| Re: Treasury Bills In Nigeria by Iamzik: 10:00am On Jan 03, 2019 |

Someone please help with First Bank Tbill rates for yesterday. Please.... |

| Re: Treasury Bills In Nigeria by dipoolowoo: 10:13am On Jan 03, 2019 |

|

| Re: Treasury Bills In Nigeria by Iamzik: 10:59am On Jan 03, 2019 |

1 Like |

| Re: Treasury Bills In Nigeria by Just2endowed2(m): 12:56pm On Jan 03, 2019 |

aremso:

Gurus,

please at what time of the day does bank credit one's account after maturity as my Tb matures today and am yet to get the alert. are you sure today is your maturity date? |

| Re: Treasury Bills In Nigeria by aremso(m): 2:41pm On Jan 03, 2019 |

Just2endowed2:

are you sure today is your maturity date? Yes Boss, i have been credited few hour ago. Many thanks 1 Like |

| Re: Treasury Bills In Nigeria by Gavrelino123: 2:52pm On Jan 03, 2019 |

|

| Re: Treasury Bills In Nigeria by drotba(m): 2:57pm On Jan 03, 2019 |

Gavrelino123:

17% plus...?

Kindly elucidate this.......Because 364 days indicates 14% plus @ CBN official website...! The thing confuse me too 1 Like |

| Re: Treasury Bills In Nigeria by Just2endowed2(m): 3:01pm On Jan 03, 2019 |

aremso:

Yes Boss, i have been credited few hour ago. Many thanks Good one..you are the boss with the money 1 Like |

| Re: Treasury Bills In Nigeria by Ikmontana1: 4:06pm On Jan 03, 2019 |

Gavrelino123:

17% plus...?

Kindly elucidate this.......Because 364 days indicates 14% plus @ CBN official website...! bro, T-bills yield is different from d actual rate. You enjoy t bills yields when u compound ur upfront interest. 1 Like |

| Re: Treasury Bills In Nigeria by feelamong(m): 4:17pm On Jan 03, 2019 |

Gavrelino123:

17% plus...?

Kindly elucidate this.......Because 364 days indicates 14% plus @ CBN official website...! Yield is different from discount rate |

| Re: Treasury Bills In Nigeria by Gavrelino123: 4:26pm On Jan 03, 2019 |

Ikmontana1:

bro,

T-bills yield is different from d actual rate.

You enjoy t bills yields when u compound ur upfront interest. Thanks bro, I'm aware of this too.....It's called True yield. You know we are all expecting TB rates to go as high as 17%- 18% this election cycle.... My biggest fear is the stability of our local currency. Can't Naira appreciate,must it always depreciate.? 1 Like |

| Re: Treasury Bills In Nigeria by ajbf: 5:00pm On Jan 03, 2019 |

Deal completed at Union bank.

12.5% To reach maturity on 21st Feb., 2019. |

| Re: Treasury Bills In Nigeria by unite4real: 5:00pm On Jan 03, 2019 |

Gavrelino123:

Thanks bro, I'm aware of this too.....It's called True yield.

You know we are all expecting TB rates to go as high as 17%- 18% this election cycle....

My biggest fear is the stability of our local currency.

Can't Naira appreciate,must it always depreciate.?

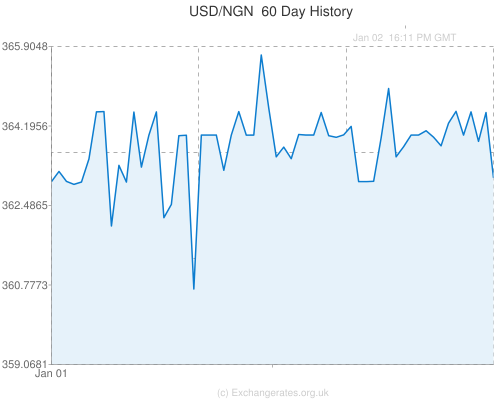

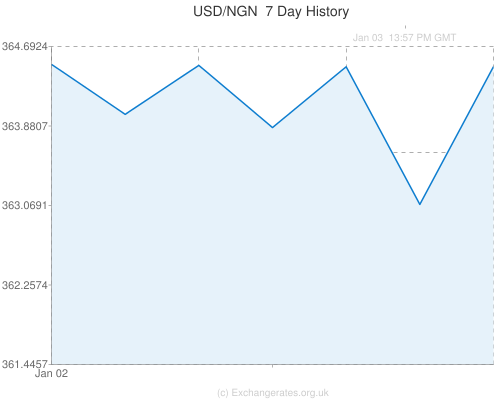

Naira doesnt always depreciate. I think you always remember the news of depreciation. It appreciates too. Look at the 60 days and last 7 days historical graph below and check if the graph is only moving one direction. https://www.exchangerates.org.uk/USD-NGN-exchange-rate-history.html

|

| Re: Treasury Bills In Nigeria by Nnamz(m): 5:08pm On Jan 03, 2019 |

Ironically, same people wishing tbills rate goes up to 17% are the very same people crying over the Naira depreciating. The higher and juicier our tbills rates are, the more useless our Naira is. So please keep that in mind the next time you go on your knees and ask God for 18% tbills. 4 Likes |

| Re: Treasury Bills In Nigeria by OgogoroFreak(m): 5:41pm On Jan 03, 2019 |

Wow! I never knew this thing called tbills existed o..  God bless Seun for creating this website and Many thanks to Oga feelamong for Opening my eyez! With all this 13%, 14% etc... And I've been keeping huge money in diamond bank HIDA account that only gives me 6% per annum. Thank God I found this thread. Let me test run with ₦5M to see how it goes. @All, which bank is better between Diamond bank and gtbank? Cos I have savings accounts with both banks. 4 Likes |

| Re: Treasury Bills In Nigeria by donshady(m): 6:06pm On Jan 03, 2019 |

OgogoroFreak:

Wow! I never knew this thing called tbills existed o..

God bless Seun for creating this website!

With all this 13%, 14% etc... And I've been keeping huge money in diamond bank HIDA account that only give 6% per annum.

Thank God I found this thread. Let me test run with ₦5M to see how it goes.

@All, which bank is better between Diamond bank and gtbank? Cos I have savings accounts with both banks. Should you thank Seun and leave feelamong out  Seun didn't create topics. Address it |

| Re: Treasury Bills In Nigeria by OgogoroFreak(m): 6:14pm On Jan 03, 2019 |

donshady:

Should you thank Seun and leave feelamong out Seun didn't create topics. Address it Seun didn't create topics. Address it Lolz, done. |

| Re: Treasury Bills In Nigeria by Gavrelino123: 7:03pm On Jan 03, 2019 |

Nnamz:

Ironically, same people wishing tbills rate goes up to 17% are the very same people crying over the Naira depreciating. The higher and juicier our tbills rates are, the more useless our Naira is. So please keep that in mind the next time you go on your knees and ask God for 18% tbills. Lol........well said. |

| Re: Treasury Bills In Nigeria by Gavrelino123: 9:36pm On Jan 03, 2019 |

feelamong:

Yield is different from discount rate

Thanks..Happy new year Boss |

| Re: Treasury Bills In Nigeria by emmasoft(m): 9:54pm On Jan 03, 2019 |

OgogoroFreak:

Wow! I never knew this thing called tbills existed o..

God bless Seun for creating this website and Many thanks to Oga feelamong for Opening my eyez!

With all this 13%, 14% etc... And I've been keeping huge money in diamond bank HIDA account that only give 6% per annum.

Thank God I found this thread. Let me test run with ₦5M to see how it goes.

@All, which bank is better between Diamond bank and gtbank? Cos I have savings accounts with both banks. If i will advice very objectively as per TBills go to FBN or IBTC |

| Re: Treasury Bills In Nigeria by amjustme2: 10:38pm On Jan 03, 2019 |

Anyone using FBN for last Auction?

What was their rate? |

| Re: Treasury Bills In Nigeria by awesomeJ(m): 12:48am On Jan 04, 2019 |

aremso:

He also failed to mention Skye bank polarised by CBN if the diamond bank had gone the way of Skye bank and sure he would not mention them. I also invest on NSE but I do a calculated risk before committing my hard earn money. He also failed to mention people who bought dollars at 450 and sold at 400 and 360 my advice is people should just study the risk before they put head. Bros, I don't think you get the point in the post. While there were uncertainties around DIAMOND, buying it would be buying into a baseless hope, and like you said, it could turn out sour. But what I was referring to is a situation where a confirmed news of a proposed merger has been announced, with a stipulated future price of over 200%. That's the opportunity I'm referring to. For those who had funds ready in their trading accounts, you could have easily bought up to 5m units on Monday 17th. That 5m would have become 10m within 3weeks. Why do you think from Tuesday bids on the stock started averaging about 500m daily with less than 1% getting filled? people were trying to key into the opportunity, but it was already late. Nairametrics confirmed the news even before market opened on Monday 17th. And on 17th, there were those who didn't have funds at all to take positions with, while there were others who for whatever reasons thought it was in ACCESS they needed to take positions. I can still remember most bids placed before 12:00 at 1.04 were filled. If you bought dollar when it was already 520, and you became aware of the CBN's interventions, and yet you held on rather than sell off, you're weren't taking opportunity, you were making a silly investment decision. The opportunity I was referring to is when you see external reserves falling from over $40bn to as low as $22 bn, with oil doing $27 from over a hundred. Then you hear of over $4bn dollars backlog in repatriation demands that the CBN has been unable to meet. You wouldn't need a prophet to tell you that a devaluation is imminent. That's when you seize the opportunity. Not that you jump in when the trends are all reversing, and then quote me wrongly. And for the guy who was listing stocks that lost money. I don't know what time frame you're picking o. But what I do know is that soon as the I&E FX window was launched by the CBN in April'17, FPIs were encouraged to return. And given the almost rock bottom prices of most stocks at that time. They were mostly cheap bargains to them, and they loaded up. The result? NSE was up 37% 3rd best performance globally. If you looked at between mid April '17 and mid Jan '18, the index gained close to 60%. So you could have waited for a few months after the FPIs started coming to confirm that the market was indeed presenting an opportunity. Then you take position in a few sound stocks, and by exiting in Jan 18, there's a pretty good chance your funds would have been doubled. That's the opportunity I was talking about. Not that you jump in when it's already over, and misconstrue an idea. When that kind of opportunity will again come to the NSE is everyone's hope. It may not be for another decade. Some people think after elections though. If you still think I'm talking trash. I agree. 7 Likes |

| Re: Treasury Bills In Nigeria by Nobody: 7:35am On Jan 04, 2019 |

awesomeJ:

Bros, I don't think you get the point in the post.

While there were uncertainties around DIAMOND, buying it would be buying into a baseless hope, and like you said, it could turn out sour.

But what I was referring to is a situation where a confirmed news of a proposed merger has been announced, with a stipulated future price of over 200%. That's the opportunity I'm referring to. For those who had funds ready in their trading accounts, you could have easily bought up to 5m units on Monday 17th. That 5m would have become 10m within 3weeks.

Why do you think from Tuesday bids on the stock started averaging about 500m daily with less than 1% getting filled? people were trying to key into the opportunity, but it was already late.

Nairametrics confirmed the news even before market opened on Monday 17th. And on 17th, there were those who didn't have funds at all to take positions with, while there were others who for whatever reasons thought it was in ACCESS they needed to take positions. I can still remember most bids placed before 12:00 at 1.04 were filled.

If you bought dollar when it was already 520, and you became aware of the CBN's interventions, and yet you held on rather than sell off, you're weren't taking opportunity, you were making a silly investment decision.

The opportunity I was referring to is when you see external reserves falling from over $40bn to as low as $22 bn, with oil doing $27 from over a hundred. Then you hear of over $4bn dollars backlog in repatriation demands that the CBN has been unable to meet. You wouldn't need a prophet to tell you that a devaluation is imminent. That's when you seize the opportunity. Not that you jump in when the trends are all reversing, and then quote me wrongly.

And for the guy who was listing stocks that lost money. I don't know what time frame you're picking o. But what I do know is that soon as the I&E FX window was launched by the CBN in April'17, FPIs were encouraged to return. And given the almost rock bottom prices of most stocks at that time. They were mostly cheap bargains to them, and they loaded up. The result? NSE was up 37% 3rd best performance globally. If you looked at between mid April '17 and mid Jan '18, the index gained close to 60%. So you could have waited for a few months after the FPIs started coming to confirm that the market was indeed presenting an opportunity. Then you take position in a few sound stocks, and by exiting in Jan 18, there's a pretty good chance your funds would have been doubled. That's the opportunity I was talking about. Not that you jump in when it's already over, and misconstrue an idea. When that kind of opportunity will again come to the NSE is everyone's hope. It may not be for another decade. Some people think after elections though.

If you still think I'm talking trash. I agree.

Great write up. My question is, how do you position yourself to make a gain from this imminent devaluation around the corner? |

| Re: Treasury Bills In Nigeria by ahiboilandgas: 8:38am On Jan 04, 2019 |

awesomeJ:

Bros, I don't think you get the point in the post.

While there were uncertainties around DIAMOND, buying it would be buying into a baseless hope, and like you said, it could turn out sour.

But what I was referring to is a situation where a confirmed news of a proposed merger has been announced, with a stipulated future price of over 200%. That's the opportunity I'm referring to. For those who had funds ready in their trading accounts, you could have easily bought up to 5m units on Monday 17th. That 5m would have become 10m within 3weeks.

Why do you think from Tuesday bids on the stock started averaging about 500m daily with less than 1% getting filled? people were trying to key into the opportunity, but it was already late.

Nairametrics confirmed the news even before market opened on Monday 17th. And on 17th, there were those who didn't have funds at all to take positions with, while there were others who for whatever reasons thought it was in ACCESS they needed to take positions. I can still remember most bids placed before 12:00 at 1.04 were filled.

If you bought dollar when it was already 520, and you became aware of the CBN's interventions, and yet you held on rather than sell off, you're weren't taking opportunity, you were making a silly investment decision.

The opportunity I was referring to is when you see external reserves falling from over $40bn to as low as $22 bn, with oil doing $27 from over a hundred. Then you hear of over $4bn dollars backlog in repatriation demands that the CBN has been unable to meet. You wouldn't need a prophet to tell you that a devaluation is imminent. That's when you seize the opportunity. Not that you jump in when the trends are all reversing, and then quote me wrongly.

And for the guy who was listing stocks that lost money. I don't know what time frame you're picking o. But what I do know is that soon as the I&E FX window was launched by the CBN in April'17, FPIs were encouraged to return. And given the almost rock bottom prices of most stocks at that time. They were mostly cheap bargains to them, and they loaded up. The result? NSE was up 37% 3rd best performance globally. If you looked at between mid April '17 and mid Jan '18, the index gained close to 60%. So you could have waited for a few months after the FPIs started coming to confirm that the market was indeed presenting an opportunity. Then you take position in a few sound stocks, and by exiting in Jan 18, there's a pretty good chance your funds would have been doubled. That's the opportunity I was talking about. Not that you jump in when it's already over, and misconstrue an idea. When that kind of opportunity will again come to the NSE is everyone's hope. It may not be for another decade. Some people think after elections though.

If you still think I'm talking trash. I agree.

your investment prowness and scope is beyond the reach and understanding of most folk there ,they basically very scare of lossing any more but want to be rich..that the irony....stock trading is for the strong mindinded... 2 Likes |

| Re: Treasury Bills In Nigeria by zamirikpo(m): 9:17am On Jan 04, 2019 |

awesomeJ:

Bros, I don't think you get the point in the post.

While there were uncertainties around DIAMOND, buying it would be buying into a baseless hope, and like you said, it could turn out sour.

But what I was referring to is a situation where a confirmed news of a proposed merger has been announced, with a stipulated future price of over 200%. That's the opportunity I'm referring to. For those who had funds ready in their trading accounts, you could have easily bought up to 5m units on Monday 17th. That 5m would have become 10m within 3weeks.

Why do you think from Tuesday bids on the stock started averaging about 500m daily with less than 1% getting filled? people were trying to key into the opportunity, but it was already late.

Nairametrics confirmed the news even before market opened on Monday 17th. And on 17th, there were those who didn't have funds at all to take positions with, while there were others who for whatever reasons thought it was in ACCESS they needed to take positions. I can still remember most bids placed before 12:00 at 1.04 were filled.

If you bought dollar when it was already 520, and you became aware of the CBN's interventions, and yet you held on rather than sell off, you're weren't taking opportunity, you were making a silly investment decision.

The opportunity I was referring to is when you see external reserves falling from over $40bn to as low as $22 bn, with oil doing $27 from over a hundred. Then you hear of over $4bn dollars backlog in repatriation demands that the CBN has been unable to meet. You wouldn't need a prophet to tell you that a devaluation is imminent. That's when you seize the opportunity. Not that you jump in when the trends are all reversing, and then quote me wrongly.

And for the guy who was listing stocks that lost money. I don't know what time frame you're picking o. But what I do know is that soon as the I&E FX window was launched by the CBN in April'17, FPIs were encouraged to return. And given the almost rock bottom prices of most stocks at that time. They were mostly cheap bargains to them, and they loaded up. The result? NSE was up 37% 3rd best performance globally. If you looked at between mid April '17 and mid Jan '18, the index gained close to 60%. So you could have waited for a few months after the FPIs started coming to confirm that the market was indeed presenting an opportunity. Then you take position in a few sound stocks, and by exiting in Jan 18, there's a pretty good chance your funds would have been doubled. That's the opportunity I was talking about. Not that you jump in when it's already over, and misconstrue an idea. When that kind of opportunity will again come to the NSE is everyone's hope. It may not be for another decade. Some people think after elections though.

If you still think I'm talking trash. I agree.

My ever awesome..j.....i have only one question for u........how did u type this write up, phone or lapi. 3 Likes |

| Re: Treasury Bills In Nigeria by dipoolowoo: 9:21am On Jan 04, 2019 |

|

| Re: Treasury Bills In Nigeria by feelamong(m): 9:47am On Jan 04, 2019 |

Gavrelino123:

Thanks..Happy new year Boss Happy New year bro... |

| Re: Treasury Bills In Nigeria by feelamong(m): 9:53am On Jan 04, 2019 |

Finally decided to go Long!

From all Indications, I do not see our rates going higher than the 15%...CBN seems battle ready to hold at that rate for now.

nevertheless I have also put some funds in Money Market Fund with present yield at 12.45%

maybe just maybe, we might see some more Oil shocks which may put pressure on CBN and Naira....Then we can move from Money market fund to Treasury Bills at higher rates than we see now.

Also have my eyes on Stocks/Cryptos......the bears there keep making me happy;

We shall all make Money this year!! 1 Like |

| Re: Treasury Bills In Nigeria by unite4real: 10:17am On Jan 04, 2019 |

feelamong:

Finally decided to go Long!

From all Indications, I do not see our rates going higher than the 15%...CBN seems battle ready to hold at that rate for now.

nevertheless I have also put some funds in Money Market Fund with present yield at 12.45%

maybe just maybe, we might see some more Oil shocks which may put pressure on CBN and Naira....Then we can move from Money market fund to Treasury Bills at higher rates than we see now.

Also have my eyes on Stocks/Cryptos......the bears there keep making me happy;

We shall all make Money this year!! This was my reason for liquidating my mutual funds and investing all in the just concluded FGN SUKUK BOND at 15.74% for 7 years. |

| Re: Treasury Bills In Nigeria by feelamong(m): 10:19am On Jan 04, 2019 |

unite4real:

This was my reason for liquidating my mutual funds and investing all in the just concluded FGN SUKUK BOND at 15.74% for 7 years. Excellent move! very good for those who can go such long term! 1 Like |

| Re: Treasury Bills In Nigeria by unite4real: 10:21am On Jan 04, 2019 |

feelamong:

Finally decided to go Long!

From all Indications, I do not see our rates going higher than the 15%...CBN seems battle ready to hold at that rate for now.

nevertheless I have also put some funds in Money Market Fund with present yield at 12.45%

maybe just maybe, we might see some more Oil shocks which may put pressure on CBN and Naira....Then we can move from Money market fund to Treasury Bills at higher rates than we see now.

Also have my eyes on Stocks/Cryptos......the bears there keep making me happy;

We shall all make Money this year!! This was my reason for liquidating my mutual funds and investing all in the just concluded FGN SUKUK BOND at 15.74% for 7 years. CBN is better prepared now to absorb shocks. Even Naira is not as weak as people anticipated. The foreign reserve is not as bad as the period we enjoyed the 18 to 19% rates in Treasury bills. Me I have locked down for long time |

| Re: Treasury Bills In Nigeria by donshady(m): 10:32am On Jan 04, 2019 |

unite4real:

This was my reason for liquidating my mutual funds and investing all in the just concluded FGN SUKUK BOND at 15.74% for 7 years. How is the Interest paid? Annually? And how can I buy? |

Seun didn't create topics. Address it

Seun didn't create topics. Address it