Properties / Networking Opportunity For Those In The Building Industry by nairajotter: 2:40pm On May 14 Properties / Networking Opportunity For Those In The Building Industry by nairajotter: 2:40pm On May 14 |

If you are in the building industry in Nigeria then you shouldn't miss this event if you really want to scale up and be on the top of your game in the industry. https://nigeriabuildexpo.net/landing2/

|

Business / Wema Records 196 Percent Profit Before Tax In 2023 Financial Report by nairajotter: 11:30am On Apr 09 Business / Wema Records 196 Percent Profit Before Tax In 2023 Financial Report by nairajotter: 11:30am On Apr 09 |

Wema records 196 percent profit before tax in 2023 financial report

Wema Bank has announced its full Year 2023 Audited financial statement, recording profit before tax growth of 196 per cent from ₦14.75bn to N43.59 billion.

The bank also proposed a dividend per share of 50kobo; up from 30 kobo in 2022 and deposit growth of 60 per cent to ₦1,860.57bn from ₦1,165.93bn reported in FY 2022.

“Return on Equity (ROAE) of 39.28%, NPL of 4.31% and N40billion 1st tranche of Capital raise awaiting final regulatory approvals,” a statement from the bank said.

Commenting on the results, the MD/CEO, Mr. Moruf Oseni said, “2023 showcased a revitalised Wema Bank as evidenced by the considerable improvements in our numbers. The performance is headlined by impressive improvements in Profit before Tax which grew strongly by 196%.”

He noted that the growth of Gross Earnings by 72%, Total Assets by 56% and earnings per share at 279.5 kobo shows the core improvements to the bank’s balance sheet.

“In addition, our cost to income ratio at 64.37% has witnessed significant improvement from the previous period.

“We also completed our N40bn Capital raise exercise (results awaiting final verification by regulators). This exercise actively positioned us for the new capital licensing requirements of the Central Bank of Nigeria. Wema Bank will accelerate its capital management plans and ensure we embark on the journey to raise the required capital as quickly as possible.

“The Bank will be proposing a dividend per share of 50 kobo to its shareholders at the next Annual General Meeting; this is in line with the Bank’s capital conservation strategy and to ensure that it continues to provide returns to its shareholders in anticipation of additional capital raises scheduled for later this year.

“We are satisfied with the bank's performance in the first year of the new leadership team, as we move in a strong growth trajectory. Our target remains clear, we want to become a Top-Tier Bank in the industry powered by Digital excellence, we have carved a niche for ourselves with ALAT as a Retail platform, but we are now positioning the enterprise as the Intelligent platform for all financial services.

“We have partnered with the Federal Government on upskilling Two Million MSMEs, provided engagement platforms for all NYSC members and are now implementing partnerships in Health, Education, Women empowerment and in the green economy.

“In the months ahead, we would be developing platforms and supporting initiatives that prioritize the needs of our customers, leveraging technology in solving problems across all sectors.”

src: https://leadership.ng/wema-bank-records-196-profit-before-tax/ 9 Likes

|

Nairaland / General / Building Industry Players! Free Registration Ongoing For The Buildexpo 2024 by nairajotter: 4:14pm On Mar 27 Nairaland / General / Building Industry Players! Free Registration Ongoing For The Buildexpo 2024 by nairajotter: 4:14pm On Mar 27 |

Igniting Innovation, Connecting Professionals, and Building Tomorrow's LandscapeThe anticipation is palpable as the construction and building material industry in Nigeria gears up for its most awaited event of the year: Nigeria BuildExpo 2024. Celebrating its 8th year, the International Construction, Building Material & Technology Exhibition promises to be a game-changer, bringing together the finest minds in the construction industry, cutting-edge technologies, and innovative solutions under one roof. Scheduled from May 21st to 23rd, 2024, at the Landmark Center in Victoria Island, Lagos, Nigeria, Nigeria BuildExpo 2024 is set to be a transformative experience for professionals across the construction spectrum. Whether you're a seasoned civil engineer, visionary architect, building equipment seller, or creative interior decorator, this expo offers unparalleled opportunities for networking, learning, and growth. Registration for Nigeria BuildExpo 2024 is FREE. To secure your spot today, click https://nigeriabuildexpo.net/landing/,

At Nigeria BuildExpo 2024, innovation takes center stage. With exhibitors showcasing the latest advancements in construction materials, technologies, and techniques, attendees will have the chance to explore groundbreaking solutions that are shaping the future of the industry from global and local experts. From sustainable building practices to smart technologies revolutionizing construction processes, every corner of the expo floor is brimming with innovation and possibilities. But, Nigeria BuildExpo is more than just a showcase of products; it's a platform for connection and collaboration. With networking events, panel discussions, and interactive workshops led by global and local industry experts, attendees will have ample opportunities to exchange ideas, forge partnerships, and stay ahead of the curve in a rapidly evolving landscape. Join us at 8th edition of the Nigeria BuildExpo 2024 and be part of a community that is shaping the future of construction in Nigeria and beyond. Whether you're a trailblazing professional or an industry enthusiast, this is an event you won't want to miss. Mark your calendars, spread the word, and get ready to embark on a journey of innovation, inspiration, and impact at Nigeria BuildExpo 2024. Website: www.nigeriabuildexpo.net#BuildExpo2024 #Construction #Building #Nigeria #Innovation #Networking #Growth

|

Music/Radio / !!! Audition Audition Audition For Music Artists by nairajotter: 12:29pm On Mar 17 Music/Radio / !!! Audition Audition Audition For Music Artists by nairajotter: 12:29pm On Mar 17 |

🎤 Are you the next music sensation? Big Beats Records wants YOU! 🌟 Auditions now open for vocalists, hip-hop artists, gospel singers, and afro beats talents. Winners would get a mouth watering music record deals worth millions of Naira. Register online today: https://forms.gle/7WwoA4G36JLCQzhv9 #BigBeatsMusicAudition

|

Nairaland / General / Re: Basking In Glitz And Glamour: Inside Wema Bank's Enchanting IWD 2024 Event by nairajotter: 9:59am On Mar 16 Nairaland / General / Re: Basking In Glitz And Glamour: Inside Wema Bank's Enchanting IWD 2024 Event by nairajotter: 9:59am On Mar 16 |

nairajotter:

Basking in Glitz and Glamour: Inside Wema Bank's Enchanting IWD 2024 Event

The Oriental Hotel in Lagos was aglow with elegance and radiance as Wema Bank hosted its remarkable International Women's Day 2024 celebration. The hall exuded sophistication, enveloped in a warm and inviting ambiance created by the soft pink tones that filled the air with a sense of femininity and empowerment. Stepping into the venue, attendees were serenaded with music that helped ease them into the already comfortable and welcoming atmosphere.

As they ventured further, their eyes were drawn to the breathtaking sight of the center stage, a grand display adorned with bold letters spelling out "SARA" and "WEMA" on the sides. But the stage transcended its role as a mere platform for speakers and performers; it became a symbol of hope and possibility with every speech and activity witnessed on it, igniting dreams of future success and achievement in the hearts of all who beheld it.

As the event unfolded, attendees were treated to thrilling live performances. Veteran vocal powerhouse Yinka Davies rose to the occasion with patriotism as she sang the national anthem with such vigor and purity. But the show was just about getting started, as Ara Nigeria's foremost female drummer raised the tempo in the room with a riveting, exciting, and energetic performance, accompanied by her dance crew, all dressed in native attire from the land of Ife.

As guests ventured through the venue, they were drawn into the enchanting SARA wonderland. From photo booths to interactive displays, Sara Wonderland offered an array of delights, each meticulously designed to evoke joy and wonder.

Among the highlights of Sara Wonderland was the 360-spin camera, a cutting-edge technology that captured stunning images of guests in motion. It proved to be a crowd favorite, with attendees eagerly lining up to strike a pose and capture the perfect shot. Other engaging setups included a pink-themed photo booth, a Barbie-inspired stand, SARA props for pictures, and Polaroid cameras for instant photos, allowing guests to unleash their creativity and express themselves freely.

As the day unfolded, the hall buzzed with infectious energy, laughter, and conversation as women from all walks of life came together to celebrate their achievements, uplift one another, and have a blast, leaving with hearts brimming with inspiration and gratitude and carrying memories that would linger for a lifetime.

Wema Bank's International Women's Day 2024 celebration was an unequivocal success, a testament to the power of unity, solidarity, and feminine grace. Looking ahead, let us continue to champion inclusivity and empowerment, forging a world where every woman can shine brightly and realize her dreams.

|

Nairaland / General / Basking In Glitz And Glamour: Inside Wema Bank's Enchanting IWD 2024 Event by nairajotter: 9:55am On Mar 16 Nairaland / General / Basking In Glitz And Glamour: Inside Wema Bank's Enchanting IWD 2024 Event by nairajotter: 9:55am On Mar 16 |

Basking in Glitz and Glamour: Inside Wema Bank's Enchanting IWD 2024 Event

The Oriental Hotel in Lagos was aglow with elegance and radiance as Wema Bank hosted its remarkable International Women's Day 2024 celebration. The hall exuded sophistication, enveloped in a warm and inviting ambiance created by the soft pink tones that filled the air with a sense of femininity and empowerment. Stepping into the venue, attendees were serenaded with music that helped ease them into the already comfortable and welcoming atmosphere.

As they ventured further, their eyes were drawn to the breathtaking sight of the center stage, a grand display adorned with bold letters spelling out "SARA" and "WEMA" on the sides. But the stage transcended its role as a mere platform for speakers and performers; it became a symbol of hope and possibility with every speech and activity witnessed on it, igniting dreams of future success and achievement in the hearts of all who beheld it.

As the event unfolded, attendees were treated to thrilling live performances. Veteran vocal powerhouse Yinka Davies rose to the occasion with patriotism as she sang the national anthem with such vigor and purity. But the show was just about getting started, as Ara Nigeria's foremost female drummer raised the tempo in the room with a riveting, exciting, and energetic performance, accompanied by her dance crew, all dressed in native attire from the land of Ife.

As guests ventured through the venue, they were drawn into the enchanting SARA wonderland. From photo booths to interactive displays, Sara Wonderland offered an array of delights, each meticulously designed to evoke joy and wonder.

Among the highlights of Sara Wonderland was the 360-spin camera, a cutting-edge technology that captured stunning images of guests in motion. It proved to be a crowd favorite, with attendees eagerly lining up to strike a pose and capture the perfect shot. Other engaging setups included a pink-themed photo booth, a Barbie-inspired stand, SARA props for pictures, and Polaroid cameras for instant photos, allowing guests to unleash their creativity and express themselves freely.

As the day unfolded, the hall buzzed with infectious energy, laughter, and conversation as women from all walks of life came together to celebrate their achievements, uplift one another, and have a blast, leaving with hearts brimming with inspiration and gratitude and carrying memories that would linger for a lifetime.

Wema Bank's International Women's Day 2024 celebration was an unequivocal success, a testament to the power of unity, solidarity, and feminine grace. Looking ahead, let us continue to champion inclusivity and empowerment, forging a world where every woman can shine brightly and realize her dreams. |

Business / IWD: Wema Bank Honors 5 Women Whose Achievements Uplifted Nigeria by nairajotter: 6:20pm On Mar 14 Business / IWD: Wema Bank Honors 5 Women Whose Achievements Uplifted Nigeria by nairajotter: 6:20pm On Mar 14 |

Wema Bank Honors Exceptional Women with ‘She Empowers Her Award By SARA’ at International Women's Day 2024 Event

In a spectacular celebration of empowerment and achievement, Wema Bank proudly announced the winners of its inaugural She Empowers Her Award By SARA, presented during a captivating International Women's Day event held at the prestigious Oriental Hotel in Victoria Island, Lagos.

Among a crowd filled with anticipation, five extraordinary women were honored for their remarkable contributions to society, exemplifying the essence of empowerment, inclusion, and positive change. These outstanding women have not only shattered glass ceilings but have also paved the way for future generations through their relentless dedication and impactful endeavors.

Adesunmbo Adeoye, Debola Agunbiade, Debola Deji-Kurunmi, Funke Felix Adejumo, and Pastor Mrs. Mary Kristilere stood out among a pool of exceptional nominees, showcasing their extraordinary achievements and commitment to uplifting others. From entrepreneurship and finance to philanthropy and leadership, each awardee has left an indelible mark on their respective fields, inspiring countless women to strive for greatness.

Moruf Oseni, MD/CEO of Wema Bank, reiterated the bank's dedication to women's success, stating. According to him, Wema Bank is committed to ensuring that women and their businesses thrive and have a positive societal impact.

In response to winning the award, one of the recipients, Pastor Mrs. Mary Kristilere expressed her gratitude. "This happened only by God's grace and the votes of all my beloved friends and family. Your votes did indeed count. I dedicate this win to the Lord Almighty and pledge more service to humanity. Thank you all for the massive support and encouragement. Thank you, Wema Bank. Words indeed fail me to express how grateful I am."

Another receipient, Debola Agunbiade said, "It’s with gratitude to God that I wish to inform you of my emergence as one of the winners of the Wema Bank She Empowers Her Award By SARA. This is the maiden award ceremony to recognize and celebrate the exemplary achievements of women inspiring inclusion in Africa. I appreciate the entire Wema Bank Plc staff and especially the MD, Mr. Moruf Oseni, for his exemplary leadership in supporting women."

The journey of the She Empowers Her Award By SARA began in 2024 to recognize and celebrate the exemplary achievements of women driving positive change and inspiring inclusion in Africa. On February 23, 2024, the award was announced to the public, marking a significant milestone in the recognition of women's empowerment efforts. The award received an overwhelming response, with up to 100 entries received across the continent. After a meticulous selection process overseen by an independent auditor, 20 nominees were shortlisted, and the top 5 winners were determined through transparent public voting.

https://www.vanguardngr.com/2024/03/international-womens-day-wema-bank-inspires-women-with-awards/amp/ 6 Likes 2 Shares

|

Nairaland / General / Naira Strengthens By 7.43% To N1750 Against Dollar At The Black Market by nairajotter: 2:12pm On Feb 23 Nairaland / General / Naira Strengthens By 7.43% To N1750 Against Dollar At The Black Market by nairajotter: 2:12pm On Feb 23 |

The Naira witnessed a notable surge on Thursday, reaching a high of N1750 per dollar in the parallel market, commonly known as the black market. This surge represents a substantial 7.43% increase, with the currency strengthening by N130.00 compared to the previous day’s closing rate of N1,880. The surge coincides with Nigeria’s intensified efforts to counter the ongoing depreciation of the Naira. In response to the currency’s decline, Nigeria has ramped up measures to stabilize its value. These efforts include cracking down on informal foreign currency street traders and targeting a popular cryptocurrency trading platform. Throughout the week, the naira experienced a significant decline in value, hitting a low of N1,880 to the dollar on Thursday. This depreciation has widened the disparity between the unofficial market rate and the official rate of the naira, presenting challenges to the government’s goal of unifying the two rates. Despite the Central Bank of Nigeria’s implementation of various policies aimed at boosting the supply of foreign exchange (forex), these developments persist, underscoring the complexities of managing currency stability in the face of economic challenges. However, the Great British Pound (GBP) remained flat at £1/N2260, same as was recorded the previous day. Additionally, the Naira against the Euro traded flat, closing at N1960/EUR1 compared to N1960/EUR1 also reported the previous day. In the cryptocurrency market where forex is sold using stablecoins, the Naira also settled at N1,708.40/$1 as of 1.15 pm. Nairametrics reported that the National Security Adviser’s Office, led by Nuhu Ribadu, in collaboration with the Central Bank of Nigeria (CBN), has initiated a joint effort to combat forex speculation and tackle the issues affecting the country’s economic stability. In a statement on Tuesday, a spokesperson for Ribadu’s office, Zakari Mijinyawa, the partnership is set to include coordinated actions with leading law enforcement agencies such as the Nigeria Police Force (NPF), the Economic and Financial Crimes Commission (EFCC), the Nigeria Customs Service (NCS), and the Nigeria Financial Intelligence Unit (NFIU). Mijinyawa pointed out that the activities of speculators, operating both domestically and internationally through different mechanisms, have played a significant role in the naira’s depreciation, thereby exacerbating inflation and leading to economic instability in Nigeria. Src: https://nairametrics.com/2024/02/23/naira-strengthens-by-7-43-to-n1750-against-dollar-at-the-black-market/

|

Business / Invalidation Of $2.4bn Forward Contracts By The CBN: Manufacturers' Fate Unknown by nairajotter: 1:37pm On Feb 23 Business / Invalidation Of $2.4bn Forward Contracts By The CBN: Manufacturers' Fate Unknown by nairajotter: 1:37pm On Feb 23 |

Invalidation of $2.4Bn Forward Contracts by the CBN; How many more manufacturers will be forced out of business?Imagine sailing on a calm sea, charts meticulously plotted, course set for prosperity. Suddenly, a colossal wave looms on the horizon, threatening to engulf your vessel and everything you hold dear.

This is the chilling reality facing Nigerian businesses, investors, manufacturers and citizens alike, thanks to the Central Bank of Nigeria's (CBN) recent invalidation of $2.4 billion worth of forward contracts. The governor of the Central Bank of Nigeria, Dr Olayemi Cardoso, during an interview on Arise TV, on the February, 5th 2024 addressed concerns about the recent volatility in the currency market and said that about $2.4bn of the $7bn foreign exchange backlog he met when he got into office were from non-existing entities, requests without import documents among other infractions.

As a financial enthusiast with a keen eye on Nigeria's economic well-being, the recent invalidation of $2.4 billion worth of forward contracts by the Central Bank of Nigeria (CBN) sends chills down my spine. This policy, shrouded in a fog of technicalities and accusations, reeks of inconsistency and recklessness. The CBN claims to have uncovered a "forex trading fraud," but according to Social Integrity Network, (SINET), a non-governmental organisation, representing legitimate businesses unfairly caught in the crossfire, vehemently disputes this narrative. They paint a picture of meticulous planning, with companies securing forward contracts 18 months ago at N450/dollar, only to have the rug pulled from under them today. Now, they face a staggering 333% increase in costs, a financial tsunami that could drown them entirely.

But this isn't just a corporate tragedy; it's a national emergency. Businesses, large and small, are gasping for air. Those who swallowed the bitter pill of borrowing funds at exorbitant rates (some exceeding 30%) to secure these contracts are now drowning in interest payments and potential defaults. Banks, caught between a rock and a hard place, struggle to fulfill their offshore obligations, jeopardizing their own creditworthiness and the nation's financial standing.

The ripple effects are as devastating as they are widespread. The manufacturing sector, already grappling with inflation and a volatile exchange rate, now faces imminent collapse. Nearly 60% of companies have already shut their doors, and this policy threatens to wipe out the remaining 40%. This translates to millions of lost jobs, plummeting production, and a drastic decline in GDP, pushing countless Nigerians deeper into poverty. According to the latest figures from the National Bureau of Statistics, unemployment climbed to a staggering 5.0 per cent in the third quarter of 2023 from 4.2 per cent in the previous quarter and Nigeria’s annual inflation rate rose to 29.90 per cent in January from 28.92 per cent in December 2023. The manufacturing sector, once a pillar of the economy, has witnessed a decline of 15% in production output year-on-year. These alarming statistics paint a grim picture of an economy on the brink.

The industry is currently burdened with the effect of fuel subsidy removal and devaluation of the naira that has led to hyper increase in the cost of production. With the cancellation of forward contracts that has already been utilized for LC establishments, shipment and costing of products already sold by these companies, it would be practically impossible to recover this cost on current production.

This policy will gradually collapse the manufacturing sector, the projected GDP growth rate for the country will collapse and the attendant impact on the microeconomic variables of the Federal Government will be adverse.

This policy isn't just a financial burden on manufacturers; it's a ticking time bomb for everyday Nigerians. Already grappling with rising costs, businesses will be forced into desperate measures to survive, pushing production costs even higher. Imagine the ripple effect: essential goods become out of reach for the average citizen, their basic needs unmet. This simmering frustration could easily boil over into widespread social unrest, destabilizing the very fabric of our nation

But the damage doesn't stop at the water's edge. Failure to honor these contracts could shatter Nigeria's international reputation, branding it as an unreliable and risky investment destination. This, at a time when the government desperately seeks foreign investors, is an act of self-sabotage, undermining years of progress and jeopardizing the nation's future prosperity.

Thankfully, we haven't reached the point where rescue efforts are futile. There's still time to navigate this treacherous storm, but it requires immediate action and a complete course correction. Open communication and transparency are the lifeline we desperately need. The government and CBN must engage with stakeholders to understand the true impact of this policy and explore solutions. A thorough review with clear criteria for identifying genuine transactions, coupled with exploring compensation options for unfairly impacted businesses, is crucial to restoring trust and preventing further economic calamity.

The CBN’s proactive measures to stabilize the foreign exchange market and stimulate economic activities is commendable, I urge the authorities to prioritize long-term economic growth and a fair playing field for legitimate businesses. This isn't just about numbers; it's about the lives and livelihoods of millions of Nigerians. We must act with transparency, fairness, and a commitment to sustainable development. This is not the time for knee-jerk reactions and opaque pronouncements. This is the time for clear communication, collaboration, and decisive action to steer our nation away from the impending economic tsunami. Together, we can build a stronger, more resilient Nigeria, but only if we choose the path of transparency and act with urgency.

In conclusion it is important for the CBN to re-evaluate this policy direction and ensure that customers with valid export documentations are exempted from the list of invalid forward contract obligations. This can be ascertained by requesting documents to prove funds was utilized for importation such as:

1.Valid Form M approved by the CBN

2. Evidence of establishment and transmission of LC

3. Bill of Lading Documentation

4. Evidence of Custom Duty payments for imported products

This will help the CBN separate genuine customers that have utilized the forex allocation for legitimate business from those who may have diverted the forex for other uses. The current approach of the CBN is punitive and has far reaching adverse effect on the economy. The CBN must also note that all the forex allocation was legitimately awarded by the apex banks and cannot seek to declare invalid same based on technicalities. The invalidation of $2.4 billion forward contracts by the CBN represents a significant setback for Nigerian manufacturers, further exacerbating the economic crisis gripping the nation. Urgent measures must be taken to address this issue and provide much-needed relief to businesses struggling to survive amidst unprecedented challenges.

Falola Shuaib is a Finance expert writing from Abuja, Nigeria. SRC: https://dailynewsreporters.com/cbns-2-4bn-contract-invalidation-how-many-more-businesses-will-be-forced-to-close/ 2 Likes 1 Share

|

Politics / Re: (UPDATE) My Experience Using Wema Bank's Newly Reintroduced Mastercard by nairajotter: 3:42pm On Aug 10, 2023 Politics / Re: (UPDATE) My Experience Using Wema Bank's Newly Reintroduced Mastercard by nairajotter: 3:42pm On Aug 10, 2023 |

I really appreciate this your review, personally I find it helpful. Looks like Wema bank is simply out to restore hope when it comes to customers satisfaction becos I have spent days talking to customer care rep from one of these other banks , issues unresolved but they seemed to have been more interested in me filling their survey form rather than fixing this issue I had. ibinaboonline:

I have an update for this post.

So, Wema Bank finally got back to me this Saturday evening. They says they'd fixed the issue with my card and apologized for the inconveniences. Although it took almost five days to get a response from them, I'm glad they actually replied with a solution instead of the usual gaslighting you typically get from Nigerian banks. Yes, it's working now!! The monthly limit is $500, but I don't mind. Who even get thousands of dollars to spend these days😄? So, yes, Wema Bank's naira Mastercard works!

So, the news broke about three weeks ago that Wema Bank has brought back the naira Visa and Mastercard. It was the best news I've heard in a year as I look forward to a hassle-free transactions, especially to pay for my website's SEO support.

So, I waited a week to see if other banks will follow suit. I was pretty sure Wema is just the first, and that offer banks like First Bank and Zenith (where I already have accounts) will make their own announcements in the following week. Wrong.

Other banks will probably join Wema in this aspect, but I couldn't wait anymore. So, I headed into a Wema Bank branch last week Wednesday and opened a savings account. I asked about the Mastercard availability before even filling the account opening form. They assured me the thing is real. Me equals very happy.

I returned to the bank on Tuesday this week to get the card. Me equals happiness again the moment I was handed the purple card with Mastercard's logo at the bottom right and my name on the left. Will it work for online transactions? Wilco, they assured me.

Back home, it was time to experience something I've missed since Buhari's administration. I waited till the next day, though. My first attempt with my shiny newly acquired Mastercard was to pay for a diib subscription to support my website. My heart skipped a beat when the otp landed in my phone. Sadly, the transaction ended with: "your card has been declined."

Note: I have more than enough balance in my account. My heart sank. It just reminded me that most of these naira MasterCards were just in name and not function even before the ban. For example, I had FCMB and Ecobank Mastercards that never worked. Only my First Bank Mastercard worked like a charm back then.

Well, I've emailed Wema Bank requesting an explanation. That was yesterday; still awaiting their reply. |

Politics / Re: (UPDATE) My Experience Using Wema Bank's Newly Reintroduced Mastercard by nairajotter: 12:11pm On Aug 04, 2023 Politics / Re: (UPDATE) My Experience Using Wema Bank's Newly Reintroduced Mastercard by nairajotter: 12:11pm On Aug 04, 2023 |

Wema bank master card works though I know a number of guys who have used it since they launched it, yours might just be a minor case of one of those verification issues. Don't forget to drop update here when you get sorted so some pple can be guided. ibinaboonline:

So, the news broke about three weeks ago that Wema Bank has brought back the naira Visa and Mastercard. It was the best news I've heard in a year as I look forward to a hassle-free transactions, especially to pay for my website's SEO support.

So, I waited a week to see if other banks will follow suit. I was pretty sure Wema is just the first, and that offer banks like First Bank and Zenith (where I already have accounts) will make their own announcements in the following week. Wrong.

Other banks will probably join Wema in this aspect, but I couldn't wait anymore. So, I headed into a Wema Bank branch last week Wednesday and opened a savings account. I asked about the Mastercard availability before even filling the account opening form. They assured me the thing is real. Me equals very happy.

I returned to the bank on Tuesday this week to get the card. Me equals happiness again the moment I was handed the purple card with Mastercard's logo at the bottom right and my name on the left. Will it work for online transactions? Wilco, they assured me.

Back home, it was time to experience something I've missed since Buhari's administration. I waited till the next day, though. My first attempt with my shiny newly acquired Mastercard was to pay for a diib subscription to support my website. My heart skipped a beat when the otp landed in my phone. Sadly, the transaction ended with: "your card has been declined."

Note: I have more than enough balance in my account. My heart sank. It just reminded me that most of these naira MasterCards were just in name and not function even before the ban. For example, I had FCMB and Ecobank Mastercards that never worked. Only my First Bank Mastercard worked like a charm back then.

Well, I've emailed Wema Bank requesting an explanation. That was yesterday; still awaiting their reply. 1 Like |

Jobs/Vacancies / Re: LAPO MFB Staff Reject 25% Salary Increase After 7 Years Of Alleged Stagnant Pay by nairajotter: 11:09am On Jun 22, 2023 Jobs/Vacancies / Re: LAPO MFB Staff Reject 25% Salary Increase After 7 Years Of Alleged Stagnant Pay by nairajotter: 11:09am On Jun 22, 2023 |

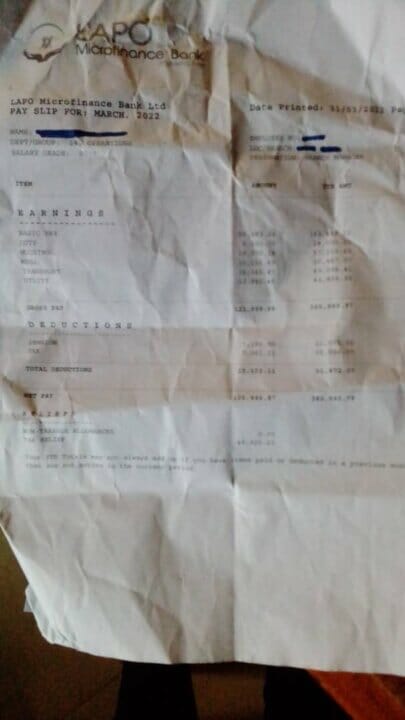

Hmm while other MFB staff are crying now because CBN has revoked the licenses, obviously the few ones like Lapo that is still managing the thrive should be commended for even trying to increase salaries during this period. I think these staffs complaining now will be alright last last. glammagazine:

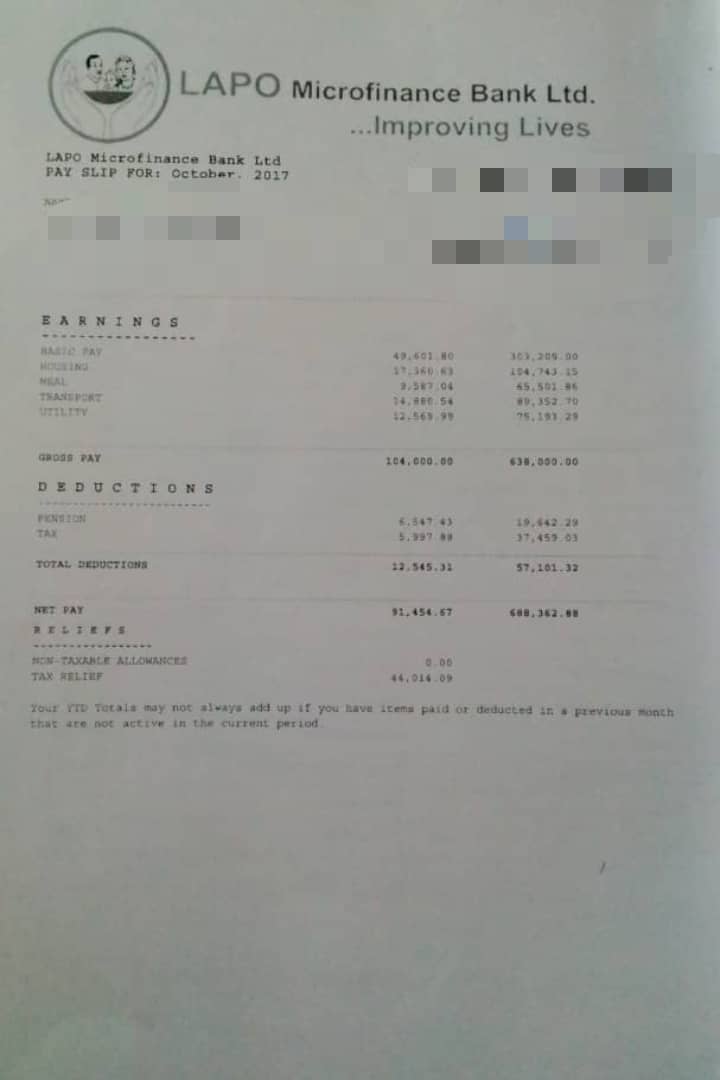

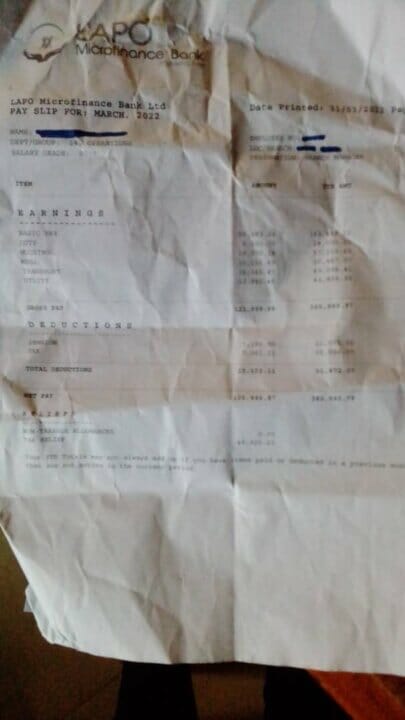

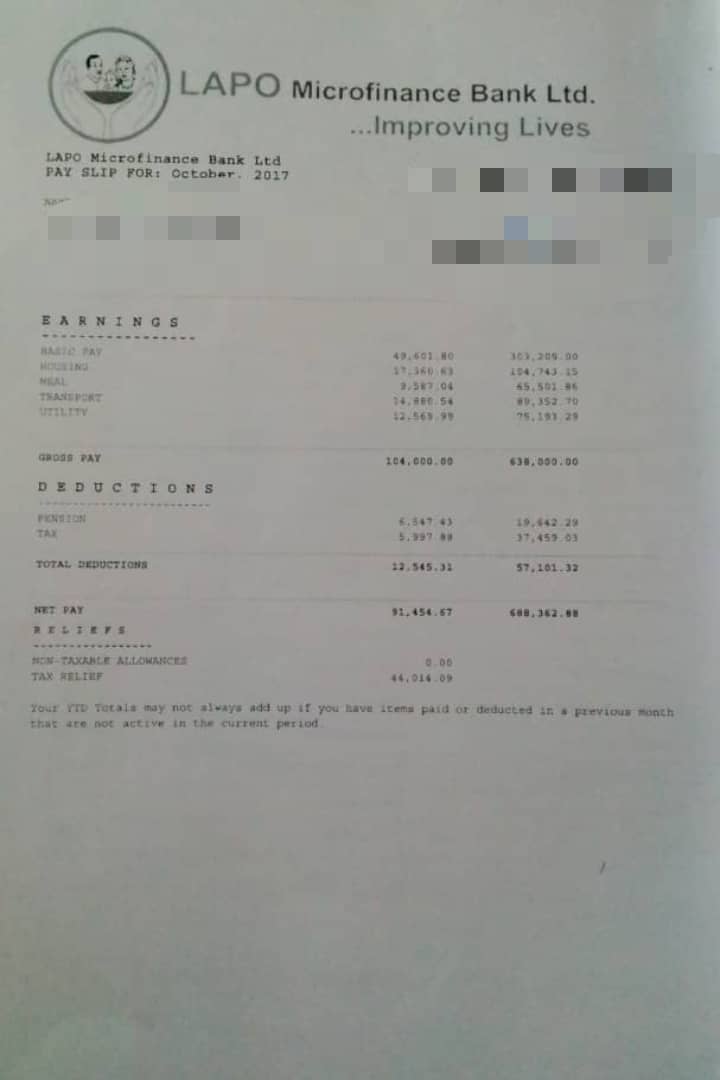

Exclusive: LAPO MFB staff reject 25% salary increase after 7 years of alleged stagnant pay, more

Members of staff of popular financial institution, LAPO Micro Finance Bank (MFB) have kicked against the bank management’s move to increase staff salaries by only 25% and 12.5% after 7 years of alleged stagnant pay.

Exclusive reports obtained by Kemi Filani reveals that the last time LAPO MFB’s staff‘s salaries were reviewed was in 2016, and their staff don’t allegedly get the annual (step) increment other organisations/institutions enjoy. “Our salaries have been stagnant since 2016″ after they reviewed it upwards by 15%. The management only reviews staff salaries as at will. It can take 10 or 7 years which is not supposed to be so.” A staff who pleaded anonymity told Kemi Filani.

Kemi Filani gathered that as at 2016, before the 15% review, graduate (BSC/HND) staff (CSOs) earned a net salary of seventy five thousand, seven hundred and fifty naira, eighty six kobo (N75,750.86K), and after the review, their net pay became ninety eight thousand, three hundred and fifty six naira, forty one kobo (N98,356.41K). While Branch Managers (BM) get same salary, but an extra eight thousand naira (N8,000) as duty allowances.

It was gathered that after seven years of stagnant pay, the bank management decided to increase staff salaries by 25% for Junior staff (Graduate CSO, BM, Auditors and AM) and 12.5% for senior staff (Zonal managers – ZM).

“We have had stagnant salaries for years with no one being able to complain. If you do, they will threaten to transfer you to another state, far away from your family. After we were able to complain, they decided to increase it by 25% for Junior staff and 12.5% for senior staff” another staff whispered to Kemi FIlani.

The staff continued, “We have told them that due to the current economic situation in the country, a 25% increase after 7 years wouldn’t make sense. A graduate working for over 10 years and up till now, my net pay is not up to 100K. I can not complain or renegotiate my pay, they only decide on when to review it, which isn’t a standard practice anywhere.”

Source>>> https://www.kemifilani.ng/news/exclusive-lapo-mfb-staff-reject-25-salary-increase-after-7-years-of-alleged-stagnant-pay-more |

Food / Re: Nigerian Indomie Noodles Very Safe To Consume - NAFDAC by nairajotter: 3:16pm On May 05, 2023 Food / Re: Nigerian Indomie Noodles Very Safe To Consume - NAFDAC by nairajotter: 3:16pm On May 05, 2023 |

You really believe the same NAFDAC that destroys fake or substandard drugs worth billions of naira would actually now put the lives of Nigerians at risk by putting out a fake claim for the satisfaction of a few? haba, you know that is not possible. Zakarara:

Believe this pple at ur own peril. Indomie top management go don do their homework... |

Food / Re: Nigerian Indomie Noodles Very Safe To Consume - NAFDAC by nairajotter: 3:11pm On May 05, 2023 Food / Re: Nigerian Indomie Noodles Very Safe To Consume - NAFDAC by nairajotter: 3:11pm On May 05, 2023 |

The message is quite clear and simple, importation of instant noodles has been banned long ago, the news scare is simply because almost the same name applies. Nigerians really just like to make a mountain out of an ant hill, the US have the FDA and the hold them in high esteem but trust Nigerians to make a mess out of our own NAFDAC's validation message. Estello:

https://tribuneonlineng.com/nigerian-indomie-noodles-safe-to-consume-%e2%80%95-nafdac/ |

Food / Re: Nigerian Indomie Noodles Very Safe To Consume - NAFDAC by nairajotter: 11:30am On May 05, 2023 Food / Re: Nigerian Indomie Noodles Very Safe To Consume - NAFDAC by nairajotter: 11:30am On May 05, 2023 |

Don't get people confused o this a a confirmed news. Aijeez:

This is fake news. NAFDAC never said so |

Food / Re: Nigerian Indomie Noodles Very Safe To Consume - NAFDAC by nairajotter: 11:25am On May 05, 2023 Food / Re: Nigerian Indomie Noodles Very Safe To Consume - NAFDAC by nairajotter: 11:25am On May 05, 2023 |

Our very own Twitter, no slander about Nairaland would be tolerated Oluwaseunbandur:

What's so special about nairaland front page |

Business / Re: Aishah Ahmad, CBN Deputy Governor In Charge Of Financial System Stability by nairajotter: 9:51pm On Jan 06, 2023 Business / Re: Aishah Ahmad, CBN Deputy Governor In Charge Of Financial System Stability by nairajotter: 9:51pm On Jan 06, 2023 |

It is actually really wrong to assume such. Aisha has never been named or caught up with Emefiele's woes. obiekunie01:

na so emefiele take escape with his loots!

him with his oga come discuss and agree say make him japa before february so the new government cant catch him.

he will not com back to this country for the next 10 years.

oya aishah na ya turn to loot your own! |

Business / Re: Aishah Ahmad, CBN Deputy Governor In Charge Of Financial System Stability by nairajotter: 9:40pm On Jan 06, 2023 Business / Re: Aishah Ahmad, CBN Deputy Governor In Charge Of Financial System Stability by nairajotter: 9:40pm On Jan 06, 2023 |

Well, it isn't really a bad idea to get to read about who is at the helm of affairs in a sector like the CBN SocialJustice:

Rubbish, is this a time for anybody at CBN to be proud of their career? |

Business / Re: Aishah Ahmad, CBN Deputy Governor In Charge Of Financial System Stability by nairajotter: 9:37pm On Jan 06, 2023 Business / Re: Aishah Ahmad, CBN Deputy Governor In Charge Of Financial System Stability by nairajotter: 9:37pm On Jan 06, 2023 |

You don't know that for a fact, she has a boss. kenbee:

She and her team failed Nigerians woefully! |

Business / Re: Ten Facts To Note About Polaris Bank by nairajotter: 6:56pm On Oct 22, 2022 Business / Re: Ten Facts To Note About Polaris Bank by nairajotter: 6:56pm On Oct 22, 2022 |

com'on Karlovych:

I see them implementing Sharia in their new policies I see them implementing Sharia in their new policies

This I have seen |

Business / Re: Ten Facts To Note About Polaris Bank by nairajotter: 6:54pm On Oct 22, 2022 Business / Re: Ten Facts To Note About Polaris Bank by nairajotter: 6:54pm On Oct 22, 2022 |

Best believe we still have NDIC in Nigeria, hence depositors' funds are always safe.Meanwhile other banks have their own issues too Freshfish4:

If you people are still confused, you should turn the banking buildings to tombo and bushmeat spots, una go sell scatter. Always changing name and always changing owners, one thing is for sure, My money ain't entering there |

Business / Re: Ten Facts To Note About Polaris Bank by nairajotter: 6:52pm On Oct 22, 2022 Business / Re: Ten Facts To Note About Polaris Bank by nairajotter: 6:52pm On Oct 22, 2022 |

That sounds like something that can be said about just any financial institution anywhere in the world Sixfiguresmart:

They are thieves in there. Never you trust any Nigerian bank. They are all criminals |

Business / Re: Ten Facts To Note About Polaris Bank by nairajotter: 6:50pm On Oct 22, 2022 Business / Re: Ten Facts To Note About Polaris Bank by nairajotter: 6:50pm On Oct 22, 2022 |

Definitely can't be a political move, the bank has had a long-standing issue with the financial regulatory body before the election period. amerengues:

This is quite a good read! I, however, have some doubts about it not being a political move. Anyways, if it's for the better, no problem. |

Politics / Enugu APGA Governorship Aspirant, Jeff Nnamani Graces Coal City Carnival by nairajotter: 3:57pm On Apr 19, 2022 Politics / Enugu APGA Governorship Aspirant, Jeff Nnamani Graces Coal City Carnival by nairajotter: 3:57pm On Apr 19, 2022 |

As Christians across the world on Sunday celebrated Easter, Enugu State governorship aspirant of All Progressives Grand Alliance (APGA), Dr. Jeff Nnamani marked the occasion by gracing the Biennial Coal Camp Cultural Carnival in Enugu state.

Received by over 10, 000 followers and participants at the carnival, Nnamani, who is a respected Oil and Gas experts is aiming at reforming the state’s political and governance atmosphere.

Nnamani, who equally celebrated Easter with a walk from street to street along with the Ndi Enugu people, amidst a magnanimous show of love from the people was at the carnival with his O be go team.

While declaring to contest in February, Nnamani noted the need to institute a truly people-centred approach to governance in order for the state to take its deserved position as the pride of the Igbo race.

|

Politics / Re: Enugu 2023: Jeff Nnamani Picks APGA Gubernatorial Nomination Form by nairajotter: 6:15pm On Apr 05, 2022 Politics / Re: Enugu 2023: Jeff Nnamani Picks APGA Gubernatorial Nomination Form by nairajotter: 6:15pm On Apr 05, 2022 |

Not anymore my friend, Ndi Enugu are tired, 23years of being under pdp has not earned the state anything but hardship Pdalds:

Enugu is a PDP state according to political calculation 3 Likes |

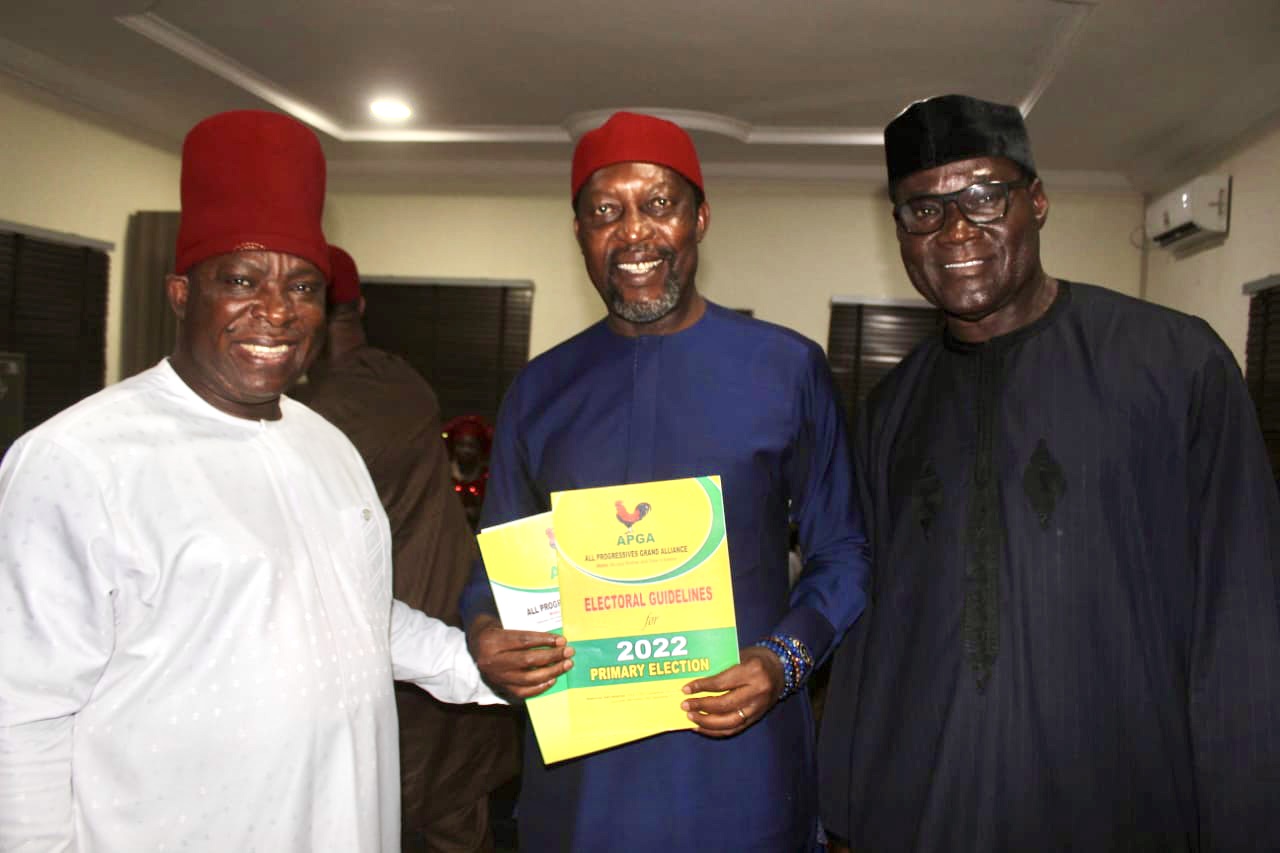

Politics / Enugu 2023: Jeff Nnamani Picks APGA Gubernatorial Nomination Form by nairajotter: 5:55pm On Apr 05, 2022 Politics / Enugu 2023: Jeff Nnamani Picks APGA Gubernatorial Nomination Form by nairajotter: 5:55pm On Apr 05, 2022 |

Enugu 2023: Dr. Jeff Nnamani picks APGA Guber nomination forms, Launches the OBEGO MovementAhead of the 2023 general elections, a frontline governorship aspirant in Enugu State under the platform of the All Progressives Grand Alliance, APGA, Dr. Jeff Nnamani obtained the expression of interest and Nomination forms from the national Secretariat of the party in Abuja on 4th April 2022.

Dr. Nnamani charged Ndi Enugu to embrace OBEGO Movement as he is ready to end the PDP misrule in the state.

Addressing reporters shortly after receiving the form in Abuja, Dr. Nnamani thanked the media for the strategic and supportive role in sustaining the nation’s democracy and encouraged journalists to remain committed to fair media coverage for everyone seeking elective offices.

He assured them that the Enugu people will experience better leadership if given the opportunity , as he will ensure that peace and development reigns supreme in the state.

Nnamani appreciated the leadership of the All Progressives Grand Alliance for their unwavering support.

‘I want to assure you that I would not disappoint Ndi Enugu" He Said

Src: https://www.dailygazetteng.com/?p=8277 2 Likes

|

Politics / Who Is Dr. Jeff Nnamani? by nairajotter: 1:51pm On Apr 05, 2022 Politics / Who Is Dr. Jeff Nnamani? by nairajotter: 1:51pm On Apr 05, 2022 |

Dr Jefferson Emeka Nnamani is an illustrious son of Enugu, born 15th December 1961, to the royal family of late HRH Igwe Daniel Nnamani, traditional ruler of Agbani, Enugu state, a District officer, Junior minister, parliamentarian in the 1st Republic and a renowned philanthropist who was instrumental in bringing development to the Wawa people of present day Enugu and Ebonyi State. Jeff grew up in Enugu State where he attended Agbani Road Primary School, Nsukka High School and National Grammar School, Nike.

He later proceeded to College of Arts and Science, Oko, Anambra, where his love for arts and culture was cultivated. He bagged his first degree in Political Science and Administration as well as a master’s degree in Public Administration at the University of Maiduguri, Borno. In his formative years in Enugu, Jeff excelled in football and was legendary for his goal scoring so much so that he was fondly teased by friends with the phrase “meme gba ka anyi na”. His love for the sport of football is still alive till date. Jeff is a man driven by his cherished values of devotion, consistency, honesty, and hard work.

All these clearly stood him out in his career as he rose from the humble position of Sales Representative at Elf Marketing Nigeria Limited (later merged with Total Nigeria Plc. in 2001) to General Manager Sales, General Manager Strategy and finally upon his retirement in 2015 to the position of Non-Executive Director, Strategy, Total Nigeria Plc.

As he journeyed through the corporate world, he garnered experience in human capital and resource management, leading to him successfully delivering on various projects yielding results and dividends for shareholders. Jeff was an instrumental member on the board of Nicon Insurance Corporation and Yaba College of Technology governing Council. He is a Fellow Institute of Credit Administrators, FICA as well as a member of Institute of Directors, IOD. In words and deeds, Jeff is a man who unabashedly preaches honesty, integrity, sacrifice, hard work and humility as the pillar upon which one must serve in any capacity in life.

These values have served him well in his almost 30 years in public service. Jeff is married to Princess Dorothy a medical doctor, daughter from the royal family of Late HRH Igwe Chukwuma Nwankwo, traditional ruler of Obinagu Uwani Akpugo, Nkanu LGA, another renowned philanthropist, known to his people as a peace maker. Who was one of those instrumental in the creation of today's Enugu State, owned the nostalgic Olympic Football Club that produced national heroes such as Christian Chukwu of Rangers and many others.

The union between Jeff and Dorothy is blessed with 4 children. Remarkably, Jeff's developmental politics is mirrored after his Father, a great man who believed in community welfare and as such delivered equity around the community of Agbani and beyond. Jeff remains driven by the understanding that development is communal.

This trait of Jeff was also sharpened under the tutelage of his brothers, the late Justice Augustine Nnamani, who was a former Attorney General and Minister of Justice of the Federal Republic of Nigeria prior to becoming Justice of the Supreme Court of Nigeria, Late Justice Chukwurah Isaac Nnamani and his late father-in law, HRH Late Igwe Chukwuma Nwankwo. The indelible influence of these great men can be seen in the various philanthropic activities of Dr Jefferson Emeka Nnamani; a humble, respectful, empathetic, burden bearer of his people and traditional man whose many acts of service have been conducted quietly but loudly recognized and applauded by those whom he has served. His philanthropic activities show that he is a man who embraces diversity and inclusion.

The Covid-relief palliatives in 2020 he donated to the various villages that make up Agbani in Nkanu West Local Government Area was instrumental in providing the people the required support and assistance as they awaited government intervention. He also contributed financially to the state government in support of other local governments in the state. Jeff is an ardent lover of culture and heritage, expressed through his love and support of arts, music, dancing across various community dance troupes.

He also supports various other community initiatives including family educational supports, youth sports initiatives, especially as he has remained an active footballer as well as lawn tennis player, etc. His various supports have led to him being awarded the chieftaincy titles “Akpaka Igbo 1 of Agbani”, “Nwanne di na mba of Achi”, “Nwa chi ya na evuro uzo of Awgu”. Enugu State University also awarded him an Honorary Doctorate for his various support in education. He was equally recognized for his selfless service with an 042 award, given to those considered to be true sons of the soil (ndi Enugu).

His mantra is often summarized in this statement, "I believe development starts from changing the mindset of the people and working with the mindset of the people.” Jeff is a man who relates across all age groups. He is loved by the youths. A great listener and always a man of the people who lives for the people, Jeff has always been self-less, contented, and respectful, an 042 original in all respects. 1 Like

|

Politics / Re: Kogi Workforce Laud Gov. Bello For Paying Full Salaries Despite FAAC Shortfall by nairajotter: 8:24pm On Apr 02, 2022 Politics / Re: Kogi Workforce Laud Gov. Bello For Paying Full Salaries Despite FAAC Shortfall by nairajotter: 8:24pm On Apr 02, 2022 |

nairajotter:

The leadership of the organised Labour in Kogi State has applauded the state governor, Alhaji Yahaya Bello for paying full salary to state civil servants for the month March despite the general shortfall in the Federal Allocation to states.

They marveled that while majority of other states are slashing salaries of their workers, Bello stood tall by ensuring that Kogi workforce get 100 percent of their salaries.

A joint statement by the state chapter of the Nigeria Labour Congress and its Trade Union Congress counterpart noted that the state government has lived up to the promise made to workers in February.by paying full salaries to state civil servants.

The statement, signed by the NLC chairman, Comrade Onuh Edoka and his TUC counterpart, Comrade Mathew Ranti Ojo, on Friday, said workers are motivated to deliver their mandates in their various duty posts since they got their full pay.

According to them, “Workers and pensioners on the payroll of the state government have been paid their March salaries hundred percent and we are happy for that.

“Civil servants at that level are now well motivated to deliver on their mandates in their various offices."

Meanwhile, they called on the governor to look into the plight of Local Government workers with a view to improving the salaries of workers at that level.

They appealed to Bello to direct the payment of arrears of February salaries and other outstanding arrears to the workers

|

Politics / Kogi Workforce Laud Gov. Bello For Paying Full Salaries Despite FAAC Shortfall by nairajotter: 8:24pm On Apr 02, 2022 Politics / Kogi Workforce Laud Gov. Bello For Paying Full Salaries Despite FAAC Shortfall by nairajotter: 8:24pm On Apr 02, 2022 |

The leadership of the organised Labour in Kogi State has applauded the state governor, Alhaji Yahaya Bello for paying full salary to state civil servants for the month March despite the general shortfall in the Federal Allocation to states.

They marveled that while majority of other states are slashing salaries of their workers, Bello stood tall by ensuring that Kogi workforce get 100 percent of their salaries.

A joint statement by the state chapter of the Nigeria Labour Congress and its Trade Union Congress counterpart noted that the state government has lived up to the promise made to workers in February.by paying full salaries to state civil servants.

The statement, signed by the NLC chairman, Comrade Onuh Edoka and his TUC counterpart, Comrade Mathew Ranti Ojo, on Friday, said workers are motivated to deliver their mandates in their various duty posts since they got their full pay.

According to them, “Workers and pensioners on the payroll of the state government have been paid their March salaries hundred percent and we are happy for that.

“Civil servants at that level are now well motivated to deliver on their mandates in their various offices."

Meanwhile, they called on the governor to look into the plight of Local Government workers with a view to improving the salaries of workers at that level.

They appealed to Bello to direct the payment of arrears of February salaries and other outstanding arrears to the workers

|

Politics / Re: I’m disciplined, committed,focused with capacity to govern Enugu-Dr Jeff Nnamani by nairajotter: 3:42pm On Apr 02, 2022 Politics / Re: I’m disciplined, committed,focused with capacity to govern Enugu-Dr Jeff Nnamani by nairajotter: 3:42pm On Apr 02, 2022 |

the man has a good reputation in the corporate industry silverlinen:

Damn...na so them dey talk, but after them reach there, na different story go dey filter comot. |

Politics / I’m disciplined, committed,focused with capacity to govern Enugu-Dr Jeff Nnamani by nairajotter: 11:26am On Apr 02, 2022 Politics / I’m disciplined, committed,focused with capacity to govern Enugu-Dr Jeff Nnamani by nairajotter: 11:26am On Apr 02, 2022 |

|

Politics / Re: Is APGA As A Political Party Ready For The Elections In Enugu Come 2023? by nairajotter: 6:08pm On Mar 18, 2022 Politics / Re: Is APGA As A Political Party Ready For The Elections In Enugu Come 2023? by nairajotter: 6:08pm On Mar 18, 2022 |

APGA is leading a new wave in Enugu state come 2023. Opinionguy:

POLITICAL OBSERVERS ARE ASKING ONE QUESTION "IS APGA AS A POLITICAL PARTY READY FOR THE ELECTIONS IN ENUGU COME 2023

|

I see them implementing Sharia in their new policies

I see them implementing Sharia in their new policies