Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:51am On Dec 06, 2023 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:51am On Dec 06, 2023 |

GSK is paying N17.42. The company is however first going to pay N8.20 and then the balance of N9.92. OBAGADAFFI:

This is confusing.

Is GSK paying N17.42 or btw N4.6--6.20 per share?

Kindly clarify. 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 1:44pm On Aug 09, 2023 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 1:44pm On Aug 09, 2023 |

Gsk according to the information put out to the public is a business that will be wound up and net realisable assets shared amongst the shareholders.

I don'tthink GSK UK wantsto buy out the minority shareholders.

[quote author=yMcy56 post=124988683]

Think I'm aware of some of these rules too, it's last six months except it changes.

There are exceptions to them too, where a company decides to treat his shareholders well and fairly too. |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 12:29pm On Mar 31, 2023 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 12:29pm On Mar 31, 2023 |

Sir, Note 26(a) is where you will find the impairment referenced on the key audit matters, it is the total impairment on the gross loan. It is inclusive of what has been further provided in the year 2022 minus those written off. Note 49 detail the Ghana bond exchange programme. RabbiDoracle:

Yes, UBA had lower debt loss than Zenith on GoG debt. 17.9B vs 58.6B. But Zenith bank took 123B impairments as seen in their report because that impairments contain loan losses to customers.

However UBA only took a total impairments of N41B (notes 12a and 12b) compared to gross loan loss of 82.8B (key audit matters) and GoG debt of N17.9B [these losses are N100B in total] . What happens to the remainder in the loan loss to customers?

Will UBA stagger these in the quarterly reports in 2023 financial year? |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:05am On Mar 08, 2023 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:05am On Mar 08, 2023 |

Dis one pass 3 days oooooo. Madam. well done for all the good things you do. [quote author=yMcy56 post=121553470] Wrong or right, at least the post don drag you out. E Ku 3 days.  /quote] 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 5:33pm On Mar 07, 2023 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 5:33pm On Mar 07, 2023 |

Which result are you waiting for? Unaudited Q4 of the company was a loss of N4.84b. yMcy56:

UACN

Closed @9.20.......Up with +65k....

Maybe some pple don see report... 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:40am On Nov 22, 2022 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:40am On Nov 22, 2022 |

It is not a bad thing to be hopeful about life. Agbalowomeri:

Looking for the dead among the living 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:57am On Sep 29, 2022 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:57am On Sep 29, 2022 |

he should wait, there is no need to sell. He should even buy more if there is money. This phase will soon go away. Willie2015:

2 options available...

Wait till it bounce back ...

Dey enjoy your interim and final dividend...

At least GTCO no go die in the next 2 years

Or

Sell if you cant sleep in the Nite. 3 Likes |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:56am On Aug 09, 2022 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:56am On Aug 09, 2022 |

Otedola has taken Prudent Energy to court for non-payment of 6m dollars. I guess this is the balance of the 200m dollars purchase price paid when Prudent acquired Ardova from Femi Otedola. Princkez:

pls any news 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:43am On Mar 16, 2022 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:43am On Mar 16, 2022 |

My Oga, this is not possible in the next 30 years sef. What will drive these stock prices to this level? Nothing. RabbiDoracle:

Market is bullish. All Emerging market. The seed has been sown long ago.

F - 50

U - 40

G - 90

A - 60

Z - 75

2Fs - 15

And many more.

This is a possibility based on TA.

Impossible is nothing.

Do your due diligence. 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:27am On Feb 28, 2022 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:27am On Feb 28, 2022 |

The stock has 24,730,354,443 units in issue. If you multiply this by 0.0016, you will have your 40m dollars. dharpzee:

Oga, na 16cents o, just got confirmation 2 Likes |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:28am On Dec 13, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:28am On Dec 13, 2021 |

Hello, I do not think you even need to disturb yourself too much, the trading symbol of BOC Gases has been changed. It is now IMG

[quote author=Slimdove post=108446556]

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 12:52pm On Dec 10, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 12:52pm On Dec 10, 2021 |

Nigerialabalaba:

Igi pawpaw o ni wo pawa o.

This line dey always crack me up. 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 12:18pm On Oct 07, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 12:18pm On Oct 07, 2021 |

Well done Madam. yMcy56:

Modified:

Oga Rebekah answered you already.  1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 12:12pm On Oct 07, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 12:12pm On Oct 07, 2021 |

[quote author=Mpeace post=106524846]Wow that something oh.

But how did you arrive at 88billion.

This is where people saw N88b. 1 Like

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:25am On Aug 20, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:25am On Aug 20, 2021 |

Banks and Insurance companies are not merging too. emmanuelewumi:

With almost 300 Stockbroking firms in Nigeria and the top 10 Stockbroking firms in terms of value of transaction controlling almost 70%.

Few years ago when the total value of transaction was N1.3 Trillion, Stanbic IBTC Stockbrokers did 15% of the transaction that is N195 billion worth of transaction.

Merger among Stockbroking firms is the best way to save costs |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 12:53pm On Aug 03, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 12:53pm On Aug 03, 2021 |

It is to avoid manipulation. Raider76:

Morgan has done something about the problem. I can now place sell/buy orders. But the Market Orders section shows only one line, so I cannot have a good picture of the bid/offers to make an informed bid. I wonder if this is the case with everybpdy. |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:54am On Jun 29, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:54am On Jun 29, 2021 |

Nothing is wrong. It is working perfectly. czarmide:

Good morning guys,pls does anybody has difficulty in placing a sell order on Morgan capital itrade .I want to know if it's general or not before I call their customer care 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 3:28pm On Jun 18, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 3:28pm On Jun 18, 2021 |

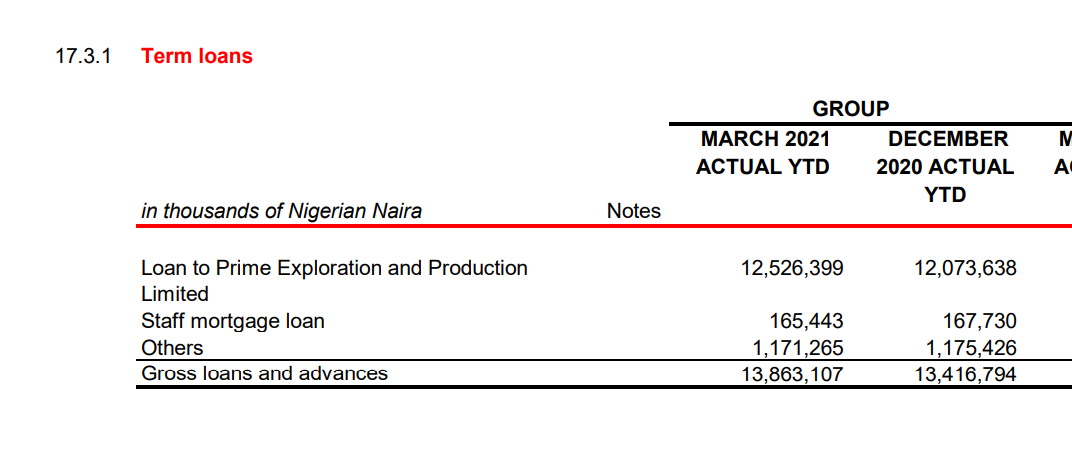

You are looking for where the loan is. Check this yMcy56:

You may be right....

.......but in the case of the attached 4.8B from Charles Enterprise and Arubiewe, it's not loan at all......but fund injection from new investors for accumulation of some % of shares of MBENEFIT @54k.

This was in pursuant of the recap capital base and, it was made public last year....... allocation was just pending SEC's approval.

We can't refer to this as loan nah.......don't mind my amateurish view o.  1 Like

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 1:08pm On Jun 18, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 1:08pm On Jun 18, 2021 |

They have subsidiaries that can be used to execute transactions like this. yMcy56:

Any link to this info oga mi?

..because sometimes lat year they sold shares worth certain amount to two coys @54k as can remember posting it here that time.......this was in pursuant to the ongoing recapitalisation. Don't know how far they've gone with the capital base anyway.

Btw, does insurance lend money?

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 11:40am On Jun 18, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 11:40am On Jun 18, 2021 |

Please run away from that stock oooo. There is about 12b loan that the coy borrowed to one oil and gas company that I really do not know much about. The Chairman and one other Director through their SPV are both looking to inject about N4.8b into the company. yMcy56:

We need to know and analyse what brought about the loss in the fair value of the Asset @ FVTPL which spoilt the good result.

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 3:48pm On Jun 17, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 3:48pm On Jun 17, 2021 |

|

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 1:13pm On Jun 02, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 1:13pm On Jun 02, 2021 |

1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 1:10pm On Jun 02, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 1:10pm On Jun 02, 2021 |

Oga Loco, Japaul will likely take some JIJOists down when the time comes. Please be careful. locodemy:

Long term holders should avoid stocks surrounded by short term traders especially day traders.Such stocks fluctuates easily and make people to loose interest but day traders enjoy it most because it responds to their actions.

Dividend paying stocks/growth stocks should be the target of long termers.

Month of June is a technical month.Traders will benefit most. 2 Likes |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 4:27pm On Apr 21, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 4:27pm On Apr 21, 2021 |

FG through AMCON is the largest shareholder of the Bank.

[quote author=Redoil post=100986453]Insiders squealed to us that the bank’s board may have perfected plans to sack her as the board has lost confidence in her leadership because she has failed to turn around the fortunes of the bank. |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 11:00am On Apr 14, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 11:00am On Apr 14, 2021 |

3 Likes 1 Share |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 2:14pm On Feb 25, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 2:14pm On Feb 25, 2021 |

You will vomit the money oooooo. You ought to have informed your stockbroker of the error so that it can quickly be corrected. It will be both MC and CSCS error. SmartMoneyGuy:

Same thing with my own. Units did not decreased as expected by price more than tripple ---X4 actually

But me i have offloaded 90% and booked my kilishi gain 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 2:04pm On Feb 25, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 2:04pm On Feb 25, 2021 |

which stockbroking firm are you using? ggoldmine:

Hello good people. Is Zenith paying or has already paid Interim dividend? I just received an alert and can't tell which is it for, whether last year or this year. I'm quite confused because I bought the shares last year and this is the first dividend I've received.

Thank you. |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 2:03pm On Feb 25, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 2:03pm On Feb 25, 2021 |

It will be taken out of his portfolio whenever he sells or put money into his trading accounts. you want to eat your cake and still have it. Ko le work. kodelee:

There is some error there oo. Same for me. Your units did not reduce in your brokers account but the units have reduced on your cscs account. the brokers are now updating some of the clients account. The whole thing is a big mess. People are seeing big profits but no be soo.. Dont know how they will sort this out for those that sold based on old reconstruction units.. |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 2:00pm On Feb 25, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 2:00pm On Feb 25, 2021 |

28kobo zionaigbokhan:

I hope you know selling at 1.2 is a big loss after reconstruction. |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 8:55am On Feb 24, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 8:55am On Feb 24, 2021 |

You have got to always review your position based on the results being churned out by a company. If the results are no longer consistent with what it was when you took a position, no crime if you exit the company to preserve your capital. Mcy56:

Exactly.

There are some stocks I can't even panic about ........even if it drops to half.

AFRIPRUD is a classic stock to me, was just negatively responded to due to expectations of higher dividend more than UCAP/drop from last fye own.

From tomorrow, I expect bargain hunters to start taking position. Afriprud can't remain down when Ucap is going up, it's the sector leader.

This is my opinion.

1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:02am On Feb 23, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 10:02am On Feb 23, 2021 |

You may need to make an exception for United Capital this time around. Q4 EPS alone is 72kobo, if the feat is repeated in Q1, 2021 be sure that UCAP will not sell under N5 for a very long time and if the trend is sustained through the next 3 quarters in 2021. N1 dividend may be feasible in 2021 FS. megawealth01:

I always laugh when certain stocks are hyped because they were pumped... I'm waiting for UCAP, WAPCO, AFRIP, GUINESSS etc... They must bow to my yearly entry  4 Likes 1 Share |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:56am On Feb 11, 2021 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by rebekah2011(m): 9:56am On Feb 11, 2021 |

There are no taxes on the sale of shares. What you have are brokers commissions, Vat, stamp duty CSCS and SMS alert. stocks and shares are exempted from tax. samguru:

At the point of selling your shares, govt has already collected their tax from the proceeds of the share sales.

The moment the fund enters your business,it is regarded as shareholder's fund.

Govt can not tax shareholder's fund rather they tax your profit |