Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 11:58am On May 31, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 11:58am On May 31, 2019 |

PJAMES1:

GBPNZD.

Bearish bias. An opportunity to go short may come up. I am looking for an entry. However, if I do not get a satisfactory reason to enter. I will stay out.

Some caution though...

1) I could be wrong.

2) Trading GBP pairs can be challenging because of fundamental issues surrounding the pairs. If you are a swing trader who uses tight stops, I believe it may be better to avoid them. Talking from experience.. My stops aren't even usually tight and yet I had to remove most of them from the pairs I trade at a time. They could be troublesome.

Always remember that one could be wrong at any time, and that money management and responsible trading are part of the core factors that make a difference. Some will be right, some will be wrong. Currently trading more than 100 pips below when I posted this. I have no reasons to think that's all. Still going down. NZD likely to show some strength. I expect EURNZD and GBPNZD to fall.. heavy. But like I always say.. I can be wrong. Things become easier when you trade knowing you could be wrong. And that money management is what makes the difference at the end of the day. Let the wins run. And cut the losses as soon as you discover you have been wrong. Summarily.. Always trade with a good RRR. 3 Likes |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 11:53am On May 31, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 11:53am On May 31, 2019 |

PJAMES1:

GBPCHF.

Bearish bias. There may be an opportunity to go short. If price retraces back to test the trendline, and there is a bearish price action. It may be a good place to sell.

Why won't I be surprised if price retraces to test the trendline. For those of us just learning. The moving average helps. Look at the relationship between the price and the moving average. Demo trade. Playing out just fine 1 Like

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 11:47am On May 31, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 11:47am On May 31, 2019 |

PJAMES1:

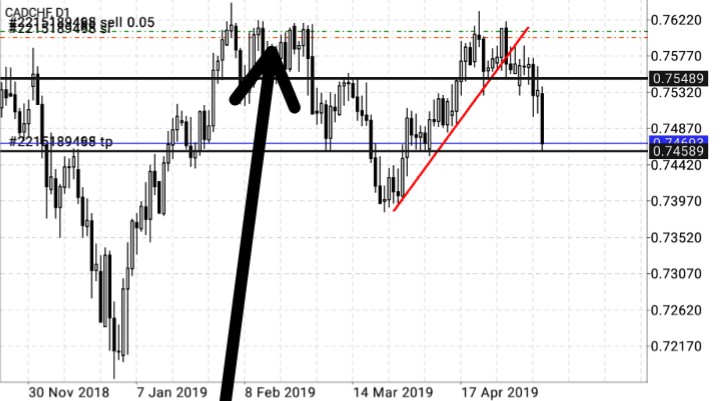

CADCHF.

Looking to sell.

Immediate target 0.7380 (likely)

Long term target 0.7200 (possible)

Demo trade. Looking for bearish price action, to sell again, around 0.7380(immediate target). If things continue to go to plan. 2 Likes

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 5:05pm On May 25, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 5:05pm On May 25, 2019 |

CADCHF.

Looking to sell.

Immediate target 0.7380 (likely)

Long term target 0.7200 (possible)

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 2:53pm On May 19, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 2:53pm On May 19, 2019 |

collitexnaira:

I couldn't agree more with you bro. GBP pairs are so radical. They have been my undoing, owning to the fact that i use tight stops when trading swings. I have severally contemplated on removing them from my pairs but due to the fact they generate more pips when traded right made me to keep few of them. Exactly!! Very radical pairs. Can frustrate. |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 9:18pm On May 18, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 9:18pm On May 18, 2019 |

GBPCHF.

Bearish bias. There may be an opportunity to go short. If price retraces back to test the trendline, and there is a bearish price action. It may be a good place to sell.

Why won't I be surprised if price retraces to test the trendline. For those of us just learning. The moving average helps. Look at the relationship between the price and the moving average. 1 Like

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:55pm On May 18, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:55pm On May 18, 2019 |

GBPNZD.

Bearish bias. An opportunity to go short may come up. I am looking for an entry. However, if I do not get a satisfactory reason to enter. I will stay out.

Some caution though...

1) I could be wrong.

2) Trading GBP pairs can be challenging because of fundamental issues surrounding the pairs. If you are a swing trader who uses tight stops, I believe it may be better to avoid them. Talking from experience.. My stops aren't even usually tight and yet I had to remove most of them from the pairs I trade at a time. They could be troublesome.

Always remember that one could be wrong at any time, and that money management and responsible trading are part of the core factors that make a difference. Some will be right, some will be wrong. 4 Likes

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:41pm On May 18, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:41pm On May 18, 2019 |

pinbar:

See why this thread could be helpful ? the name FOREX TRADE ALERTS was coined for a reason, to bring traders together and just as iron sharpeneth iron, we can help ourselves. i made extra money yesterday thanks to currentprice. I also want to say a big thank you to so many traders keeping this thread active , redsox, infofirst(by the way , thank you sir for all the help you are dishing out to new traders, i hope they will take advantage of the knowledge), pjames(your analysis is amazing, pls keep it up. i look forward to your live account) , femora(trust the account is growing smoothly) Ak284, Eddie, Tunderr... and many others .

cheers Thank you. |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:38pm On May 18, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:38pm On May 18, 2019 |

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:38pm On May 18, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:38pm On May 18, 2019 |

infofirst:

Thumbs bro. Loved your effort. Tapping from you. Thank you. |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:53pm On May 13, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:53pm On May 13, 2019 |

PJAMES1:

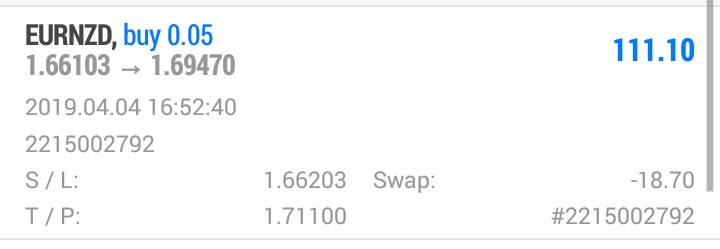

Closed this demo trade. I guess that's enough.

Got about about 330 pips.

Held for about 4 weeks. Swap took like 40 pips.

Obviously will be watching this pair for two reasons. If it will eventually reach the tp and for the next impulsive bearish movement as explained in this post. Massive pips to be harvested if the analysis is correct. Those just starting with charts could read that post. It turned out to be correct. One could learn a thing or two ( I am talking to those just starting to analyse charts). Closed too early. Eventually reached the target, about 490 pips from entry. Now watching to see if a clear bearish setup will appear. 1 Like

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:38pm On May 13, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:38pm On May 13, 2019 |

Closed manually. Demo trade.

Tp wasn't triggered but still close enough.

Strong Supply zone (black arrow) was respected again. Had other reasons to sell CADCHF but when the price got back to the strong supply zone, it seemed like the right time to sell. Another place one could have sold is the retest of the broken trendline.

Hopefully the charts help someone. Especially with price action trading. 3 Likes

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 12:13pm On May 08, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 12:13pm On May 08, 2019 |

infofirst:

Lovely one bro. I hope you do this on live account soon. Keep it up. So simple and effective one from you. Thank you very much. This comment means a great deal to me. I will do it live someday   . Still trying to find that consistency and discipline. But I am definitely getting better. Before the end of the year, hopefully should be ready. I am not in a rush. I will just keep learning and practicing. Will keep at it till I get it right. 2 Likes |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:02pm On May 07, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:02pm On May 07, 2019 |

PJAMES1:

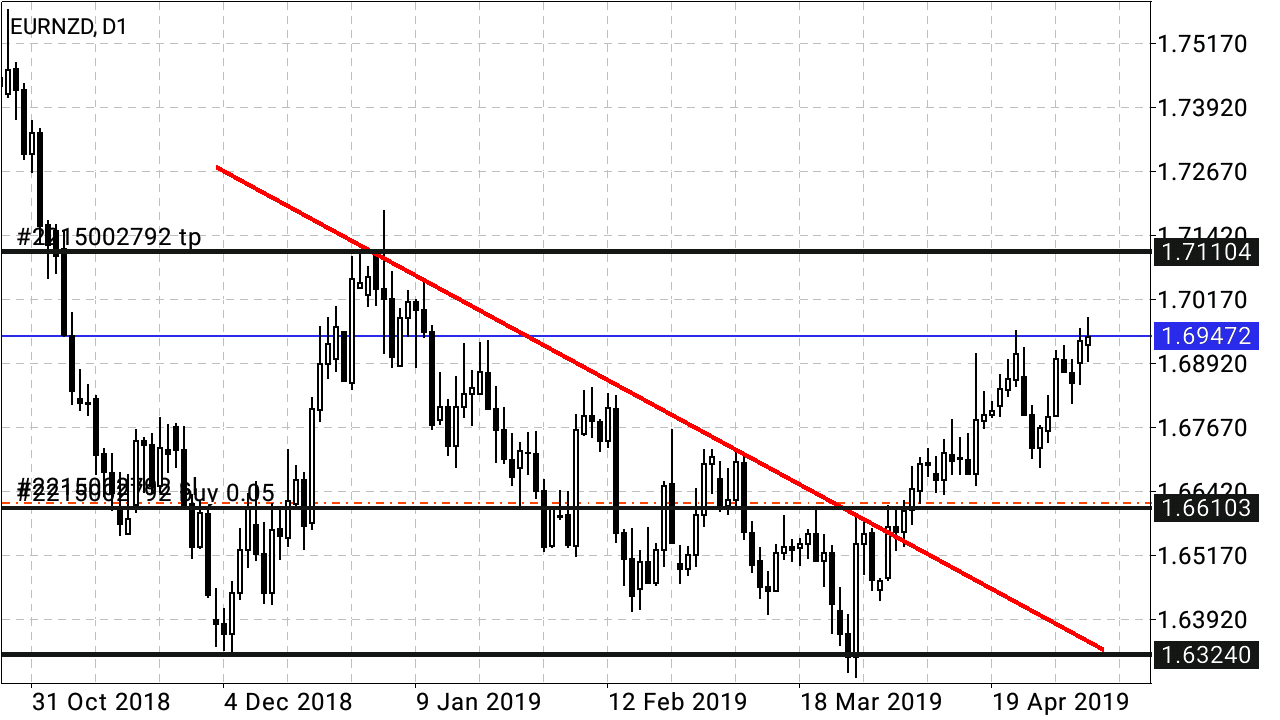

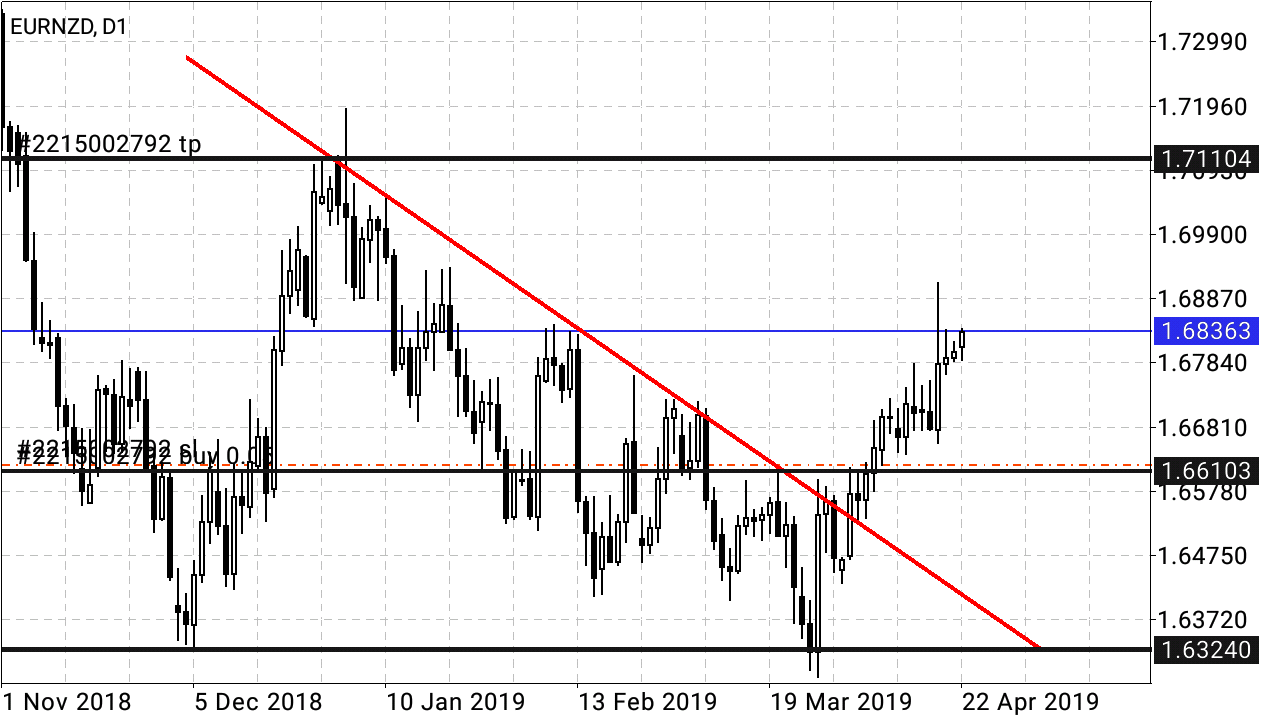

I know I have talked about EURNZD before. And how I was expecting a significant upside move. It appears we have that coming into play now. Weekly chart shows an incomplete head and shoulder pattern. But I am not thinking short yet. And I don't think the pattern will be completed now.

Weekly chart also shows a clear double bottom pattern.

Daily chart shows more details. There is a clear break of the trendline and it has been retested. The trendline held as support.

Also, I personally don't do much of Elliot Wave analysis but from the little I have learned from the charts of those who do.. I also believe we are seeing an ABC correction of the downward move that started in October 2018 and ended in December. A and B already completed.. C, the last part of the correction has started and would target 50% of the original downward move. This corresponds with the upper resistance I drew. That 1.7110 area.

The four Hour chart shows a clear inverted head and shoulder pattern. A pull back to the green line (neckline) area gives an opportunity to go long. The experts teach to allow he trade come to one. If it doesn't, one should let it go. The pullback gives a reasonable Risk Reward Ratio.

So from a technical point of view, medium to long term, EURNZD is up.. Then downnnn (on completion of the correction). In the next down impulsive move, I speculate the neck line of the weekly head and shoulder pattern will be broken.

But what do I know? I am just a learner putting out my perspectives on pairs. And who is striving to be better. This is not in anyway a financial advice. And trading decisions should not be based on this. Let us see what happens. Closed this demo trade. I guess that's enough. Got about about 330 pips. Held for about 4 weeks. Swap took like 40 pips. Obviously will be watching this pair for two reasons. If it will eventually reach the tp and for the next impulsive bearish movement as explained in this post. Massive pips to be harvested if the analysis is correct. Those just starting with charts could read that post. It turned out to be correct. One could learn a thing or two ( I am talking to those just starting to analyse charts). 6 Likes

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 1:59pm On Apr 22, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 1:59pm On Apr 22, 2019 |

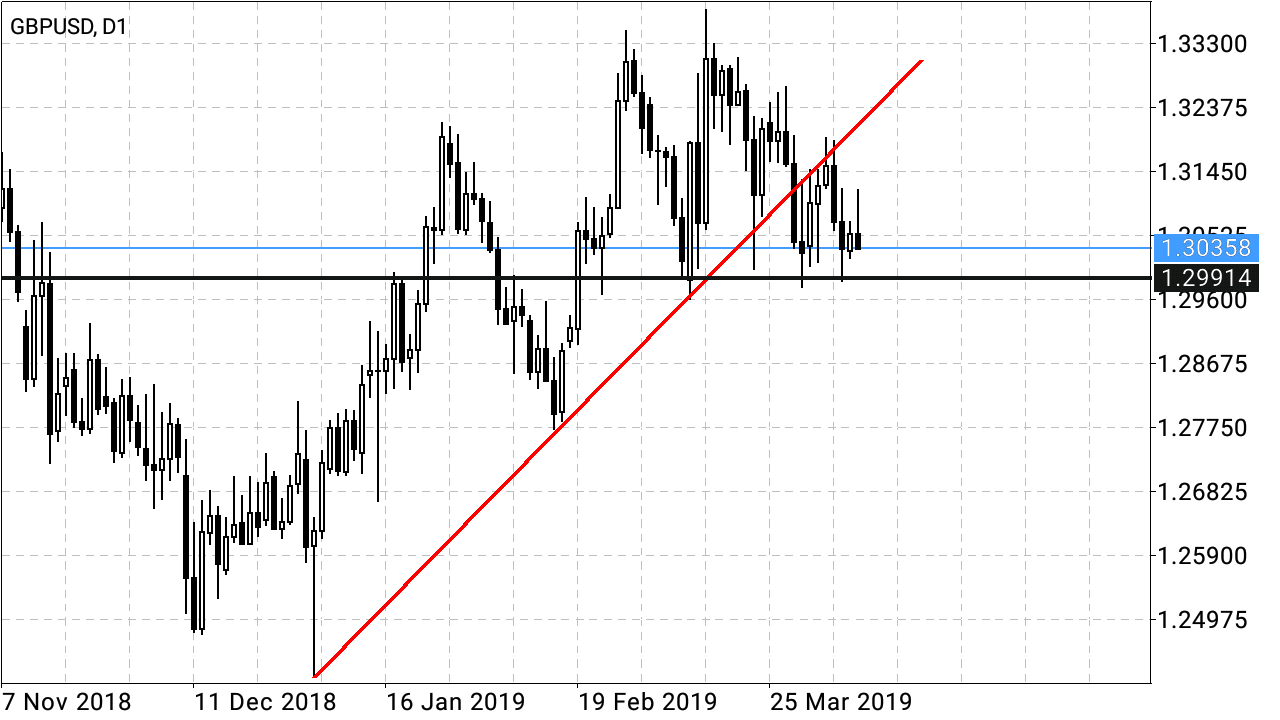

GBPUSD

Another demo trade.

My only concern is that there could be a pullback again to the trendline before we see further downside move. In a sell position already because I expect that resistance (black line) to hold.

Let's see what happens 1 Like

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:43am On Apr 22, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:43am On Apr 22, 2019 |

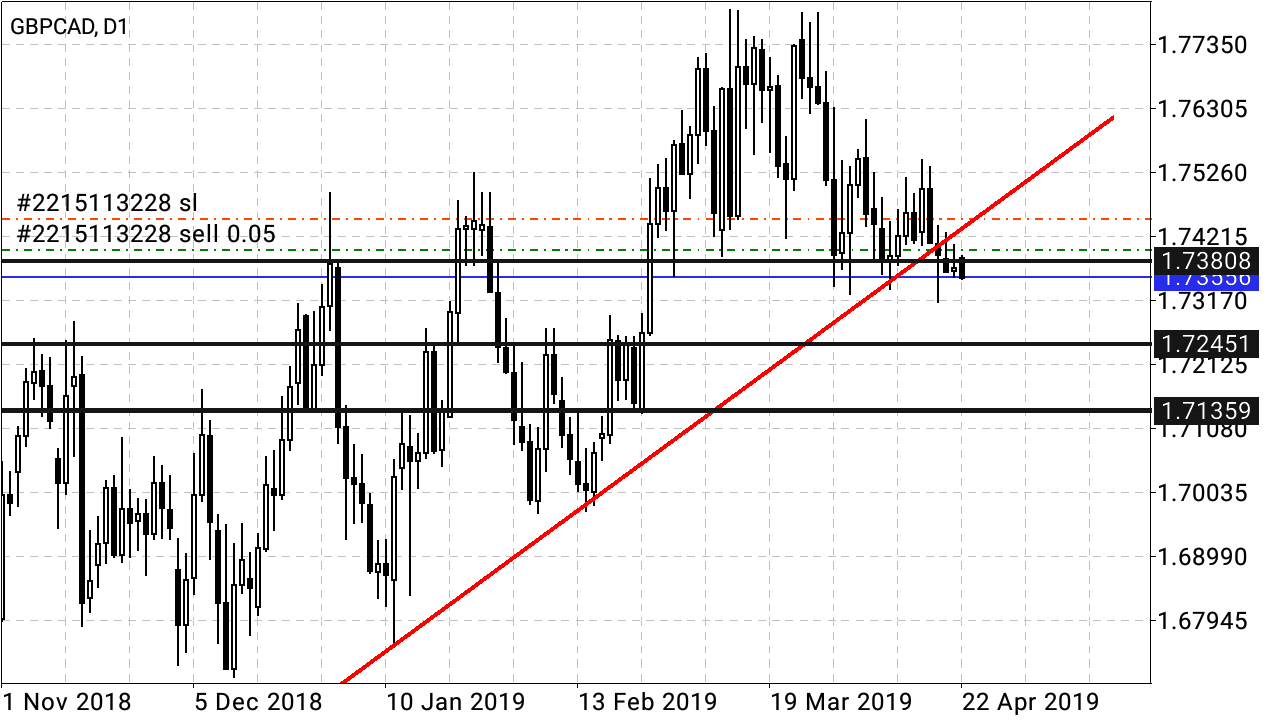

GBPCAD

Chart of an ongoing demo trade.

I think this will reach 1.7250 area. And possibly 1.7140 area.

May be too late to enter.

But If there is a pull back. There may be an opportunity to go short. 1 Like

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:35am On Apr 22, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:35am On Apr 22, 2019 |

PJAMES1:

GBPJPY

GBPUSD

GBPAUD

GBPCAD

I have looked at these ones recently and I wouldn't want to buy any of them at the moment. Especially because I am not an intra day trader. Similar patterns. Some of the pairs at important levels or approaching an important level. The opportunities for more downside move open when those levels are breached. Personally have a Bearish bias for these pairs.

Well, that's my own view.

I may be wrong.

Would post charts of some GBP pairs later. Not changed my bearish bias. And some have actually declined since this post. I think some would go further down and short opportunities might come in, if not already present. That's if you are a medium to long term trader. I tend to look medium to long term. I am not an intra-day trader. 1 Like |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:31am On Apr 22, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:31am On Apr 22, 2019 |

PJAMES1:

I know I have talked about EURNZD before. And how I was expecting a significant upside move. It appears we have that coming into play now. Weekly chart shows an incomplete head and shoulder pattern. But I am not thinking short yet. And I don't think the pattern will be completed now.

Weekly chart also shows a clear double bottom pattern.

Daily chart shows more details. There is a clear break of the trendline and it has been retested. The trendline held as support.

Also, I personally don't do much of Elliot Wave analysis but from the little I have learned from the charts of those who do.. I also believe we are seeing an ABC correction of the downward move that started in October 2018 and ended in December. A and B already completed.. C, the last part of the correction has started and would target 50% of the original downward move. This corresponds with the upper resistance I drew. That 1.7110 area.

The four Hour chart shows a clear inverted head and shoulder pattern. A pull back to the green line (neckline) area gives an opportunity to go long. The experts teach to allow he trade come to one. If it doesn't, one should let it go. The pullback gives a reasonable Risk Reward Ratio.

So from a technical point of view, medium to long term, EURNZD is up.. Then downnnn (on completion of the correction). In the next down impulsive move, I speculate the neck line of the weekly head and shoulder pattern will be broken.

But what do I know? I am just a learner putting out my perspectives on pairs. And who is striving to be better. This is not in anyway a financial advice. And trading decisions should not be based on this. Let us see what happens. Slowly moving towards the target as explained in this post. Up by 200 pips plus from entry. Still holding. It's a trade on demo. I want to observe how long it will take to reach tp (if it does). Also, I want to see the impact of swap as it is already disturbing. I have held for about 2 weeks. Swap has taken like 20 pips off the profit. And I may still hold for for a while. Stop loss like 10 pips above entry point already. Will be looking to lock down more profits. 1 Like

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 11:16pm On Apr 09, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 11:16pm On Apr 09, 2019 |

bojbest:

There is news tomorrow on GBP. I’m looking at price reaching the daily support before going back up. If you check weekly timeframe, price is ranging after breaking and retesting a down trend.

But until the brexit saga is finished, GBP pairs will range. What I feel sha It's a possibility. I must admit that it's very risky trading the gbp pairs at the moment. Price might bounce off those levels to be honest. Rather than breach them. I can't say I am actually confident about my bias. Let's see what happens. 1 Like |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 5:17pm On Apr 09, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 5:17pm On Apr 09, 2019 |

alphaNomega:

I see you ignored the flash-crash pinbar on GBPUSD, however your trend line is valid, you should look for short trades from that level when it is broken.

Also note that trend line has been responsible for bullish moves of 100+ pips when the buyers put their foot down.   Boss. Two trendlines can be drawn. Another one can be drawn using the pinbar. That one has been broken already. Infact a renowned trader used the other one which I just drew. But I have missed out on that. Best entry would have been the pinbar at the retest of the trendline. So The horizontal support is my best bet. I also think the one I drew is valid. It has three touches. Thank you. 3 Likes 1 Share

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 5:13pm On Apr 09, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 5:13pm On Apr 09, 2019 |

PJAMES1:

GBPJPY

GBPUSD

GBPAUD

GBPCAD

I have looked at these ones recently and I wouldn't want to buy any of them at the moment. Especially because I am not an intra day trader. Similar patterns. Some of the pairs at important levels or approaching an important level. The opportunities for more downside move open when those levels are breached. Personally have a Bearish bias for these pairs.

Well, that's my own view.

I may be wrong.

For GBPUSD, a daily close below that trendline and that support, an opportunity to go short may come up. For GBPJPY, entry should have been at 2nd retest of the broken channel support (trendline). But a break of that horizontal support may give another chance for an entry. GBPCAD, the opportunity to go short may come after break of that confluence support formed by the trendline line and the horizontal support. Break of these levels may usher in more downside move. For GBPJPY, the next horizontal support may be where to expect price to reach. Same with GBPCAD. GBPUSD, maybe the 1.2775 area. |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 4:58pm On Apr 09, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 4:58pm On Apr 09, 2019 |

alphaNomega:

The long term sentiment for GBPUSD favours the bears, any long signal you get is a retracement provided price does not close above 1.3200

The bears are heading to 1.2700 region GBPJPY GBPUSD GBPAUD GBPCAD I have looked at these ones recently and I wouldn't want to buy any of them at the moment. Especially because I am not an intra day trader. Similar patterns. Some of the pairs at important levels or approaching an important level. The opportunities for more downside move open when those levels are breached. Personally have a Bearish bias for these pairs. Well, that's my own view. I may be wrong.

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:59am On Apr 07, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:59am On Apr 07, 2019 |

I know I have talked about EURNZD before. And how I was expecting a significant upside move. It appears we have that coming into play now. Weekly chart shows an incomplete head and shoulder pattern. But I am not thinking short yet. And I don't think the pattern will be completed now.

Weekly chart also shows a clear double bottom pattern.

Daily chart shows more details. There is a clear break of the trendline and it has been retested. The trendline held as support.

Also, I personally don't do much of Elliot Wave analysis but from the little I have learned from the charts of those who do.. I also believe we are seeing an ABC correction of the downward move that started in October 2018 and ended in December. A and B already completed.. C, the last part of the correction has started and would target 50% of the original downward move. This corresponds with the upper resistance I drew. That 1.7110 area.

The four Hour chart shows a clear inverted head and shoulder pattern. A pull back to the green line (neckline) area gives an opportunity to go long. The experts teach to allow he trade come to one. If it doesn't, one should let it go. The pullback gives a reasonable Risk Reward Ratio.

So from a technical point of view, medium to long term, EURNZD is up.. Then downnnn (on completion of the correction). In the next down impulsive move, I speculate the neck line of the weekly head and shoulder pattern will be broken.

But what do I know? I am just a learner putting out my perspectives on pairs. And who is striving to be better. This is not in anyway a financial advice. And trading decisions should not be based on this. Let us see what happens. 4 Likes 1 Share

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:02pm On Apr 02, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:02pm On Apr 02, 2019 |

coolvibes:

Here's the particular lesson

babypips.com/learn/forex/black-crack Thank you. 1 Like |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 1:33am On Apr 02, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 1:33am On Apr 02, 2019 |

coolvibes:

Could be WTI Oil bro. So long it's rising, the Cad SHOULD continue to strengthen.

What's up with @awesome duru Alright. Thank you. 1 Like |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:51pm On Apr 01, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:51pm On Apr 01, 2019 |

Rough day.. Market doing absolute opposite of things I expected.   These streets are tough. Sigh What's driving this CAD.. Who knows what's giving it this strength? Is it an anticipation of the speech by the governor of the Bank of Canada.. Or something else? |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:22am On Apr 01, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 8:22am On Apr 01, 2019 |

shegzyRico:

Bro, please see my screen shot, thats what am talking about. Carefully read babypips.. Don't trade live for now Carefully read babypips.. You will figure things out. 4 Likes |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 9:59pm On Mar 31, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 9:59pm On Mar 31, 2019 |

telescopefx:

Check daily TF, u will see a sweet Head and Shoulders formation, currently retesting the neck line. True. Inverted Head and Shoulders. A good place to buy. Aud interest rate on Tuesday, so some caution while trading this pair. 2 Likes |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:17pm On Mar 31, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:17pm On Mar 31, 2019 |

AK284:

Seconded because of the flattening top formed :A bull market truncation, at the moment it could still go up a little bit It could. Will be watching closely till there is a clear reason to enter. |

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:18am On Mar 31, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:18am On Mar 31, 2019 |

NZDCHF

I expect more downside move. 1 Like

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:14am On Mar 31, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:14am On Mar 31, 2019 |

AUDCAD

Ascending channel on the four hour timeframe. Up or Down.

I personally have a bullish bias. 1 Like

|

Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:12am On Mar 31, 2019 Business / Re: Forex Trade Alerts: Season 19 by PJAMES1(m): 7:12am On Mar 31, 2019 |

CADCHF

Head and shoulders patterns on the daily timeframe with the neckline being retested. 1 Like

|

. Still trying to find that consistency and discipline. But I am definitely getting better. Before the end of the year, hopefully should be ready. I am not in a rush. I will just keep learning and practicing. Will keep at it till I get it right.

. Still trying to find that consistency and discipline. But I am definitely getting better. Before the end of the year, hopefully should be ready. I am not in a rush. I will just keep learning and practicing. Will keep at it till I get it right.

These streets are tough. Sigh

These streets are tough. Sigh