Investment / Re: Commercial Papers by ernie4life(m): 7:12pm On Apr 25 Investment / Re: Commercial Papers by ernie4life(m): 7:12pm On Apr 25 |

sirrotex:

How do I get in touch with you A DM will suffice |

Investment / Re: Commercial Papers by ernie4life(m): 6:43am On Apr 25 Investment / Re: Commercial Papers by ernie4life(m): 6:43am On Apr 25 |

sirrotex:

Does going through you give you any form of edge, like meeting up with a target or enabling you to get commission. If yes, then send me an official email address I could deal with and if no, I would reach out to my folks in Greenwich We all have deliverables, but for ease of transaction it's better you deal with Greenwich since you already have a relationship with them and you are conversant with their process. But from a point of value, dealing with me could mean I will offer you more investment options in the future that offer better returns. 1 Like |

Investment / Re: Commercial Papers by ernie4life(m): 6:39am On Apr 25 Investment / Re: Commercial Papers by ernie4life(m): 6:39am On Apr 25 |

freeman67:

If you deal directly with the arrangers most times you would not pay any service charge. It's only stock brokers like Afrinvest that usually charges for their service. Service charge is usually borne by the issuer.

The problem I have about WHT on CP is that they don't usually state whether a particular CP is exempted or not till when it is close to maturity. But you can always ask before investing, for example the last johnvents CP, there was no withholding tax |

Investment / Re: Commercial Papers by ernie4life(m): 9:45pm On Apr 24 Investment / Re: Commercial Papers by ernie4life(m): 9:45pm On Apr 24 |

sirrotex:

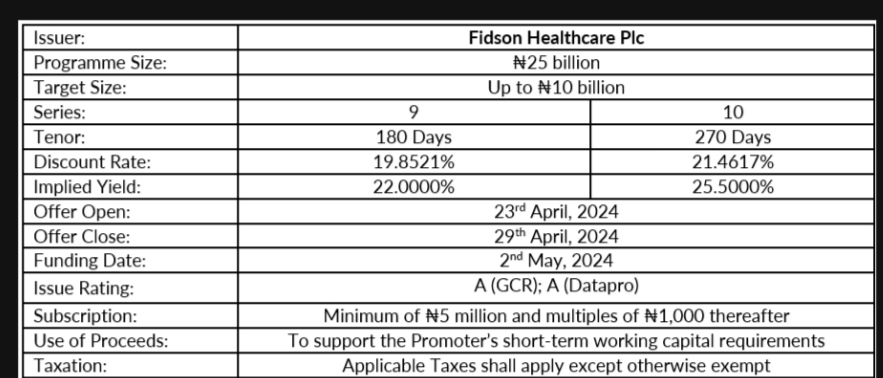

This looks good. How does one subscribe to it? I work with Coronation, we can help you buy or your can approach any regulated fund manager to help you buy |

Investment / Re: Commercial Papers by ernie4life(m): 1:10pm On Apr 24 Investment / Re: Commercial Papers by ernie4life(m): 1:10pm On Apr 24 |

These rates we see today will not always be here 3 Likes

|

Investment / Re: Commercial Papers by ernie4life(m): 9:42am On Apr 16 Investment / Re: Commercial Papers by ernie4life(m): 9:42am On Apr 16 |

New offer 1 Like

|

Investment / Re: Buy A House And Pay Instalmentally In 20-30 Years by ernie4life(m): 9:20am On Apr 16 Investment / Re: Buy A House And Pay Instalmentally In 20-30 Years by ernie4life(m): 9:20am On Apr 16 |

Welovetruecrime:

Thanks alot for your questions sir.

Our interest rate is 26% of the total sum, no matter how long you take the loan. If you take it for one year, interest is 26%. If you take it for 30 years, interest is still 26% sir.

We are affiliated with so many mortgage houses including NHF so we can help you access NHF loan.

However,

If we use the other mortgage houses we are affiliated with, the whole process takes a Maximum of 2 months and you will be in your dream home.

But the entire process for ONLY NHF loan takes a longer time(over a year).

If your employer deducts pension funds from your salary, you can use part of that pension fund as equity payment for the mortgage too.

My company can help you access the pension funds because your pension company will not give you the raw cash for equity. It has to be accessed through a reputable mortgage company like mine.

Also, my company DOES NOT have properties we are selling.

You are the one to look for your dream property anywhere you want, and we will help you finance the payment.

Thank you for your response. follow-up questions. When you say 26% i assume you mean if the interest on the loan is 26% for 5 years and lets say i take 10m i will be paying 2.6m as interest every year for the entire 5 years bringing my total payback to 23m(interest plus capital) for the whole 5 years, correct me if am wrong, i want to be clear about this. What conditions must my choice property meet before you agree to finance it through your mortgage. |

Investment / Re: Buy A House And Pay Instalmentally In 20-30 Years by ernie4life(m): 7:54am On Apr 16 Investment / Re: Buy A House And Pay Instalmentally In 20-30 Years by ernie4life(m): 7:54am On Apr 16 |

This sounds interesting so for the benefit of others i will make all my enquires here.

What's your current interest rate?

Do you assist people to get NHF loan to buy off the loan from your organization?

if yes, what's the typical timeline?

am interested. |

Investment / Re: Commercial Papers by ernie4life(m): 8:26am On Apr 03 Investment / Re: Commercial Papers by ernie4life(m): 8:26am On Apr 03 |

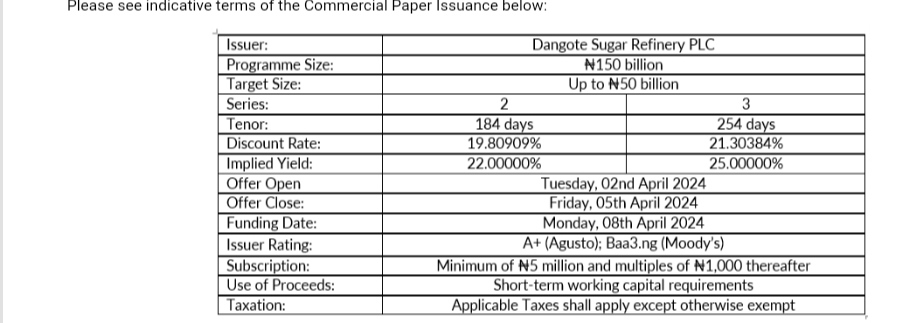

Cp offer 1 Like

|

Investment / Re: Fgn Bond: Sovereign Sukuk Offer For Subscription by ernie4life(m): 5:29am On Mar 25 Investment / Re: Fgn Bond: Sovereign Sukuk Offer For Subscription by ernie4life(m): 5:29am On Mar 25 |

When is the next sukuk bond offer |

Investment / Re: Commercial Papers by ernie4life(m): 7:25pm On Mar 23 Investment / Re: Commercial Papers by ernie4life(m): 7:25pm On Mar 23 |

Open offers 3 Likes

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by ernie4life(m): 10:30am On Mar 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by ernie4life(m): 10:30am On Mar 22 |

yeah stronglink:

that is, he should multiply it by one million..... because anything multiply by zero is equal to zero, right? |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by ernie4life(m): 7:25am On Mar 22 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by ernie4life(m): 7:25am On Mar 22 |

ExcessKJ:

Please 🙏, this N'M means the figures is to be multiply by 6 zeros right? Or what is the appropriate interpretation of the N'M

Secondly, why are some figures on the sheet written in brackets. Thanks Bracket means its a negative amount and N,M means multiply by 6 zeros 4 Likes |

Investment / Re: Mutual Funds by ernie4life(m): 6:41am On Feb 23 Investment / Re: Mutual Funds by ernie4life(m): 6:41am On Feb 23 |

VeeInsider:

How please? I do only long term and I chose MM due to no knowledge of capital preserved alternatives.

If you do long term, why don't you consider bonds, Sukuk bond offered 15%+ savings bond is also offering returns above 12% the last FGN bond auction(though the minimum is quite high) offered 19%. If you strategically invest in an equity fund when the price is low with a 5 years tenor in view, i can assure you that your return will surpass that of MMF. 1 Like |

Investment / Re: Mutual Funds by ernie4life(m): 3:12pm On Feb 19 Investment / Re: Mutual Funds by ernie4life(m): 3:12pm On Feb 19 |

vefexam:

Thanks, as a young guy Omo I can't make the mistake my parents made.

I was just looking at my pension statement of account today lol.

The reason I choose MM was because of liquidity cos the money I am investing is both my emergency funds and savings, I will only have a little cash for day to day expenses.

Also I will send the questions over to MM for more answers. There is a better way to do that, you should be able to match your investments with a tenor that aligns to it. Investing long term money is a short term asset is not the best way, because you could make way more. But i respect your strategy. |

Investment / Re: Mutual Funds by ernie4life(m): 4:50pm On Feb 16 Investment / Re: Mutual Funds by ernie4life(m): 4:50pm On Feb 16 |

[quote author=vefexam post=128469259]Hello everyone.

I wish to invest with ARM investment, I wanna start with #500k for their money market and $1000 for there euro bond, as at when I made enquiries the rate for MM was 11% PA, i can't remember for the euro bond.

Please help advise.

What is your investing horizon? Because if you want to keep the funds for more than a year, I recommend that you examine other asset classes, as inflation is at an all-time high; nevertheless, if your investment horizon is less than a year, you can proceed with an MMF investment.

I am glad that people like you are taking the bold step of diversifying their investments to other denominations to hedge against any potential naira devaluation. Before you proceed with the dollar investment, ask them what their benchmark is, what their last year's return was, what their current return is, and what valuation method they use. |

Investment / Re: Mutual Funds by ernie4life(m): 9:21am On Feb 01 Investment / Re: Mutual Funds by ernie4life(m): 9:21am On Feb 01 |

ernie4life:

This year, try diversifying your investment to a more stable currency.

Explore balanced funds and equity funds this year especially if your investment horizon is between 1 to 2 years, they had an impressive performance last year and still hold lots of potentials.

Do something different this year in your investment journey and watch the results.

MMF is not the only mutual fund in the world!

If you diversified your assets to USD when i made this post, you would have made more that 15% flat. 2 Likes |

Investment / Re: Mutual Funds by ernie4life(m): 11:12am On Jan 13 Investment / Re: Mutual Funds by ernie4life(m): 11:12am On Jan 13 |

This year, try diversifying your investment to a more stable currency.

Explore balanced funds and equity funds this year especially if your investment horizon is between 1 to 2 years, they had an impressive performance last year and still hold lots of potentials.

Do something different this year in your investment journey and watch the results.

MMF is not the only mutual fund in the world! 4 Likes |

Investment / Re: Commercial Papers by ernie4life(m): 3:47pm On Nov 29, 2023 Investment / Re: Commercial Papers by ernie4life(m): 3:47pm On Nov 29, 2023 |

RayRay06677:

Poor rates Same with MTN but was over subscribed. |

Investment / Re: Commercial Papers by ernie4life(m): 10:14am On Nov 29, 2023 Investment / Re: Commercial Papers by ernie4life(m): 10:14am On Nov 29, 2023 |

Dangote CP is available, reach out if interested.

|

Investment / Re: Mutual Funds by ernie4life(m): 5:10am On Nov 22, 2023 Investment / Re: Mutual Funds by ernie4life(m): 5:10am On Nov 22, 2023 |

Team MMF our time has come, as treasury bills rate go high, MMF rates will follow, if you are have invested in fixed income fund or equities fund now may be a good time to rotate back your portfolio to MMF. 2 Likes |

Investment / Re: Mutual Funds by ernie4life(m): 10:09am On Sep 10, 2023 Investment / Re: Mutual Funds by ernie4life(m): 10:09am On Sep 10, 2023 |

chimex38:

Please house,

Is a 10% average yield on a 1Million Mutual Fund capital per quarter or per annum?

Like:

100k payment each quarter of the yr?

OR

25K payment each quarter of the yr?

25k per quarter. 1 Like |

Investment / Re: Eurobond by ernie4life(m): 8:32am On Sep 08, 2023 Investment / Re: Eurobond by ernie4life(m): 8:32am On Sep 08, 2023 |

Gilgil:

Can we resurrect this thread?

Absolutely fantastic people and info here

I bow to all of una  |

Investment / Re: Mutual Funds by ernie4life(m): 8:51am On Sep 04, 2023 Investment / Re: Mutual Funds by ernie4life(m): 8:51am On Sep 04, 2023 |

newreality:

I dey about to run away from anything with dz company name. I've been trading stocks through them for some time now, I hardly get information about the amount a stock is bought or sold on my behalf except I asked & it will take them weeks to respond & God blessed them with a good lady that always answer call when body do her , she go talk down on person always making person feel sad for even calling to seek information.

Just wow! So you mean they don't send contract note after the buy stocks? That is not good. |

Investment / Re: Mutual Funds by ernie4life(m): 6:27pm On Aug 22, 2023 Investment / Re: Mutual Funds by ernie4life(m): 6:27pm On Aug 22, 2023 |

emmasoft:

Dollar Mutual Fund

A dollar mutual fund of 12.13% is available at Norrenberger Asset Management.

Get in touch with my displayed contacts. Net or gross |

Investment / Re: Mutual Funds by ernie4life(m): 8:58am On Jul 27, 2023 Investment / Re: Mutual Funds by ernie4life(m): 8:58am On Jul 27, 2023 |

Now that treasury bills result is out, it is clear that all rates are going to nose dive, for those always looking for who has the best rate, goodluck 2 Likes |

Investment / Re: Mutual Funds by ernie4life(m): 4:06am On Jul 26, 2023 Investment / Re: Mutual Funds by ernie4life(m): 4:06am On Jul 26, 2023 |

emmasoft:

No. Just that the volatility of the rate is less compare to mmf. The reason is because part of the underlying asset is FGN Bonds which bring about the major difference between mmf and fixed income fund.

Don't mistake it with fixed deposit in commercial banks.

Presently the industry is experiencing rate decline. The bullish run in the stock market could be a factor among others.

However, with the decision of the MPC today, rate could reverse pisitively in the days ahead.

Market is no longer concerned with MPR, it's today's tbills auction that will decide the direction of rates. 2 Likes |

Investment / Re: Commercial Papers by ernie4life(m): 8:54am On Jul 10, 2023 Investment / Re: Commercial Papers by ernie4life(m): 8:54am On Jul 10, 2023 |

amordi:

Who has tried these guys before. What do you think? Who is the issuing house? |

Investment / Re: Mutual Funds by ernie4life(m): 11:52am On Jul 05, 2023 Investment / Re: Mutual Funds by ernie4life(m): 11:52am On Jul 05, 2023 |

emmasoft:

It simply means that FBNQuest, the fund manager of the listed mutual funds has gotten approval from SEC to also act as a registrar to these funds they are managing, this will save cost and will mean better returns to the unit holders in the funds. Before now the job of registrar was contracted to First registrars for a fee. In my opinion I will still prefer an external registrar to ensure checks and balances. Yes, it could improve operational efficiency but I don't think the cost aspect is so significant. In the coming days I will see if their rates will be way above their peers. 3 Likes |

Investment / Re: Mutual Funds by ernie4life(m): 7:35pm On Jul 02, 2023 Investment / Re: Mutual Funds by ernie4life(m): 7:35pm On Jul 02, 2023 |

sgtponzihater1:

With Chaka, for example, their intermediary is drive wealth US, and they buy stocks with your name. If Chaka goes burst, they cannot take your fund "legally", as they are only a platform for you as an individual to purchase that stock or ETF. Moreover Chaka is owned I.e Citi Investment Capitial . There is trove, bamboo etc, but I like to stick with medium to longterm industry players. Most of the others are business men who's main objective is making profit from exhorbitant fees, which shouldn't be the main motivation.

Another app based in the UK is Dodl which is actually owned by AJbells. Money box, invest engine etc are also available in the UK.

Having an app that purchases several stocks/index fund/ETF is actually a game changer for the average investors. I have tinkered with starting one with much lower fees than what currently obtains, but with questions like yours, I imagine Nigerians may not be exactly ready. Also any management fees above 0.5% -1% annually is actually too expensive, but I see Nigerians unlike people in western world are very comfortable paying this, so I imagine low fees may not tilt people towards patronising low cost players at the moment.

In the end every investor should do their due diligence and take responsibility for their profits and losses.

Best regards

Thanks for this, I doubt if the other fintechs in Nigeria do this, I have some insights on how they are structured but that's a discussion for another day. 1 Like |

Investment / Re: Mutual Funds by ernie4life(m): 6:07pm On Jul 02, 2023 Investment / Re: Mutual Funds by ernie4life(m): 6:07pm On Jul 02, 2023 |

sgtponzihater1:

For most fintech companies you still have a CSCS number, if you buy an ETF or stocks then it's in your name.

Also for MMF fund bought under those platforms, it should usually be in the investors name, the platform should only be an intermediary between the individual and the mutual fund company. It is the duty of the investors to ask for his investment certificate and have it handy. If those platform go burst, then you can contact the provider or the platform may transfer your details to another platform.

If cowry wise invests your money with their name, then it's a Ponzi scheme and you've got to run.

PonziHater

List some of the fintech companies that do this " buy an ETF or stocks then it's in your name" |

Investment / Re: Mutual Funds by ernie4life(m): 6:00pm On Jul 02, 2023 Investment / Re: Mutual Funds by ernie4life(m): 6:00pm On Jul 02, 2023 |

Tohmey:

welldone sir, please help recomend a trusted firm that can offer both MMF & FIXED INCOME FUND Go to SEC website, look for capital market operators registered at "portfolio manager" reach out to them for their offerings Top on my list would be stanbic fund managers. ARM fund managers. Gtco Afrinvest. United capital. Investment one doesn't qualify (based on your "offer both MMF & FIXED INCOME FUND"  since they sold out their fund managing department to gtco but they still offer good investment. 5 Likes |

since they sold out their fund managing department to gtco but they still offer good investment.

since they sold out their fund managing department to gtco but they still offer good investment.