Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 10:24pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 10:24pm On Jan 22 |

Streetinvestor2:

Two things are involved by one comedian

1 security reasons

2 Audio life as we say on this forum

Use your tongue to count your teeth....na watin dey teach me for street oh,lol

You are definitely correct |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 9:53pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 9:53pm On Jan 22 |

emmanuelewumi:

Money Market Fund, cash and fixed income are also liquid, I guess his networth was tied to market value of his highly speculative stock positions

I shared the story of the guy whose N30 million portfolio turned to N2.5 million at a time when Naira to dollar was about N120.

If he diversified into cash, real estate, personal business and other cash producing assets he would not have been badly hit.

Someone said networth is a lousy metric and cash flow is far better. I guess that contributed to why Warren Buffett is the longest member of the Forbes list. Being there for decades.

Networth fuels the ego, cash flow fuels the yatch, jet and living expenses Words on marbles 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 9:35pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 9:35pm On Jan 22 |

essentialone:

If this was a Facebook group, or Whatsapp group, would you been as active as you are here? NEVER... I hate disclosing my identity to people 3 Likes |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:27pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:27pm On Jan 22 |

But the market didn't do badly today sha... We all know we are approaching month-end and results will soon start shooting in...

We hope for the best but all newbies be careful with rushing into any recommendation by ANYONE 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:25pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:25pm On Jan 22 |

veecovee:

Hmmm !! agba case senior me oo I guess Agba is a polygamist  |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:24pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:24pm On Jan 22 |

Agbalowomeri:

Market is never rational

The market is long overstretched

February/March is poised for the bears

Enjoy the game

Softly na |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:21pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:21pm On Jan 22 |

KarlTom:

One thing i admire about you.

Your analyses show you are an excellent judge of the market...

She is honest and clean |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:20pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:20pm On Jan 22 |

Agbalowomeri:

My position is still in dollars since mid last year Wish I listened to my in-law's advise on this... I was told when naira was 500+/$ to convert all my naira to USD... I declined BUT Thanks to JESUS for crypto |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:55pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:55pm On Jan 22 |

Zagee:

Hahaha. I come in peace oh!

Let us know who cannot survive again oh!!  You eh  1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:51pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:51pm On Jan 22 |

Agbalowomeri:

That's a very expensive joke

Nor try am again Lol Agba abeg no vex ooooo... I announced it here this moniker was banned that the babe moniker will act until MEGA is unbanned ooooo Ask Mercy and others ooooo... Na you go dey confused without reading messages  |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:36pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:36pm On Jan 22 |

yMcy56:

That's how the b.o.t. misbehaves sometimes.......it's not peculiar to only you.

Agba no dey take eye see babes.

He needs to go for deliverance session with Pastor Vee....  PASTOR VEE abeg help out  1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:28pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:28pm On Jan 22 |

yMcy56:

Dey don unban you

Agba think say he don see fine babe....

I dey o.

Not much update to give today.......was just observing the market for the most part.

But from the look of things, there's some kind of resistance by quite some stocks despite the profit taking in them. Some kind of defence ongoing in-between.......

Upward movement observed in some, some tradedat day's high and few on full bid...

Billions still spent on the likes of Transcorp, ACCESS, DANGCEM and maybe few others....

We see how tomorrow goes again.....God willing I was unbanned not long ago... I don't even know MEGA'S offence to the BOT I was just laughing at AGBA, E don see fine babe  |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:13pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:13pm On Jan 22 |

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 6:17pm On Jan 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 6:17pm On Jan 22 |

|

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:55am On Jan 19 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:55am On Jan 19 |

1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:53am On Jan 19 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 8:53am On Jan 19 |

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 11:31pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 11:31pm On Jan 18 |

phantom:

Abeg how much is international breweries now? I sank 100k into the its IPO at 0.87k in 2008 even though my shares eventually appeared less than what I should have gotten.

What is the website for checking your shares and amounts? I've totally forgotten. IB is #6+... You can check with the app/web of your broker 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 11:30pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 11:30pm On Jan 18 |

Papamrs:

Which app can one use to buy Nigeria shares

Do you have a CSCS account? |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 10:48pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 10:48pm On Jan 18 |

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 10:45pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 10:45pm On Jan 18 |

Kreos44:

The next step is to apply to NGX for delisting. I think someone said payment will now be within 10 business days from when trading in it is suspended.

Sometimes all these bureaucracy dey tire person. Something they suppose ask us "se e fowosi abi e o fowosi? and all of us will chorus "a fowosi o" next day make dem pay us. All these rakatia is not necessary. They are following due process sha just that I thought it shouldn't take this long |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 9:30pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 9:30pm On Jan 18 |

Idrismusty97:

Who read the news that Eternal Plc will be the sole distributor of Dagote petroleum? I am thinking of putting small thing in Eternal shares by month end but needs your expert opinions. Thanks all. Sole ke? Na one of the several distributors... The queues for their stock go soon end sha The main BULL for ETERNA dey come nobi now sef |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 9:27pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 9:27pm On Jan 18 |

Zagee:

They say they want $1trillion economy, so therefore, power sector must be efficient. MOFI has already taken over of FG stake in DISCOs. It is not business as usual. More Disco boards will be dissolved if they don't sit up. I love this |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:03pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 7:03pm On Jan 18 |

Zagee:

Just for stats:

"Investors on the NGX made N11 trillion last year. Investors in 🇳🇬 stock market made N10 trillion this month"

COPIED This is getting serious ooooooo... More monies getting into this market as THE BLACK... guys don show face with huge moneybags |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 5:42pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 5:42pm On Jan 18 |

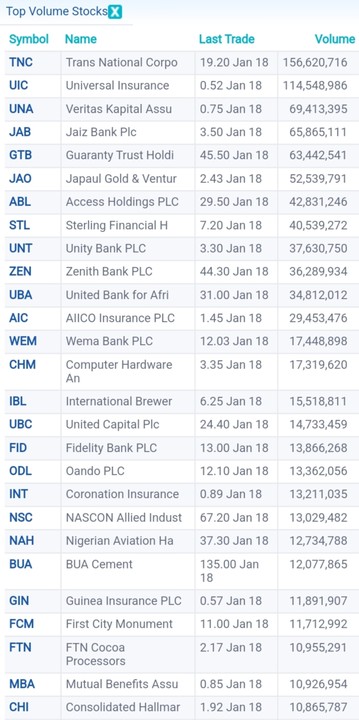

Today's Top trades... 18th January, 2024

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 3:02pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 3:02pm On Jan 18 |

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:40pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:40pm On Jan 18 |

lasisi:

What a finish today by NAHCO! It was in the red almost all day and few minutes to close of market "BOOM" - brought close to maximum gain. Any News? CHAI |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:37pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:37pm On Jan 18 |

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:36pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:36pm On Jan 18 |

To whom it concerns... NB is undervalued... This isn't their real value...

Time and bull go justify this statement...

DD pls

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:22pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:22pm On Jan 18 |

yMcy56:

Renewed interest in NASCON...

The kind fund wey dey enter TRANSCORP ehnn

N2.9bn so far....

PZ...some Cross Deals @39.20! That PZ is surprising sha |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:21pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:21pm On Jan 18 |

KarlTom:

The company stated the reasons (FX)...

That's true... They are going into DRY GIN, sachets bitters etc 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:19pm On Jan 18 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by megawealth01: 2:19pm On Jan 18 |

yMcy56:

Renewed interest in NASCON...

The kind fund wey dey enter TRANSCORP ehnn

N2.9bn so far.... PATIENCE is GOLDEN... Imagine those that bought the IPO at #7 or so... They have all made extremely crazy gains |