| Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by Islie: 8:28am On Jun 26, 2023 |

The recent devaluation of the naira against the United States dollar has sparked conversation on the urgency around the need to raise the capital base of commercial banks in the country, Daily Trust reports.

Some analysts have argued that the 2004 banking industry recapitalization, which increased banks’ capital base from N2 billion to the current N25 billion, had weakened.

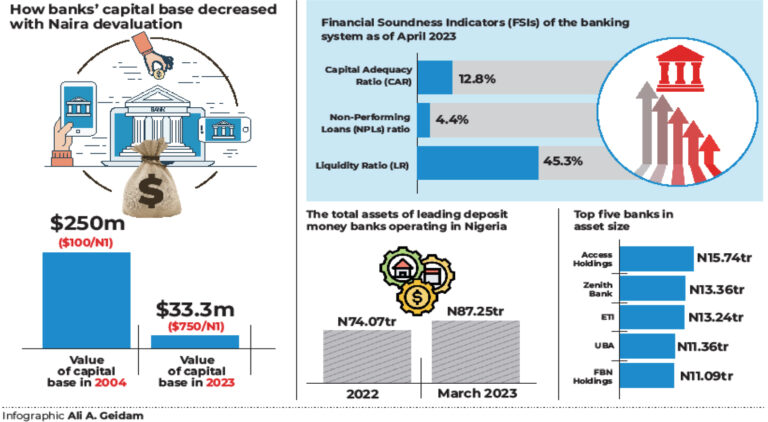

Analysis by this newspaper shows that N25 billion in 2004 exchange rate, which was about N100 saw the banks’ capital base in dollar terms average $250 million.

Today, if we relate N25 billion at N750, it is substantially lower to just $33.3 million.

Capital adequacy ratio is one of the important concepts in banking, which measures the amount of a bank’s capital in relation to the amount of its risk weighted credit exposures.

The last monetary policy committee of the CBN held in May, 2023, had noted the sustained stability in the banking system, evidenced by the performance of the Financial Soundness Indicators (FSIs).

It disclosed that the Capital Adequacy Ratio (CAR) of the banking system stood at 12.8 per cent, Non-Performing Loans (NPLs) ratio at 4.4 per cent and Liquidity Ratio (LR) at 45.3 per cent, as of April 2023.

Effort to get the reaction of the CBN was not successful as the spokesman of the apex bank, Dr Abdulmumin Isa, was said to be in a meeting. The essence was to find out whether they are planning to do recapitalization anytime soon, and what do they think about the concerns being expressed about the banks’ capital base after massive naira depreciation from N100/$ in 2004 to N770/$ today.

Why recapitalisation is necessary

Speaking on recapitalisation, Musa Wapahyal Balla, a Compliance Officer working in a Tier 2 bank in his analysis said Nigerian banks and firms will lose valuation.

According to him, since valuation is done at FX rates, the perception of the strength of most organisations will decline marginally.

Balla said: “Should the current FX rate float at the current rate for long, we should expect recapitalisation of banks, insurance companies and other financial organisations.

“Recall that minimum capital requirement for commercial banks is N25 billion; the naira has depreciated five times since then, the apex bank- CBN may need to recapitalise banks to strengthen the banking industry and financial industry at large.

“My personal prediction for capitalisation is N100 billion. We might see more mergers and acquisitions, especially in Tier 2 and 3 segments, which could lead to loss of jobs,” he said.

Former Economist and Head, Investor Relations at UBA Plc, Abiola Rasaq said recapitalisation should be looked at from the perspective of necessity.

He said based on the most recent reliable estimate from the CBN, the capital adequacy ratio of the overall banking system stood at 13.7% as of February 2023, a couple of months before the liberalisation of the FX market, which has resulted into almost 50 per cent depreciation of the naira in the official market, that the Investors and Exporters window.

He said: “About 40% of Nigerian banks’ loans are in foreign currency and these loans are translated into naira using the official exchange rate.

“A back of the envelope analysis suggests that the banking sector risk weighted assets should have increased by over 20 per cent, which would shave off some 300 basis points off the capital adequacy ratio of 13.7 per cent, thus we may be seeing capital adequacy ratio sitting below 11 per cent at the moment.

“Whilst that is not so bad, especially considering the fact that most banks also have positive net exposure to foreign currency and would be booking some decent gains on the back of the naira depreciation as FX revaluation gain.”

He said most banks would moderate dividend pay-out ratios, notwithstanding the expected growth in profitability.

“So, when we take a balanced view of these issues, the sector would remain stable and not in a bad position,” he said.

Abiola said every regulator would want banks to have good capital buffers to ensure sustainability of the sector and that makes a strong argument for banking sector recapitalisation, especially as a substantive CBN governor is expected to be announced on or before mid-August to give clarity on the leadership of the apex bank and align policy orientations.

“Again, as the new government sets the stage for audacious reforms across multiple sectors, it would be essential for banks to have strong capital ratios that can support credit expansion in the economy.

“So, expectedly, banking sector recapitalisation is likely to be on the plate of the new CBN governor to ensure the sector is able to effectively fund economic growth, going forward,” he said.

Speaking in a similar vein, Ayokunle Olubunmi, head of banking, Augusto & Co, a Pan-African Credit Rating Agency and a leading provider of industry research and knowledge in Nigeria, said the ongoing liberalisation of the FX market is something that everybody expected.

“The industry and analysts have been expecting that there would be some devaluation, especially given the position of the three leading candidates in the last election,” he said.

He argued that all the banks were already prepared for this, saying, “They have been trying to do their scenario analysis, to see where they would be if we have a devaluation. Some have a simulation, a capital base with a devaluation up to N1000/$.”

Olubunmi said various banks have been engaging in different capital raising exercises in the form of tier 1, tier 2 or At1 and some are doing the right issue.

“Wema just finished. TAJ Bank, FCMB and Fidelity bank did it. If you check the capital of most banks, some are 3 times or even 10 times more than the regulatory minimum.

“There are about 3 to 5 banks that are looking at completing their capital raise before the end of the year.”

He said to shore up their Tier 1 capital, banks were allowed to raise a special class of bonds known as AT1 bonds from investors.

According to him, AT1 bonds, like other bonds, pay regular interest. But they do not have a maturity date, as they are a permanent part of the bank’s capital, akin to equity.

However, he said, there are some banks that even before now are already having capital issues.

“Some of them have negative shareholders’ funds. So, they are struggling. If you look at the industry capital, it is the struggling banks that are dragging the others.”

He said a lot will depend on the incoming CBN governor.

“There were times that no sitting CBN governor would allow a capital below the regulatory minimum not to talk about banks having negative capital. With the last CBN governor, you will notice that not one, not two banks had negative capital, so a lot will depend on the approach of the new CBN governor,” he said.

‘Not comfortable with regulatory induced recapitalisation’

An economist and professor of capital market, Prof Uche Uwaleke, however, kicked against what he described as “A recapitalisation compelled by the apex bank.”

He said: “I won’t advise any regulatory induced recapitalisation of banks on the back of the deep naira devaluation occasioned by exchange rates unification.”

Professor Uwaleke said there are other workable options. “Deposit Money Banks can be encouraged to recapitalise either by way of mergers and acquisition or via the stock market,” he said.

“The CBN can use incentives in this regard given that a stronger capital base for banks in dollar terms will put them in a better position to attract foreign capital as well as improve their IT infrastructure and compete in the global scene.”

He said the argument for banks recapitalisation is like saying the country’s GDP should be rebased simply because of the naira devaluation, adding that this will be a weak ground to do so.

He said: “Let the current tiered structure of banks remain. Banks that wish to play in the big league will have no choice but to shore up their capital base.

“But it should not be forced on them in the spirit of a more liberalised financial system, which the naira float signifies. Doing otherwise would mean the apex bank does not expect any significant appreciation of the naira even in the medium to long term.”

Daily Trust reports that the conversation around recapitalisation is not new as the now suspended CBN governor, Godwin Emefiele had at a time disclosed that the CBN would embark on a programme that would lead to the recapitalisation of the banking industry.

Emefiele who stated this in June 2019, while unveiling the five-year plan of the apex bank, said the objective was to position Nigerian banks among the top 500 in the world.

“We will continue to improve our on-site and off-site supervision of all financial institutions while leveraging on data analytics and our in-house experts across different sectors to improve our ability to identify potential risks to the financial system as well as risks to individual banks.

“In the next five years, we intend to pursue a programme of recapitalising the Nigerian banking industry so as to position Nigerian banks among the top 500 in the world.

“Banks will, therefore, be required to maintain a high level of capital as well as liquid assets in order to reduce the impact of an economic crisis on the financial system…,” he had said.

State of Nigerian banks’ assets

The total assets of leading deposit money banks operating in Nigeria rose to N87.25 trillion ($116billion at NN750/$) in the first quarter ended March 31, 2023, up by 17.8 per cent from N74.07 trillion in the corresponding period in 2022.

The banks are Zenith Bank Plc, Access Holdings Plc, United Bank for Africa (UBA) Plc, Guaranty Trust Holding Company (GTCo) Plc, FBN Holdings Plc, Fidelity Bank Plc, Unity Bank Plc and Union Bank of Nigeria (UBN) Plc. Others are Stanbic IBTC Holdings Plc, Ecobank Transnational Incorporated (ETI) Plc, FCMB Group and Wema Bank Plc.

On the top five in the category, Access Holdings Plc emerged the biggest bank in asset size as its total assets for the period stood at N15.74 trillion, followed by Zenith Bank Plc with N13.36 trillion assets size. ETI placed third with N13.24 trillion,UBA and FBN Holdings Plc emerged fourth and fifth with N11.36 trillion and N11.09 trillion respectively.

In comparison, assets of Standard Bank Group, the leading banking service provider in South Africa in terms of assets in 2022, reached around 170.9 billion U.S. dollars. FirstRand and Absa Bank followed, with assets of around 98.8 billion and 84.7 billion U.S. dollars, respectively.

Daily Trust recalled that after the CBN’s recapitalisation of banks in 2004, the number of banks reduced to 24 from 89.

Capital base eroded by $4.5bn since 2005- CBN Source

A senior management source at the CBN who prefers not to be quoted said: “I can tell you that recapitalisation has been very much on the table and even the commercial banks know this.

“Due to the current value of the national currency, the value of the capital base of each commercial bank has been reduced by $216m from the $250m it was after recapitalisation in 2005.

“If you do your math, based on the number of deposit money banks, which stands at 21, the total value of the capital base may have been eroded by about $4.5bn.

“So, yes, the apex bank has been looking at the modalities and framework for some time now because clearly, it has become imperative,” he said. https://dailytrust.com/naira-devaluation-nigerian-banks-heading-for-recapitalisation/ 4 Likes 1 Share

|

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by TemplarLandry: 8:30am On Jun 26, 2023 |

|

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by SoftP(m): 10:41am On Jun 26, 2023 |

Long epistle of St. Paul 94 Likes 7 Shares

|

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by b0rn2fuck(m): 10:41am On Jun 26, 2023 |

Hunger in the Land , it should lead to success, I know some Anti-Tinubu will want to make the job difficult but Tinubu shall succeed, that's is why he is called JAGABAN.

Modify, I love Tinubu before joining the obedient screw, now that Tinubu has entered, I am with the moving train 14 Likes 5 Shares |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by mixta14: 10:41am On Jun 26, 2023 |

It is well 2 Likes

|

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by Nobody: 10:41am On Jun 26, 2023 |

Buhari chastised Nigerians with whip, Tinubu Will chastise them with a scorpion,at the end,all the senseless tribalism will end and people will gain sense . 87 Likes 3 Shares |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by SalamRushdie: 10:41am On Jun 26, 2023 |

Tinubu has set himself up for failure , after the new electricity tarriff I don't see how he can recover again 42 Likes 3 Shares |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by BrownSugq: 10:42am On Jun 26, 2023 |

Lol

Una go suffer shaa 8 Likes |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by BigBlackPreek(m): 10:42am On Jun 26, 2023 |

He's capable to the task

On his mandate I stand,

Ashiwaju Jagaban 5 Likes |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by lavylilly: 10:42am On Jun 26, 2023 |

If you have money leave Nigeria 81 Likes 9 Shares |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by manuelcc(m): 10:43am On Jun 26, 2023 |

Hmm |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by mcmurphy132(m): 10:43am On Jun 26, 2023 |

Who get Time to dey read this long episode.

Abeg anybody to brief am for me 21 Likes |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by iyke2frankeze: 10:43am On Jun 26, 2023 |

They said Tinubu raised the value of the Naira. Upon using our foreign reserve to defend the Naira under short period of time under Tinubu, the Naira is still going down. 16 Likes 3 Shares |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by emmadejust(m): 10:44am On Jun 26, 2023 |

Be equipped

Be determined

Be focus

This rides is gonna be more interesting & bombay 1 Like |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by ManWater: 10:44am On Jun 26, 2023 |

|

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by tobenuel(m): 10:44am On Jun 26, 2023 |

Abeg an analyst should summarize it for us |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by bigdammyj: 10:44am On Jun 26, 2023 |

Noted. |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by Klington: 10:44am On Jun 26, 2023 |

By time this baba lagbaja is done destroying the tiny rope holding this country's economy together, everyone will understand that there's a huge difference btw six and half a dozen. 19 Likes

|

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by onez: 10:44am On Jun 26, 2023 |

A |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by specialmati(m): 10:44am On Jun 26, 2023 |

19 Likes 2 Shares |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by adioolayi(m): 10:44am On Jun 26, 2023 |

Make Banks also solve their own wahala and leave me out of this.. I get my own headaches I dey nurse.. And please, they shouldn't put their wahala of looking for capital on my #2535 in my accounts with their frivolous charges... Olopa ma ko everybody ni     2 Likes |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by gentposh: 10:45am On Jun 26, 2023 |

Anything to move our naija forward |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by Beverlyjean(f): 10:45am On Jun 26, 2023 |

More job losses .... increase in fraud and prostitution... APC is the devil's party , while Buhari and Tinubu are the party demons...and their supporters are the evil defenders and enforcers 26 Likes 4 Shares |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by PediakAuthor: 10:45am On Jun 26, 2023 |

Gross Intercontinental Best Performing Currency (GIBPC) index is an accurate benchmark to measure the appreciation or depreciation status of Naira in every 24 hours (This same Chess Intelligence formula applies for other currencies).

A fiscal report by ACS-Web-X x-Tokk, between 24/06/23 - 25/06/23 points that the Cumulative Intercontinental Purchasing Power Parity (CIPPP) index of Naira gains +0.000015 strength at the Intercontinental Market.

Watch out for more inventional theories by #AppliedChessScience. 1 Like 1 Share

|

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by viodemus: 10:46am On Jun 26, 2023 |

when the foundation is very weak, the building on top of it, will be temporary.

Nigeria is a mentally lazy country, easy way out is the norm, and un-wise Bola aka the greedy fraudulent stealibu is a true definition of it. We all hoped that we will be consciously shedding ourself from that mindset, then the chief of advanced criminality showed up.

What are we doing? what are younger Nigerians, say from 20 and below learning? we are continuously etching criminality in to their mindset. May God, help us all. 6 Likes |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by Godstiger(m): 10:47am On Jun 26, 2023 |

The long thing we have been in for ages seems to have no end |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by OgbanjeProphet: 10:47am On Jun 26, 2023 |

Tinubu's government will do wonders! |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by Menclothing: 10:48am On Jun 26, 2023 |

Most bank have spent customers money it’s needed

Make it 50b |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by Nobody: 10:48am On Jun 26, 2023 |

b0rn2fuck:

Hunger in the Land , it should lead to success, I know some Anti-Tinubu will want to make the job difficult but Tinubu shall succeed, that's is why he is called JAGABAN. Your sn speaks volumes. You absolutely know nothing more. Just air on the internet, assume what you like, then go back to hiding, Then later apply for international passport to leave the country, possibly claim citizenship of Canada and blame the country for its folly in the near future, in the real sense, you and the rest of your kind are the root cause of the downfall of your country. **Spits Don't worry, you will learn, I just do not pray you learn in a very hard way. But as for learning, accept it, it wont be long. 10 Likes 1 Share |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by Randal: 10:48am On Jun 26, 2023 |

Good |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by Godstiger(m): 10:48am On Jun 26, 2023 |

mcmurphy132:

Who get Time to dey read this long episode.

Abeg anybody to brief am for me Well in summary,prepare for next level pro max 2 Likes |

| Re: Naira Devaluation: Nigerian Banks Heading For ‘recapitalisation’ by Steinmann: 10:49am On Jun 26, 2023 |

#DAY29(STOLEN MANDATE)

PRAYER:May the Good lord grant us justice at the tribunal .

Amen 8 Likes |

celebration everywhere, if you are not celebrating na you sabi. if you are not earning in dollars you are wrong. now i see why many youths are into yahoo yahoo. imagine hitting 20000 dollar now omo .APC came to steal,kill and destroy

celebration everywhere, if you are not celebrating na you sabi. if you are not earning in dollars you are wrong. now i see why many youths are into yahoo yahoo. imagine hitting 20000 dollar now omo .APC came to steal,kill and destroy