Investment / Re: Treasury Bills In Nigeria by needful: 5:15am On Jan 17, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 5:15am On Jan 17, 2020 |

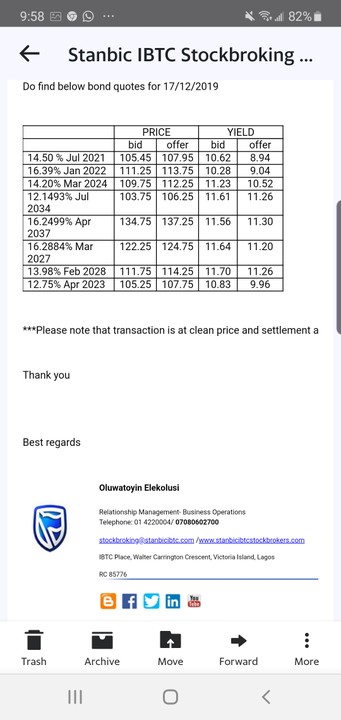

For those interested in FG Bond.

Check the attached file below |

Business / Re: What To Do To Make Money Online? by needful: 2:19am On Jan 15, 2020 Business / Re: What To Do To Make Money Online? by needful: 2:19am On Jan 15, 2020 |

New yr gift.

Sold

Dingmanfuneral dot com

Price; $499

Afternic

Hold time is 4months

Inbound sales

Happy new yr to everyone 38 Likes 2 Shares |

Investment / Re: Treasury Bills In Nigeria by needful: 6:05pm On Jan 07, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 6:05pm On Jan 07, 2020 |

emmanuelewumi:

If we are open to new ideas, cross fertilise ideas with genuine and forward thinking people. Get the necessary information and knowledge, I think there are endless opportunities in the Nigerian Investment terrain.

While some of us are lamenting the Indians, Lebanese, Chinese, South Africans are making a kill in our economy.

Recently developed interest and learning about the agricultural sector, My name na follow follow ooooo, I go dey follow u for back Sir. 1 Like |

Investment / Re: Treasury Bills In Nigeria by needful: 5:23pm On Jan 07, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 5:23pm On Jan 07, 2020 |

emmanuelewumi:

You must be enjoying the performance by Zenith bank dividend yield just fell to 12.5% in 3 months for those who bought yesterday at N20, you bought at N16 when the dividend yield was 15.5%. Oga is so sweet and I accumulated enough units. 1 Like |

Investment / Re: Treasury Bills In Nigeria by needful: 9:21am On Jan 07, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 9:21am On Jan 07, 2020 |

emmanuelewumi:

Thanks, I will make my findings. I thought the moratorium of 2 years is when the principal will be kept in the sinking fund over a period of 8 years.

I am not buying I can get a better dividend yield in the next 6 months.

Got the mail last night and decided to share. Same here sir. So UACN is a good buy?. Let me tap into it sharp sharp. Thank u sir 1 Like |

Investment / Re: Treasury Bills In Nigeria by needful: 11:44pm On Jan 06, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 11:44pm On Jan 06, 2020 |

richforever123:

Unless the state is dissolved (usually due to war) which is 99% unlikely, don't worry, your funds are safe Thank you Sir |

Investment / Re: Treasury Bills In Nigeria by needful: 10:48pm On Jan 06, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 10:48pm On Jan 06, 2020 |

emmanuelewumi:

Just got a mail from United Capital with N10 million you can buy LASG bond the rate is between 11.75% and 12.5%. The bond was given a liquid status by CBN.

The offer will close on Monday 13th January 2020.

I expect most of the fund managers, Insurance companies and other Institutional investors to divert Funds to this offer. LASG bonds are usually oversubscribed. Sir, is there no risk associated with buying state bonds? What if they refuse to comply with the terms and conditions. Just asking Sir |

Investment / Re: Treasury Bills In Nigeria by needful: 12:33am On Jan 06, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 12:33am On Jan 06, 2020 |

emmanuelewumi:

N25 million will buy you 5,800,000 of UPDC REIT and will give you an income of N3.3 million by October 2020.

Google UPDC REIT they have investments in a number of highbrow property valued at over N30 billion and also have over N5 billion of part of the rent collected over the years invested in highly liquid assets suchTreasury Bills, money market funds, commercial papers, FG bonds, State bonds and corporate bonds I have been online trying to discover what they do but couldn't succeed. Is this some kind of shares or real estate investment Sir? 1 Like |

Investment / Re: Treasury Bills In Nigeria by needful: 10:33pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 10:33pm On Jan 05, 2020 |

Adiwana:

Hello,which bond currently offers this?? Can the interest be compounded?? Federal govt Bond with stanbic stock brokers or stanbic bank. Infact u can get it from any of the approved investment house but avoid afri invest because their fee is outrageous. 1 Like |

Investment / Re: Treasury Bills In Nigeria by needful: 5:43pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 5:43pm On Jan 05, 2020 |

seyisanya:

Sweet deal. Hope you haven't sold your Access. No Bro, all thanks to God and Sir Emma. I follow him on stock thread quietly and buy. U can do that as well. 1 Like |

Investment / Re: Treasury Bills In Nigeria by needful: 3:31pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 3:31pm On Jan 05, 2020 |

isangjohnson:

Though I'm not an authority in this line of investment, but I guess this must be Fgn Bond. Fgn Bond |

Investment / Re: Treasury Bills In Nigeria by needful: 3:30pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 3:30pm On Jan 05, 2020 |

isangjohnson:

If 20m is used to buy 19m worth of bond and coupon rate calculated based on 19m and not 20m, how much will be your gain should you decide to hold it to 2yrs maturity period?

Please educate me. Its 2yrs bond but will mature in a yr and six months time. It's not possible to increase or reduce it except u decide to sell before maturity. The yrs are stated clearly during the transaction period but may not get to the stated time before maturity. This is only applicable to secondary market FG bond. |

Investment / Re: Treasury Bills In Nigeria by needful: 3:25pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 3:25pm On Jan 05, 2020 |

thebargainhunte:

Your calculation is perfectly okay but I am not okay losing 1mil from my initial capital. So are u saying? u arent comfortable loosing 1m to gain 4,510,000? in one yr and 6months. Recheck oga because TB is currently at 3.5% oooooo 1 Like |

Investment / Re: Treasury Bills In Nigeria by needful: 3:22pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 3:22pm On Jan 05, 2020 |

emmanuelewumi:

You have made over 20% in 18 months Exactly what am trying to explain to him. 1 Like |

Investment / Re: Treasury Bills In Nigeria by needful: 3:22pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 3:22pm On Jan 05, 2020 |

emmanuelewumi:

It is also possible to use N18 million to buy N20 million worth of bond, this will occur when the bond is selling at a discount. Yes u are very correct sir |

Investment / Re: Treasury Bills In Nigeria by needful: 2:54pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 2:54pm On Jan 05, 2020 |

thebargainhunte:

Madam, tell me more. Just the transaction alone, you have lost 1mil  "u use 20m to buy a bond worth of 19m". I think they will pay you 14.5/4, which is 3.625% per quarter and not 14.5% per quarter. "u use 20m to buy a bond worth of 19m". I think they will pay you 14.5/4, which is 3.625% per quarter and not 14.5% per quarter. U get payment twice a yr. 19m by 14.5% is 2,755,000 for yr1 multiply by 2 that would be N5,510,000 plus 19,000,000 equal to N24,510,000. This is what your are getting at the end of 1yr and six months. Coupon rate plus capital at maturity gives u that N24,510,000. So tell me if u are still losing according to ur own calculation. 5 Likes |

Investment / Re: Treasury Bills In Nigeria by needful: 2:47pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 2:47pm On Jan 05, 2020 |

emmanuelewumi:

The board of Zenith and GTB will meet in January to declare dividends based on last year payment.

Zenith paid a final dividend of N2.5 on each stock you bought at N16

While GTB paid N2.45k on each bought at N25 .

Try to perfect or update your e-dividend mandate so that your dividend will drop in you account by March or first week in April Oga the thought of that dividend is overwhelming. Thank you sir. |

Investment / Re: Treasury Bills In Nigeria by needful: 2:29pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 2:29pm On Jan 05, 2020 |

emmanuelewumi:

Can you name them.

Who is your Stockbroker? Sir I use Morgan and stanbic. Gtb, access, uba, zenith, etc. You advised on this stock and I grabbed zenith at 16n, gtb at 25 and access at 5n. It pained me that I didn't see money to buy una. |

Investment / Re: Treasury Bills In Nigeria by needful: 1:54pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 1:54pm On Jan 05, 2020 |

emmanuelewumi:

Prices of property are subjective the easiest way to determine the price is the income you can generate from the property.

Same applies to when buying shares, a business or any investment. Oga happy new yr. Pls sir, do u have any stock in mind capable of giving 10 to 20% interest?. The 4 stocks u recommended within the last few months has giving more than 30% Sir. 1 Like |

Investment / Re: Treasury Bills In Nigeria by needful: 1:50pm On Jan 05, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 1:50pm On Jan 05, 2020 |

zamirikpo:

U have my mindset but come to think of it critically, u may have lost almost 6.6% of the value of ur money whenever u want to spend it. wrt inflation.

I structured all my expenses around TB....but to my greatest surprise it's gone for now. Ive never been a fan of bonds cos the grammar is too much. But we have to move on and restrategize.

If like they say that bonds can give 12% ROI, and I need to spend as well as save, like my TB days, I've decided to take off the interest and invest the balance. E.g I have 20m. and 12% of 20m is abt 2.4m.....the idea is to invest 18m in bonds and keep back 2m. In essence I have preserved my 20m at the end of the bond tenure and still have 2m to spend just like in my TB days.

Don't know if I could get a year on those fgn bond or eurobonds offer. Cos my budgets are structured yearly.

Don't hold on to TB at 3.5% biko.....

.i still have to read up on Bonds,though my major TB investment doesn't mature on till June 2020 It's TRUE that we do not agree for reason best to known to us but try that bond. The 2yrs bond is actually a year and 6months and the good thing is that my first coupon payment will arrive on the 15th of this January and next one will be in July. The mathematics is very clear to me now as in, u use 20m to buy a bond worth of 19m on the coupon rate of 14.5%. U get 14.5% of 19m quarterly and upon maturity, u will receive 19m instead of 20m. It's as simple as that from the recent bond I did. If u can queue into that particular 2yrs bond which is actually a yr and six months, ur first coupon will still arrive in January 15th. 2 Likes 1 Share |

Investment / Re: Treasury Bills In Nigeria by needful: 3:06pm On Jan 02, 2020 Investment / Re: Treasury Bills In Nigeria by needful: 3:06pm On Jan 02, 2020 |

Donbrig:

The new West Africa Currency (ECO), is one area we should also look into, whatever decision FG takes will affect us all one way or another. Now that all the CFA countries have finally subscribed to ECO, CBN should do everything to counter the influence of France on the future currency. Nigeria should embrace ECO, because having other Ecowas countries use ECO without Nigeria will send Naira into automatic extinction. Naira should not be allowed to die automatic death by pressure from ECO, as this will cost us more as the economic giant of Africa. Only Togo has all the necessary requirements to embrace ECO. Weeks and months to come, Nigeria should use every trick in the book to boost our national reserve and ensure a stabilized naira before embracing ECO, this will give Nigeria more advantages with ECO.

Althoug Nigeria will no longer have monetary powers to dictate the exchange rate and stability of ECO, but Nigeria will definitely have lots of other advantages with the new West African currency, but firstly, we have to do our economic homework before making any decision about ECO. What is the ECO equivalents to $. 1 Like |

Travel / Re: My Experience At A Restaurant In Canada by needful: 3:16am On Jan 02, 2020 Travel / Re: My Experience At A Restaurant In Canada by needful: 3:16am On Jan 02, 2020 |

My Canada, peaceful land of milk and honey, the nicest people as far as north America is concerned. For those bad mouthing Canada on their work ethics, u need to go back to naija where ur colleagues cover up for u whenever u mess up. As for canadian colleagues, u get reported at a slightest mistake and our naija doesnt feel good about it. That is their own work ethics, accept it or return to naija where una dey loathe with pen simple. As for me, am enjoying it and will still do because it simply make me a honest soul. 1 Like |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by needful: 8:08pm On Dec 28, 2019 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by needful: 8:08pm On Dec 28, 2019 |

emmanuelewumi:

Will the tax be more than 10%. Yes sir, is about 15% but the good thing for the resident of canada is, when filling for the income tax, one may claim it on the basis of household low income. But for non resident, I really do not no what may happen |

Investment / Re: Nigerian Stock Exchange Market Pick Alerts by needful: 3:52pm On Dec 28, 2019 Investment / Re: Nigerian Stock Exchange Market Pick Alerts by needful: 3:52pm On Dec 28, 2019 |

leo1234:

That means the dividend yield is close to 20% per year.

How can one invest in a company like this? Dont even bother looking for how to invest with Scotia Bank. The dividend is sweet but after tax deductions both provincial and federal with other deductions, u go carry vex enter ur bedroom � 1 Like |

Investment / Re: Treasury Bills In Nigeria by needful: 4:50pm On Dec 19, 2019 Investment / Re: Treasury Bills In Nigeria by needful: 4:50pm On Dec 19, 2019 |

bikerboy1:

Any idea what the interest rate might be for 1 year? And where I can purchase it from?

I just need a head start as I might settle for FGN bond.

TB is bleeding   Even the Bond is dropping daily with higher premium and lower offer yield. No where to run to� 4 Likes |

Investment / Re: Treasury Bills In Nigeria by needful: 11:16pm On Dec 18, 2019 Investment / Re: Treasury Bills In Nigeria by needful: 11:16pm On Dec 18, 2019 |

|

Investment / Re: Treasury Bills In Nigeria by needful: 2:46pm On Dec 18, 2019 Investment / Re: Treasury Bills In Nigeria by needful: 2:46pm On Dec 18, 2019 |

crowntoro:

You are very daft!!!!!!! This is too much abeg. 4 Likes |

Investment / Re: Treasury Bills In Nigeria by needful: 2:45pm On Dec 18, 2019 Investment / Re: Treasury Bills In Nigeria by needful: 2:45pm On Dec 18, 2019 |

[quote author=Willie2015 post=85007722]

Dont forget to look at the premium you are paying for the bond.

Discouraging but what can we do nau. TB 5%, Bond 8%, fixed deposit 4%. So i rather go with bond because TB rate will crash more. |

Investment / Re: Treasury Bills In Nigeria by needful: 2:58am On Dec 18, 2019 Investment / Re: Treasury Bills In Nigeria by needful: 2:58am On Dec 18, 2019 |

Just2endowed2:

It get blurred when one zoom. Can you make it more clearer? 1 Like

|

Investment / Re: Treasury Bills In Nigeria by needful: 9:09pm On Dec 17, 2019 Investment / Re: Treasury Bills In Nigeria by needful: 9:09pm On Dec 17, 2019 |

Adiwana:

Since things have gone south,planning on fixing 35-40m in 2yrs time in the 16%/yr bond. Still dont understand the whole 16 and 12% stuff but if its 16% that will be received every year, looking at at least 5 mill passive income a year. May 0God help us all I dont think you can get upto that in bond right now. Am planning to do one but rates are discouraging. Take a look below. Pls ignore those high rates and focus on the offer yield as that is what u are going home with.

|

Investment / Re: Treasury Bills In Nigeria by needful: 11:15pm On Dec 16, 2019 Investment / Re: Treasury Bills In Nigeria by needful: 11:15pm On Dec 16, 2019 |

Nnamz:

@needful madam this is what I was telling you. For this reason I am moving all my funds to Canada so that I don't go from a FOR EXAMPLE $100,000 CAD owner to $20,000 CAD owner overnight.

Btw who here lives in Halifax? Hit me up You are right. But I have been hedging with Eurobond. Call me let's talk |

Investment / Re: Treasury Bills In Nigeria by needful: 2:26am On Dec 07, 2019 Investment / Re: Treasury Bills In Nigeria by needful: 2:26am On Dec 07, 2019 |

Omonigeriarere:

There is no point for secret conversation. But let me showcase my latest discovery on TB at Access Bank after they have labelled me as a marketer for I-Invest without knowing that constant online research on money making na him dey worry me.

Dear just click on https://tbills.ng/#/ to see the TB rates available in Access Bank daily. The window is always opened between 8-4 on daily if I am not wrong.

A form will be displayed upon clicking on 'get started' button. Same would be deactivated after 4pm daily.

Input your BVN, acct to be debited, account to be credited etc in the form. Gbam! You are done in less than 5minutes.

They bought at discount and pay in full at maturity.

You can also consider I-Invest application own by Sterling Bank. It is the easiest of them all and they have best of rates. The only disadvantage is that your interest and principal are paid upon maturity.

My experience with Stanbic IBTC when it comes so service delivery is poor inspite of all the hype on this forum. I have to move all my money out of the bank recently.

I use both means of investment and I have never regretted any. The site is okay but the maximum invest is just 5m |

"u use 20m to buy a bond worth of 19m". I think they will pay you 14.5/4, which is 3.625% per quarter and not 14.5% per quarter.

"u use 20m to buy a bond worth of 19m". I think they will pay you 14.5/4, which is 3.625% per quarter and not 14.5% per quarter.