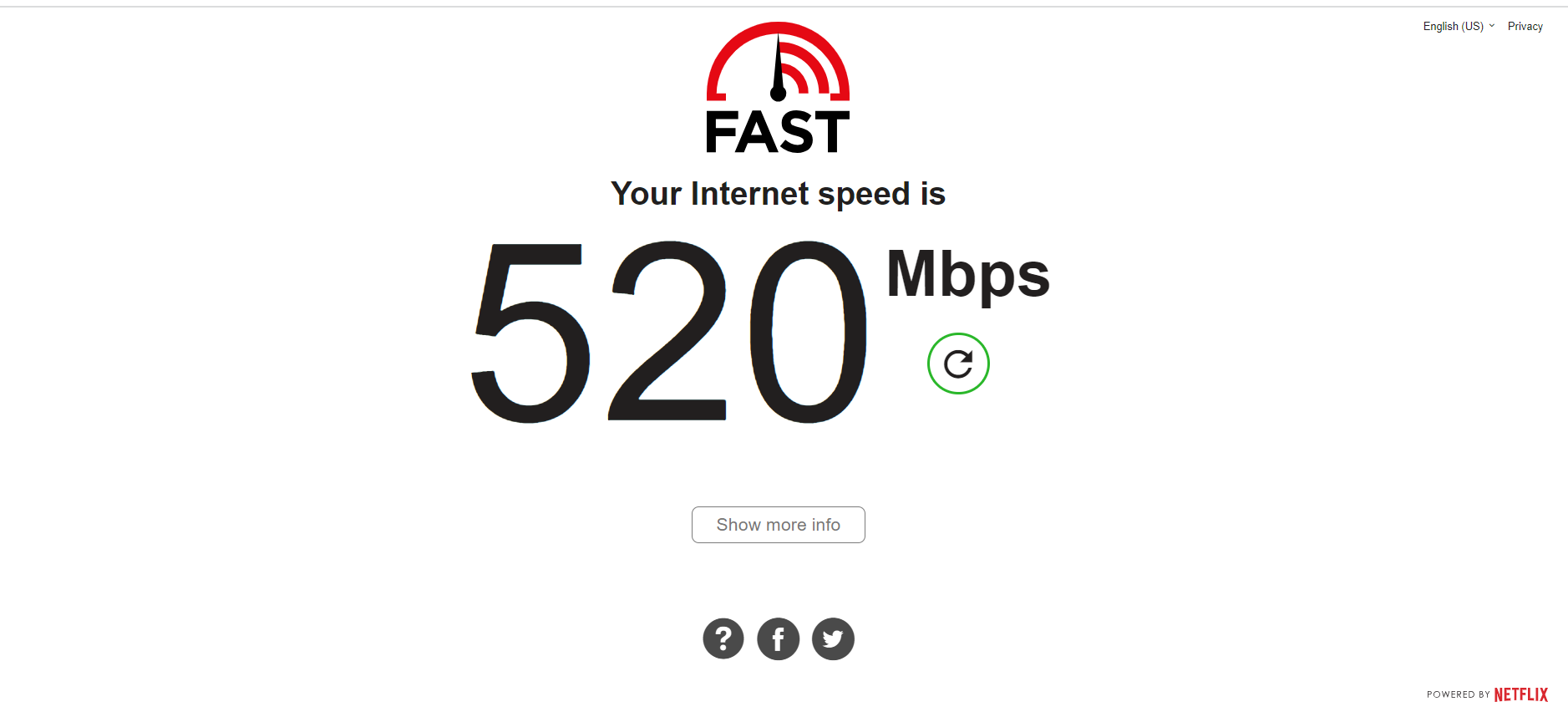

Phones / Re: How Fast Is Your Internet? by Bjrokenhear003: 2:42pm On Aug 05, 2023 Phones / Re: How Fast Is Your Internet? by Bjrokenhear003: 2:42pm On Aug 05, 2023 |

Ireland, Dublin

|

Travel / Re: Should I Invest In Nigeria Or Wait Until I Get A Permanent Stay In Abroad? by Bjrokenhear003: 2:13pm On Dec 15, 2020 Travel / Re: Should I Invest In Nigeria Or Wait Until I Get A Permanent Stay In Abroad? by Bjrokenhear003: 2:13pm On Dec 15, 2020 |

generationz:

Why are people so obsessed with buying land and investing in Nigeria? The naira keeps falling daily compared to dollars and Euro. You are in another mans country that they can reverse changes at their will. Will you like to come back with nothing as you built all your life here. Even the Lithuanian guy at my work place is retiring back to his country,in simple words he said you can be in this country and never safe 10000 euros for 5 years if care is not taken even after you receive 1000 after tax fortnightly as bills is the second life When hustling you think of both sides,if it dosent work out I have cash and investment back home but if it does I’m covered 2 Likes |

Travel / Re: Should I Invest In Nigeria Or Wait Until I Get A Permanent Stay In Abroad? by Bjrokenhear003: 2:31am On Dec 15, 2020 Travel / Re: Should I Invest In Nigeria Or Wait Until I Get A Permanent Stay In Abroad? by Bjrokenhear003: 2:31am On Dec 15, 2020 |

Hi basalt

I’m planning coming to Germany next week or so. I reside in Ireland and trust me, enjoy your life while you can and make investment back home. I have tested both of those world

My reason is I bought 7 plots of land ibeju lekki from 750k each. Now the issue of residency is, even in Ireland it’s hard to get a job after school. Only few in my set got jobs for critical skills and those others that got couldn’t get the 30K Minimum annually. I ended up hustling

If you want to get the PR as somebody rightfully said, surest way Na to get babe or pikin. Now the tricky part is if the babe insist the pikin must carry her last name, you don’t have right to that child. Most of the girls here know say Na paper you Dey find come, them go use u no be small. Shebi you wan kn**ck, you go knack your future commot and still u no go c Pali or PR or the one wey go free for you, you go pay house rent plus bills all together, this is mostly common among the black so u have to shine eyes and pray. The white u go Bleep ur pe**s commot as e no Dey do them, if u can’t they go bring another person come inside house to Dey service them. Truthfully the really educated white ones won’t do that but u go see signs of cheating and the white ones for wake up one morning call marriage over your PR don stop immediately

With German PR you can’t use it to work in any other European country as you are a resident of Germany but if your spouse is EU, then the gates are open as you can work in any EU country but your wife must be exercising her Eu treaty rights in the state

See It took me 1 year 4 months to refine my girl with both therapist, my family, people to see things in my perspective, she’s still learning but I know the insult I took from pouring water on me, throwing cartons at me, shouting and screaming, threatening to call police because I ask for my phone, throwing me out of the house severally as I sleep for school, my phone isn’t unlocked. I Neva marry am ohh, she be my last option and she knows I no Dey follow for paper as come back naija and she see my cabal, her head rest, but the feeling of he’s using me for papers still Dey her head a little till now

Even after you get the PR and passport, if the lady mean you she go say you obtained it by falsEhood and tricking her as she was down at that moment, your PR is revoked. So you have to try the other option to increase your German and get job or Canada

Lastly no think of contract marriage, if e burst for u, consider Nigeria as your final home for life as your immigration history go Dey whole of Europe

That’s why if u invest the first year hard work back home and hustle for the other year, you will be solid

Remember cash is king but it does nothing in the bank and when u are in a serious relationship here, she must know how much is your bank account balance, monthly salary and you guys will have joint account. So all those savings wey u save don enter you and her lifestyle

So think well and enjoy this time 12 Likes |

Investment / Re: Treasury Bills In Nigeria by Bjrokenhear003: 2:37am On Nov 27, 2020 Investment / Re: Treasury Bills In Nigeria by Bjrokenhear003: 2:37am On Nov 27, 2020 |

emmasoft:

First thing first - invest in yourself by reading on how investment in stocks works. You can read stuffs here, https://www.nairaland.com/1131485/nigerian-stock-exchange-market-pick/5523 and other pages on stock thread, read materials from sites like nairametrics.com, ask questions, even listening to economic news can add to your knowledge.

N.B: If your risk tolerance is low I will advice you start with low risk investment options like mutual funds particularly VGIF from there you can begin to build your confidence.

While doing the reading and equipping yourself, you need to open a stockbroking account and have a cscs account. You can do that by clicking the link on my signature to have a stock account or any form of investment account with Investment One.

Hello I was reading in relation to the VGIF, how is it done, can I invest quarterly or annually. Is there tax on deduction if my income or any charges |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 9:18am On Nov 11, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 9:18am On Nov 11, 2020 |

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 9:12am On Nov 11, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 9:12am On Nov 11, 2020 |

maishai:

As u trade please remember that commission......

I always budget 4.5%[buy + sell]

Learn what makes a stock overpriced or underpriced too

@ below 200 Dangote is yet to be overpriced baring any announcement in the future.....

Why don't u just wait it out

Thanks losds |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 11:52am On Nov 10, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 11:52am On Nov 10, 2020 |

Should I sell my dangote and invest in access or glaxo as dangote is reducing 1 Like

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 5:23pm On Jul 27, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 5:23pm On Jul 27, 2020 |

RabbiDoracle:

The result is not yet out and the qualification date is yet to be announced. Thanks |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 4:48pm On Jul 27, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 4:48pm On Jul 27, 2020 |

I said it that Dangote and his boys are up to something, getting ready to beat the previous high before dividend payment

Lafarge impressed me I must say. The comeback is massive

Pls I bought shares this year(May) in zenith bank, will I qualify for interim payment or when is their register closing 2 Likes |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 8:45pm On Jul 23, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 8:45pm On Jul 23, 2020 |

RabbiDoracle:

Zenith should pay 35kobo abeg.

This will be a cushion to the hardship caused to shareholders by the covid. if them do am, share price go increase, make we pray to God to touch big men in suit |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 4:02pm On Jul 23, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 4:02pm On Jul 23, 2020 |

DexterousOne:

Between 396 and 432

That's my prediction

I dont think it will get to the 500 bus stop Hopefully if inflation drops the foreign exchange will follow |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 12:03pm On Jul 20, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 12:03pm On Jul 20, 2020 |

ojesymsym:

Are they a dividends paying stock?

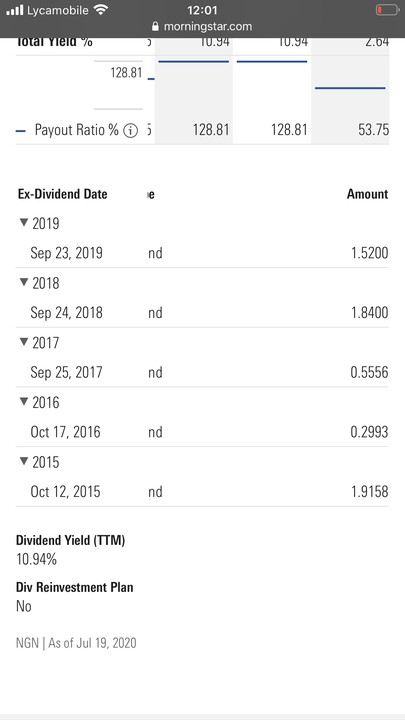

Yes sir They have established a dividend policy payment on the SEM

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 11:08am On Jul 20, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 11:08am On Jul 20, 2020 |

GUINESS still going low. In less than 6 months GUINESS has lost over N15

Will it rebound ?

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 11:06am On Jul 20, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 11:06am On Jul 20, 2020 |

DexterousOne:

A business that generates 12% monthly?

That's a > 144% return annually

What kind of business in today's Nigeria give such returns? Bro they are so many businesses that can generate such especially with start ups where cost is purely maintained and few workers |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:31pm On Jul 19, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:31pm On Jul 19, 2020 |

emmanuelewumi:

BGL was a major financial advisor to MTN when they came to Nigeria, the major pioneer Investors were bankers, Investment banking firms and corporate lawyers. You would have been invited if you were found worthy.

MTN had another private placement in 2006, I think the minimum Investment was $1 million. Afrinvest played a major role in the second private placement That’s a lot of capital there $1 million. Crazy 1 million dollars at the current fx is close to their equity start up capital 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:24pm On Jul 19, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:24pm On Jul 19, 2020 |

2 Likes |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:15pm On Jul 19, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:15pm On Jul 19, 2020 |

emmanuelewumi:

Pioneer Investors who invested N1 million about 20 years ago are earning dividends of about N40 million.

MTN was not ready to be listed, those of us who bought on the floor bought at a premium.

Just as we have some big guys who currently have shares in Dangote Refinery, by the time the company will be listed we will be buying at a premium And that’s where it all falls down to, where can we see all this company that does private placement I use Afri invest stock broking firm and no one offers me private placement to be pioneer investors on them platforms, Any other platforms that offers to private investors |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:04pm On Jul 19, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:04pm On Jul 19, 2020 |

emmanuelewumi:

What will you say about those who bought land banana Island in 2010 at N800 million,, who are currently looking for buyer for the same land at N600 million in 2020.

That same N800 invested in Zenith bank shares and dividends reinvested would have grown to N2.67 billion in 2020 The stock market is not a funny place, I was thinking about my own investment and if only I put my 1m in a business that generates 12-15% monthly, in two years I would have gotten investors I will sell my shares at a higher price and expand. looking at mtn financials, started business with only 407m, only the first investors enjoyed, now us is at the mercy of the market 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 6:53pm On Jul 19, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 6:53pm On Jul 19, 2020 |

RabbiDoracle:

I agree with you if you in live in Nigeria and invest naira and spend naira.

Remember that some people don't live in Nigeria. Some live in Japan for example and invest in Nigeria. In Japan, inflation had been jumping from negative to around +1% for years.

The only thing such an investor will be concerned about is devaluation of naira. Nothing concern am with inflation in naira because he is not spending whatever he gets there in Nigeria.

Just my thought. Inflation affects the exchange rate bro |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 3:09pm On Jul 12, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 3:09pm On Jul 12, 2020 |

You can forecast dividend |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 2:44pm On Jul 12, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 2:44pm On Jul 12, 2020 |

DrAwo:

Stocks with the highest dividend yield over a 5 year period... To get dividend yield @ this moment It’s DPS/MPS So zenith bank dividend as at last year div 2.8, Share price is 16.5 @ now 2.8/16.5 = 16.9% E.g N500,000 * 0.169 * 0.9(After tax)= 76,050 So in this scenario, your compare the yield with commercial papers, treasury bill rate, time deposit and inflation rate and you see you get more value for your money yearly, however the share price might plummet and yield falls So the denominator plays a crucial part, if the shares goes lower, you get the shares at a cheaper price 2 Likes |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 11:56am On Jul 09, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 11:56am On Jul 09, 2020 |

onegentleguy:

Both of u are actually saying the same thing but using different perspectives.

Yes ur right about the fact that a script/bonus issue may not impact the EPS of a coy that much, but perhaps u haven't put it out in a more explicit light.

In practice, the EPS= net income(NI)/weighted average of OS... and not just NI/OS

So no doubt, the issuance of a script affects(inverse variation) the distributable earnings(EPS/EM in view)... but it will be wrong to infer this as the sole reason for it.

Oftentimes, the degree of impact will depend on how well a coys profit margin(net income) measures against what it can offer to its common equity holders(OS in view) at the time.

The numerator of that formula(NI) is the biggest driver of EPS. ...if it grows faster than the WA of OS at the time of consideration, then there'll be no need to fret. How?

See if the coy is growing REVENUE/SALES faster than its COST LINE. The former can be seen from looking at the broader economy(top-down approach) and how it affects the demand curve for its services while the latter looks at how well management can optimize cost.(see the 5 yr review of JB posted by Dr. Awo)

Also, if a coy has lower need for funding(capex in view) and better cash flow, then expect NI to remain relatively stable post script issuance.

Again, the denominator(WA of OS), which is where there are concerns is sometimes exaggerated. ...how?

The weighted average of a coys common stock post bonus issuance can sometimes be less than the assumed estimate, so the total OS may not be enough to offset the NI line(assuming it remains constant) and cause a remarkable drop in EPS.

...a brief;

Assuming a coy X with an OS of 1B issued a bonus of 1 for 5, then post exercise, total OS can only be 1.2B(i.e 1/5x1B + 1B) if the said issuance was made to reflect at the beginning of the coys financial reporting calender yr. ...otherwise it would be less !!

If the issuance was made to reflect mid-way through its financial yr, then the OS has to mirror the actual WA. ...that is; 6 months for 1B OS and the remaining 6 months for the 1.2B OS... so WA of OS= 6/12(1B) + 6/12(1.2B)= 1.1B and NOT the initially assumed 1.2B.

So unless there is a wide drop in NI, the EPS can only witness a lesser degree of impact.

The truth is; investors will often tend to sell off after a script/bonus issuance... including those who may not have done their homework well.(even exiting at a loss)

But ur concern should be on how to get some reward from such equity. There is way to play such stocks.

...u sell into the hype that comes with the issuance, then look to play the contrarian and buy back into the fear that follows thereafter.

JULIUS BERGER presented that opportunity 2 days ago.

Note that an appreciable knowledge in FA and TA is needed to succeed better though.

On a side note, that part in bold is erroneous. ...it might cause u a costly mistake.

It's best to use the EPS to look in on a coys PE... but NOT the PE to adjudge its EPS.

...that way, u can adjust ur investment strategy to seek a better time value for ur money at any given time.

Disclosure: I currently do not hold JB in any portfolio under my watch.

NOT an investment advice. ...due diligence still applies as always.

My advise: Just follow ur instinct. So correct bro thanks for citing the part of EPS |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 11:56am On Jul 09, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 11:56am On Jul 09, 2020 |

megawealth01:

Wait until then but I don't think so sha... Over to the bosses in tge HOUSE No dividend declared |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 1:35am On Jul 09, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 1:35am On Jul 09, 2020 |

S007:

You've succeeded in repeating what I wrote in point 1 and 3. Which person is quoting textbook now.

If d tin look like textbook stuff to you. No vex. Na human being dey write textbook, not spirit.

Point 2 is not true all the time. Maybe you don't understand what I mean by exceptions. Lmao I no quote textbook and I no vex, Na market we Dey try analyze naa But what I was trying to tell you is that the selling pressure becomes worse when a company issues bonus shares and some people sell theirs immediately dragging down the price, panic grows in other investors mind, making them sell their bonus issue and some of their portfolio and it drags it down more, next coy qtr result wasn’t close to expectation, Na GOBE JOIN The only way the MPS won’t fall is if their PE ratio is high, so it’s would be an additional advantage having such shares for free Instead of dividend because I know with the cash the company is retaining, they can increase their PAT and it won’t drag the EPS down south Imagine amazon doing bonus issue I won’t sell mine because I know it will grow further and another coy with unstable earnings |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 1:35pm On Jul 08, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 1:35pm On Jul 08, 2020 |

S007:

Selling/buying pressure happens all the time. One of the ways dilution happens is when total units of stock is increased without corresponding increase in net profit thereby affecting the EPS. Market will eventually re-price the stock with time. There are exceptions though. Continue quoting textbook, what I saw when trading is different,Go look At forte oil when they issued bonus shares and people rushed and sold theirs on the floor, the truth is that when they issue bonus shares, 1) the shares in the company increases 2) people rush to sell it on the floor crashing the price 3)if the company sustains the NP level as before EPS falls and MPS falls automatically and it’s get worse if NP level falls EPS falls further So in any way I don’t like when a company issues bonus shares to its investors or does right issues( Flour mill 2018 if you don’t buy you have lost as TERP price falls) and people still rush to sell on the floor. Truth is cost of equity is expensive and isn’t tax free, whilst cost of debt is cheaper |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:31am On Jul 08, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:31am On Jul 08, 2020 |

freeman67:

No you are not. It is part of the requirements of processing e-dividend mandate through your broker. So I can fill the dividend form without transferring shares ? |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:24am On Jul 08, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 7:24am On Jul 08, 2020 |

arduino:

I have not seen anything to warrant this level of free fall. Dividend was only reduced by 75k and nothing more.

If JB issued bonus shares, the share price must fall because people will rush to the stock exchange to sell their bonus issue and the dilution of shares has occurred 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 2:11am On Jul 08, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 2:11am On Jul 08, 2020 |

Please guys i want to be sure I’m I transferring my shares to my stock broker when I want to collect dividend because there is a document Here that states I’m transferring to the transferee to hold, so I want to be sure |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 2:07am On Jul 08, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 2:07am On Jul 08, 2020 |

arduino:

I have not seen anything to warrant this level of free fall. Dividend was only reduced by 75k and nothing more.

Lmao When I was complaining of dangote cement free fall from when I bought for 140, I just started averaging down |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 8:12pm On Jul 05, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 8:12pm On Jul 05, 2020 |

Lion123:

TOE is building a new N12 billion mansion in Ikoyi, with JB as contractors. He has a lot of Dollar loans, and you know how things have been going. I hope UBA is well. It’s well let me start getting ready to monitor UBA wit one eyes 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 8:06pm On Jul 05, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 8:06pm On Jul 05, 2020 |

RabbiDoracle:

Don't worry. When it is time, you will see that Tesla's last low of 350 will be shattered again. What will cause it, I don't know. I said it that even ford and ge that do electric cars went down this week by 2-4% and this are well known brands. |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 9:30am On Jul 05, 2020 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by Bjrokenhear003: 9:30am On Jul 05, 2020 |

BullBearMkt:

Let's keep it real! The top-down approach to analysis is looking at a bigger picture before you zoom in to the specific. So, in TA, apart from looking at general market breadth, sector analysis, the next line of action is to see the bigger picture of the stock you want to invest in. It is much more safer looking at the monthly first before going to the daily.

Your assertion about wire card is completely wrong! Had it been the bigger picture of the stock was checked, the so called "investors" would have seen the RISK earlier (I'm sure the real investors - smart monies have long dumped the stock)... What you don't know, you don't know!

You are correct it showed LH all through since 2018, but as u said. However new Investors who came onboard this year shortly never anticipated its fall To that extreme. So many stocks have had lH and made HH after some years, what will u refer to investors who stayed strong and holding What I’m saying in short is technical analysis can’t tell you full info of the stock, in one day they released info the company had 2.1billion missing from It’s AFS,that’s what crashed it... TA can’t tell u that from beginning 2020 the stock will fall hard. 1 Like |