Treasury Bills In Nigeria - Investment (2157) - Nairaland

Nairaland Forum / Nairaland / General / Investment / Treasury Bills In Nigeria (4434468 Views)

Fixed Deposits Or Treasury Bills, Which Is Better? / Fixed Deposit And Treasury Bill Investments From Abroad / I Need Information On Treasury Bills In Nigeria (2) (3) (4)

(1) (2) (3) ... (2154) (2155) (2156) (2157) (2158) (2159) (2160) ... (2228) (Reply) (Go Down)

| Re: Treasury Bills In Nigeria by eniorisha(m): 8:04pm On Sep 14, 2023 |

Pls what is the current average TB Secondary market for a tenor around 365 days? Any one who ask about or did one lately? |

| Re: Treasury Bills In Nigeria by skydiver01: 5:24am On Sep 15, 2023 |

The last TBill auction was two days ago (13 Sept 2023). The next one is expected in two weeks (27 Sept 2023) as shown in the 4th quarter schedule below. cutedharmee: 2 Likes

|

| Re: Treasury Bills In Nigeria by Foodempire: 6:46am On Sep 15, 2023 |

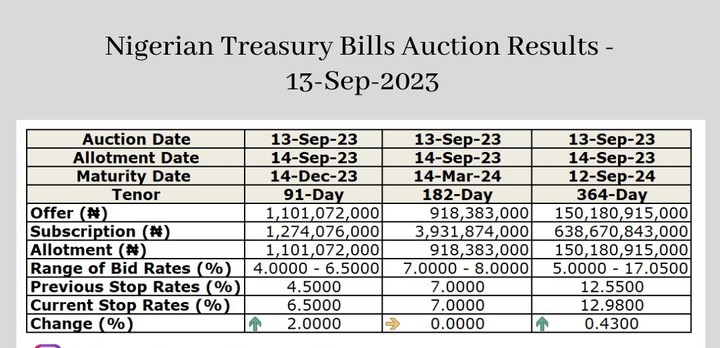

Treasury bills results 2 Likes

|

| Re: Treasury Bills In Nigeria by lalalista: 10:04am On Sep 15, 2023 |

Treasury bills is now trash. Why should I invest to earn 7% per annum when I have a bank that gives me 15% in 6months in fixed deposit 1 Like |

| Re: Treasury Bills In Nigeria by enque(f): 10:13am On Sep 15, 2023 |

lalalista: what bank is that please? 1 Like |

| Re: Treasury Bills In Nigeria by oluayebenz: 10:14am On Sep 15, 2023 |

lalalista: Which bank gives 15% abeg? |

| Re: Treasury Bills In Nigeria by freeman67: 10:19am On Sep 15, 2023 |

lalalista: Just make sure it's a commercial bank and not microfinance bank sha... So they won't be stories that touch. I have been out of TB for a while too. I have Concentrated more on CP even though it's riskier. |

| Re: Treasury Bills In Nigeria by lalalista: 10:42am On Sep 15, 2023 |

freeman67:it's a microfinance bank that's insured by ndic. What's wrong with a microfinance bank? |

| Re: Treasury Bills In Nigeria by DonFreshmoney(m): 10:48am On Sep 15, 2023 |

Foodempire: If one has 50 million to invest in Tbills.. plz calculate the 3 month, 6 month and 1 year yield payment using this interest.. I want to check something Who can assist with this plz? Finance gurus in the house |

| Re: Treasury Bills In Nigeria by richforever123: 11:24am On Sep 15, 2023 |

lalalista: NDIC will give you 500,000 if the bank goes bust, Microfinance Banks are a lot more riskier, If the money is huge you are better investing with a SEC regulated firm 3 Likes |

| Re: Treasury Bills In Nigeria by lalalista: 12:18pm On Sep 15, 2023 |

richforever123:please which firms are regulated by sec? |

| Re: Treasury Bills In Nigeria by lalalista: 12:21pm On Sep 15, 2023 |

richforever123:what if the bank is licensed by central bank? |

| Re: Treasury Bills In Nigeria by eniorisha(m): 12:34pm On Sep 15, 2023 |

Pls, we need more up-to-date info about NTB. Not everyone has d bigger capital & high risk appetite for more rewarding investments |

| Re: Treasury Bills In Nigeria by creategist: 1:25pm On Sep 15, 2023 |

lalalista: You can search for SEC-registered firms using the link below: https://sec.gov.ng/cmos/ 1 Like |

| Re: Treasury Bills In Nigeria by freeman67: 2:07pm On Sep 15, 2023 |

lalalista: Forget that NDIC insurance first. Even for commercial bank it's just about 500k that it covers in case of eventuality. However, since the recapitalisation of the commercial banks during Soludo's era they are now well structured with assets and customers bases that will make them to not just liquidate or vanish existence incase of distress like microfinance banks. The worst that can happen to a commercial bank now is either it is acquired, merged or taken over by Assets Management Cooperation of Nigeria (AMCON). it's only the shareholders that will bear the brunt not customers or people that invested through the bank. Also, the CBN has its eyes more on the commercial banks than the microfinance. I assume their regulation on microfinance banks to be weak. Since that recapitalisation, a lot of microfinance banks have come and gone. Others are barely existing. If you invest a substantial amount with them, stories might come up when it matures. Majority of the commercial banks are publicly listed on stock exchange. They are also usually in some sort of securities dealings. This double or tipple the regulation on them; meaning aside CBN'S regulation, they are also regulated by Securities and exchange commission and their books/ reports are opened to public scrutiny. 2 Likes |

| Re: Treasury Bills In Nigeria by RayRay06677(m): 2:34pm On Sep 15, 2023 |

freeman67: Please what are the risk associated with CP? |

| Re: Treasury Bills In Nigeria by freeman67: 3:44pm On Sep 15, 2023 |

RayRay06677: Though Commercial paper is a senior (unsecured) debt which a company would consider repaying before going out of business if it had to. There is a risk of default even while the business is a going concern, the issuer may not have generated enough fund to settle the investor as and when due. There could also be liquidity issue. If you want to put it up for sale or recoup your funds before it matures. Some company could als not be attractive to prospective buy if you put up for sale. The acceptability is not as wide but of course, the return is most time higher than what the TB offer. While TB is backed by the full faith of FGN and can also be easily liquidated especially when rates are good. Sometimes the same bank or investment house through which you invested can just add your investment to their pool and pay you if you want to liquidate. |

| Re: Treasury Bills In Nigeria by lalalista: 4:07pm On Sep 15, 2023 |

freeman67: |

| Re: Treasury Bills In Nigeria by Adinije(f): 4:22pm On Sep 15, 2023 |

How long does it take to get debited for T-bills pls. Stanbic hasn't debited for Sep 13th auction. |

| Re: Treasury Bills In Nigeria by freeman67: 4:45pm On Sep 15, 2023 |

Adinije: Contact them to confirm if their/your bid was successful. |

| Re: Treasury Bills In Nigeria by Adinije(f): 4:46pm On Sep 15, 2023 |

freeman67:Do you have their CS number pls |

| Re: Treasury Bills In Nigeria by freeman67: 5:08pm On Sep 15, 2023 |

| Re: Treasury Bills In Nigeria by otomatic(m): 6:41am On Sep 16, 2023 |

richforever123: 200K for MFB |

| Re: Treasury Bills In Nigeria by jedisco(m): 8:27am On Sep 16, 2023 |

Oyindamolah: It was the locale I was familiar with. Ongoing violence has rendered many parts of suburban Northern states (which traditionally saw the fastest growth) unlivable even for locals. The reverse hs been the case in some parts of the South where folks relocating has pushed up house price. Overall, Abuja seems to be a safe bet. Relatively safe, more liquidity, rapidly expanding, fair infrastructure, easier to verify the authenticity and less issues with locals compared to elsewhere. 1 Like |

| Re: Treasury Bills In Nigeria by jedisco(m): 8:47am On Sep 16, 2023 |

maishai: Your land or property can be knocked down at the whim of some big man even if you have all legitimate papers. It's the risk to bear for having weak property laws and a weak judiciary. Not defending hooligans but one can factor that cost into sales... 3-10%/ flat rate e.t.c for estate fees, local chiefs e.t.c. Your price of sale is guided by market forces. Mostly, they'd even want you to sell for a higher price so their cut is larger from both you and buyer. |

| Re: Treasury Bills In Nigeria by emmasoft(m): 11:32am On Sep 16, 2023 |

Want dollar mutual fund investment without Dollar? Norrenberger is the answer Get in touch for a SEC regulated firm to use. |

| Re: Treasury Bills In Nigeria by freeman67: 2:41pm On Sep 16, 2023 |

emmasoft: If I want to get back my investment proceeds in what currency will it be remitted? |

| Re: Treasury Bills In Nigeria by emmasoft(m): 2:58pm On Sep 16, 2023 |

freeman67: It's in dollars. The conversion from naira to dollar is only at d point of investment. The operations, returns, redemption or liquidation is in dollars. Kindly let me know anytime you key in so that the inflow can be booked for me. Thank you. |

| Re: Treasury Bills In Nigeria by Plus10(m): 3:31pm On Sep 16, 2023 |

emmasoft:What will be their charge if one wants to withdraw/liquidation his or her investment? |

| Re: Treasury Bills In Nigeria by ibechris(m): 4:06pm On Sep 16, 2023 |

Plus10: Intelligent question. |

| Re: Treasury Bills In Nigeria by emmasoft(m): 6:38pm On Sep 16, 2023 |

Plus10: Norrenberger Dollar Fund NDF is a normal mutual fund. You are only charged or pay penalty if you wish to redeem your fund less than the witholding period of 90 days otherwise no charge. |

| Re: Treasury Bills In Nigeria by Oyindamolah: 9:16pm On Sep 16, 2023 |

jedisco:Thank you 2 Likes |

(1) (2) (3) ... (2154) (2155) (2156) (2157) (2158) (2159) (2160) ... (2228) (Reply)

Nigerian Stock Exchange Market Pick Alerts

Viewing this topic: 1 guest(s)

(Go Up)

| Sections: politics (1) business autos (1) jobs (1) career education (1) romance computers phones travel sports fashion health religion celebs tv-movies music-radio literature webmasters programming techmarket Links: (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Nairaland - Copyright © 2005 - 2024 Oluwaseun Osewa. All rights reserved. See How To Advertise. 45 |