Politics / Economy: Nigerians No Longer Accommodate Relatives As Cost Of Living Soars by Great100000: 11:16am On Apr 01 Politics / Economy: Nigerians No Longer Accommodate Relatives As Cost Of Living Soars by Great100000: 11:16am On Apr 01 |

The era where people take in young relatives, raising them along with their children is gradually coming to an end.

The limited purchasing power of every Nigerian at the moment fuels that.

It has reduced living standards and Nigerians are becoming conscious of how they spend their money. As a result, Nigerians have been sourcing ways to cut the cost of feeding. Economy and lifestyle discovered that one of such new ways is turning down the adoption or accommodation of close relatives or returning those who had been under their care. Before now, Nigerians take turns assisting various family members, particularly those with low economic power. But today, an average family of five can hardly fend for themselves, let alone, adding a relative. Therefore, an additional member to them is like committing suicide. Mrs. Amanda Odudu, a fashion designer, complained bitterly about how her niece had returned her daughter, who had stayed with them for six years.

“Last month, my niece called, saying that my daughter, who had stayed with them for six years, would be returning home.

“I thought she was joking, not until I saw her at my doorstep the next day.

“My niece’s action was based on her husband’s request who complained bitterly about the state of the economy.

“She noted that she had no job to support her husband which could have made her keep my daughter.

“She had to succumb.”On her part, Mr Onokoya Samson, a businessman, said his son was returned to him after spending three years with his brother.

“It is still like a dream. I have a family of six.

“My brother was the one who requested I allow my son to live with him so that he can reduce my responsibility.

“My brother just brought my son to the house without informing me.“He said that he and his family are travelling abroad for greener pastures and have sold all they have to acquire their Visa and flight tickets.

“He has two children and a wife.“I didn’t blame him but was grateful that he even helped me for three years.

“Now I am faced with an extra responsibility.

“Business is not profiting anymore. But my hope is in God. I believe he will save Nigerians from this horrible situation we have found ourselves in.”Mrs. Sarah Okwudili, a baker and a widow, lamented how she will now be faced with catering for three children.

According to her, “ After the demise of my husband, his sisters volunteered to take care of two of my kids.“I agreed. They were taken good care of and attended good schools. If they were with me I won’t be able to afford the fees.

“But as we all know, the country is not smiling at anyone.

“ Recently, they returned my children with the complaint of a bad economy.

“Reasons like increased school fees, rent and low income were given as reasons for returning them.“I was very sad but had to thank them because it is not easy to take care of children in this economy.

“ People can only allow relatives that are working to stay with them because they won’t have any burden to bear.

“Now I am saddled with the responsibility of taking care of three children.

“I just believe God will surprise me.”Source: https://www.vanguardngr.com/2024/04/economy-nigerians-no-longer-accommodate-relatives-as-cost-of-living-soars/

|

Sports / Re: Alonso: Amid Bayern Munich, Liverpool Links, I'll Stay as Coach at Leverkusen by Great100000: 2:54pm On Mar 29 Sports / Re: Alonso: Amid Bayern Munich, Liverpool Links, I'll Stay as Coach at Leverkusen by Great100000: 2:54pm On Mar 29 |

I think this is the best decision of his life.

He is an amazing coach but he needs to continue with Leverkusen for now.

If he goes to Liverpool or Bayern, they might not be that patient like that, but with Leverkusen, he can continue building his career. 21 Likes 1 Share |

Politics / Trade Grant Scheme: Applicants To Link NIN To Bank Account To Receive Grants. by Great100000: 4:22pm On Mar 25 Politics / Trade Grant Scheme: Applicants To Link NIN To Bank Account To Receive Grants. by Great100000: 4:22pm On Mar 25 |

Trade Grant Scheme: Applicants to link NIN to Bank account to receive grants, says FGThe federal government has mandated all applicants of the presidential trade grant programme to link their National Identification Numbers (NIN) to their bank accounts to be eligible for the proposed grants. The Minister of Industry, Trade and Investment, Doris Uzoka-Anite, made this announcement on Sunday. The Minister stated that this requirement complies with the Central Bank of Nigeria (CBN)’s recent directive on account verification with NIN. She therefore explained that the ministry intends to send a text message through “FGGRANTLOAN” to applicants, asking for their NIN to be submitted for verification through a secure link. “The Ministry of Industry, Trade and Investment thanks all applicants for their interest in the Presidential Conditional Grant Programme and assures that applications are being thoroughly processed.

“Due to new regulations from Central Bank of Nigeria, it is now required for all applicants to link their National Identification Numbers (NIN) with their bank accounts. We currently do not have a record of the NINs of those who applied.

“Therefore all applicants will receive an SMS from ‘FGGRANTLOAN’ with instructions to submit this information via a secure link. This step is essential for the continuation of the application process.“Only verified applicants will receive this notification, and NINs must match applicant’s name for the process to proceed,” she said.

Backstory Earlier in December 2023, the Federal Government of Nigeria released an application portal for its Presidential Conditional Grant for Nano Businesses under the Presidential Palliative Program. The scheme offers a grant of N50,000.00 per beneficiary, aiming to support one million nano businesses across the 774 local government areas.

To select beneficiaries for its latest initiative, the Federal government said it will work alongside State Governments, Ministers, NASME, Senators, and House of Representative Members.It also plans to allocate 70% of spots to women and youth, 10% to individuals with disabilities, 5% to senior citizens, and 15% to other groups based on specific selection criteria.Source: https://nairametrics.com/2024/03/25/trade-grant-scheme-applicants-to-link-nin-to-bank-account-to-receive-grants-says-fg/ |

Politics / Re: NIMC Unveil App For Nigerians To Correct Name, Date Of Birth On NIN by Great100000: 3:40pm On Mar 24 Politics / Re: NIMC Unveil App For Nigerians To Correct Name, Date Of Birth On NIN by Great100000: 3:40pm On Mar 24 |

Grenn:

This is good Yes, it is. |

Politics / Re: UK, Nigeria Dialogue On Migration, Justice, Others by Great100000: 3:39pm On Mar 24 Politics / Re: UK, Nigeria Dialogue On Migration, Justice, Others by Great100000: 3:39pm On Mar 24 |

Good |

Politics / Those Who Want Naira To Be N400 To Dollar Are Living In Dream World – Moghalu by Great100000: 3:38pm On Mar 24 Politics / Those Who Want Naira To Be N400 To Dollar Are Living In Dream World – Moghalu by Great100000: 3:38pm On Mar 24 |

A former deputy governor of the Central Bank of Nigeria, Kingsley Moghalu, has said that those who want the Naira to be N400 to the Dollar are living in a dream world. According to him, the exchange rate should reflect its market value in reality. Moghalu claimed that Godwin Emefiele’s era at the Central Bank created artificiality that it sought to maintain to please economic illiterates in political power at the time. Moghalu, who made this known in a post on his X handle on Sunday, insisted that artificiality created room for massive arbitrage by speculators which bled the economy. He suggested that the sooner the country focused on the creation of value-added manufacturing export economy that earned forex beyond oil in real and significant terms, the better. He said: “Those who want the Naira to be N400 to the $ are living in a dream world. Even discounting for the negative impact of speculative attacks on the value of the Naira, the exchange rate will (and should) reflect its market value in reality, not the artificiality that the Emefiele era central bank sought to maintain to please economic illiterates in political power at the time.“That artificiality created room for massive arbitrage by speculators which bled the economy. Nigeria does not (yet) have a productive export economy. That’s the heart of the matter.

“And we do not have $100 billion in foreign reserves. So on what basis would the Naira forex rate return to some fantasy land soon? It will also take time to regain or achieve full investor confidence such as we had when we were there (and the rate was N150-165 to the $.“The sooner we focus on a painstaking creation of value-added manufacturing export economy that earns forex beyond oil in real and significant terms, the better. Key to this is the electricity conundrum in which we are at less than 4,000 megawatts of generation for a population of 200 million for decades now.

“Take power to even 20K megawatts (let’s not talk of 50K for South Africa’s 60 million population or Brazil’s 181K megawatts for a population only slightly larger than Nigeria) and you will see what the Nigerian entrepreneurial spirit is capable of.”Source: https://dailypost.ng/2024/03/24/those-who-want-naira-to-be-n400-to-dollar-are-living-in-dream-world-moghalu/ 10 Likes 1 Share

|

Politics / UK, Nigeria Dialogue On Migration, Justice, Others by Great100000: 8:51am On Mar 24 Politics / UK, Nigeria Dialogue On Migration, Justice, Others by Great100000: 8:51am On Mar 24 |

Senior officials from the United Kingdom, UK, held a crucial meeting with a delegation from Nigeria to discuss migration, justice, home affairs, and other important issues between the two countries.The meeting which was held in London on Tuesday also reaffirmed the strong collaboration between Nigeria and the UK, underlining commitments across a range of priority areas of mutual interest. Both Nigeria and the UK also discussed the insecurity pervading the former, as well as appreciating the support of the latter in ending the challenges as soon as possible. The communique of the dialogue which was signed by Director, UK Home Office, Asim Hafeez, and Nigeria’s Ambassador, Ministry of Foreign Affairs, Akinremi Bolaji, was issued by the UK on Friday. The communique read, “Senior officials from the United Kingdom Home Office welcomed a delegation from the Federal Republic of Nigeria to co-chair the annual Migration, Justice, and Home Affairs dialogue on 19 March 2024 in London. The discussions reaffirmed the strong relationship between Nigeria and the UK, with commitments made across a range of priority areas of mutual interest.“The commendable collaboration between the 2 nations on migration and countering criminality in all its forms was acknowledged. In this spirit of collaboration, there was agreement to raise awareness within each country of our respective internal systems and cultures.

“Regarding serious and organised crime, Nigeria and the UK expressed mutual appreciation for ongoing efforts to prevent vulnerable young people from being engaged in criminality, intercepting and disrupting organised crime groups trafficking people and illicit commodities, as well as new opportunities to work together to combat online fraud.“Both parties recognised the improved engagement and information sharing between our respective governments and high commissions. They committed to proactively engage with relevant authorities to resolve outstanding issues as well as promoting our joint work to the public. The significance of returning nationals with no right to remain in each other’s territories was mutually agreed, facilitated by the 2022 Memorandum of Understanding on Migration Partnership.“Both sides pledged to explore a deeper migration partnership and welcomed progress towards a criminal record data-sharing arrangement through technical working groups, the latest of which took place on 20 March 2024. This work will form the foundations for a deeper relationship on criminal records data sharing.

“The collaborative efforts of Nigeria and the UK on these issues underscore our shared commitment to tackling crime and destabilizing factors directly, highlighting the depth of the relationship between the 2 countries. Both nations committed to further meetings to assess progress against the commitments made ahead of the next annual talks and ongoing regular engagement between the Nigerian High Commission and the UK Home Office in London.

“The next annual Migration, Justice, and Home Affairs talks, hosted by Nigeria, will take place in 2025 and will include contributions and participation from all relevant ministries, departments, and agencies from Nigeria and the UK.”Source: https://www.vanguardngr.com/2024/03/uk-nigeria-dialogue-on-migration-justice-others/

|

Politics / NIMC Unveil App For Nigerians To Correct Name, Date Of Birth On NIN by Great100000: 8:34am On Mar 24 Politics / NIMC Unveil App For Nigerians To Correct Name, Date Of Birth On NIN by Great100000: 8:34am On Mar 24 |

The National Identity Management Commission (NIMC) has unveiled a mobile application for modification of data on the National Identification Number (NIN). According to the post made by NIMC on Saturday via X, Nigerians can make corrections of name, date of birth, and phone numbers incorrectly registered with their NIN on the mobile application.

The application and online portal allows visitors to register to use the service. Thereafter, it requests for visitors’ NIN, last name, email address before launching the data modification channelIn the past, modifying data on the National Identification Number (NIN) has posed challenges for Nigerians. Hundreds of individuals have flocked to NIMC offices across the country to either register for the NIN or request corrections to their data.

The situation became more concerning for many in 2021 when the NIMC announced fees ranging from N5,000 to N15,000 for rectifying incorrect data on the NIN database.

Before now, Nigerians who wanted to modify their data on NIN have had to go through a difficult process, besieging NIMC’s offices nationwide.

However, the commission has announced that all modifications on the NIN can now be done seamlessly on the NIMC Self-Service App. NIN:How to modify your data Log on to https://selfservicemodification.nimc.gov.ng

Click on Register if you don’t have an account Click on login if you already have an account After login, you will be requested to provide your NIN, last name and email address

After providing the above, the data modification channel will be accessibleSource: https://guardian.ng/news/nimc-unveils-mobile-app-for-nigerians-to-correct-name-date-of-birth-others-on-nin/#:~:text=Number%20(NIN).-,Nigerians%20can%20make%20corrections%20of%20name%2C%20date%20of%20birth%2C%20phone, the%20NIMC%20Self%2DService%20App%3F https://newsexpressngr.com/news/221280/nimc-unveils-mobile-app-for-nigerians-to-correct-name-date-of-birth-others-on-nin

|

Health / Can’t Sustain My Family With It – Nigerian Nurse In The UK Earning N5.3 Million by Great100000: 12:01pm On Mar 22 Health / Can’t Sustain My Family With It – Nigerian Nurse In The UK Earning N5.3 Million by Great100000: 12:01pm On Mar 22 |

Can’t Sustain My Family With It – Nigerian Nurse in the UK Earning N5.3 million Monthly Cries Out Over Insufficient Salary.In her video, the nurse revealed that her monthly salary as a band five nurse amounts to £2,767 (equivalent to approximately N5.3 million).A Nigerian nurse based in the United Kingdom by name Wemimo has taken to social media to lament over her salary. She revealed that her salary is not enough to sustain her. Wemimo revealed that she earns £2,767 (equivalent to approximately N5.3 million) monthly but finds it difficult to sustain her life with that. She lamented that after taxes and other various deductions, she's left with just £1,973 (equivalent to approximately N3.8 million). She pointed out the prevalent misconception among some husbands that their wives’ nursing salaries suffice for the family’s needs. In her words;

“It’s high time men in the diaspora whose wives are Nurses step up and start helping in the family. I don’t think I have seen any family surviving on one income in the UK.”

Netizens Reactions:

@Figer Walata said; “A lot of people make more money than nurses. Business analysts.”

@Jennifer Chino said; “Nursing career is just name. Most HCA receive more then the nurses.”

@Mrs K said; “I am a team leader in a care home and I bring home £2500 after tax and other deductions….all nurses should be considering care homes not NHS.” @nelsongarande said; “I am in Africa, December alone my hustle made me in excess of US$7 000 and I finished my house, yet we still want to find a way to come to the UK, crazy.” Source: https://www.tori.ng/news/264970/cant-sustain-my-family-with-it-nigerian-nurse-in-t.html https://www.legit.ng/people/family-relationship/1584227-salary-n53-million-month-registered-nurse-working-uk-discloses-income-taxes/

|

Travel / Re: Canada To Reduce Number Of Foreign Workers by Great100000: 8:23am On Mar 22 Travel / Re: Canada To Reduce Number Of Foreign Workers by Great100000: 8:23am On Mar 22 |

iamtardey:

e no go badd if I enter this year o Aje And God will do am, just believe, work smart and work hard. 20 Likes 6 Shares |

Health / Japa: Council, Nurses Begin Legal Battle Over New Certification Guidelines by Great100000: 8:21am On Mar 22 Health / Japa: Council, Nurses Begin Legal Battle Over New Certification Guidelines by Great100000: 8:21am On Mar 22 |

Some Nurses in the country have sued the Nursing and Midwifery Council of Nigeria, and the Minister of Health among others over the new certificate verification guidelines.

The NMCN had on February 7, 2024, issued a circular revising the guidelines for requesting verification of certificates for nurses and midwives.

The council stated, among others, that applicants seeking verification of certificates from foreign nursing boards and councils must possess two years of post-qualification experience from the date of issuance of the permanent practising licence.

The new guidelines came into force on March 1, 2024.

But nurses and midwives, under the aegis of the National Association of Nigeria Nurses and Midwives, expressed concern that the NMCN’s revised guidelines for certificate verification were targeted at preventing them from going abroad in search of greener pastures.

They are particularly uncomfortable with the provision in the guidelines that a nurse seeking NMCN certification must have a minimum of two years post-qualification experience.

They are also opposed to the requirement that a nurse applying for NMCN’s certification must obtain a letter of good standing from the Chief Executive Officer of their place of work and the last training institution attended while the processing of application shall take a minimum of six months.

As a result of this, nurses in Abuja and Lagos protested to demand the reversal of the new guidelines.

Pushing their demands forward, some dissatisfied nurses on behalf of their colleagues dragged the Registrar, NMCN; the Coordinating Minister of Health and Social Welfare; Federal Ministry of Health; and the Attorney General of the Federation before the National Industrial Court in Abuja.

The complainants in the suit marked: NICN/ABJ/ 76/2024, are Desmond Aigbe; Kelvin Ossai; Catherine Olatunji-Kuyoro; Tamunoibi Berry; Osemwengie Osagie; Abiola Olaniyan; Idowu Olabode, and Olumide Olurankinse.

They are urging the court to restrain the defendants and their agents from implementing the NMCN circular pending the determination of the suit.

The nurses also urged the court to suspend the commencement of the new guidelines.

They want “an interlocutory order suspending the commencement of the 2nd defendant’s Revised Guidelines for Verification of Certificate(S) with the Nursing and Midwifery Council Of Nigeria, earlier proposed to take effect from the 7th of March, 2024 as indicated on the 2nd defendant’s circular dated 7th February, 2024, pending the hearing and determination of the claimants/applicants Originating Summons in this suit.”

They also want “an interlocutory order restraining the defendants, their partners, parastatals, subjects, counterparts and agents from taking any further step that may hinder, restrict, or infringe on the constitutional rights and freedom of nurses and midwives in Nigeria from emigrating to the country to seek better career opportunities and training abroad.”

At the proceedings on Wednesday, counsel for the complaints, Ode Evans, told the court that he had just received the preliminary objection filled by the first and second defendants.

He pleaded with the court to adjourn the matter to enable him to reply to their applications.

Evans said, “I confirmed the receipt of the application from the first and second defendants this morning. We shall be asking for a date to enable us to file our responses.”

Justice Osatohanmwen Obaseki-Osaghae adjourned the matter till May 20 for hearing.

She ordered that the hearing notice be served on the Federal Ministry of Health and the Attorney General of the Federation who had no legal representation in court.

Source: https://punchng.com/japa-council-nurses-begin-legal-battle-over-new-certification-guidelines/ 2 Likes 1 Share

|

Travel / Re: Canada To Reduce Number Of Foreign Workers by Great100000: 8:15am On Mar 22 Travel / Re: Canada To Reduce Number Of Foreign Workers by Great100000: 8:15am On Mar 22 |

iamtardey:

Abeg make I enter before dem go stop Nigeria sha  Baddest     6 Likes |

Travel / Canada To Reduce Number Of Foreign Workers by Great100000: 8:02am On Mar 22 Travel / Canada To Reduce Number Of Foreign Workers by Great100000: 8:02am On Mar 22 |

Canada for the first time is planning to curb the number of temporary foreign workers it welcomes, officials announced Thursday, after years of lofty immigration levels.

Ottawa is proposing to reduce the number of temporary residents to five percent of the population over the next three years, down from the current 6.2 percent (2.5 million people).

That target will be firmed up after consultations with Canada’s provinces, some of which have been pushing back on large migrant inflows amid a housing crunch and soaring demands for services.

Restrictions on temporary foreign worker permits will start on May 1.

This follows a recently announced cap on new permits for international students and visa requirements for some Mexican travellers.

“Canada has seen a sharp increase in the volume of temporary residents in recent years, from a rise of international students to more foreign workers filling job vacancies to those fleeing wars and natural disasters,” Immigration Minister Marc Miller told a news conference.

However, Canada’s labour market is now much tighter, with its population growth, fueled by massive immigration, outpacing job creation.

According to government data, job vacancies fell 3.6 percent to 678,500 in the last three months of 2023, marking the sixth straight quarterly decline from a record high of 983,600 reached in the second quarter of 2022.

“Changes are needed to make the system more efficient and more sustainable,” Miller said.

Employment Minister Randy Boissonnault urged employers to consider hiring refugees before seeking to bring in temporary foreign workers.

He said businesses that are currently allowed to have temporary foreign workers make up to 30 percent of their workforce will see that proportion drop to 20 percent, except in the health care and construction sectors.

Canada’s immigration department, meanwhile, has been ordered by Miller to conduct a review of existing programs that bring in temporary labourers to better align them with labour needs and weed out abuses.

Source: https://www.vanguardngr.com/2024/03/for-first-time-canada-to-reduce-number-of-foreign-workers/ 4 Likes 1 Share

|

Business / Dangote, MTN, Others Lose N1.7 Trillion To Naira Depreciation by Great100000: 7:37am On Mar 21 Business / Dangote, MTN, Others Lose N1.7 Trillion To Naira Depreciation by Great100000: 7:37am On Mar 21 |

Dangote Group, Nestle Nigeria and MTN Nigeria, alongside four of Nigeria’s most capitalised companies, lost N1.7tn to the depreciation of the naira in 2023.

According to an analysis of their financial statements published on the website of the Nigerian Exchange Group, the listed firms incurred significant losses in the 2023 financial year, largely due to forex-related losses.

Nigeria’s largest conglomerate, Dangote Industries, in its 2023 financial statement said it incurred N164bn FX loss in 2023. The conglomerate said the loss was primarily due to its operations in other countries.

Another manufacturing giant, BUA, also reported a forex loss of N69.9bn. This represented a significant increase from the N5.5bn it recorded in 2022.

The firm said, “The Company is exposed to foreign exchange risk arising from future commercial transactions and some recognised assets and liabilities to the US dollar and euro.

“Management minimises the effect of the currency exposure by buying foreign currencies when rates are relatively low and using them to settle bills when due. The company is primarily exposed to the US dollar and Euro.”

Meanwhile, Nigerian Breweries, in its audited 2023 financial report, recorded a loss of N153bn, a sharp contrast to the N26.3bn recorded in 2022. This means that the company’s loss increased by 83 per cent in 12 months.

The forex loss had a huge impact on the firm’s overall performance in the 2023 financial year, driving its net loss to N106bn.

FMCG giant, Nestle Nigeria, was not also spared. In its 2023 financials; the company said that due to the depreciation of the naira, it incurred forex-related losses to the tune of N195.bn.

The firm said its profit-after-tax was negatively impacted by the depreciation of the naira as its operating cost jumped by 41.2 per cent to N122.7bn.

Another big player in the FMCG sector, Cadbury Nigeria, in its 2023 financial statement said it incurred a loss of N36.93bn due to exchange rate differences in 2023.

The currency-related challenge was a major theme that negatively impacted the company’s financials in 2023.

In response to the negative equity of N15.08bn recorded in 2023, reflecting a 213 per cent decrease from the previous year, Cadbury Nigeria has proposed a strategic move to address its financial structure.

The company plans to convert its outstanding $7.7m loan payable to its major shareholder, Cadbury Schweppes Overseas Limited, into equity.

In the telecommunications sector, MTN Nigeria recorded a staggering forex loss amounting to N740.4bn. This represented an 804 per cent increase compared to the N81.8bn recorded in 2022.

In the banking industry, FBN Holdings took a significant forex loss valued at more than N350bn in the 2023 financial year.

The HoldCo, in its unaudited financial report, said N253.7bn net forex losses were recorded in the final quarter alone.

It blamed the losses on a policy shift implemented in June 2023 — the liberalisation of the foreign exchange market.

Cumulatively, the seven firms lost a total of N1.7tn to the depreciation of the naira.

In recent months, businesses in Nigeria have grappled with the volatility of the exchange rate, a development that has had devastating consequences for firms with significant forex exposure.

The situation became exacerbated after the Central Bank of Nigeria announced in June 2023 that it would float the local currency to allow it to find its true value.

In its ‘Africa Outlook 2024,’ released in November 2023, the research and analysis division of the Economist Group — Economist Intelligence Unit warned that high inflation and the gap between the official and parallel market rates of the naira will continue to fuel exchange rate instability and result in periodic devaluations.

It said, “Elsewhere, double-digit currency depreciation is anticipated in the major economies of Egypt, Sudan, Ethiopia, Angola, and Nigeria.

“In Nigeria, an unsupportive monetary policy implies that the naira will remain under pressure, while the central bank lacks the firepower to adequately supply the market or clear a backlog of foreign exchange orders, which will keep foreign investors unnerved.

“High inflation and a continued spread with the parallel market will leave the exchange rate regime unstable and result in periodic devaluations.”

Consequently, in January 2024, the CBN opted to change the methodology for the calculation of the official exchange rate. This led to a further devaluation of the naira, as the local currency reached an all-time low of N1,800/$ in February.

Speaking with The PUNCH, the Vice Chairman Of Highcap Securities Ltd, David Adonri, said the suddenness of the exchange rate floating did not give much room for companies to brace against the impact the new policy would have on business profitability.

Adonri also warned that if the exchange rate crisis is not resolved definitively, more multinational companies may decide to exit Nigeria.

He said, “The floating of the naira was something that happened suddenly. A lot of these users of hard currencies did not prepare for the sudden change of events. That is why they were caught napping.

“Otherwise, if some time was given for them to adjust, they would have been able to review their outstanding obligations in hard currencies or discontinue the pursuit of new obligations in hard currencies until they restructured their systems to absorb the change.

Asked if more multinational companies may decide to join the likes of Procter & Gamble, GSK and Sanofi to exit Nigeria, Adonri said, “Yeah. Because those companies you mentioned are all import-dependent multinational foreign companies that are manufacturing in Nigeria. All their inputs are sourced from their parent companies abroad or outside Nigeria.

“So, the sudden floating of the naira has dealt them a severe blow on the viability of their businesses in Nigeria. That is why they are leaving.”

Source: https://punchng.com/dangote-mtn-others-lose-n1-7tn-to-naira-depreciation/ 6 Likes 1 Share

|

Travel / UK Graduate Route: Restrictions Coming Up For International Students by Great100000: 7:14am On Mar 21 Travel / UK Graduate Route: Restrictions Coming Up For International Students by Great100000: 7:14am On Mar 21 |

The UK Graduate route review recommendations will be provided by Migration Advisory Committee.The UK government has decided to cut the net migration rate of the country. Several steps have already been implemented while some are in the offing. One of the proposed changes impacts international students’ ability to work in the UK after finishing their studies.

The UK Graduate route review is taking place and the Migration Advisory Committee (MAC) is expected to submit the report to the government by May 14. The UK government in December 2023 decided that modifications will be made to the Graduate route to encourage firms to invest in the native workforce rather than relying too much on migration.Yash Dubal, Director & a Senior Immigration Associate, A Y & J Solicitors, London, United Kingdom says, “It is an uncertain time for international students studying in the UK who are nearing the end of their courses as the results of the review are due to be presented in May. The UK Government has made a commitment to reduce levels of migration coming into Britain so it is highly possible that the review will recommend restrictions to the Graduate Visa route.

It may even be cancelled altogether, which will dramatically reduce the options available for graduates who wish to remain in the UK to work after their studies. If the route is cancelled, students will have to return to their home nations if they do not have a viable visa route to switch into after completing their studies, and consider their options from overseas. One route for entrepreneurs could be the Self – Sponsor route.”The Graduate route launched in July 2021 is an unsponsored route which allows students to stay for 2 years (or 3 years for PhD students) after graduation. To be eligible, a student must hold valid leave under the Student route and have completed an undergraduate, postgraduate or doctoral degree with a Higher Education Provider.

Applicants to the Graduate route do not need to provide evidence of their financial ability to support themselves in the UK, have a job offer or be earning a particular salary.The immigration rules state that “This route is for a Student in the UK who wants to work, or look for work, following the successful completion of an eligible course”. When the route was launched, the Government said that it wanted to attract and retain bright international students to contribute to society and the economy post-study and help businesses recruit highly qualified talent from across the globe to drive the economy forward.Further, an international student can spend relatively little on fees for a one-year course and gain access to two years with no job requirement on the Graduate route, followed by four years access to a discounted salary threshold on the Skilled Worker route.

This means international graduates can access the UK labour market with salaries significantly below the requirement imposed on the majority of migrant skilled workers.Graduate route was introduced to attract the best and brightest students to study in the UK. However, below are some government findings:

Early data suggests that only 23% of students switching from the Graduate route to the Skilled Worker route in 2023 went into graduate-level jobs.

In 2023, 32% of international graduates switching into work routes earned a salary above the general threshold at the time (£26,200), with just 16% earning over £30,000 – meaning that the vast majority of those completing the Graduate route go into work earning less than the median wage of other graduates.Initial data shows that the majority of international students switching from the Graduate route to the Skilled Worker route go into care work.Source: https://www.financialexpress.com/business/investing-abroad-uks-graduate-route-review-by-government-to-impact-international-students-3430428/#google_vignette |

Business / Access Holdings To Acquire National Bank Of Kenya Limited by Great100000: 6:54am On Mar 21 Business / Access Holdings To Acquire National Bank Of Kenya Limited by Great100000: 6:54am On Mar 21 |

[ b]Access Holdings has announced plans to acquire the National Bank of Kenya in its first major deal since the death of Herbert Wigwe.[/b]

This is sequel to an earlier report from Nairametrics on the announced sale of National Bank of Kenya by KCB.

According to a corporate disclosure on the NGX website seen by Nairametrics, it was noted that Access Bank Plc, the leading subsidiary of Access Holdings would acquire the entire issued share capital of National Bank of Kenya Limited from KCB.

Access Bank stated that it entered into a binding agreement with Kenyan-based KCB Group Plc (“KCB”) for the acquisition of the entire issued share capital of National Bank of Kenya Limited (“NBK” or ‘the Target’’) from KCB. KCB is also the holding company of KCB Bank Ltd, Kenya’s largest commercial bank.

The bank said this is in line with Access Bank’s strategic expansion initiative and is poised to solidify its presence in the Kenyan market.

Speaking on the transaction, Bolaji Agbede, the Acting Group CEO of Access Holdings Plc noted,

- “This proposed acquisition marks a significant step in the execution of our five-year strategic plan aimed at positioning the Bank as Africa’s Gateway to the World. The deal with NBK, a historically strong and well-known bank in Kenya with a balance sheet in excess of US$1.1 billion, presents a compelling opportunity to scale up our growth in the East African market.

- We remain confident that our investments towards diversifying and strengthening the Bank’s long-term earnings profile will deliver significant value for our shareholders, customers, and wider stakeholder groups.”

This will be Access Corporation’s first acquisition since the demise of its former GMD/CEO Herbert Wigwe, suggesting the bank will continues with its inorganic aggressive growth model.

National Bank of Kenya Results

- Checks from Nairametrics reveal the bank reported a third quarter loss of about Ksh 3 billion ($22.5 million) in September 2023.

- The bank also has a net equity of Ksh 10.6 billion ($79.6 million) at the end of September 2023.

- A closer look at the results also shows the bank carries a retained loss of about Ksh 7.9 billion ($59.3 million) Source: https://nairametrics.com/2024/03/20/access-holdings-to-acquire-national-bank-of-kenya-limited/ 13 Likes 2 Shares

|

Business / Binance Users’ Assets Exceed $100 Billion by Great100000: 9:12am On Mar 19 Business / Binance Users’ Assets Exceed $100 Billion by Great100000: 9:12am On Mar 19 |

The world’s biggest cryptocurrency exchange, Binance, has announced that the value of assets it holds for its users has crossed the $100bn threshold.

The crypto exchange made this disclosure in a statement on Monday.

This achievement comes amid a surge in digital asset prices and an influx of strong inflows throughout March.

The exchange wrote on X (former Twitter), “The value of user asset holdings on Binance now exceeds $100bn.

“All user funds are backed at a 1:1 ratio and are fully verifiable through our Proof of Reserves, which highlight our commitment to user funds transparency,”

Two weeks ago, Binance announced its decision to cease its naira to dollar exchange services in Nigeria due to a dispute with Nigerian authorities, who accused the platform of manipulating the country’s foreign exchange rate.

Despite denying these allegations and refuting claims of facilitating illicit fund flows, Binance faced increasing scrutiny.

The Central Bank of Nigeria Governor Yemi Cardoso said that over $26bn in illicit funds had transited through the platform in the previous year.

In response to concerns, Binance disclosed that it had restricted 281 accounts belonging to Nigerians due to money laundering suspicions in 2022.

The platform highlighted its collaboration with the federal government to combat illicit activities and protect users.

However, tensions persist as Nigerian authorities sought detailed information from Binance, including data on its top 100 users and transaction histories for the past six months.

Despite the request, Binance had not yet responded.

Subsequently, a Federal High Court in Abuja issued an order for Binance to furnish the Economic and Financial Crimes Commission with comprehensive information regarding all Nigerian traders on its platform, following an ex-parte motion filed by the EFCC.

Source: https://punchng.com/binance-users-assets-exceed-100bn/ 5 Likes 2 Shares

|

Culture / Two ‘Next-In-Lines’ That Never Became Olubadan Of Ibadan In Recent Years by Great100000: 8:24am On Mar 19 Culture / Two ‘Next-In-Lines’ That Never Became Olubadan Of Ibadan In Recent Years by Great100000: 8:24am On Mar 19 |

In every true son of Ibadan, there’s a potential Olubadan. However, becoming Olubadan is a long haul of climbing 23-step rungs of either of the two chieftaincy ladders: Olubadan line (civil) and Balogun line (Military).

While the Obaship system and ascension to the coveted throne of Olubadan is unique and predictable, getting to the top of the ladder means a gift of long life for the highest ranking chiefs of the ancient Yorùbá capital city of Oyo State.

Becoming Olubadan is on rotational basis between the two lines of ascension to the throne headed by Ọtun Olubadan (Civil line) and Balogun (Military line). But in recent years, over a decade, there have been two high chiefs and of course, next-in-lines to the throne who never get to the top – Olubadan.

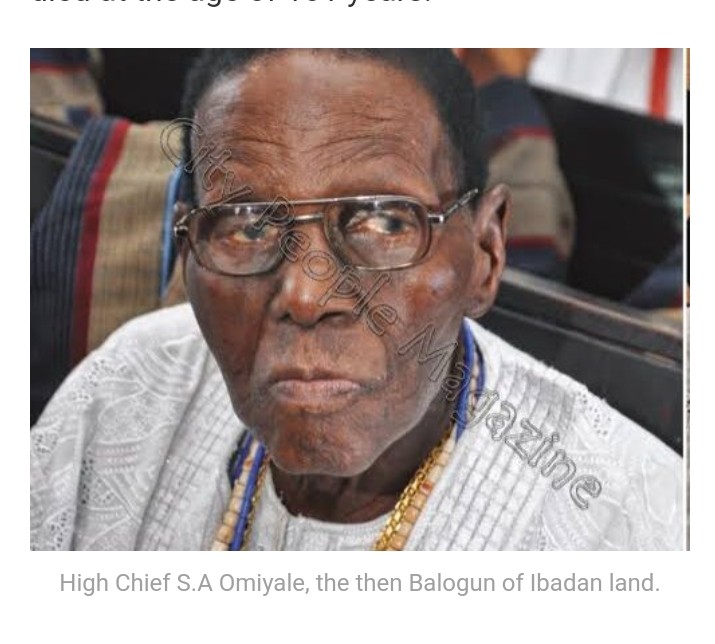

High Chief S.A. Omiyale (Balogun of Ibadan)

High Chief Sulaimon Adegboyega Omiyale was the Balogun of Ibadan land and next-in-line to Oba Samuel Odulana Odugade 1, the 40th Olubadan who reigned from 11th of August, 2007 to 19th of January, 2016 and died at the age of 101 years.

With Oba Odulana, who succeeded Oba Yinusa Ogundipe Arapasowu 1, as next-in-line from the Civil line, it was supposed to be the turn of High Chief Omiyale, had it been he lived to succeed the aged monarch.

But the Balogun of Ibadan land died on Saturday, 7th November, 2015 at the University College Hospital, UCH, Ibadan, at the age of 91.

Two months after his death, the reigning Olubadan, Oba Odulana died on 19th January, 2016.

High Chief Omowale Kuye (Ọtun Olubadan)

High Chief Omowale Kuye was the Ọtun Olubadan, traditional head of the Civil line. With Omiyale’s death, Kuye was a step closer to becoming Olubadan, but he also didn’t live to succeed the monarch.

Kuye, who was a former Director General, Special Duties and later Budget in the Office of the President of Nigeria — under both Alhaji Shehu Shagari and General Olusegun Obasanjo — died on 20th November, 2015; barely two weeks after the demise of Balogun of Ibadan land.

Because of the earlier death of Balogun Omiyale whose line was supposed to produce the next monarch after the reigning Olubadan, High Chief Kuye would’ve become the next Olubadan being the highest ranking of the Olubadan-in-Council, but he also passed on before Oba Odulana.

Additionally, the demise of both Balogun Omiyale and Ọtun Olubadan Kuye, paved the way for the then Otun Balogun, Saliu Akanmu Adetunji, who eventually succeeded Oba Odulana as the 41st Olubadan in 2016. He was also succeeded in 2022 by the recently deceased 42nd Olubadan, Oba Lekan Balogun, Alli Okunmade II.

Following the death of Oba Lekan Balogun, the next-in-line and Olubadan designate is the current Balogun from the Military line, Oba Owólabí Olakulehin. Source: https://tribuneonlineng.com/two-next-in-lines-that-never-became-olubadan-of-ibadan-in-recent-years/ 8 Likes 2 Shares

|

Business / Ownership Of Oil Palm Giant, Presco Returns To Nigeria After 33-Years by Great100000: 7:41am On Mar 19 Business / Ownership Of Oil Palm Giant, Presco Returns To Nigeria After 33-Years by Great100000: 7:41am On Mar 19 |

Ownership of oil palm giant Presco returns to Nigeria after 33-year Belgian control.

Presco is the country’s biggest fully integrated agro-industrial palm processor, according to GCR Ratings. Oil palm powerhouse Presco switched ownership from long-time investor Siat N.V, based in Brussels, Belgium, which had held on to the company’s majority control for well over three decades until the start of this month. Fimave N.V., holder of 86.7 per cent of the total issued shares of Siat, which owned a 60 per cent interest in Presco, consummated a deal shifting that stake to Oak and Saffron Limited, the oil palm processor said in a regulatory note. Oak and Saffron, PREMIUM TIMES check with Corporate Affairs Commission shows, is backed by Rasheed Sarumi, founder, owner and managing director of Saro Africa International, an agribusiness group whose subsidiaries include Gossy Warm Springs, Saro Agrosciences, Saro Oil Palms and Saro Lifecare. Oak and Saffron is “established for oil palm, rubber and horticulture businesses” and “intends to keep Presco Plc Plc listed on the NGX,” Presco stated in the document. Yet, the company has little or no online presence, with no website. The document said the transaction is “strategic” for Oak and Saffron, especially “its long-term commitment to developing the oil palm and rubber industries in West Africa and the horticulture industry in China, Belgium and the United States.”

The takeover moves the control of approximately 50,000 hectares of currently-cultivated oil palms on a plantation able to produce 100,000 metric tons of palm kernel oil, crude palm oil and natural rubber in thousands of metric tons every year to the new investor.

Benin City-based Presco is the country’s biggest fully integrated agro-industrial palm processor, GCR Ratings says. In addition to six oil palm plantations are a palm kernel crushing plant, palm oil milling facilities and vegetable oil refining & fractionation plants.Siat has been operating in Nigeria since 1991 when it bought the government-owned Obaretin Estate, then comprising 2,700 hectares of cultivated area.

Last March, it was fingered in a report by Journalismfund Europe for polluting the groundwater of its host community in Rivers State where the company acquired the assets of Risonpalm, a smaller rival owned by the state.Such sustainability issues and others like deforestation and land grab for oil palm production are generating heated debates on the need for the industrial oil palm industry to adhere to high environmental, social and governance (ESG)principles. That is compelling activists and environmentalists to demand strict criteria for how an organisation like Roundtable for Sustainable Palm Oil issues, of which Siat is a member, issues badges of approval to companies they deem to be environmentally responsible. Presco ended 2023 reporting a 27.3 per cent growth in revenue, and its net profit, at N30.4 billion, more than three times higher than the previous year’s.Total assets rose to N171.7 billion from N132.4 billion a year earlier, according to its unaudited earnings report.

Source: https://www.premiumtimesng.com/business/business-news/678571-ownership-of-oil-palm-giant-presco-returns-to-nigeria-after-33-year-belgian-control.html 13 Likes 1 Share

|

European Football (EPL, UEFA, La Liga) / Re: Chelsea Vs Leicester City: FA Cup (4 - 2) On 17th March 2024 by Great100000: 2:32pm On Mar 17 European Football (EPL, UEFA, La Liga) / Re: Chelsea Vs Leicester City: FA Cup (4 - 2) On 17th March 2024 by Great100000: 2:32pm On Mar 17 |

Cold Palmer is a goal 4 Likes |

Politics / Tinubu Determined To Resolve Power Shortfall, Estimated Billing - Gbajabiamila by Great100000: 1:18pm On Mar 17 Politics / Tinubu Determined To Resolve Power Shortfall, Estimated Billing - Gbajabiamila by Great100000: 1:18pm On Mar 17 |

Tinubu determined to resolve power supply shortfall, estimated billing – Femi Gbajabiamila

resident Bola Tinubu is determined to resolve the lingering power supply shortfall, energy theft, estimated billing and stealing of power infrastructure, his Chief of Staff Femi Gbajabiamila said on Saturday.

Gbajabiamila noted the Tinubu-led administration is working assiduously with the relevant stakeholders to ensure that the challenges bedeviling the power sector is resolved within the shortest possible time frame.

The former Speaker of the House of Representatives gave this assurance while inaugurating two units of 20MVA Injection substation in his Surulere Constituency, Lagos, which were facilitated during his tenure as Speaker.

Gbajabiamila, who was represented by Senator Wasiu Sanni Eshinlokun(Lagos Central), further pledged the president’s commitment to improved electricity supply nationwide.

“Mr President has made an allocation of over N340 billion in the 2024 budget towards improving infrastructure in the power sector. President Tinubu is also concerned about cases of energy theft, estimated billing and stealing of power infrastructure,” Gbajabiamila said.

While expressing delight at the project, the CoS assured that it would help to improve power supply to Surulere environs including: Akerele, Randle, Ishaga, Ogunlana, Shitta, and Adelabu.

He said when he briefed him, the President “was pleased about this public–private sector partnership between the Federal Government and Eko Distribution company. We owe this dividend of democracy to Mr. President.”

Expatiating, Gbajabiamila said: “The Tinubu administration has shown its dedication to solving the power supply challenges of Nigeria from the get-go with the signing of the 2023 Electricity Act just days into taking over the reins of power of our country.

“Stakeholders and professionals have been engaged to achieve our dream of attaining a 24/7, uninterrupted power supply in our nation.”

He described the commissioning as “a testament to the power of partnership and the tireless efforts of all stakeholders involved.”

He praised the collaboration with Eko Electricity Distribution Company (EKEDC), alongside other stakeholders, saying it had been pivotal to the project.

“We have demonstrated what can be achieved when public and private entities join forces with a shared purpose,” he said.

Lagos Governor Babajide Sanwo-Olu, who was represented by the Commissioner for Energy and Mineral Resources, Mr. Biodun Ogunleye, commended Gbajabiamila and the private-public partnership that resulted in the project.

He pledged that “in less than two years there’ll be segments of this city that will say bye bye to darkness.”

He urged the people to “Pay your bills, don’t beat up staff, don’t bypass metres. Change is here and for that change to have an impact all of us must behave responsibly.”

Source: https://thenationonlineng.net/tinubu-determined-to-resolve-power-supply-shortfall-estimated-billing-gbajabiamila/ 7 Likes 1 Share

|

Sports / Re: How Joshua Turned £15,000 First Pay To £500 Million Career Earnings by Great100000: 5:58am On Mar 17 Sports / Re: How Joshua Turned £15,000 First Pay To £500 Million Career Earnings by Great100000: 5:58am On Mar 17 |

pquaver:

The op dey help Joshua dey calculate him money.. What is wrong with op and his monitoring spirit? Loz, my brother check the source of the news ooooo 2 Likes |

Sports / How Joshua Turned £15,000 First Pay To £500 Million Career Earnings by Great100000: 5:37am On Mar 17 Sports / How Joshua Turned £15,000 First Pay To £500 Million Career Earnings by Great100000: 5:37am On Mar 17 |

In the world of boxing, tales of rags-to-riches journeys often captivate audiences, but few stories rival the meteoric rise of Anthony Joshua. From his humble beginnings in the ring, marked by a meager £15,000 payday for his inaugural professional bout, to his staggering career earnings totaling £500,140,000, Joshua’s journey is a testament to unwavering resilience, unyielding dedication, and a relentless pursuit of excellence, PETER AKINBO writes.

Before the glitz and glamor of the professional circuit, Joshua honed his craft in amateur boxing, amassing accolades and acclaim that foreshadowed his future dominance.

With an impeccable amateur record and a 2012 Olympic gold medal adorning his chest, Joshua transitioned seamlessly into the professional ranks, signaling the dawn of a new era in heavyweight boxing.

Emanuele Leo was his first opponent in the pros and he was quickly secured his first pro paycheck by knocking Leo out in the first round at the 02 Arena pocketing £15,000 for the bout.

Joshua went on to earn £50,000 in his next two fights which he won by knockouts against Paul Butlin and Hrvoje Kisicek. He followed that up with a £75,000 pay-day against Dorian Darch who also fell victim to Joshua’s knockout power.

His first million-pound purse would wait till his 8th professional bout against Konstantin Airich who he also dispatched by TKO and bagged a £1m purse. Joshua steadily climbed the ranks, each triumph contributing to his burgeoning reputation and financial standing.

Joshua’s ambition had always set him apart from his peers. In a candid interview dating back to April 2017, Joshua spoke of his aspirations to not only conquer the boxing world but to transcend it, aiming to become the sport’s first billionaire.

“When I first started, the aim was to become a multi-millionaire,” Joshua said.

“But now there are ordinary people, grandmas and granddads, who are worth millions just because of property prices. So the new school of thought is that I need to be a billionaire.”

Joshua went on to earn £1m from four other fights and £2m from wins over Kevin Johnson and Gary Cornish before a £3m purse for his win over Dillian Whyte and a total of £14.5m from his next three bouts.

However, it was his resounding victory over Wladimir Klitschko in the same month that catapulted Joshua into boxing stardom. Not only did the win secure his status as a heavyweight champion, but it also significantly boosted his earnings, with a staggering £15m purse attached to the fight.

His rematch with Andy Ruiz Jr., which saw him reclaim his titles from the American who handed him his first loss, brought in a monumental £66m payday, a testament to his enduring appeal and drawing power.

Joshua’s highest purse from a bout was made in his rematch with Oleksandr Usyk which he lost by split decision. In the first bout, Joshua earned £20m and in the rematch in Saudi Arabia, the two-time heavyweight champion bagged a whopping sum of £70m.

Undeterred by setbacks, such as his defeats to Usyk, Joshua showcased his resilience by bouncing back with triumphant victories in his next four fights which saw him earn a total of £86 with the biggest pay coming from his most recent fight against Francis Ngannou in Saudi Arabia where he pocketed £40m.

Each victory not only added to his legacy in the ring but also swelled his bank balance, underscoring his status as one of boxing’s most bankable stars.

Looking ahead, Joshua’s sights are set firmly on the horizon, his appetite for success as voracious as ever. With a record of 28-3-0 (25 KOs), the 34-year-old now has his sights set on becoming a three-time heavyweight champion. Source: https://punchng.com/how-joshua-turned-15000-first-pay-to-500m-career-earnings/ 48 Likes 11 Shares

|

Culture / Ooni Of Ife And 3rd Wife, Olori Tobi Welcome Twins by Great100000: 6:26pm On Mar 16 Culture / Ooni Of Ife And 3rd Wife, Olori Tobi Welcome Twins by Great100000: 6:26pm On Mar 16 |

The Ooni of Ife, Oba Adeyeye Ogunwusi, and one of his queens, Olori Tobi, have welcomed twins. The Ooni shared the news on his verified Instagram account, revealing that Olori Tobi gave birth to a prince and princess on Saturday. He said, “To God be the glory, great things he has done. Hearty congratulations to the entire House of Oduduwa and Olori Tobiloba, who today birthed a prince and princess to the royal throne of Oduduwa.

“Mother and children are doing well to the glory of God Almighty.” Source: https://punchng.com/ooni-of-ife-queen-welcome-twins/ 42 Likes 5 Shares

|

Politics / Tinubu's U-Turn On Niger Sanctions Received With Relief In Northern Nigeria by Great100000: 4:06pm On Mar 16 Politics / Tinubu's U-Turn On Niger Sanctions Received With Relief In Northern Nigeria by Great100000: 4:06pm On Mar 16 |

Bola Tinubu's U-turn on Niger sanctions received with relief in northern Nigeria.

After the army seized power in Niger last year, the president of its giant neighbour Nigeria was at the forefront of demands that the junta step down, even warning that the West African bloc could use military force to oust the generals, while imposing tough sanctions and closing the border. However just eight months later, Bola Tinubu has lifted all those restrictions. In many ways, it is a huge climbdown for the regional bloc, Ecowas, but it is also personally embarrassing for Mr Tinubu, analysts say. The warm welcome for the lifting of sanctions in both Niger and across the border in northern Nigeria also shows the unpopularity of his original, hard-line position. The about-turn was partly because Niger, along with its fellow juntas in Burkina Faso and Mali, hugely increased the stakes by saying they would pull out of Ecowas altogether, raising serious questions about the bloc's future. The three countries had been suspended from Ecowas, which has been urging them to return to democratic rule. It seems Ecowas realised its waning influence after the trio went ahead to form an alliance, sever ties with France and forge closer relations with Russia. Nigerian political commentator Sani Bala thinks Mr Tinubu was too hasty eight months ago in trying to prove himself, and act like the "strong man". He had only been in office two months when Niger's coup took place and had just taken over as chairman of Ecowas. "It was a huge mistake from President Tinubu to impose those sanctions without fully appreciating the special relationship we have with Niger," the Kano-based analyst told the BBC.Mr Tinubu's own background - being forced into exile by a military regime in the 1990s - may have influenced his tough stance. Yet Mr Bala feels he should not have been so quick to act: "He should have consulted widely from the start."Mahmud Bawa, a political analyst in the city of Kaduna, agrees.

"Bola [Tinubu] is too impulsive. He will act and think later - just like in his inaugural speech," he told the BBC.This is a reference to how the president announced that Nigeria's long-standing fuel subsidy would be ending - a seemingly off-hand remark during his inauguration ceremony at the end of May last year. It caused chaos at the time and the subsequent huge jump in the price of petrol has had huge knock-on costs for consumers. "He is facing the consequences now," said Mr Bawa, adding that the president has just had to suspend his student loan scheme, due to start this month, as the legislation was put together too hastily. "So I think this is embarrassing."

The fact that the 71-year-old president had initially threatened military action against Niger was what really raised hackles.Nigeria and Niger share strong ethnic, economic and cultural ties, with families living either side of the border.

Closing the border and cutting off the electricity, which caused blackouts in cities across Niger, also angered many.Trade suffered - and essentials such as cement could no longer be imported. The landlocked country depends on imports brought in by road. Hamidou Kalalabuwa, a small-time trader in Diffa, a city in south-eastern Niger on the border with Nigeria, said poor mainly Muslim communities on both sides had suffered most.

"This is amazing news and even more special coming in the Ramadan month of fasting," he told the BBC."In Hausa we have a saying 'bayan wuya sai dadi', which translates as 'after suffering comes relief'. This is a relief," he said.

In Nigeria, business in the northern city of Kano - an economic hub for the region - was greatly affected because of the sanctions.The absence of businessmen from Niger, often in town to buy products to export, was keenly felt.

Kano property developer Auwalu Yakasai is over the moon about Mr Tinubu's U-turn - given that the economy is suffering on multiple fronts."It is good news and my hope is that the economy benefits and gets better," he told the BBC.

This joyous response from both sides may give Nigeria's president some reprieve, Mr Bala says.

"Niger has always been Nigeria's friend and this move will go a long way to repair the damaged relationship."Source: https://www.bbc.com/news/world-africa-68563579 4 Likes 1 Share

|

Business / Naira Falls At Parallel Market, Appreciates In Official Window by Great100000: 5:22am On Mar 16 Business / Naira Falls At Parallel Market, Appreciates In Official Window by Great100000: 5:22am On Mar 16 |

The naira, on Friday, depreciated to N1,600 per dollar at the parallel section of the foreign exchange (FX) market.

This represents a 1.91 percent decline compared to the N1,570/$ reported on March 13.

Currency traders in Lagos, also known as bureau de change (BDC) operators, quoted the buying rate of the dollar at N1,580 and the selling price at N1,600 — leaving a profit margin of N20.

At the Nigerian Autonomous Foreign Exchange Market (NAFEM), the country’s official window, the naira appreciated by 0.38 percent to N1,602.75/$ — from N1,608.98/$ on March 14.

Meanwhile, the Central Bank of Nigeria (CBN), on March 14, reiterated banks must not utilise gains from foreign currency revaluation to pay dividends and expenses.

“Further to our letter dated September 11, 2023, referenced BSD/DIR/CON/LAB/16/020 on the above subject, the Central Bank of Nigeria wishes to reiterate that banks are required to exercise utmost prudence and set aside FCY revaluation gains as a counter-cyclical buffer to cushion any adverse movements in the FX rate,” CBN said.

“In this regard, banks shall not utilize such FX revaluation gains to pay dividends or meet operating expenses.”

CBN had issued guidelines on September 11, 2023, on how banks can manage the impact of FX reforms. Source: https://www.thecable.ng/naira-falls-at-parallel-market-appreciates-in-official-window/amp?/naira-falls-at-parallel-market-appreciates-in-official-window 4 Likes 1 Share

|

Politics / Tinubu Appoints Zubaida Umar As First Female NEMA DG by Great100000: 5:11am On Mar 16 Politics / Tinubu Appoints Zubaida Umar As First Female NEMA DG by Great100000: 5:11am On Mar 16 |

President Bola Tinubu has approved the appointment of Mrs. Zubaida Umar as the Director-General of the National Emergency Management Agency (NEMA).

Mrs. Umar is the first woman to be appointed as Director-General of the pivotal interventionist and humanitarian agency, and her appointment further underlines the President’s avowed commitment to gender inclusion.

According to a statement by Presidential spokesman, Ajuri Ngelale, the new Director-General of NEMA has over 20 years of work experience in diverse fields, including Human Resources, and Finance and Administration. She is a member of the Chartered Institute of Bankers and the Institute of Credit Administration.

She holds ACCA certifications in Public Financial Management and Digital & Sustainability Financing.

“As Executive Director, Finance and Corporate Services at the Federal Mortgage Bank, Mrs. Umar drove the strategy and repositioning of the bank and successfully facilitated the transformation of the institution into a modern, digitized mortgage and financial service provider.

“The President expects that the new Director-General will bring the much-needed financial and operational discipline and refashion the agency into a performance-driven and proactive emergency response provider with a focus on prevention and climate change readiness in the execution of its core mandate,” Ngelale stated. Source: https://leadership.ng/just-in-tinubu-appoints-first-female-nema-dg/ 8 Likes 4 Shares

|

Politics / Tinubu Appoints Ex-Rivers Commissioner As DG Of Border Agency by Great100000: 7:44am On Mar 15 Politics / Tinubu Appoints Ex-Rivers Commissioner As DG Of Border Agency by Great100000: 7:44am On Mar 15 |

President Bola Tinubu has approved the appointment of Dakorinama George, a former Commissioner of Work in Rivers State, as the Director-General of the Border Communities Development Agency, BCDA.

Presidential spokesperson Ajuri Ngelale disclosed this in a statement on Thursday.

Tinubu urged George to put his experience into developing the agency.

George holds a PhD in Construction Management; an MSc in Quantity Surveying and Construction Engineering, and a B.Tech, in Quantity Surveying.

He is a fellow of the Certified Institute of Practising Professionals, USA; a fellow of the Association of Strategy Professionals, USA, and a member of other distinguished associations.

George is a former commissioner for works in Rivers State under the then governor of the state and current Minister of Federal Capital Territory, Nyesom Wike. Source: https://dailypost.ng/2024/03/14/tinubu-appoints-ex-rivers-commissioner-as-dg-of-border-agency/https://www.channelstv.com/2024/03/14/tinubu-appoints-alabo-george-as-dg-of-bcda/ 11 Likes 1 Share

|

Travel / Japa: 10 New Changes Nigerians, Other Foreigners Should Know Before Relocating by Great100000: 7:35am On Mar 15 Travel / Japa: 10 New Changes Nigerians, Other Foreigners Should Know Before Relocating by Great100000: 7:35am On Mar 15 |

Japa: 10 new changes Nigerians, other foreigners should know before relocating to UK In its bid to cut the influx of migration, the United Kingdom, UK, has made some changes in the visa schemes offered to Nigerians and other foreigners.

On Monday, the UK announced that foreign health workers and caregivers would not be allowed to bring their dependants with their work visas.

The Secretary of State for the Home Department, James Cleverly disclosed this, reiterating it was part of the plan to check high migration.

In another move, the UK, Thursday, said orders have been laid in the Parliament to increase the family visa minimum income requirement.

“This will ensure people only bring dependants to the UK they can financially support,” the Home Office said.

Cleverly said in the X account of the Home Office, “Migration is too high. We have to bring the numbers down to create a fairer system for the British people.”

Considering these changes, in this article, Vanguard reveals new 10 changes that foreign nationals should know before relocating to the UK.

Some of the rules affected the family and work visas for 2024.

According to the House of Commons, “Some of the changes have come into force and most of the rest will by 11 April 2024, in accordance with two sets of changes to the Immigration Rules released on 19 February and 14 March.”

Below are the 10 latest changes implemented by Prime Minister Rishi Sunak-led UK government:

1. Social care workers are no longer permitted to bring families (that is, spouses and children) on their visas.

2. The minimum salary to be sponsored for a Skilled Worker visa is increasing, with the baseline minimum rising from £26,200 to £38,700 (but not for the Health and Care Worker visa, which includes social care, or for education workers on national pay scales).

3. Changes to the Shortage Occupation List to reduce the number of jobs where it will be possible to fund someone for a Skilled Worker visa on less than the usual minimum salary (which is the main purpose of the list).

4. The minimum income normally required to sponsor someone for a spouse/partner visa is rising in stages from £18,600 per year to £29,000 and ultimately around £38,700.

5. A review of the Graduate visa, a two-year unsponsored work permit for overseas graduates of British universities.

6. The ban on newly arriving care workers bringing immediate family has been in place since 11 March 2024.

7. The Skilled Worker minimum salary increases will happen on 4 April 2024.

8. An interim Immigration Salary List, replacing the Shortage Occupation List, will also come in on 4 April 2024; the list will be reviewed later.

9. The spouse/partner visa minimum income will first increase to £29,000 on 11 April 2024; to around £34,500 at an unspecified time later in 2024; and finally to around £38,700 “by early 2025”.

10. The review of the Graduate visa has begun, with the Home Secretary asking for a report by 14 May 2024. Source: https://www.vanguardngr.com/2024/03/japa-10-new-changes-nigerians-other-foreigners-should-know-before-relocating-to-uk/

|

Agriculture / CBN Resumes Agric Funding With ₦100 Billion by Great100000: 7:18am On Mar 15 Agriculture / CBN Resumes Agric Funding With ₦100 Billion by Great100000: 7:18am On Mar 15 |

The Central Bank of Nigeria (CBN) has resumed its funding intervention for agriculture sector apparently in response to the challenges of food security in the country.

The apex bank has earmarked N100 billion to purchase 2.5 million bags of fertilizers for distribution to farmers.

The Governor of the CBN, Mr. Olayemi Cardoso, said that the investment in agriculture would increase food production and reduce inflation, currently at 29. 9 percent.

Speaking during the fertilizer handover event at the Ministry of Agriculture and Food Security yesterday, he said, “As we are all well aware, the Central Bank of Nigeria significantly emphasises maintaining price stability as one of its primary mandates.

“Food prices are a crucial component of inflation, especially considering that a substantial portion of household expenditure in Nigeria is allocated towards food and non-alcoholic beverages.

“This reinforces the critical need to address food inflation as a pivotal aspect of managing overall headline inflation rates. While the CBN has been implementing comprehensive measures to curb inflation, it is evident that in the short term, inflationary pressures may persist, predominantly driven by escalating food prices.

“This is precisely why we convened today- to strengthen our collaboration with the Ministry of Agriculture to mitigate the surge in food prices. “In alignment with our strategic shift towards focusing on our fundamental mandate, the CBN has veered away from direct quasi-fiscal interventions and transitioned towards leveraging conventional monetary policy tools for executing monetary policies effectively.

“In this light, we aim to extend our support and foster closer ties with Ministries, Departments, and Agencies (MDAs) with the mandate and expertise to undertake these critical initiatives.

“Consequently, we aim to enhance our partnership with the Ministry of Agriculture, bolstering your endeavours to enhance food productivity and security, ultimately curbing food inflation and fortifying our pursuit of price stability.

“In pursuit of these shared goals, we are delighted to announce the allocation of 2.15 million bags of fertiliser, valued at over 100 billion Naira, which we humbly hand over to the Ministry of Agriculture and Food Security. This contribution from the Central Bank aims to amplify food production capabilities and foster price stabilization within the agricultural sector.”

Source: https://www.vanguardngr.com/2024/03/cbn-resumes-agric-funding-with-n100bn-2/ 5 Likes 1 Share

|

Politics / Nigerians Criticize Accountant General, Commissioners Over UK Workshop by Great100000: 6:29am On Mar 14 Politics / Nigerians Criticize Accountant General, Commissioners Over UK Workshop by Great100000: 6:29am On Mar 14 |

Civil society and rights groups have lambasted the Accountant General of the Federation, commissioners of finance of the 36 states of the federation and other government officials for choosing to hold a workshop in the United Kingdom at a time when the economy is experiencing a major downturn.

The Office of the AGF reportedly held a workshop on Public Financial Management and International Public Sector Accounting Standards in London, UK.

Findings showed that the workshop was held at Copthorne Tara Hotel, Kensington London, from March 4 to March 9, 2024.

The workshop, titled “Public Financial Management and IPSAS,” brought together state commissioners of finance and officials from the Office of the Accountant-General of the Federation.

Over the course of five days, participants engaged in discussions related to IPSAS and its impact on accountability.

The workshop delved into other critical areas such as accounting and reporting in a hyperinflationary economy, as well as the challenges faced in public financial management implementation in Nigeria.

Budget implementation challenges were also discussed.

Nigeria is grappling with a persistent foreign exchange crisis, which is worsening the challenges faced by businesses, especially manufacturers. This crisis has been prolonged, stemming from the government’s decisions to remove petrol subsidies and allow the naira to float.

The country is battling with high inflation that has eroded the purchasing power of consumers, aside from food shortage that has led to hunger protests in pockets of the state.

As part of his cost-cutting strategy, President Bola Tinubu recently reduced the size of his entourage and encouraged his team to do the same.

As part of the UK workshop activities, participants had the opportunity for a courtesy visit to the Nigerian High Commissioner in London. The sessions commenced daily at 10:00 am and concluded at 2:30 pm, with participants departing for their respective destinations on March 9, 2023.

However, some Nigerians and rights groups have criticised the AGF and the commissioners for being insensitive to the mood of the nation, saying such a workshop should have been held within the country to save costs.

A human rights group, the International Society for Social Justice and Human Rights, described the travel embarked upon by the Office of the AGF as needless and a waste of the country’s financial resources.

The Chancellor of the group, Jackson Omenazu, told the PUNCH on Wednesday that the decision to move about 36 members of the implementation committee of the agency who are also commissioners of finance for the 36 states to London showed how insensitive the public servants were to the economic plight of the country.

“This is the height of financial recklessness and insensitivity to the economic situation of Nigeria today. If it is a workshop as they have claimed, the accountant general can go for the workshop and come back to replicate the knowledge here to the other commissioners,” he said.

Jackson added that the journey was absolutely unnecessary and wasteful.

He said, “The journey is absolutely unnecessary for him to travel with the 36 commoners of finance. Looking at the cost of the travel and the economic situation Nigeria has found itself in today, there is no prudence in such a decision. We need public servants who will key into the situation of this country and salvage the country.

“It is cheaper to bring the facilitators to Nigeria to train the participants looking at the high exchange rate. The accountant general and the approving agency that approved the trip need to be cautioned.”

The Chairman of the Centre for Anti-corruption and Open Leadership and the President, Centre for the Defence of Human Rights, Debo Adeniran, said it was important to know the content of the courses the OAGF and his team had travelled to London to ascertain if they were readily available in the country.

While he did not chide the accountant general for the trip, he noted that the accountant general should have embraced a cheaper option of ‘training the trainers’ where if necessary only few principal officers of the agency would travel for the training and return to train others.

“Determining whether the journey was frivolous depends on the availability and accessibility of the courses they travelled for in Nigeria. The world is a global village and we want to know if the course can be readily assessed online here in the country. However, to save the cost of foreign exchange needed to travel to London, it would have been cheaper to go for ‘training of the trainers’ depending on the institution’s mobility,” he said

However, the Director of Press at the Office of the AGF, Bawa Mokwa, defended the trip, explaining the reason behind hosting the workshop in the United Kingdom.

In a conversation with The PUNCH on Wednesday, he emphasised that the workshop was an annual event held regularly.

According to him, the event was held in London because the facilitators are based in the UK.

He also stated that the event was approved by the National Economic Council.

“It is an annual event. The OAGF members present at the meeting are sub-committees of Federal Allocation Account Committee. Members of the implementation committee are commissioners of finance of the 36 states,” he said.

“They usually go to the UK to do it annually because the resource persons are resident in the UK and they implement it to the letter,” he added.

Also, an economist at Lotus Beta Analytics, Shedrach Israel, said it was not economically wise to spend the country’s scarce forex on such travels, noting that the AGF should have either opted for a virtual study for the team.

“The government has said it will cut down cost of governance but what has happened is contrary to the initiative of reducing the cost of governance. We are living in a digital world. Do people have to travel to workshops? they don’t need to necessarily travel to be trained.

“The problem with most of our government agencies is that they budget more for recurrent expenditure instead of capital.

“It is not economically wise to transport such a high number of people to London to-and-fro looking at the high exchange rate. We must do all we can to make the naira improve its value,” he said.

Source: https://punchng.com/nigerians-lambast-accountant-general-commissioners-over-uk-workshop/ 5 Likes

|

Politics / US Court Orders Ex-Binance CEO, Changpeng Zhao To Surrender All Passports by Great100000: 6:11am On Mar 14 Politics / US Court Orders Ex-Binance CEO, Changpeng Zhao To Surrender All Passports by Great100000: 6:11am On Mar 14 |

A United States (US) district court has ordered Changpeng Zhao, the founder and former CEO of Binance, to surrender all his passports (active or expired) to a third party and keep authorities updated on his travel plans.

The order was contained in a legal filing tendered on Tuesday, modifying Zhao’s bond conditions for release.

This development comes after the US applied to modify its bond requirements on March 5.

Bond conditions are court-enforced demands that a defendant on pretrial release must follow until his case is resolved under law.

As part of the bond, Richard Jones, a US district judge, ordered Zhao to remain in the US and notify court authorities of any travel arrangements.

“Defendant must remain in the continental United States through the imposition of sentence,” the judge said.

“Defendant must notify Pretrial Services before any travel within the continental United States.

“Defendant must surrender his current Canadian passport to a third-party custodian employed and supervised by his counsel of record. The third-party custodian must retain control over that Canadian passport and must accompany the Defendant on any travel that requires identification documents.