| Foreign Debt: Let Borrowing Binge Stop - Punch by NadiaR(m): 2:31am On Jul 22, 2020 |

THE country is sinking deeper into the debt peonage. The Lagos Chamber of Commerce and Industry recently joined other observers to highlight this, deploring the Federal Government’s recourse to borrowing for every spending need rather than the sensible path of fiscal reforms to stimulate production and private investment.

The alarm bells have pealed louder since it emerged that of the total government revenue of N950.56 billion in the first quarter of this year, N943.12 billion — a massive 99.21 per cent — was spent on debt servicing. Elsewhere, this would have triggered a shift into emergency mode; but the regime of Major General Muhammadu Buhari (retd.) appears unperturbed at the imminent national bankruptcy.

Debt servicing deepens poverty, drawing funds away from infrastructure, education, health, roads and agriculture. “High public debt can inhibit private investment, increase fiscal pressure, reduce social spending, and limit governments’ ability to implement reforms,” the World Bank warns.

Ironically, a debt buy-back package in 2005/06 had enabled the country to exit a three-decade old external debt overhang. About $12.4 billion was paid to the Paris Club of creditors to obtain forbearance of $18 billion. But successive governments since then have been borrowing afresh, reaching a feverish, irresponsible pitch under the Buhari regime. In his first four years in office, external debt rose by 148 per cent, from $10.32 billion in June 2015 to $25.61 billion by March 30, 2019. With the Senate’s approval last month of another $5.51 billion loan request, external debt reached $33.18 billion by June end, a frightening 91.37 per cent of total external reserves. In December 2019, at $27.68 billion, foreign debt was 75 per cent of reserves. Total public debt as of March 30 was N28.62 trillion.

Debt should be assessed with consideration of the key indicators of sustainable debt management. These reflect to a degree the economy’s capacity to repay the debt. Some of these are composition of debt maturities, the ratio of debt to Gross Domestic Product and the ratio of debt service to export earnings. Also important is the government’s capacity to meet its debt servicing burdens. Both the World Bank and the IMF had separately and repeatedly declared that Nigeria’s debt is unsustainable. For them, the modest debt-to-GDP ratio of 28 per cent by November last year should not be the marker; rather, rising revenue-to-debt ratio should dictate caution. A former Central Bank of Nigeria Governor, Lamido Sanusi, believes the country is already bankrupt.

There is no doubt that a well-structured debt is recognised as an essential tool for developing and emerging economies to break out of the poverty loop. For an economy characterised by low domestic savings, external debt is considered as an important funding source. But government borrowing is only productive when it is used to enhance the economy’s growth potential through targeted investment in infrastructure and human capital. The World Bank says, “Debt can be a useful tool if it is transparent, well-managed, and used in the context of a credible growth policy.” One major problem is that with the binge borrowing, the economy and the state’s productive assets have not expanded. There are doubts too of where the debt has gone into. Deploying debt to fund infrastructure development when government resources are inadequate makes a lot of economic sense. But debt service payments have seriously affected the government’s capacity to fund basic services, such as security, education and health.

This debt is unsustainable. Debt-to-GDP ratio has since climbed to 28-30 per cent by various estimates. Fitch, a global rating agency, is set to downgrade the country’s credit score, forecasting that the debt-to-revenue ratio will deteriorate further by this year’s end. The government unwisely borrows massively for what, with liberalisation, foreign and domestic private capital will undertake more efficiently without burdening the taxpayer. One is railways where Chinese loans have become the ready recourse for imprudent Nigerian governments. By overthrowing the state monopoly and emplacing a robust regulatory regime, private capital, local and foreign, will do the job better. This applies also to other state-owned enterprises such as the Ajaokuta Steel, airports, seaports, downstream oil and gas assets. The privatisation of eight of India’s container ports promoted competition and encouraged the state to pursue further Public Private Partnership deals.

Foreign or external debt is distinguished from other kinds of foreign investment capital inflow such as foreign ownership, because it carries with it the obligation to pay interest or repay principal when it is due. The impact of exchange rate movements on the level of debt is also critical for a country like Nigeria. That explains why the Asian countries relied more on a mix of loans, aid, liberal economic policies and direct foreign investment, coupled with state funding to emerge from underdevelopment to become export-oriented economies.

Instead of crashing further into debt traps, the Buhari regime should look at what some progressive African leaders are doing to achieve the UN Sustainable Development Goals. Rwanda, for instance, owes $3.2 billion, but is praised by development agencies for channelling it into critical infrastructure and opening up job-creating sectors. Ethiopia is building its landmark $4.8 billion Grand Renaissance Dam while avoiding foreign credit. It limited foreign borrowing to $1.8 billion, raising the remaining $3 billion partly from bonds targeted at the Ethiopian Diaspora. Yet, the dam is expected to transform the economy by providing 6,450 megawatts of electricity power for domestic use and export, generate a massive tourism industry and produce 7,000 tonnes of fish annually while providing hundreds of thousands of jobs down the sectoral value chains.

Private capital will also eliminate the interference of politics — ethnicity, religion sectionalism — in economics where loans are diverted to projects that cannot pay their way, while neglecting revenue-yielding projects like the Apapa port access roads. Borrowing $500 million for the Nigerian Television Authority is unreasonable; $500 million for airports “remodelling” and $470 million for the installation of CCTV facilities both failed. Nigeria’s airports are still rated some of the worst in the world and the CCTV funds simply vanished. Unprofitable SOEs should be privatised to end the waste and raise funds for productive purposes. Let the private sector lead and the government concentrate on social services, regulation and security. Other countries may run the SOEs, but Nigeria has failed woefully in this regard because politics overcomes rationality in government business ventures. Loans should be taken only for projects that can repay and are capable of creating thousands of jobs, boosting exports and raising human capital and technology acquisition.

What is more, as Nigeria is borrowing, the public treasury is leaking through illicit financial outflows and outright stealing. The Brookings Institution reports that the top four emitters of illicit flows — South Africa, the Democratic Republic of Congo, Ethiopia, and Nigeria — emit over 50 per cent of total illicit financial flows from sub-Saharan Africa put at over $1.3 trillion between 1980 and 2018. As of 2005, Nigeria’s past rulers reportedly stole or misused £220 billion. The Economist (London) says as of 2019, about $582 billion had been stolen from Nigeria since independence in 1960. The much bigger question, says The Economist, is where Nigeria could be if its politicians and officials were a little more honest. It quotes PwC as claiming that Nigeria’s economy, which was worth $513 billion in 2014, might have been 22 per cent bigger if its level of corruption were closer to Ghana’s, a nearby West African country or “worth some $534 billion more (adjusted for inflation), or about as much as the economy is currently worth.”

Forestalling bankruptcy and bridging the infrastructure gap demands an intelligent approach to public finance, debt management and governance. Corruption, the country’s number one enemy, should be tackled differently. Countries where corruption is high attract less foreign investment. The federal and state governments need to drastically cut down the cost of governance, plug all revenue leakages, improve and enforce tax laws and regulations and ensure remittance of all statutory revenues.

Compellingly, the government needs a new funding strategy that would emphasise private investment, PPP and bonds over loans. Debt should be a last resort, not the first as the regime lazily makes it today. The bonds market offers more disciplined use of credit and the prospect of deepening the capital market.

https://www.google.com/amp/s/punchng.com/foreign-debt-let-borrowing-binge-stop/%3famp=1 8 Likes 3 Shares

|

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by socialmediaman: 2:32am On Jul 22, 2020 |

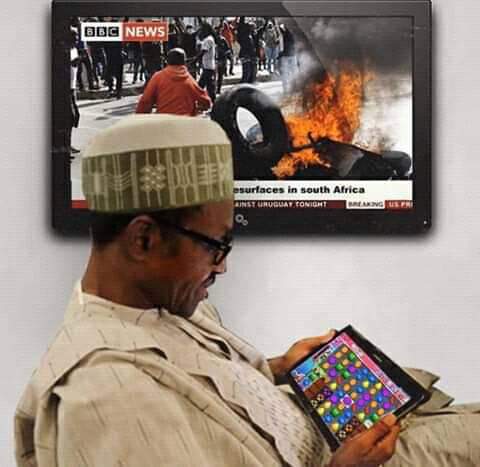

The people you put their photos up there, if you know what they’ve done to Nigeria since 2015, you’ll have chills for a whole month! 32 Likes 1 Share |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by NigeriaIsDoomed: 2:34am On Jul 22, 2020 |

His foolish and wretched zombies say there is nothing wtong.

They borrow and loot while their poor and hungry fans are applauding. 14 Likes 2 Shares |

|

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by RIHMEEK(m): 3:30am On Jul 22, 2020 |

It's unfortunate that 100 years from now unborn Nigerians will be paying for the lack of economic vision and wastage of our leaders 19 Likes

|

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Slawormir: 6:36am On Jul 22, 2020 |

Damnnnnn niggarrr

Isoright |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Chiedu4Trump: 6:36am On Jul 22, 2020 |

What did Nigerians expect when they rigged in an illiterate Herdsman? 24 Likes

|

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by fallingsky(m): 6:36am On Jul 22, 2020 |

Ok |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by krissy111(f): 6:36am On Jul 22, 2020 |

Hi.

Check my profile |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by allthingsgood: 6:39am On Jul 22, 2020 |

the sensible path of fiscal reforms to stimulate production and private investment.Wtf does this mean  Nigerians love meaningless phrases. You don't want to produce anything, u don't want govt to tax u and u also don't want govt to borrow. So how will we develop  Very stupid post 6 Likes 3 Shares |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Helpfromabove1(m): 6:39am On Jul 22, 2020 |

.99.21 per of total government revenue for the first quarter on debt servicing . Hmmmm

Ok no prob we will soon be borrowing money to service borrowed money abi na with the hieght of corruption in this country we will get dere very soon

We never finish Magu case we don't enter NDDC case and next na another 6 Likes 1 Share |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by soberdrunk(m): 6:39am On Jul 22, 2020 |

If they like they should continue borrowing ,Me I sha know say I nor collect money from any foreign government, my debts are local and he nor pass 650k!  3 Likes |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Gkay1(m): 6:41am On Jul 22, 2020 |

let borrowing continue. |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by allthingsgood: 6:41am On Jul 22, 2020 |

saheedbadmus:

With rate this govt of ours dey borrow money,I just pray our great grandchildren won't die of Paying debt of what dey know nothing of All the debt incurred by this administration are paying for themselves. E.g Abuja train alone makes more than 5million a month. That's how the loaan will be repaid. Compared with past regimes where they just borrow money and pocket. Borrowing this time around is always tied to a project 1 Like 1 Share |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Macphenson: 6:41am On Jul 22, 2020 |

Honestly speaking this administration is on a borrowing spree, the simple question is what is Buhari doing with all these heavy funds as they are not commiserate with infrastructure on ground.

Ever since the inception of this disaster of a regime, it has been borrow, tax, borrow, tax.

Buhari came in and implemented TSA, increased vat from five to seven percent, introduced stamp duty charges, increased custom duties on new cars to seventy percent, removed fuel subsidy, introduced deduction on bank and POS transactions and other forms of extortion on hapless and hard-working Nigerians, yet it did not satisfy his insatiable lust for funds.

He has borrowed away the future of generations yet unborn, and he is not telling us the repayment plan of all these reckless loans he is piling up.

The irony of this whole thing is these funds are been looted with reckless abandon as it has been proven beyond all reasonable doubts ( even to the e-diots and zombies ) that this is the most corrupt regime ever in the history of this country.

Look at the amount been spent on debt servicing , close to a Trillion Naira.

I hope the people that voted this disaster of a president will explain to their children how they allowed a man close to his grave plunge his generation into such heavy debt.

Time will tell. 12 Likes 1 Share |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Kobicove(m): 6:42am On Jul 22, 2020 |

This government has no intention of stopping its borrowing jamboree until it has completely enslaved the country to creditors!  1 Like |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by grammarian247(m): 6:42am On Jul 22, 2020 |

|

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by obazo1: 6:42am On Jul 22, 2020 |

Looking back Looking forward I don't know what we have done wrong with our resources as a nation. We are yet to learn or understand that this nation is sinking deep into debts and bankruptcy.. Naija Wake up... But I pity the next president come 2023 |

|

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Tomide007: 6:43am On Jul 22, 2020 |

allthingsgood:

All the debt incurred by this administration are paying for themselves. E.g Abuja train alone makes more than 5million a month. That's how the loaan will be repaid. Compared with past regimes where they just borrow money and pocket. Borrowing this time around is always tied to a project Million dollars? 11 Likes |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by LibertyRep: 6:45am On Jul 22, 2020 |

Yet the borrower-in-chief wouldn't stop plunging the nation further into the cesspit 4 Likes |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by gbagyiza: 6:46am On Jul 22, 2020 |

This country don enter one chance mode. |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by boom99(m): 6:46am On Jul 22, 2020 |

allthingsgood:

All the debt incurred by this administration are paying for themselves. E.g Abuja train alone makes more than 5million a month. That's how the loaan will be repaid. Compared with past regimes where they just borrow money and pocket. Borrowing this time around is always tied to a project Guy no vex ooo. I hate you 22 Likes 3 Shares |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Perfecttouchade: 6:49am On Jul 22, 2020 |

Dem go hear so? |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by soberdrunk(m): 6:49am On Jul 22, 2020 |

allthingsgood:

All the debt incurred by this administration are paying for themselves. E.g Abuja train alone makes more than 5million a month. That's how the loaan will be repaid. Compared with past regimes where they just borrow money and pocket. Borrowing this time around is always tied to a project Ehhhheeennn!!! You don't mean it!! Tell us more!! 15 Likes |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Nobody: 6:50am On Jul 22, 2020 |

Nigeria generated N950bn total revenue in first quarter with 99% going to debt service...

Yet Akpabio's NDDC misappropriated over N80bn (10% of Nigeria's total first quarter revenue)...

Problem dey ooo... 9 Likes 1 Share |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Bobbyfreshh(m): 6:50am On Jul 22, 2020 |

allthingsgood:

All the debt incurred by this administration are paying for themselves. E.g Abuja train alone makes more than 5million a month. That's how the loaan will be repaid. Compared with past regimes where they just borrow money and pocket. Borrowing this time around is always tied to a project See analysis!!! 40billion dollar will repay by itself  Think nah haba so all the borrowing to fund budgets are tied to what  Not surprised by your economic analysis 13 Likes 1 Share

|

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by jaytee01(m): 6:51am On Jul 22, 2020 |

allthingsgood:

All the debt incurred by this administration are paying for themselves. E.g Abuja train alone makes more than 5million a month. That's how the loaan will be repaid. Compared with past regimes where they just borrow money and pocket. Borrowing this time around is always tied to a project Are you okay? How much was spent on the Abuja project? Can your 5million service the loan and pay overhead costs....in how many years? 12 Likes |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by DesChyko: 6:52am On Jul 22, 2020 |

What a read! When next they look to borrow, their urchins would still troop out to defend the borrowing  1 Like |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Amspecial: 6:59am On Jul 22, 2020 |

|

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by Nobody: 6:59am On Jul 22, 2020 |

allthingsgood:

All the debt incurred by this administration are paying for themselves. E.g Abuja train alone makes more than 5million a month. That's how the loaan will be repaid. Compared with past regimes where they just borrow money and pocket. Borrowing this time around is always tied to a project you just fall your hand by yourself The estimated cost of the Abuja-Kaduna railproject was $874m. China's EXIM bank provided $500m as a concessionary loan for the project. The remainder was provided by Nigeria's Federal Government. now how many years will it take to pay up 170billion naira? with your 5m per month 15 Likes |

| Re: Foreign Debt: Let Borrowing Binge Stop - Punch by pointstores(m): 7:00am On Jul 22, 2020 |

Good one 1 Like 1 Share |

Think nah haba so all the borrowing to fund budgets are tied to what

Think nah haba so all the borrowing to fund budgets are tied to what