elders are neither a burden nor paperweights whatsoever.

Matawalle had, in a statement with the title, ‘Tinubu Presidency: Northern Elders Forum, a political burden to the North, said they do not speak for the region, and described the Northern Elders as ‘paperweights and a burden’.

In a statement, he issued on Sunday, Marafa said rather than negatively portraying the Northern elders, Matawalle should have listed the achievements, programmes and policies, projects of President Bola Ahmed Tinubu in the North and the country as a whole in the first 10 months of the administration.

He said calling the elders of the region, which has and gave the highest number of votes to ensure victory for the Tinubu presidency, was counterproductive and a great disservice to the president, who is working tirelessly towards addressing the numerous challenges facing all segments and sectors of the country, among them terrorism, insurgency, economic and financial malfeasance and infrastructural decay, to list a few.

At the moment, Marafa insists that what President Tinubu needs from his appointees is support, loyalty and hard work to actualise the Renewed Hope Agenda conceived to return the country to the path of progress and prosperity, not sycophancy and unguarded statements.

Marafa, who represented Zamfara Central Senatorial District (2011 -2019), called on the minister to withdraw the offensive statement and tender, without delay, an unreserved apology to the Northern elders and Northerners in general.

“In the last one week, I have been inundated with calls from well-meaning and prominent stakeholders in our region and party, the APC, who know my relationship with the President.

“They are worried and disturbed that the unfortunate statement by the Minister of State for Defence, if not addressed, could affect the president’s electoral fortunes in our region because it will be seen as if the minister spoke the mind of the president or the Presidency.

“The crux of the matter is that; whether you like them or not these people are called Northern Elders, so, unless they are stripped of that title by the people of the region, insulting them is tantamount to insulting the entire people of the region.

“It’s not in our culture and upbringing to insult elders. No descent society will refer to its elders as a burden and paperweights. The North is not an exception.

” As one of the senators who worked very closely with Asiwaju as party leader (as he was then called) from the formation of APC through the primaries that led to the emergence of General Muhammadu Buhari as APC presidential candidate in Lagos, the politics of the National Assembly leadership in 2015 and 2019 and the processes and intrigues that characterised the 2023 Presidential Primaries, I can say without mincing words that President Tinubu holds the North, the Northerners, and their leaders in high esteem.

“Although, I’m not the mouthpiece of either the president or the Presidency, as a Northerner and an elder in the region, as an APC stakeholder and one that has worked closely with both the president and the Vice President, I want to state categorically that this view expressed by Mr Matawalle is his personal opinion and not in any way that of Mr President or the Presidency, and should, therefore, be disregarded.

“I know for sure that the North, Northerners and the Northern elders are neither a burden nor a paperweight in the scheme of things in the region and the country as a whole. The president shares this view, and therefore he is with me on this,” Senator Marafa concluded. https://dailytrust.com/withdraw-offensive-remark-against-northern-elders-marafa-tells-matawalle/?utm_source=beloud.com&utm_medium=beloud.comNlfpmod 4 Likes 1 Share |

Business / How Adeduntan Resigned As First Bank CEO On Cbn’s Order by dre11(m): 10:26am On Apr 21 Business / How Adeduntan Resigned As First Bank CEO On Cbn’s Order by dre11(m): 10:26am On Apr 21 |

There are strong indications that the sudden resignation of former Managing Director and CEO of First Bank, Dr Adesola Adeduntan was triggered by directives from the Central Bank of Nigeria (CBN).

LEADERSHIP gathered that news of his resignation broke in Nigeria while Adeduntan was still attending the World Bank/IMF Spring Meetings in Washington DC.

The former CEO suddenly notified the board of his intention to leave with effect from April 20, eight full months to the expiration of the third term of three years which he won as a reprieve by former CBN governor Godwin Emefiele.

Announcing his retirement, the MD said: “As you are aware, my contract would be expiring on 31 December 2024 after which I would no longer be eligible for employment within the Bank having served as the Managing Director/Chief Executive Officer of FirstBank for a record time of nine years.

“During this period the Bank and its subsidiaries has undergone significant changes and broken new grounds. We have repositioned the institution as an enviable financial giant in Africa. I have however decided to proceed on retirement with effect from 20 April 2024 to pursue other interests.

“I am eternally grateful to the board of directors of FirstBank and FBN Holdings Plc for the support that I received from them during my stewardship. I wish our iconic institution continued success and progress as we move into the next phase of its evolution.”

Messages sent to the Bank were not replied as at the time of writing this report.

According to one inside source, “there are several moving parts in the unfolding drama.

There is the matter of an unresolved issue flagged by the regulator years ago and how this has not been fully resolved to the satisfaction of the apex bank and there is also the issue of mismanagement of relationships and added to this is the question of ego.”

One source said following the questions raised by the central bank, the initial target had been the entire board of the bank itself and there is a suggestion the apex bank dialled back once it realised that the current board of the bank was appointed by the CBN itself.

Recall that FBN Holdings Plc also cancelled its Extraordinary General Meeting (EGM) scheduled for April 30th, 2024 to get shareholders’ approval on the raising of N300 billion capital.

Before this sudden resignation there had been expectation that Adeduntan would take up the position of managing director at the HoldCo level but it is unclear if this plan was abandoned because the regulator withheld its approval of the request from the bank. There is what is called a two-year “cooling off period” imposed by the regulator between directorship tenures in banks in Nigeria and this may have counted against the plot for Adeduntan to move up.

On April 28, 2021 former directors at a board meeting of the bank had voted for Adeduntan to be retired as his second term was to expire but he regained his position after the board was sacked by CBN Governor Emefiele.

It is unclear why the bank CEO is leaving now but First Bank has had a policy by which Managing Directors of the bank were allowed only two terms of three years each. Adeduntan would have been the first CEO to last three full terms on the job.

“As you are aware, my contract would be expiring on 31 December 2024 after which I would no longer be eligible for employment within the Bank having served as the Managing Director/Chief Executive Officer of FirstBank for a record time of nine years,” Adeduntan said in his letter resigning.

According to the letter, “during this period the Bank and its subsidiaries have undergone significant changes and broken new grounds. We have repositioned the institution as an enviable financial giant in Africa. “I have however decided to proceed on retirement with effect from 20 April 2024 to pursue other interests.”

Furthermore, he expressed gratitude towards the board of directors of First Bank and FBN Holdings for the support he received from them during his tenure.

Adeduntan was appointed as CEO of First Bank in 2016. Prior to his appointment, he served as the bank’s executive director and chief financial officer (CFO). Before joining First Bank in July 2014, he was a director and the pioneer CFO/business manager of Africa Finance Corporation (AFC). Adeduntan formerly worked as a senior vice-president and CFO at Citibank Nigeria Limited, as a senior manager in the financial services group of KPMG Professional Services, and as a manager at Arthur Andersen Nigeria. https://leadership.ng/how-adeduntan-resigned-as-first-bank-ceo-on-cbns-order/ 6 Likes 1 Share

|

Politics / Greatest Naira Comeback Unleashes Prospects For Economic Turnaround - THISDAY by dre11(m): 11:18am On Apr 20 Politics / Greatest Naira Comeback Unleashes Prospects For Economic Turnaround - THISDAY by dre11(m): 11:18am On Apr 20 |

Official FX market records $12.66bn turnover in three months

· Analysts applaud monetary policy reforms, call for supportive fiscal measuresThe Central Bank of Nigeria (CBN) appeared to have finally subdued arguably one of the most grueling and the multi-faceted attacks on the Naira in recent times.

This is just as data compiled by THISDAY on the daily turnover on the official Nigerian Autonomous Foreign Exchange (NAFEM) between January 18 and April 18, 2024, revealed the market has recorded total turnover of $12.66 billion over three months.

The trend in the daily turnover data showed fluctuations in value, with some days recording relatively low turnovers and others recording higher amount.

But findings showed that in February, there was a significant increase in turnover, with some days experiencing exceptionally high turnovers, particularly towards the end of the month.

Following a bouquet of reforms launched by the apex bank to sanitise the foreign exchange (FX) market at the inception of President Bola Tinubu’s administration, the local currency had received direct hits from attackers who were mostly currency speculators.

The official exchange rate of the Naira to a dollar stood at about N465.07/$ at the time Tinubu took over the helm of affairs in June last year, promising to achieve a unified exchange rate in contrast to the multiple exchange system, which he had inherited.

The president, who had blamed the country’s economic woes and currency challenges on faulty policies of the central bank, immediately approved new measures aimed at stabilising the FX segment.

One of the major reforms introduced by the apex bank was the floating of the Naira, which immediately opened up a floodgate of vulnerabilities against the local currency.

Before the eventual liberalisation of the FX market, the past leadership of the central bank had been under severe pressure to float the local currency and allow it to find its real value. But the central bank, rather chose to adopt a managed-float regime, intervening in the market whenever the situation demanded.

The reluctance of the apex bank to float the currency was largely because the country remained heavily import -reliant and given that the move would create a likely liquidity crisis.

However, following the liberalisation of the exchange rate market, where forces of demand and supply determined the value of the currency, and amid series of devaluations, the Naira shed significant value.

As of June 21, 2023, the local currency had lost 38.7 per cent to trade at N763/$ on the official window– at par with the parallel market rate.

Among other things, the resulting confidence crisis as a result of a backlog of unsettled FX liabilities amid the expected liquidity challenges also limited the local currency’s chances of survival.

As of February this year, the Naira depreciated to about N1,800 to the dollar on the parallel FX market as its woes continued, amid a high inflationary environment and attendant impact on prices of goods and services.

At some point, analysts had called for the reverse of monetary policies to address the economic hardship resulting from the policy choices.

However, the CBN apparently achieved a breakthrough when it started to clear genuine FX backlogs, initially estimated at about N7 billion but reduced to about $4.5 billion as over $2 billion requests turned out to be fraudulent. It also commenced the sale of the greenback to Bureau De Change operators who hitherto were banned as well as lifted ban on 43 items that were prohibited from accessing FX from the official market.

The settlement of the outstanding FX indebtedness boosted confidence of local and international investors, particularly portfolio investors who had since injected significant liquidity in the market to help strengthen the ailing Naira.

The local currency has since returned to winning ways and currently trade at about N1,100/$, with the Naira’s positive performance expected to have salutary effects on the economy.

Only recently, Goldman Sachs, in a report, predicted Nigeria to rank as the world’s 5th largest economy by 2075. The report had also projected the country to emerge as world’s 15th largest economy by 2050.

The top global investment banker had further predicted the country’s GDP to reach $13.1 trillion by 2075, further solidifying its position as Africa’s largest economy.

The projection puts Nigeria ahead of Pakistan at 6th position, Egypt (7th), Brazil (8th), Germany (9th), UK (10th) Mexico (11th), Japan (12th), Russia (13th), Philippines (14th), and France (15th).

Analysts believed the feat was achieved through liquidity boosts and the aggressive monetary tightening regime implemented by the CBN Governor, Mr. Olayemi Cardoso, who have raised the Monetary Policy rate (MPR) by 600 basis points since assumption of office in a bid to achieve price stability.

The Naira’s major comeback has continued to attract accolades from analysts who have hailed the recent monetary policy direction of the apex bank.

But they have also expressed concerns that the present gains may become unsustainable in the long-run without a commensurate policy action by the fiscal authority.

Analysts who spoke with THISDAY emphasised the critical need to boost oil output, which has been dwindling, and underscored the significance of diversifying the economy and stimulating non-oil exports to enhance foreign exchange earnings.

They also hoped that the recent interest rate hike and current banking industry recapitalisation drive could further attract foreign exchange inflows.

Group Chief Executive Officer, Cowry Asset Management, Johnson Chukwu, emphasised the need to improve oil production to sustain the Naira’s current gains.

He told THISDAY that, “It is going to be tough one to sustain the current gains we have in Naira without improving oil production. The gains we have in Naira are driven by withdrawals from the central bank and DMO who have collectively withdrawn about N12.7 trillion and in addition, you have foreign portfolio investors who are enjoying the benefits coming in at low exchange rates and high interest rates.

“So, these are not sustainable measures. What is sustainable that will make the naira remain strong or improve further will be if we have improved our operating cash flow or operating foreign currency cash flow. And current cashflow for Nigeria for now remains oil production.”

He said, “We have witnessed a consistent decline in oil production in the past three months from a high of 1.64 million barrels per day in January to about 1.4 million barrels in march.

“The assured route to having stability in the naira will be to have significant improvement in oil production otherwise it would be difficult to sustain.”

On his part, the Head of Financial Institutions Ratings at Agusto & Co, Mr. Ayokunle Olubunmi, also harped on the need to diversify the economy, and bolster foreign exchange (FX) earnings.

He said, “The moves now for the CBN to handle the gains in the exchange rate. We have seen them raising the rates, settling the outstanding obligation actively engaging the international investment community to improve their confidence in Nigeria.

“All those are good, But the truth is that if we are going to maintain this appreciation, in summary, what we need to do is to increase our FX earnings and a bulk has to do on the fiscal side.

“What we have seen thus far that has helped us is actually foreign portfolio investments, and those are short-term funds, the next year they may take their funds out.

“So, things that can promote export, improve our non-oil exports because oil sentiment is going down and in the long-term, non-oil export would be critical while also looking at our oil export because that is the low hanging fruit.”

Olubunmi said, “As a country, we have a lot of non-oil exports that we can export out. Also, trying to reduce the bureaucracy and the challenge of exporting goods would help. Also, there should be reforms at the ports to enhance exports.

“Also, there is a need to increase the consumer purchasing power of Nigeria because when the economy is booming, that is when you’ll see those foreign direct investors start coming into the country.

He said the planned bank recapitalisation exercise would attract foreign investors and further support the Naira’s appreciation.

According to him, “The amounts that the banks need to recapitalise. The expectation is that a lot of them will also reach out to foreign investors. And with GT bank saying the amount that it wants to raise is denominated in dollars. So now we also, in the medium term, support the naira appreciation because more funds would come in based on the recapitalisation process.”

On his part, Head, Global Markets, Parthian Partners, Ronke Akinyemi, acknowledged the positive impact of recent monetary policies on the Naira.

She also emphasised the importance of encouraging exports, and managing imports effectively, as well as enhancing trade balance to ensure long-term currency stability.

She said, “The recent strengthening of the Naira is a positive development, although the anticipated reduction in prices has been slower than expected. The Central Bank of Nigeria (CBN) has played a vital role in managing the Naira’s value through foreign reserve management, interest rate adjustments, and various policy reforms.

“To further bolster the Naira, it is imperative to encourage exports, manage imports effectively, and enhance our trade balance. This will contribute to currency stability in the long term.

“Additionally, ensuring stability and instilling confidence in the financial market can be achieved through strengthening regulatory frameworks and enhancing transparency. The recent announcement of bank recapitalisation by the CBN, scheduled for 2026, is a step in the right direction.

“Another essential aspect is improving government spending efficiency and refining taxation policies, which will help sustain the Naira’s strength.” https://www.thisdaylive.com/index.php/2024/04/20/greatest-naira-comeback-unleashes-prospects-for-economic-turnaround 10 Likes 1 Share

|

Politics / 2027: Lagos APC Stakeholders Push For Ambode’s Candidacy by dre11(m): 8:48pm On Apr 19 Politics / 2027: Lagos APC Stakeholders Push For Ambode’s Candidacy by dre11(m): 8:48pm On Apr 19 |

All Progressives Congress (APC) stakeholders have stressed the need for the party to give the governorship ticket to former governor of the state, Mr. Akinwunmi Ambode, saying he has the midas touch to transform the state.

Speaking on behalf of the stakeholders in Lagos, a stalwart of the APC, Oluwaseyi Bamigbade, said Ambode’s four-year tenure in the state witnessed massive development in infrastructure.

This came on the heels of Muslims in Lagos State yearning for one of their own as governor in 2027 as disclosed by an Islamic human rights organization, the Muslim Rights Concern (MURIC).

He said many groups are on a daily basis yearning for the return of Ambode in 2027 to continue his midas touch in Lagos development agenda, saying they believe he should be given the opportunity to have a second shot in the Government House as the constitution permits.

Bamigbede said, ‘’Within four years in office, he remodelled Lagos, making it an investment destination for big businesses from within and outside the country. He massively touched the lives of millions of Lagosians in every sphere such that it would appear as if he had been in office for a far longer period.

‘’He caused a paradigm shift, taking the government from the urban centre to the suburbs and opening up their narrow roads, giving them modern streets with lights that also link the arterial highways. It’s been a seamless arrangement that has prevented traffic glut on the expressways.

‘’Ambode’s health and education initiatives equally penetrated across suburbs in Lagos, giving opportunities to the son of a nobody to have access to free and decent education that would prepare them for the future. Understanding the place of science in the current educational system, during his tenure in office, Ambode established templates suggesting a progressive look into the future where science and tech will lead.’’

He added that the Ambode administration established the Lagos State Neighborhood Safety Agency saddled with the responsibility of collaborating with the Federal Police and other security outfits to ensure a safe Lagos State.

‘’The Lagos State Neighborhood Safety Corps is a model for community policing and other state governments are now replicating it in view of the prevalent security challenges,’’ he said. https://leadership.ng/2027-lagos-apc-stakeholders-push-for-ambodes-candidacy/#google_vignette 34 Likes 4 Shares

|

Politics / Insecurity: Nigeria Is A Disgrace To The World –gen. T.Y Danjuma by dre11(m): 6:49pm On Apr 19 Politics / Insecurity: Nigeria Is A Disgrace To The World –gen. T.Y Danjuma by dre11(m): 6:49pm On Apr 19 |

A former Chief of Defence Staff, General Theophilus Y. Danjuma, (rtd), says that Nigeria’s security challenges have made the country become a laughing stock and a disgrace to the world.

General Danjuma, while speaking at the annual Nwonyo Fishing and Cultural Festival in Ibbi Local Government Area of Taraba State on Friday, advised that urgent steps must be taken to address the security challenges facing the country.

“Nigerian authority must take urgent measures to redeem the battered image of the country by addressing the security challenges confronting the nation,” he said.

The retired General maintained that no person, especially foreigners, would be willing to come to the country to invest or visit tourist sites when their security was not guaranteed.

“No person or group of persons will want to come to our state or country if we continue to kill and butcher ourselves,” he noted.

The retired general further lamented the security challenges across Nigeria, adding that the ugly situation required immediate attention of the government.

He urged that all hands must be on deck in order to put “the right pegs in the right holes.”

He said, “Those in position of authority must work hard to make the country safe for all Nigerians including foreigners before we could attract more and more investors into the country

“If we continue to make our roads unsafe for people to move around, our dreams of making Nwonyo fishing and cultural festival an international festival, can not be achieved.

“It is sad that Nigeria as a nation has become a laughing stock following the security challenges.

“As the country is currently, we are a disgrace to the whole world and therefore we must redeem our image and put our house in order because right now we have become a laughing stock to the whole world.” he said.

Speaking at the event, the Governor of Adamawa State, Ahmadu Fintiri, pledged that his administration would work round the clock to foster mutual cooperation between his state and Taraba State Government. https://dailytrust.com/insecurity-nigeria-is-a-disgrace-to-the-world-gen-t-y-danjuma/ 10 Likes 2 Shares

|

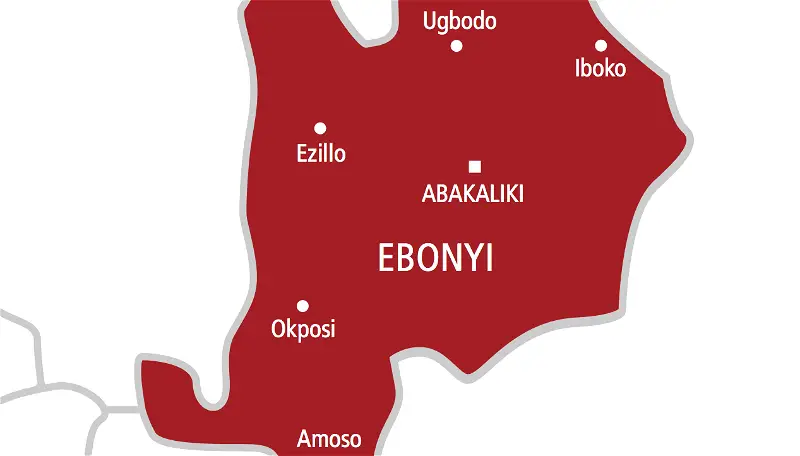

Politics / Two Commissioners In Ebonyi Exchange Blows In Public by dre11(m): 9:25pm On Apr 18 Politics / Two Commissioners In Ebonyi Exchange Blows In Public by dre11(m): 9:25pm On Apr 18 |

Two Commissioners in the present administration in Ebonyi State, were said to have publicly fought each other in a public gathering at Ezza North Local Government Area of Ebonyi State.

The two Commissioners who are said to be stakeholders in their various communities had a field day as they reportedly exchanged blows, not minding those that were watching them.

Speaking with newsmen, an eye witnessed said: “Nobody told me anything about it. I saw everything myself. I don’t know the cause of their fight but they fought and this is the 5th fight between them.

“As a leader of thought in my place, this is embarrassing to me, our people and the people of Ebonyi State. It happened during the defection of some people into APC at Ezza North. “It was a very big fight and it was not hidden.”

https://www.vanguardngr.com/2024/04/drama-as-two-commissioners-in-ebonyi-exchange-blows-in-public/ 6 Likes

|

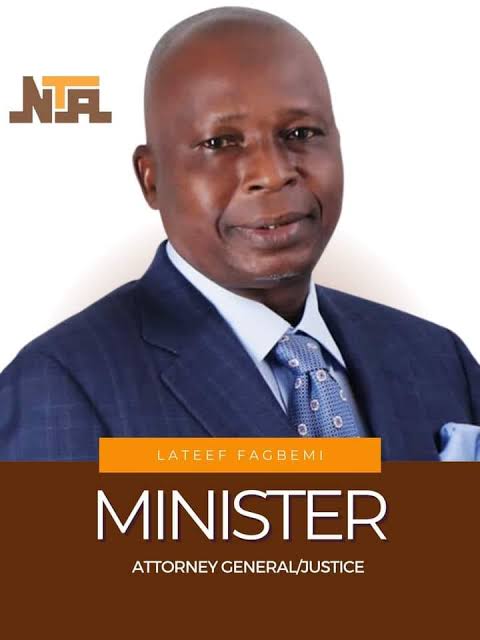

Politics / Lateef Fagbemi Tackles Governor Ododo For Helping Yahaya Bello Evade Arrest by dre11(m): 2:08pm On Apr 18 Politics / Lateef Fagbemi Tackles Governor Ododo For Helping Yahaya Bello Evade Arrest by dre11(m): 2:08pm On Apr 18 |

The Attorney General of the Federation, AGF, and Minister of Justice, Lateef Fagbemi, has faulted Governor Usman Ododo of Kogi State for obstructing the arrest of his predecessor, Yahaya Bello, by operatives of the Economic and Financial Crimes Commission, EFCC.

Fagbemi said it’s “insufferably disquieting” for Ododo to obstruct EFCC from arresting Bello.

On Wednesday, operatives of EFCC had stormed Bello’s residence in Abuja in an attempt to arrest him over an ongoing fraud investigation.

But Bello was reportedly smuggled out of his residence by Ododo to evade arrest by the anti-graft agency.

Reacting, Fagbemi said EFCC should not be obstructed from carrying out its lawful duties.

In a statement he personally signed, the AGF said: “A situation where public officials who are themselves subject of protection by law enforcement agents will set up a stratagem of obstruction to the civil and commendable efforts of the EFCC to perform its duty is to say the least, insufferably disquieting.

“A flight from the law does not resolve issues at stake but only exacerbates it.

“I state unequivocally that I stand for the rule of law and will promptly call EFCC and indeed any other agency to order when there is indication of any transgression of the fundamental rights of any Nigerian by any of the agencies but I also tenaciously hold the view that institutions of State should be allowed to function effectively and efficiently.” https://dailypost.ng/2024/04/18/nigerian-govt-tackles-gov-ododo-for-helping-yahaya-bello-evade-arrest/ 45 Likes 1 Share

|

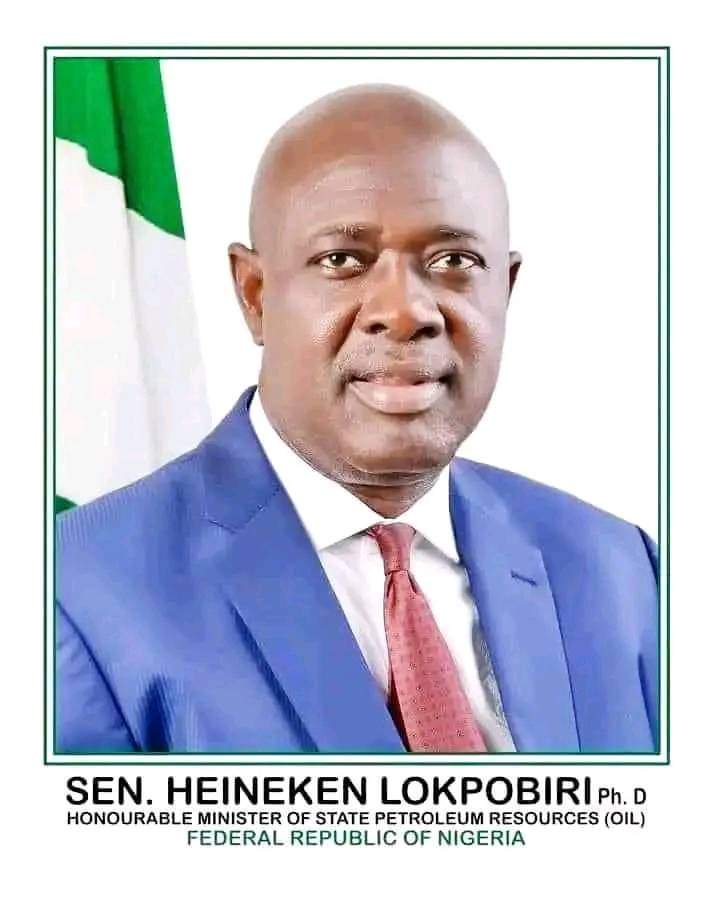

Politics / FG Counters El-rufai, Marketers’ Claims On Payment Of Petrol Subsidy by dre11(m): 10:10am On Apr 18 Politics / FG Counters El-rufai, Marketers’ Claims On Payment Of Petrol Subsidy by dre11(m): 10:10am On Apr 18 |

El-Rufai, marketers subsidy payment claims wrong – FG, NNPCThe Federal Government through its Ministry of Petroleum Resources and the Nigerian National Petroleum Company Limited have stated that the various claims by different individuals and groups on the alleged return of subsidy on Premium Motor Spirit, popularly called petrol, were wrong.

The government also challenged those who make this argument to provide evidence to justify their allegations, stressing that since President Bola Tinubu had declared the end of subsidy on petrol, the situation remains so.

The Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, stressed that fuel subsidy was a sensitive issue, but noted that the government had made its position known on the matter.

When contacted for the reaction of the Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, on the matter, his media aide, Nneamaka Okafor, provided a video clip where her boss reacted to the claims of the former Kaduna governor and marketers.

In the clip, Lokpobiri insisted that petrol subsidy had ceased to exist, and urged those who alleged that the government was still subsidising the commodity to provide evidence and facts.

The minister said, “I don’t want to delve into that issue. It is a very sensitive issue. It is better we get all the facts. As far as I’m concerned, the President removed the subsidy and it remains removed till today. Anybody who is saying that subsidy is being paid, it is left for the person to bring the facts and then we will talk about them.”

Asked whether the price being paid for petrol currently is determined by market forces, the minister replied, “It may not be determined by market forces but let us deal with the price as it is today.

“Every government has a duty to do certain things, not only in the petroleum sector but in several other sectors, to be able to cushion the effect and burden on Nigerians.”

The NNPC also said it was recovering its full cost on the petroleum products that it imports into Nigeria, and insisted that there was nothing like petrol subsidy any more. NNPC is the sole importer of petrol into Nigeria currently.

Their comments came as oil marketers backed the claim by the immediate past Governor of Kaduna State, Nasir El-Rufai, that the Federal Government had resumed the payment of subsidy on Premium Motor Spirit also called petrol.

Oil dealers also pointed out that the current cost of PMS at filling stations should be around N900/litre if there were no subsidy on the commodity.

This price, according to them, is because of the recent appreciation of the naira against the United States dollar.

The pump price of petrol is currently between N600 and N700/litre depending on the area of purchase.

El-Rufai had told journalists in Maiduguri on Monday that many citizens were not aware that the government had reintroduced the PMS subsidy.

“The Federal Government is now subsidising fuel; many people don’t know this. It is the right policy. I have always supported the withdrawal of oil subsidies; but in the course of implementing the policy, the government realised that subsidy has to be back; right now, the government is paying a lot of money for subsidy, even more than before.

“You start implementing a policy because you are sure it is the right policy, but in the course of implementation, you come across bottlenecks, and you modify.

“The keyword in leadership, in my view, is pragmatism. You should be pragmatic. So when you make a policy, you start implementing it, and it doesn’t seem to work well. You should have the humility to stand back and say this is not working, and you modify it,” the former governor stated.

Marketers back El-Rufai

Reacting to this on Wednesday, oil dealers under the aegis of the Independent Petroleum Marketers Association of Nigeria, stated that what the former governor said was not far from the truth.

They argued that the subsidy on petrol kept rising as the exchange rate of the United States dollar increased, stressing that the government spent more on the PMS subsidy at the time the dollar exchanged for about N1,500.

The marketers, however, noted that since the local currency started appreciating against the dollar, the subsidy on PMS had been on the decline.

This, according to them, is because the dollar remains the major component that influences the cost of petrol, as Nigeria imports the commodity through NNPC Ltd.

The Public Relations Officer, IPMAN, Chief Ukadike Chinedu, told our correspondent that petrol prices at the pumps should be around N900/litre.

“I’ve said before that the PMS subsidy had been returned, and the government said it was a lie. I said before that the government is subsidising PMS and it is on till this moment. I said before that what the government was doing was quasi-subsidy and that has not changed,” Ukadike stated.

When asked what would have been the landing cost of petrol at the depots and tank farms if there was no subsidy on the commodity, he replied, “Going by the steady appreciation of the naira against the dollar lately, the amount being spent as subsidy on petrol should be on the decline.

“Since the dollar is currently around N1,000, then PMS landing cost should be around N800/litre, while the cost at the pumps should be nearing N900/litre.”

No subsidy, NNPC insists

But the Chief Corporate Communications Officer, NNPC Ltd, Olufemi Soneye, insisted that the national oil firm had stopped subsidising petrol.

“We are recovering our full costs from the products we import. It is important to emphasise that the subsidy is no longer in place. Contrary to allegations, the petrol subsidy has not been reinstated,” he stated.

Before the recent claims on the return of petrol subsidy by the Federal Government, the Group Chief Executive Officer, NNPC, Mele Kyari, had told state house correspondents after an audience with the President at the Aso Rock Villa a few months ago that fuel subsidy had not been returned.

“No subsidy whatsoever. We are recovering our full cost from the products that we import. We sell to the market, and we understand why the marketers are unable to import. We hope that they do it very quickly and these are some of the interventions the government is doing. There is no subsidy,” Kyari had stated.

His reaction at the time came after the Petroleum and Natural Gas Senior Staff Association of Nigeria confirmed the return of fuel subsidy.

PENGASSAN’s National President, Festus Osifo, had said the government still subsidised petrol due to the cost of crude oil in the international market and the exchange rate.

“They (government) are paying subsidies today. In reality, today, there is a subsidy because, as of when the earlier price was determined, the price of crude in the international market was around $80 for a barrel.

“But today, it has moved to about $93/94 per barrel for Brent crude. So, because it has moved, the price (of petroleum) also needed to move. The only reason the price will not move is when you can manage your exchange rate effectively and you can pump in supply and bring down the exchange rate.

“So, if the exchange rate comes down today, we will not be paying a subsidy. But with the exchange rate value and the price of crude oil in the international market, we have introduced the subsidy,” Osifo had explained.

In his inaugural address after taking the oath of office on May 29, 2023, President Bola Tinubu announced that the Federal Government was closing the curtains over the subsidy era.

“Subsidy can no longer justify its ever-increasing costs in the wake of drying resources.

“We shall instead re-channel the funds into better investment in public infrastructure, education, health care, and jobs that will materially improve the lives of millions. Petrol subsidy is gone!” Tinubu had declared.

The President’s announcement sparked the increase in fuel price from N197 to between N480 and N570. The pump price was subsequently reviewed upward to N617/litre and now sells for between N620 and N700/litre. https://punchng.com/el-rufai-marketers-subsidy-payment-claims-wrong-fg-nnpc/?amp 2 Likes

|

Business / 10 Key Impacts To Expect From Dangote’s Diesel Price Cut To N1,000 by dre11(m): 4:56pm On Apr 17 Business / 10 Key Impacts To Expect From Dangote’s Diesel Price Cut To N1,000 by dre11(m): 4:56pm On Apr 17 |

The recent decision by the Dangote Petroleum Refinery to slash the price of diesel from N1,200 per litre to N1,000 per litre has several potential impacts on Nigeria’s domestic economy and the lives of its citizens.

Chairman of Dangote Group, Alhaji Aliko Dangote, recently said that his refinery’s capacity to sell diesel at greatly reduced prices would offer immediate relief to Nigeria’s inflation challenges.

“That can actually help to bring inflation down immediately. And I’m sure when the inflation figures are out for the next month, you see that there’s quite a lot of improvement in the inflation rate,” Dangote said.

Meanwhile, here are ten things you could expect from this price reduction:

Decrease in Transportation Costs

Diesel is a major fuel for transportation, especially for goods. The reduction in its price will likely lead to lower transportation costs for goods and services, potentially translating to lower retail prices for consumers.

Lower Inflation

A decrease in transportation and production costs can help curb inflation, as lower fuel costs can lead to reduced prices for goods and services across various industries.

Increased Purchasing Power

As inflation rates decrease and goods become more affordable, consumers may find their purchasing power increases. This can lead to higher consumption and potentially stimulate economic growth.

Positive Impact on Industries

Industries reliant on diesel, such as manufacturing, logistics, and agriculture, may experience cost savings due to the lower diesel prices. These savings can be reinvested in business growth and expansion.

Potential Market Stability

Lower diesel prices can contribute to market stability, encouraging investment and fostering a better environment for business operations in Nigeria.

Encouragement for Domestic Production

With the reduction in diesel prices, there could be increased motivation for businesses to produce goods domestically, reducing reliance on imports and boosting local industries.

Competitive Edge for Dangote

Dangote’s move to lower diesel prices may provide the company with a competitive edge over other suppliers in the market, potentially increasing its market share.

'

Better Business Profitability

Businesses in various sectors, including transportation and logistics, that use diesel as their primary fuel source may experience higher profitability due to the reduced fuel costs.

Positive Sentiment

The reduction in diesel prices could lead to positive sentiment among businesses and consumers, which could translate to increased confidence in the economy.

Improvement in Local Economy

As businesses save on diesel costs and potentially pass on savings to consumers, there may be an overall improvement in the local economy due to increased spending and investment.

These changes will likely contribute to a more stable and prosperous economic environment in Nigeria, benefiting businesses and consumers alike. https://www.vanguardngr.com/2024/04/10-key-impacts-to-expect-from-dangotes-diesel-price-cut-to-n1000/ 37 Likes 6 Shares

|

Politics / Dangote Refinery Slashes Diesel Price To N1,000 Per Litre by dre11(m): 10:26pm On Apr 16 Politics / Dangote Refinery Slashes Diesel Price To N1,000 Per Litre by dre11(m): 10:26pm On Apr 16 |

BY BUNMI ADULOJU

The Dangote refinery says it has reduced the price of automotive gas oil (AGO), also known as diesel, to N1,000 per litre.

According to a statement on Tuesday by the refinery, the price of the product was dropped from N1,200 per litre.

“In an unprecedented move, Dangote Petroleum Refinery has announced further reduction of the price of diesel to from 1200 to 1,000 naira per litre,” Dangote refinery said.

“While rolling out the products, the refinery supplied at a substantially reduced price of N1,200 per litre three weeks ago, representing over 30 per cent reduction from the previous market price of about N1,600 per litre.

“This significant reduction in the price of diesel, at Dangote Petroleum Refinery, is expected to positively affect all the spheres of the economy and ultimately reduce the high inflation rate in the country.”

The development comes days after Dangote refinery fixed the minimum volume of diesel that can be purchased by oil marketers at one million litres.

The 650,000 barrels per day (bpd) capacity refinery was inaugurated by former President Muhammadu Buhari in May 2023.

Subsequently, the plant commenced operations with the production of diesel and aviation fuel on January 12 — after receiving six shipments of crude from oil marketers. https://www.thecable.ng/dangote-refinery-slashes-diesel-price-to-n1000-per-litre/amp/Nlfpmod 1 Like |

Politics / Why PDP Has Not Sanctioned Wike – Ologbondiyan by dre11(m): 10:00pm On Apr 16 Politics / Why PDP Has Not Sanctioned Wike – Ologbondiyan by dre11(m): 10:00pm On Apr 16 |

A former National Publicity Secretary of the Peoples Democratic Party (PDP), Kola Ologbondiyan, has explained why the party is yet to take any serious action… A former National Publicity Secretary of the Peoples Democratic Party (PDP), Kola Ologbondiyan, has explained why the party is yet to take any serious action against one of its ex-presidential aspirants and current Minister of the Federal Capital Territory (FCT), Nyesom Wike.

The appointment of Wike as the FCT Minister had raised questions within the PDP, with some accusing the ex-Rivers governor of forming alliance with the All Progressives Congress (APC) under President Bola Ahmed Tinubu.

However, the PDP has yet to take any disciplinary action against Wike.

Reacting to the issue, the former PDP spokesperson, Ologbondiyan, said the party was following due process in handling the case.

He said there’s a disciplinary committee whose responsibility is to look extensively into the situation before deciding whether or not to sanction the FCT minister, adding that the party has a constitution that guides its affairs.

He said, “Let me start by saying that the constitution of the party provides for how the party should be managed. That has been clear from the onset. The responsibility of the day-to-day running of the party lies in the office of the national chairman.

“So in respect of the minister of the FCT, Nysom Wike, it’s about disciplinary action. And I can recall that under the leadership of Secondus, when the former Governor of Ebonyi State, (Dave) Umahi, started relating with the APC, a letter was written to him in form of a query and issued to him to explain to the party why he was rallying with the APC.

“So the constitution of the party provides for disciplinary measures. It’s not a mob. Somebody can’t rise from somewhere and carry wood and say ‘You are responsible for this and that.’

“So the purview of sanctioning is with the current working committee to consider your action this way or that. The party also has a disciplinary committee where matters of this nature are addressed.” https://dailytrust.com/why-pdp-has-not-sanctioned-wike-ologbondiyan/#google_vignetteNlfpmod 1 Like

|

Politics / Military Kills ISWAP Commanders, 30 Members In Fresh Operation by dre11(m): 4:25pm On Apr 16 Politics / Military Kills ISWAP Commanders, 30 Members In Fresh Operation by dre11(m): 4:25pm On Apr 16 |

Troops of the Nigerian military attached to Operation Hadin Kai in the Northeast have neutralised more terrorists’ commanders and over 30 members wreaking havocs on innocent citizens in the Lake Chad region of Borno State.

It was learnt that the air component of the operation rained airstrikes on the adversaries following the terrorists’ refusal to surrender their weapon and ammunition to the military after a series of appeal by the authority and community leaders.

No fewer than 50 tough and hardened terrorists’ commanders have been taken out by the military across all the theatres of operations, particularly in the Northwest and Northeast in the last one year.

The military high command last month declared high-profiled terrorists’ commanders including Simon Ekpa, the notorious leader of proscribed Indigenous People of Biafra, wanted over their nefarious activities.

Daily Trust reports that the senior terrorists’ commanders, who were killed during the operation that was carried out on Saturday, included Ali Dawud, Bakura Fallujah and Mallam Ari.

The spokesman of the Nigerian Air Force, Edward Gabkwet, who confirmed this to journalists in Abuja, explained that terrorists’ numerous vehicles, motorcycles and logistical assets were destroyed.

Gabkwet, an Air Vice Marshal, said the air troops executed a precision airstrike on the hideouts of ISWAP terrorists nestled within Kolleram village along the shores of Lake Chad.

According to him, the operation yielded significant success as the Battle Damage Assessment (BDA) post-strike conducted revealed the neutralisation of over 30 terrorists apart from the commanders that were taken out.

“Intelligence gathered after the airstrike further indicated that the aerial bombardment effectively obliterated a key facility within the Kolleram enclave, which served as a hub for the terrorists’ food processing activities, including grinding machines.

“The success of these airstrikes underscores NAF’s commitment to eradicating terrorism and ensuring the safety and security of Nigerian citizens. By neutralising key terrorist figures and destroying their logistical infrastructure, the operation has significantly degraded the capabilities of the ISWAP group in the region.

“These airstrikes complement the ongoing efforts of ground forces in the Lake Chad flank and represent a crucial step forward in the fight against terrorism in Nigeria,” the senior military officer told newsmen. https://dailytrust.com/military-kills-iswap-commanders-30-terrorists-in-fresh-operation/ 9 Likes 1 Share

|

Career / Fear Of Sacking Hits NDLEA, Code Of Conduct Bureau, Others by dre11(m): 12:25pm On Apr 15 Career / Fear Of Sacking Hits NDLEA, Code Of Conduct Bureau, Others by dre11(m): 12:25pm On Apr 15 |

Fear Of Sacking Hits NDLEA, Code Of Conduct Bureau, Others As President Tinubu Moves To ‘Overhaul’ AgenciesChief executives of some Nigerian government agencies including the National Drug Law Enforcement Agency (NDLEA), Nigerian Correctional Service (NCS), Code of Conduct Bureau, Public Complaints Commission, National Human Rights Commission (NHRC), and the Legal Aid Council are reportedly anxious over moves by President Bola Tinubu’s administration to overhaul the agencies.

This is part of plans for the justice sector reform, multiple sources told SaharaReporters.

It was gathered that some of them would be sacked while others would be retained or moved to other agencies.

The wave of reforms may be also extended to the Supreme Court, Courts of Appeal and High Courts.

SaharaReporters learnt that the reforms may take effect after the National Summit on Justice to be held later in the month.

The Attorney-General of the Federation (AGF) and Minister of Justice, Lateef Fagbemi (SAN) last Thursday in Abuja said President Tinubu would on April 24, 2024, declare Nigeria’s justice sector reform summit open.

According to him, the reforms were in line with the agenda of Tinubu to protect the rights of the citizens, allow access to justice and ensure speedy dispensation of justice.

Most of the heads of the agencies who suspect that they would be affected are reportedly apprehensive over the planned overhaul.

The country’s justice system is currently fraught with delays in the adjudication of cases.

Many criminal cases involving politically exposed persons like former governors and ministers linger in courts for upward of five to 10 years before they are disposed of.

Multiple sources told SaharaReporters that the government has been uncomfortable with the NDLEA, PCC, NHRC and the correctional service, which underewent reforms under the administrations of the late President Umaru Yar'Adua and ex-President Goodluck Jonathan.

One of the sources specifically identified NDLEA as one of the main agencies to be affected because it is a “strategic agency.”

“Apart from the low rate of prosecution of suspects, there was rumpus recently in the NDLEA on alleged lopsidedness in the promotion of workers, and irregularities in rank assignments and regularisation.

“There was also tension on the purported reappointment of the secretary of the NDLEA, Shadrak Usman Haruna, for a second term in office,” one of the sources said.

“Despite the rating of the performance of the NDLEA Chairman, Gen. Buba Marwa above average by stakeholders and international partners, the Tinubu administration discovered that the former Military Administrator of Lagos State appears a lone ranger.

"NDLEA bureaucracy is stinking for a meaningful war against drugs," the source in the presidency said.

But according to findings, Marwa might be given an ambassadorial appointment given his track record as a defence attache.

The likelihood of the restructuring of NDLEA has reportedly made Marwa to begin moves to save his job.

"Marwa is also battling to stay on the job, at least to complete his tenure," one of the sources said.

“Given his devotion to the Rule of Law, President Bola Ahmed Tinubu is interested in Justice Sector Reform. He was a pacesetter in Lagos, he will also reform the sector at the national level.

"The overall objective is to enhance the Rule of Law, uphold the sanctity of fundamental human rights, ensure equal access to justice and speedy dispensation of cases.

"Issues in the sector are around the judiciary, the National Drug Law Enforcement Agency (NDLEA), the Nigerian Correctional Service (NCS), the Code of Conduct Bureau, the Public Complaints Commission, the National Human Rights Commission (NHRC), and the Legal Aid Council among others.

"In fact, the low prosecution of drug suspects by NDLEA is worrisome to the government. In the 29 months of Marwa's tenure, NDLEA arrested 31, 675 drug offenders out of which 5,147 were prosecuted and convicted.

"The drug trafficking bust is increasing compared to the low number of prosecutions and convictions. NDLEA needs a drastic reform. The agency's bureaucracy is not giving adequate backup.

"There are a lot of matters coming up, including the tension over the reappointment of the agency's secretary and promotion lopsidedness.”

On the fate of Marwa, another source added, “I think he is being considered for a strategic ambassadorial appointment.

"The Justice Sector Reform is really not about individuals; it is about putting the right institutions in place to become sustainable.

"All the courts will undergo the reform too. The number of cases pending in the Supreme Court is alarming too. We need to decongestant the place."

Last week, SaharaReporters reported how some NDLEA officers raised an alarm and accused the agency of lopsidedness in the promotion of workers, and irregularities in rank assignments and regularisation.

The aggrieved officers alleged that while the names of certain officers had been released for promotion examinations, including those who were recruited at the same time with them, the names of Course 3 and 4 officers had not been included in the process.

According to them, the omission of their names in the promotion examinations list has left them deeply troubled and raises serious questions about the fairness and transparency of the promotion process.

They further accused NDLEA authorities of discriminatory practices in the recruitment and rank assignment processes.

The officer said that many officers, including Course 3 and 4 officers, who applied with degree qualifications were “unjustly” recruited as junior officers while others were short-changed with one rank each.

https://saharareporters.com/2024/04/08/officers-nigerias-anti-narcotic-agency-ndlea-allege-lopsidedness-promotion-process

Nigeria’s Attorney General last Thursday spoke on the forthcoming National Summit on Justice.

Addressing the press on one of the summit’s goals, Fagbemi said it was to “review, validate, and adopt the revised National Policy on Justice 2024 - 2028 to drive prison reforms, access to justice for the average Nigerian, as well as the review of electoral laws and procedures in handling election-related cases, among several other reforms".

He said, “This comprehensive policy document outlines a broad framework and initiatives in 17 thematic areas aimed at

reforming the justice sector to enhance its effectiveness and accessibility to all Nigerians, ensuring that justice is not just a privilege for the few, but a right for all.

“The policy aims to address various challenges within the legal framework, seeking to promote social cohesion, bolster economic development, and foster good governance.”

He added that the summit will deliberate on draft legislation proposed to address specific challenges within the justice sector, relating to the judicial appointments process, administration, funding and budgeting for the judiciary, and the elimination of delays and inefficiencies in justice delivery.

It will equally evolve ways to reduce the amount of time for adjudication of cases, eliminate some of the associated technicalities, and reduce the number of cases getting to the Supreme Court.

He said, “In this regard, we intend to look at a situation where many cases will terminate at the Court of Appeal to reduce the burden on our noble justices of the Supreme Court.

“These proposed laws are expected to serve as a catalyst for collective action and provide a guiding framework for relevant governmental institutions at both the national and sub-national levels to establish an effective, efficient, and people-centred justice system.

"The country cannot afford to remain complacent in the face of the obstacles impeding the efficient delivery of justice for all Nigerians. The Summit will present an opportunity for us to unite our efforts, leverage our collective expertise, and chart a course toward a more just and equitable society.”

Fagbemi also expressed the hope that the national summit on justice will usher in a new era of positive change and progress in the country’s justice sector, ensuring a fair, accessible, and efficient legal system that upholds the rule of law while safeguarding fundamental human rights. https://saharareporters.com/2024/04/14/exclusive-fear-sacking-hits-ndlea-code-conduct-bureau-others-president-tinubu-moves 4 Likes 1 Share

|

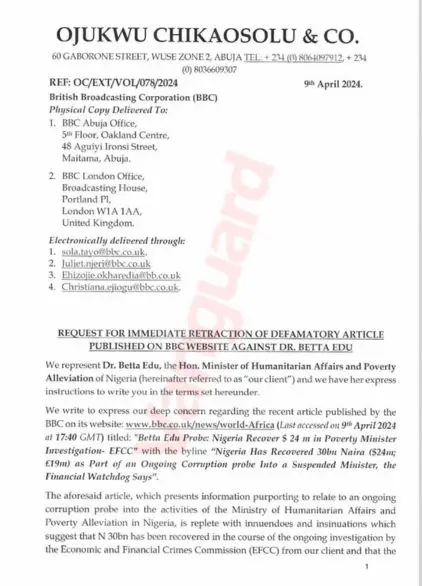

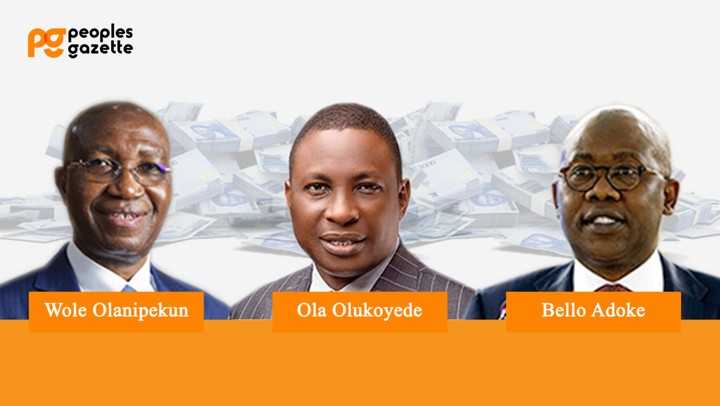

Politics / EFCC Recovers ₦32.7 Billion From Humanitarian Affairs Officials by dre11(m): 10:08pm On Apr 14 Politics / EFCC Recovers ₦32.7 Billion From Humanitarian Affairs Officials by dre11(m): 10:08pm On Apr 14 |

The Economic and Financial Crimes Commission (EFCC) on Sunday, April 14, said it has so far recovered N32.7billion and $445,000 from top officials of the the Ministry of Humanitarian Affairs, Disaster Management and Social Development.

It also said some banks implicated in the ministry’s scandal are being investigated.

It admitted that the Managing Directors of the implicated banks have made useful statements to EFCC investigators.

But the anti-graft agency said it was yet to clear any of the suspects under probe.

It said those found wanting will be prosecuted accordingly.

The EFCC, which gave the status update in a statement through its Head of Media and Publicity, Dele Oyewale, said discreet investigations by have been opened on other fraudulent dealings involving Covid -19 funds, the World Bank loan, Abacha recovered loot released to the Ministry.

The statement said: “The Economic and Financial Crimes Commission (EFCC) , has noticed the rising tide of commentaries, opinions, assumptions and insinuations concerning its progressive investigations into the alleged financial misappropriation in the Ministry of Humanitarian Affairs, Disaster Management and Social Development.

“At the outset of investigations, past and suspended officials of the Humanitarian Ministry were invited by the commission and investigations into the alleged fraud involving them have yielded the recovery of N32.7billion and $445,000 so far.”

The EFCC said it has opened investigations into more activities of the Ministry.

The statement added: ” Discreet investigations by the EFCC have opened other fraudulent dealings involving Covid -19 funds, the World Bank loan, Abacha recovered loot released to the Ministry by the Federal Government to execute its poverty alleviation mandate.

” Investigations have also linked several interdicted and suspended officials of the Ministry to the alleged financial malfeasance.”

On the involvement of banks, the EFCC said some Managing Directors of such institutions have been interrogated.

The statement said: “It is instructive to stress that the commission’s investigations are not about individuals. The EFCC is investigating a system and intricate web of fraudulent practices.

“Banks involved in the alleged fraud are being investigated.

“Managing Directors of the indicted banks have made useful statements to investigators digging into the infractions. Those found wanting will be prosecuted accordingly.”

But the EFCC clarified that it was yet to clear anyone implicated in the fraudulent deals under investigation.